Captive Real Estate Investment Trust Templates

A captive real estate investment trust (REIT) is a specialized type of REIT that is established by a financial institution for the purpose of investing in real estate. It operates as a subsidiary of the financial institution and is subject to specific tax regulations.

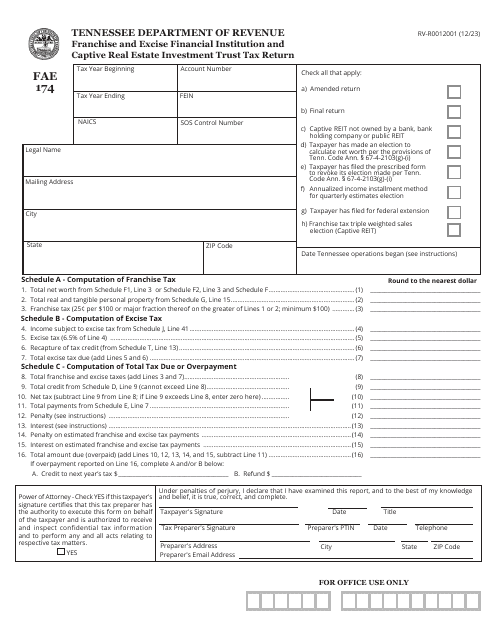

Whether you are a franchise or excise financial institution or a captive real estate investment trust in Tennessee, it is important to understand the tax obligations and filing requirements associated with your entity. The Form FAE174 (RV-R0012001) is the designated tax return form for reporting franchise and excise tax liabilities.

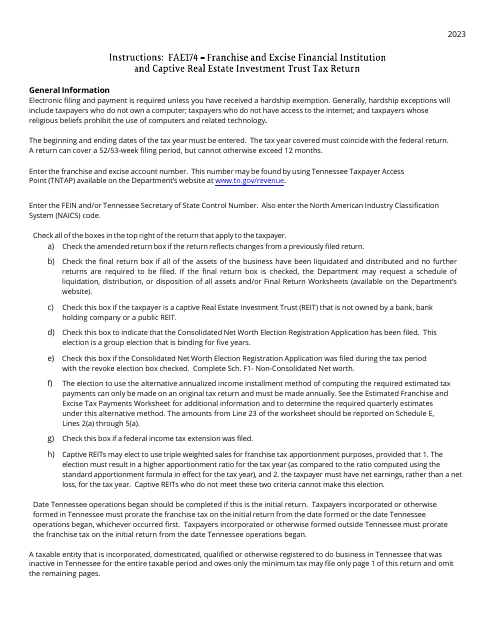

Our comprehensive collection of documents includes not only the Form FAE174 (RV-R0012001) Franchise and Excise Financial Institution and Captive Real Estate InvestmentTrust Tax Return for Tennessee, but also the accompanying instructions to ensure accurate and timely filing. These instructions guide you through the various sections of the tax return, providing valuable insights and clarifications along the way.

Navigating the complexities of tax compliance can be overwhelming, which is why our documentation also covers the Instructions for Form FAE174, RV-R0012001 Franchise and Excise Financial Institution and Captive Real Estate Investment Trust Tax Return for Tennessee. These instructions go beyond the basic form completion and offer explanations of key terms, calculation methods, and any recent updates or changes to tax laws that may impact your filings.

At Templateroller.com, we recognize the unique challenges faced by captive REITs and financial institutions, and our priority is to provide you with the resources needed to ensure compliance with the Tennessee tax requirements. From the Form FAE174 (RV-R0012001) tax return to the instructions that accompany it, our comprehensive document collection is your go-to source for accurate and up-to-date information for franchise and excise tax reporting.

Trust Templateroller.com to simplify the process of tax compliance for captive real estate investment trusts and franchise and excise financial institutions. With our extensive collection of documents, including the Form FAE174 (RV-R0012001) tax return and detailed instructions, you can navigate the complex world of tax filings with confidence.

(Note: The given example document titles are very repetitive, so the text may also reflect some repetition to account for that.)

Documents:

5