Capital Loss Templates

Documents:

60

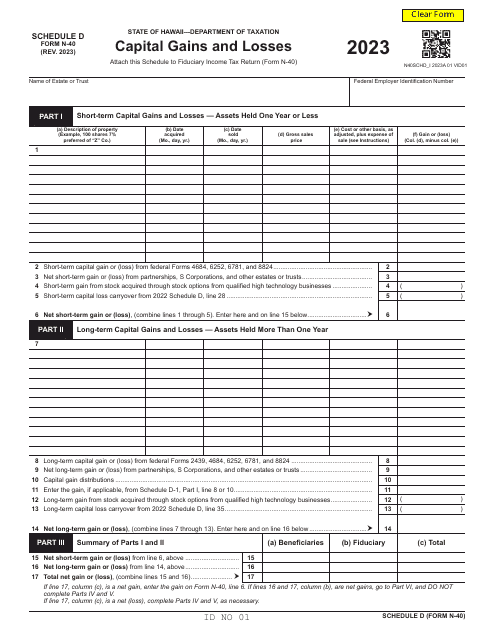

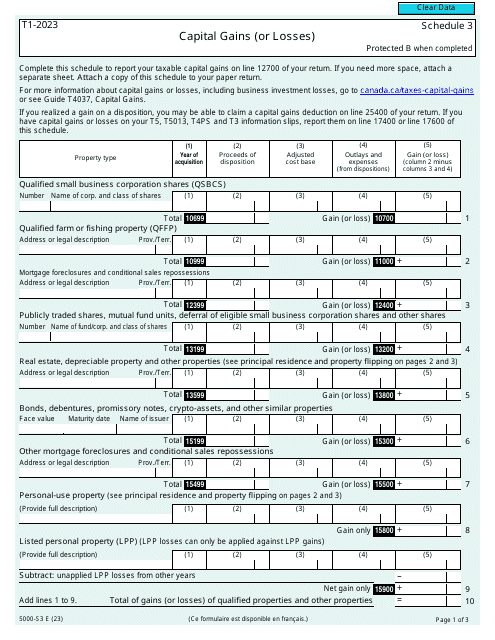

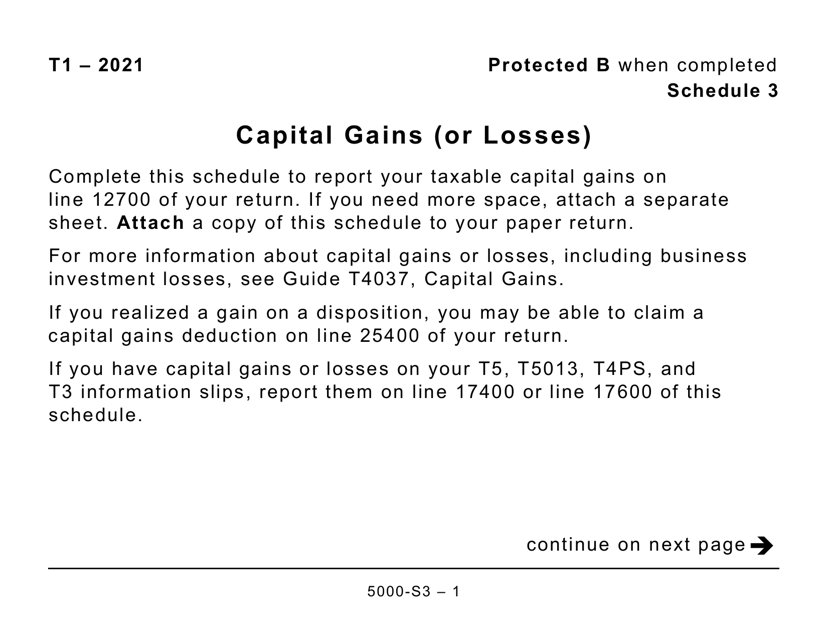

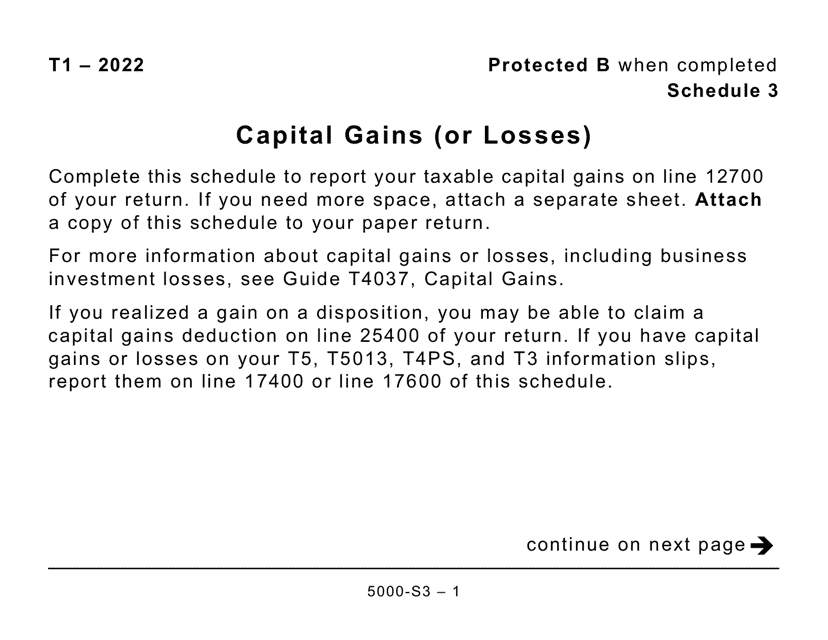

This form is used for reporting capital gains or losses in Canada. It is in large print format to make it easier to read.

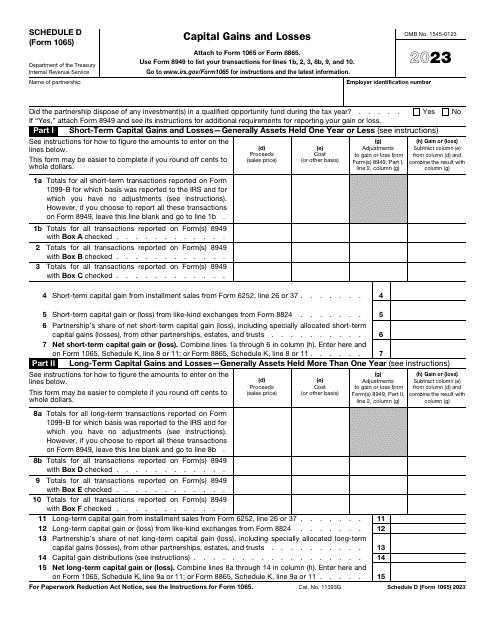

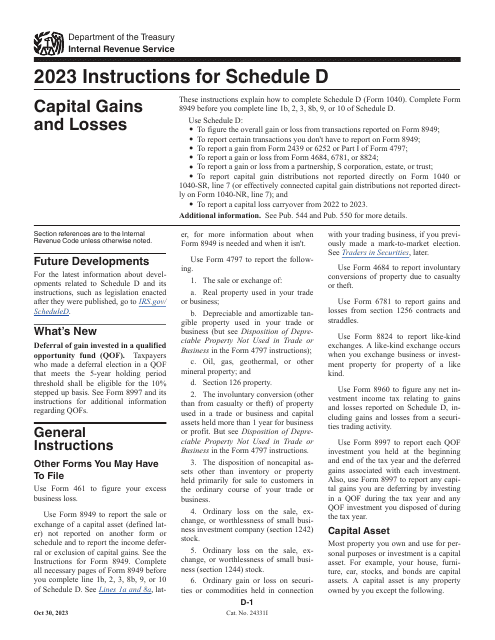

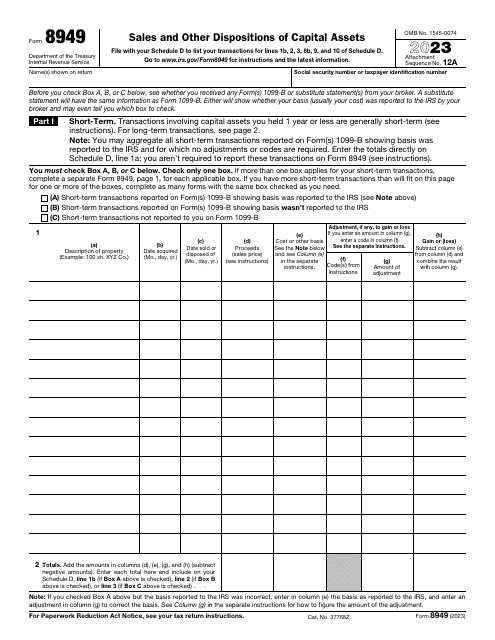

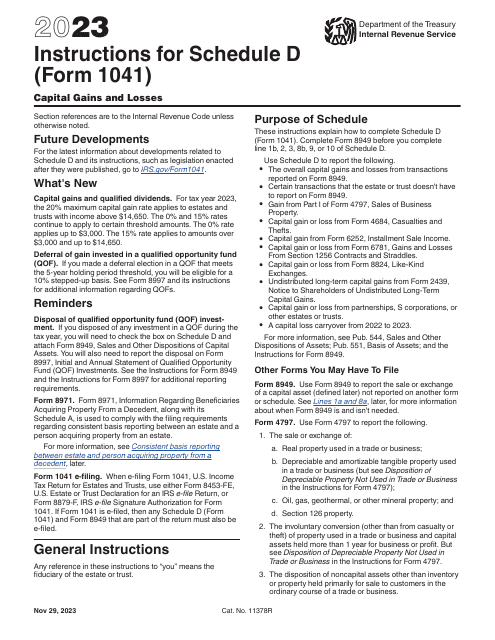

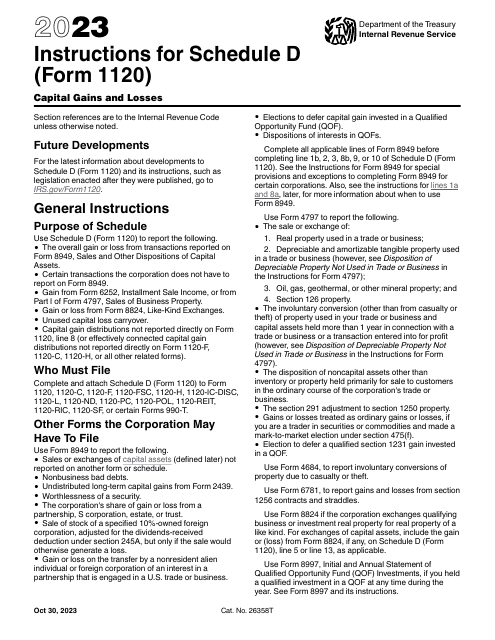

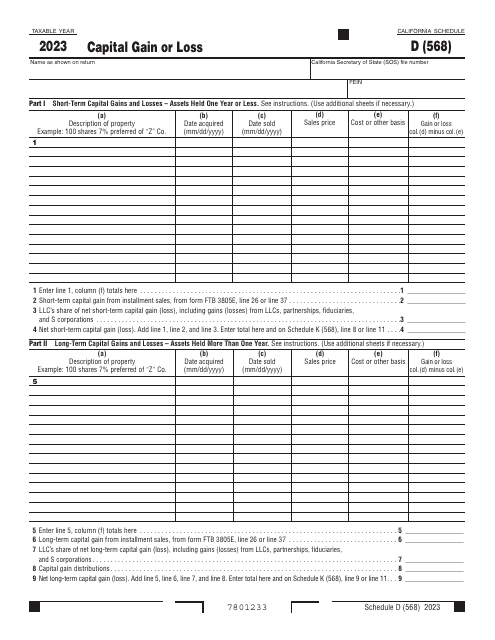

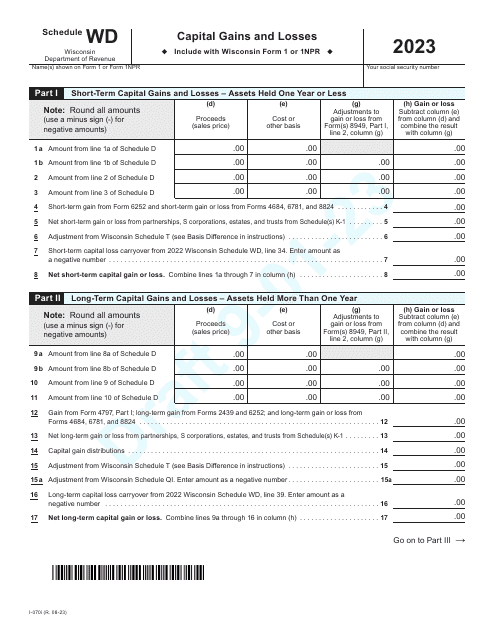

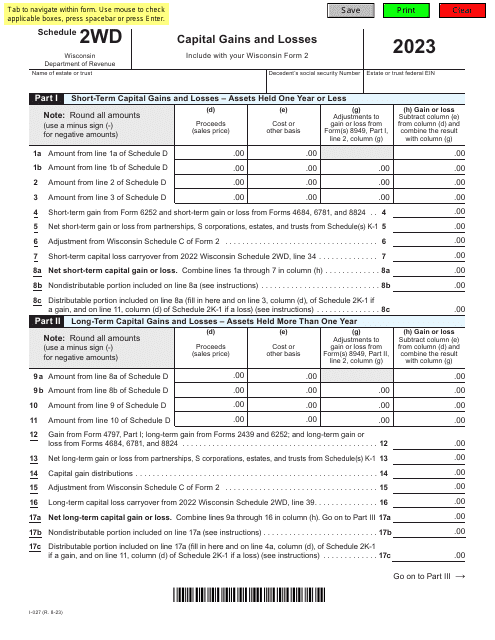

This is a legal document used to report exchanges and sales of capital assets, both long- and short-term capital gains and losses, to the IRS.

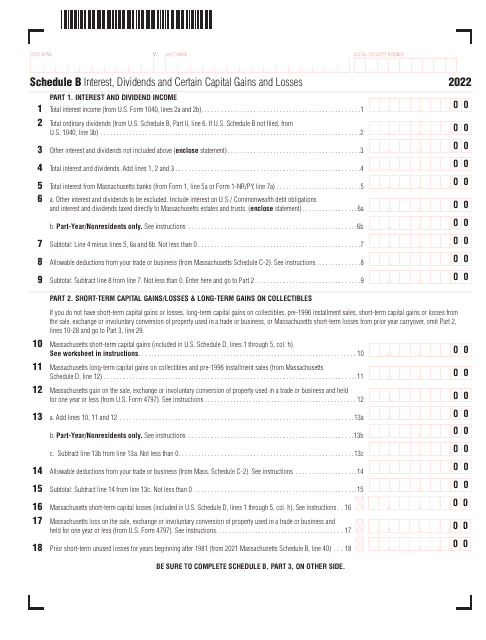

This document is used for reporting interest, dividends, and certain capital gains and losses in the state of Massachusetts.

This form is used for reporting capital gains or losses in Canada. It is a large print version of Schedule 3.