Meal Expenses Templates

Are you a business traveler looking to keep track of your meal expenses? Look no further! Our meal expenses documentation is designed to help you easily manage and report your meal expenses during your travels. Whether you're an employee, a contractor, or self-employed, it's essential to accurately record your meal expenses for tax purposes or reimbursement.

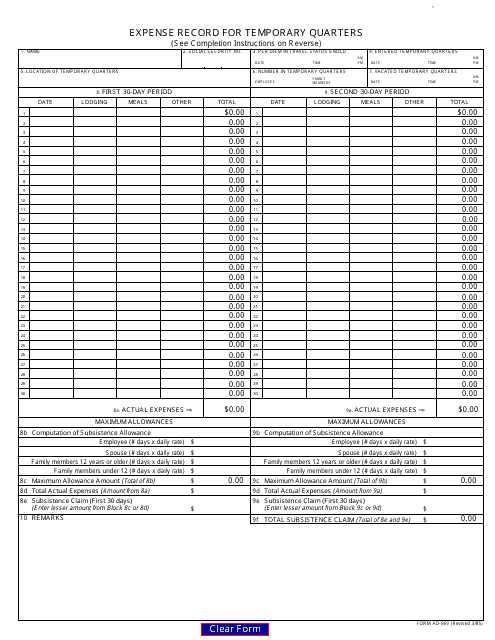

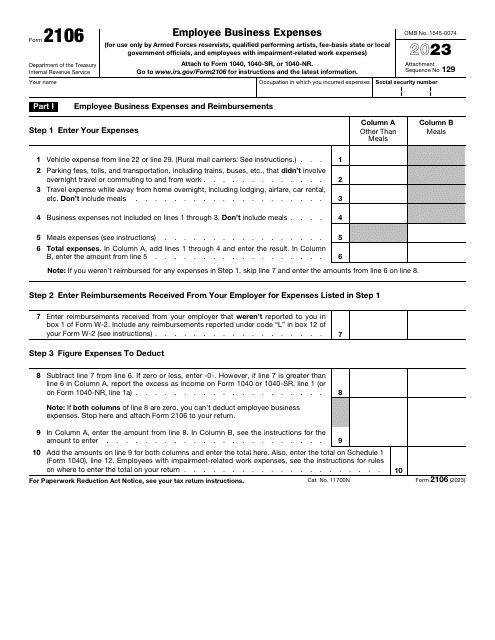

Our documentation includes a variety of forms that cater to different requirements and jurisdictions. If you're in the United States, you can use Form AD-569 Expense Record for Temporary Quarters or IRS Form 2106 Employee Business Expenses to keep track of your meal expenses. These forms are specifically tailored for individuals seeking to claim their meal expenses as tax deductions.

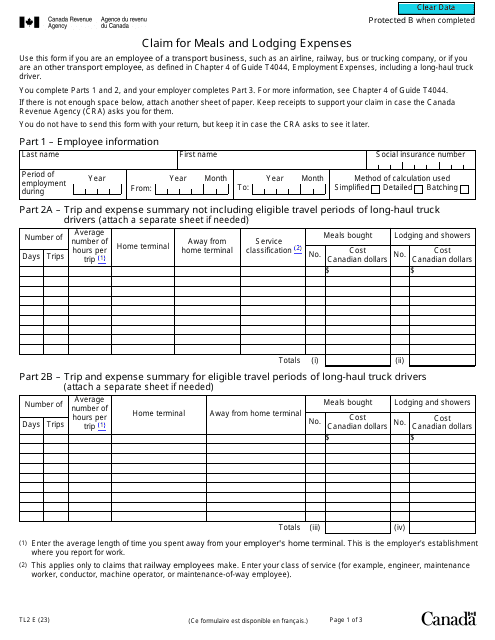

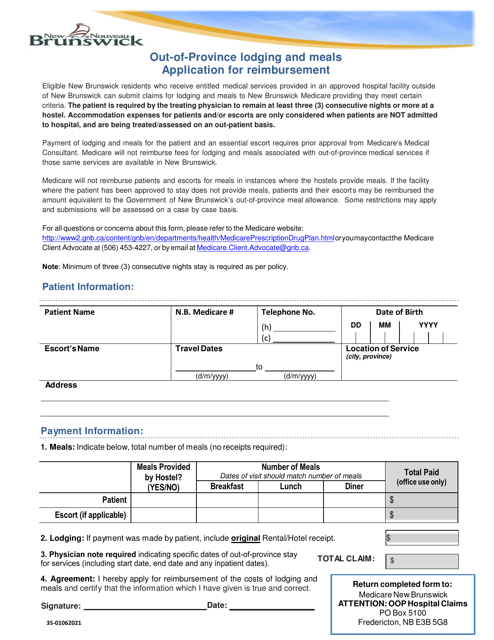

If you're a Canadian resident, you'll find valuable resources such as Form TL2 Claim for Meals and Lodging Expenses, which allows you to report your meal expenses for tax purposes. In addition, there's the Out-Of-Province Lodging and Meals Application for Reimbursement, specifically for residents of New Brunswick, Canada.

We understand that meal expenses documentation can sometimes be confusing, especially with varying requirements across different regions. That's why we've consolidated all the necessary forms and information to simplify the process for you. With our extensive collection of meal expenses documentation, you can have peace of mind knowing that you're accurately recording your expenses and staying compliant with tax regulations.

Don't let the daunting task of managing your meal expenses consume your valuable time and energy. Use our meal expenses documentation and ensure that you're accurately recording and reporting your expenses. Start streamlining your documentation process today and focus on what matters most – your business and your travels.

Note: Please ensure appropriate usage of IRS forms in accordance with the Internal Revenue Service guidelines. It is recommended to consult a tax professional for guidance on tax-related matters.

Documents:

8

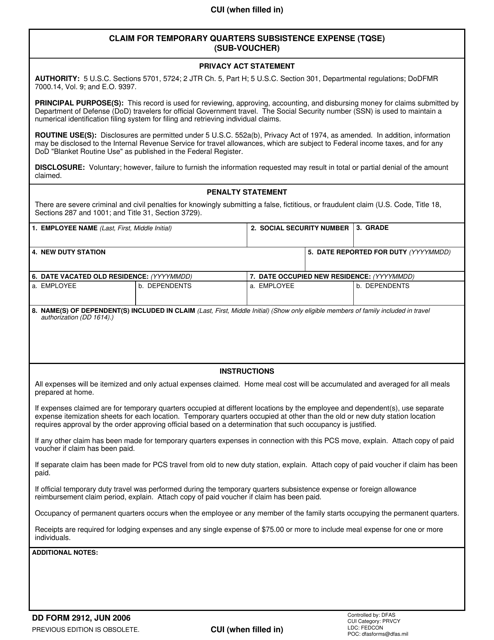

This Form is used for recording expenses related to temporary lodging while on official travel.

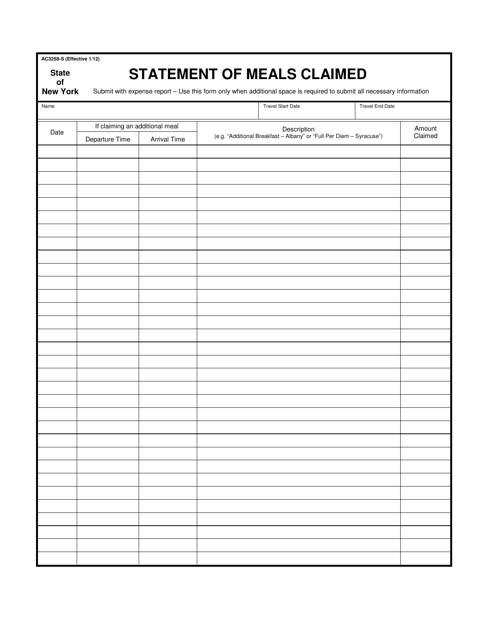

This document is used for claiming meals expenses in New York. It is known as the Statement of Meals Claimed.

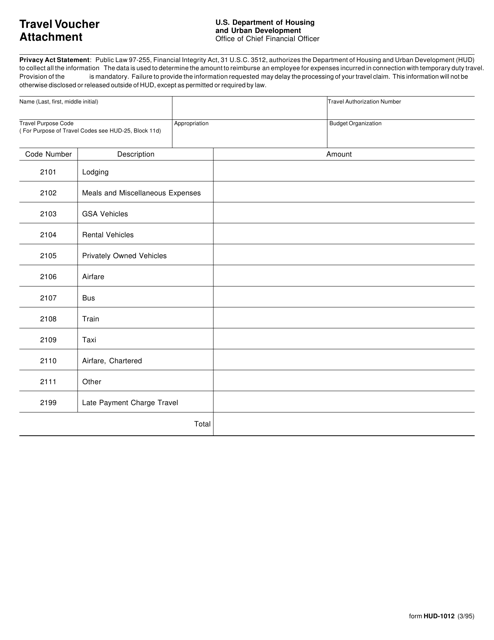

This form is used as an attachment to the Travel Voucher (Form HUD-1012) for documenting additional information related to travel expenses.