Supplemental Attachment Templates

Are you looking for a comprehensive resource to find supplemental attachments for various forms and schedules? Look no further! Our webpage is your go-to source for all your supplemental attachment needs, featuring a wide range of documents necessary for compliance and reporting purposes.

Whether you're an employer seeking to make an election for reciprocal coverage, an individual needing to provide additional details on your tax return, or a business owner with multi-state workers, our collection of supplemental attachments has got you covered. With our user-friendly interface and extensive array of documents, you'll be able to find the right attachment to meet your specific requirements.

Our supplemental attachments cater to different states and federal forms, ensuring that you have access to the most up-to-date and relevant documents. Our collection includes supplemental attachments for various forms such as the IRS Form 8916-A, the Form RTS-6A, and state-specific attachments like the Form RC-1(A)-ARK for employers in Arkansas.

With our webpage, you can easily navigate through the different categories, making it convenient for you to find the necessary supplemental attachment for your particular situation. No more hassle of scouring through multiple websites or struggling with complex government portals – we have simplified the process for you.

Don't let the complexities of compliance and reporting overwhelm you. Trust our reliable and comprehensive collection of supplemental attachments to ensure that you are in full compliance with the necessary forms and schedules. From alternative base calculation supplemental attachments to combined election supplemental attachments, our webpage has it all.

Take advantage of our user-friendly interface and start exploring our extensive collection of supplemental attachments today. Simplify your compliance needs and streamline your reporting process with our webpage.

Documents:

17

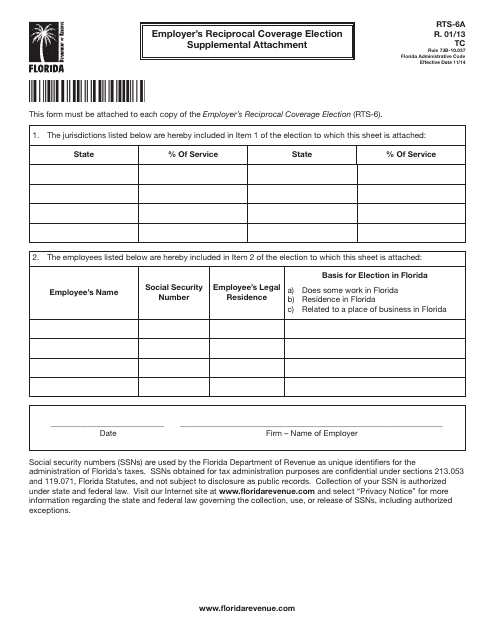

This form is used for employers in Florida to provide additional information and make an election for reciprocal coverage.

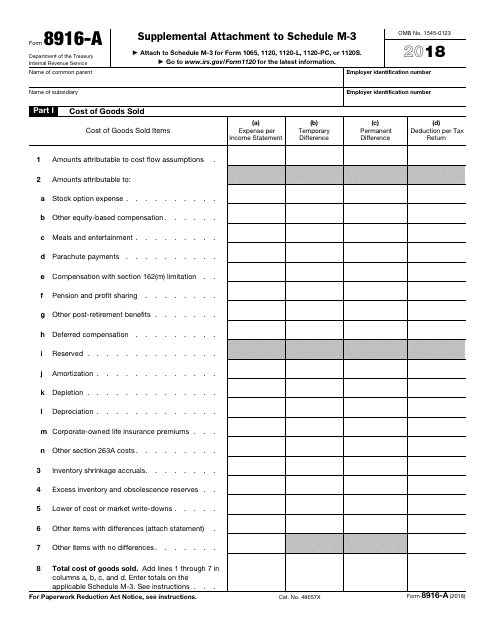

This form is used for providing additional information and attachments to the Schedule M-3 when filing taxes with the IRS.

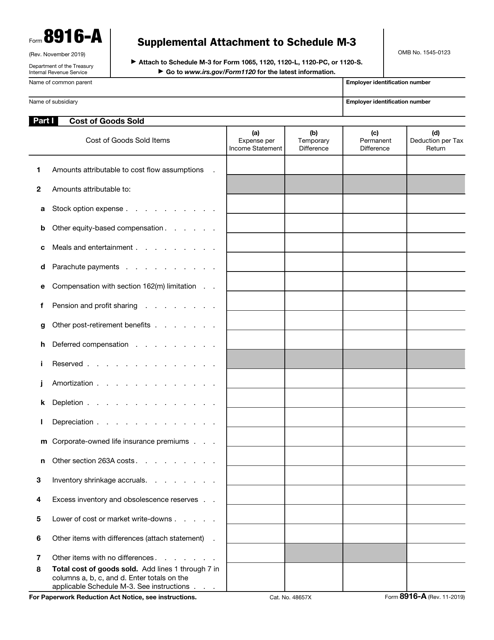

This Form is used for providing additional information to Schedule M-3, in relation to Washington state taxes.

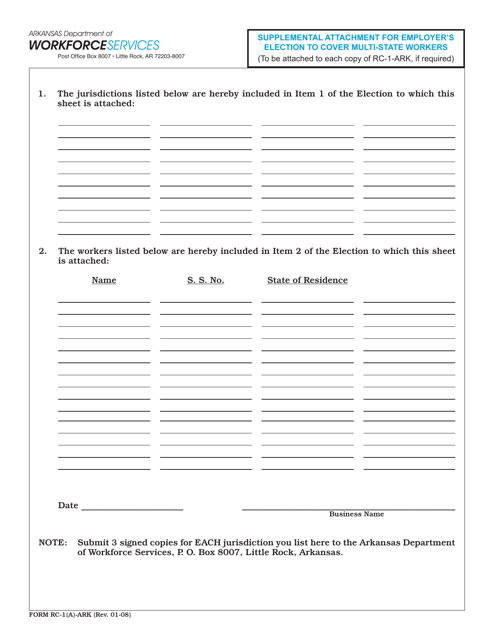

This form is used for employers in Arkansas who want to elect coverage for multi-state workers. It serves as a supplemental attachment to Form RC-1(A).

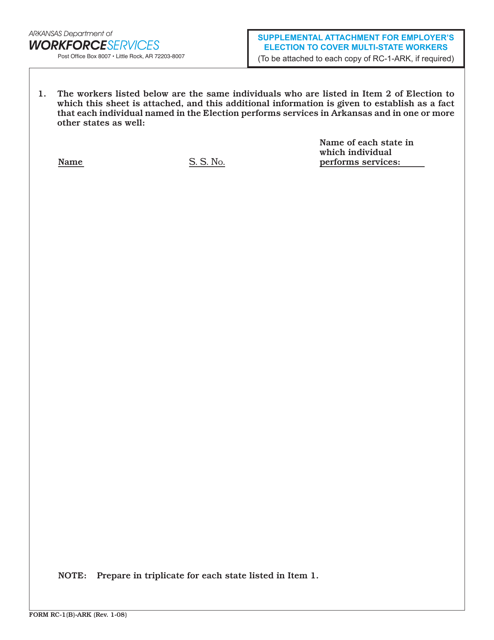

This document is a supplemental attachment to Form RC-1(B), specifically for employers in Arkansas who wish to elect coverage for multi-state workers. It provides additional information and details regarding the employer's election process.

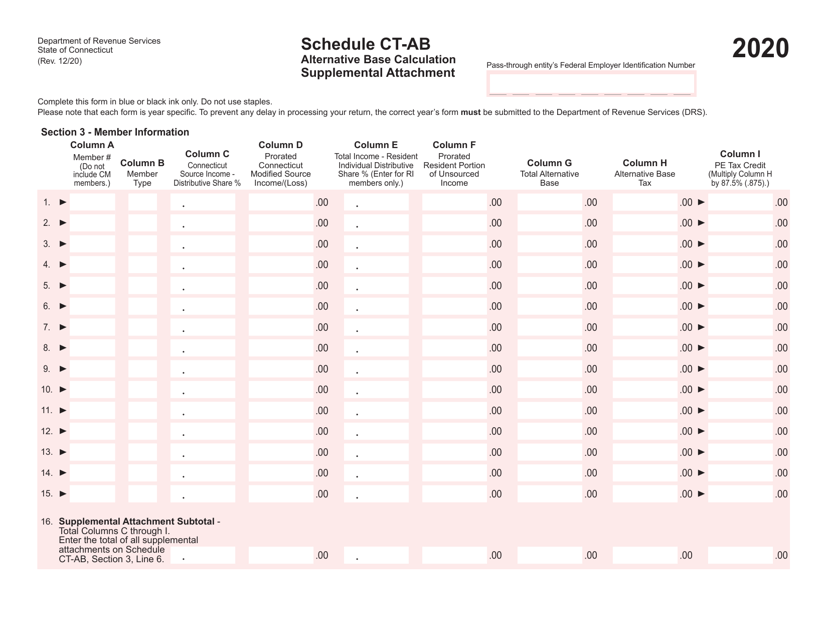

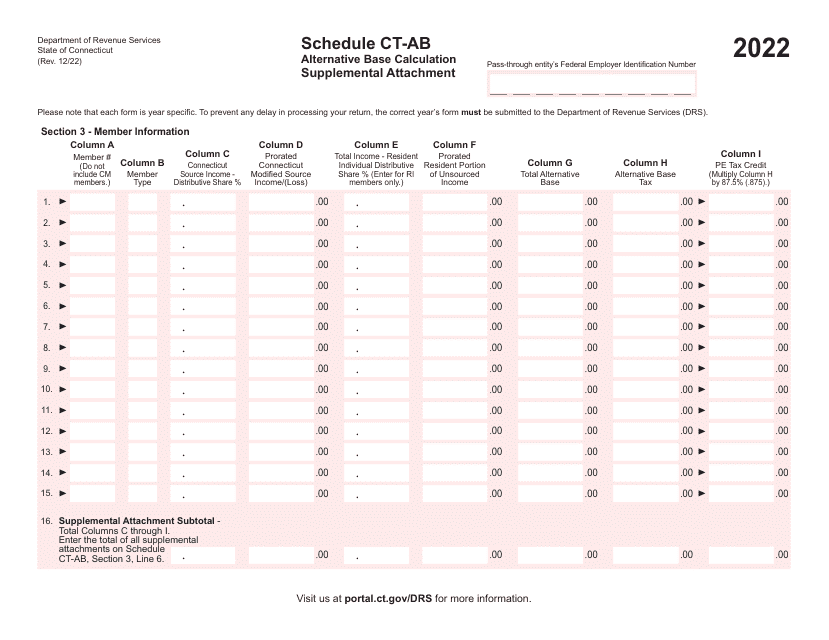

This form is used for calculating alternative base for Connecticut state taxes.

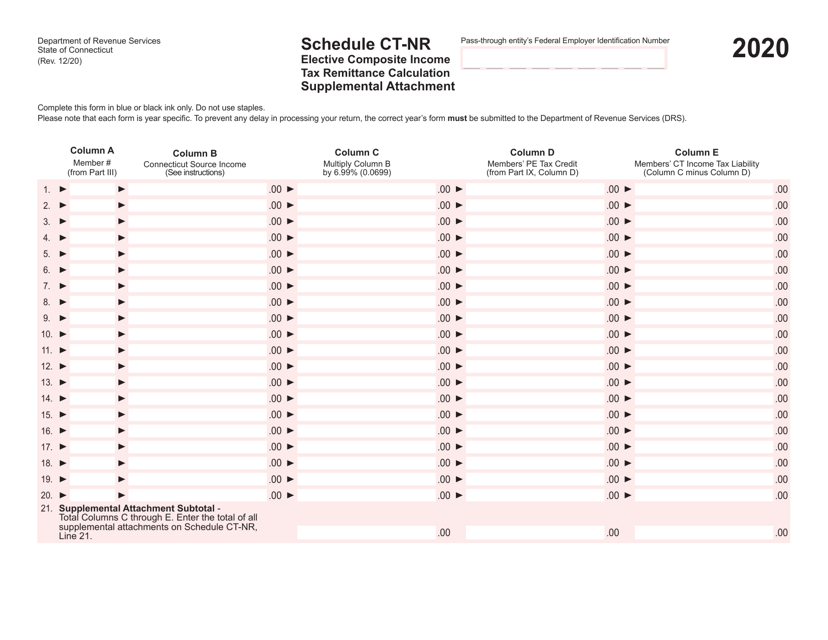

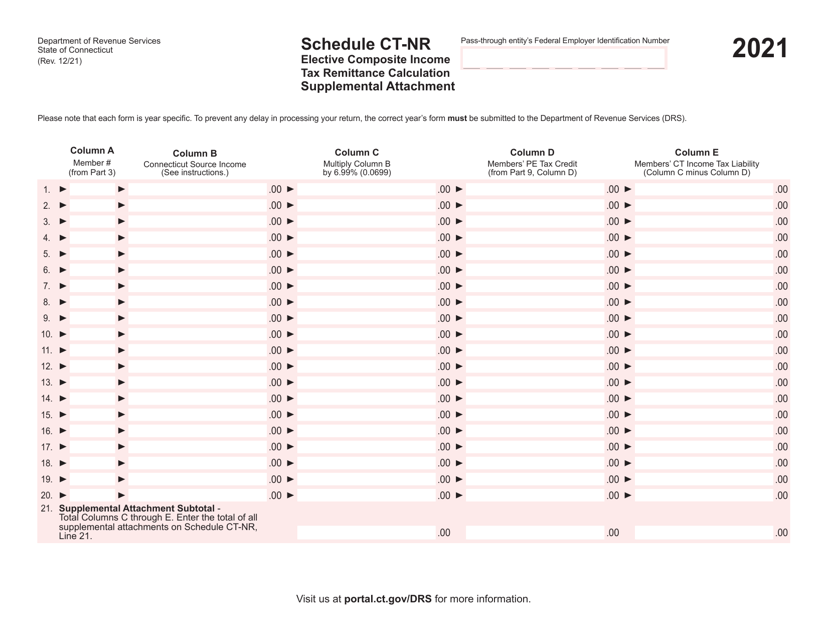

This document is a supplemental attachment used for calculating the composite income tax remittance for nonresident electing composite filers in Connecticut.

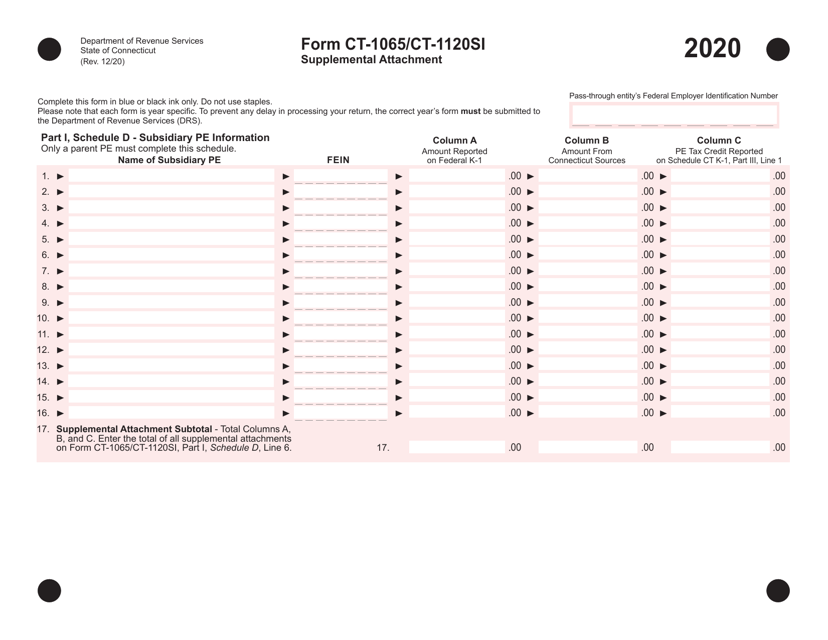

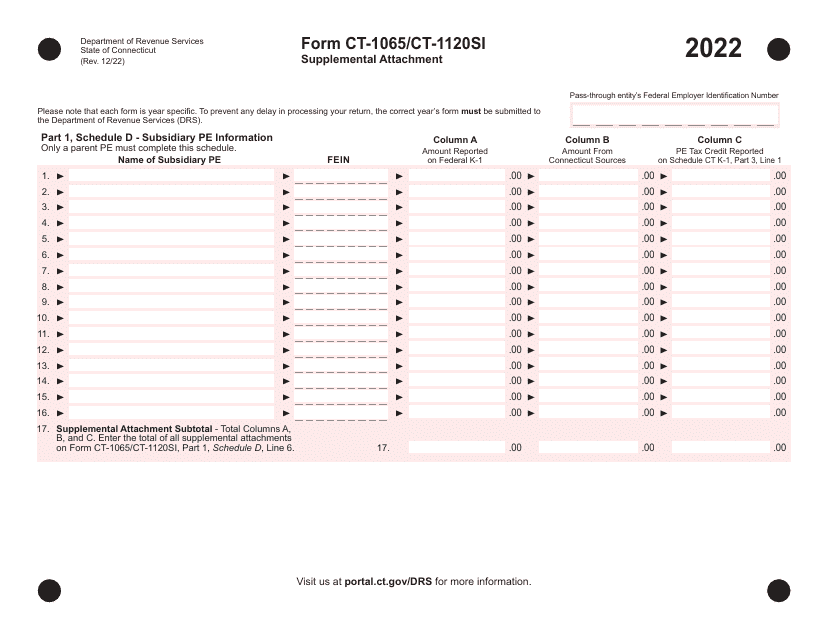

This form is used for filing the supplemental attachment for Connecticut Pass-Through Entity Tax Return. It is specifically for entities in Connecticut.

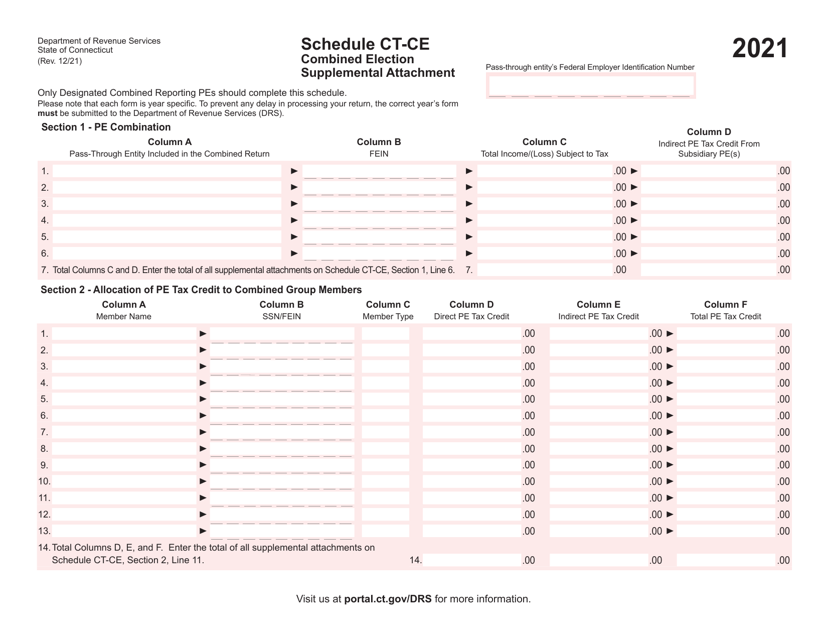

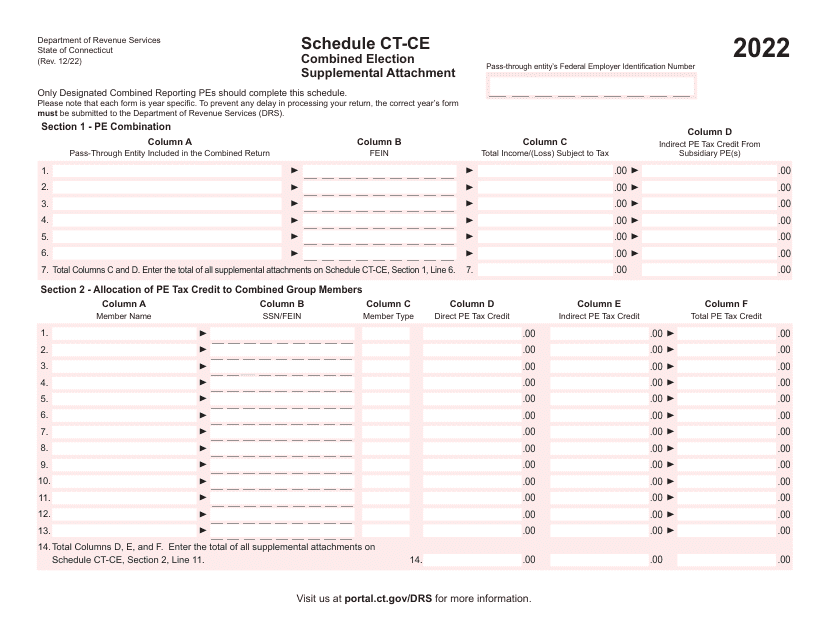

This document is a supplemental attachment to the Schedule CT-CE Combined Election form in Connecticut. It provides additional information or requirements for the election process.

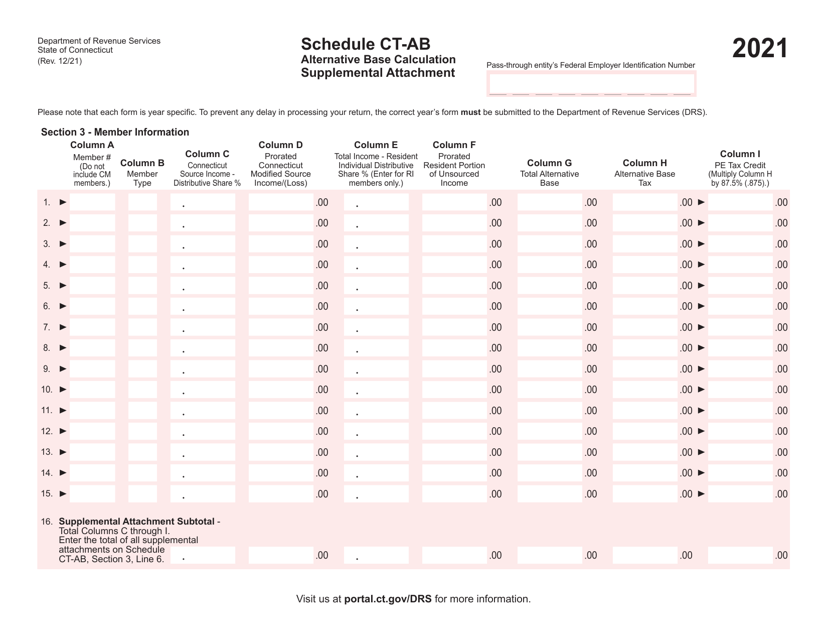

This form is used for providing a supplemental attachment for the alternative base calculation on Schedule CT-AB in Connecticut.

This document is a supplemental attachment for calculating the composite income tax remittance for nonresident electing Connecticut taxpayers. It is used to schedule and calculate the remittance amount.

This document is used as a supplemental attachment for the CT-CE Combined Election Schedule. It provides additional information and details that are necessary for completing the election schedule.

This document is used for submitting a supplemental attachment for the Alternative Base Calculation (CT-AB) in Connecticut. It provides additional information to support the alternative base calculation.

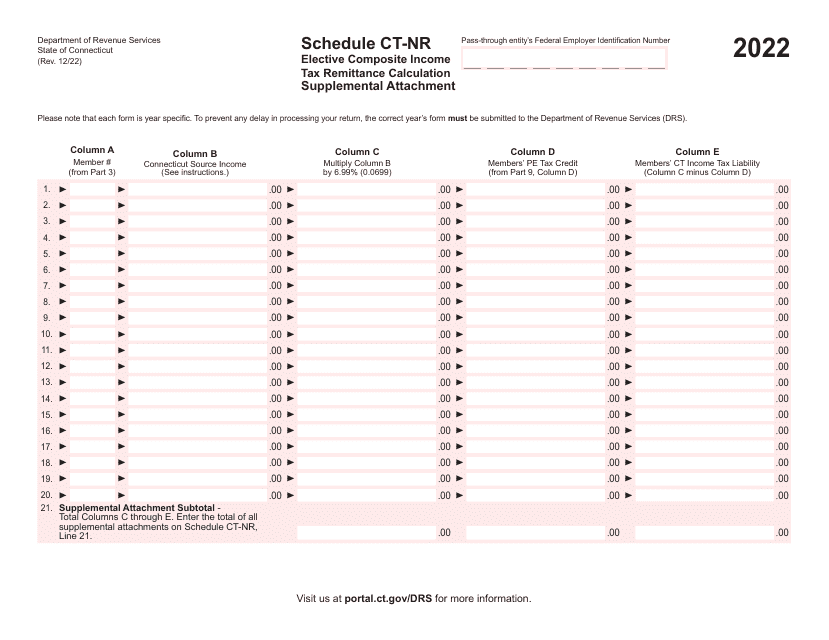

This document is a supplemental attachment used for the calculation of elective composite income tax remittance in Connecticut. It is used in conjunction with Schedule CT-NR.