Schedule Se Templates

If you're self-employed or have a side business, understanding and correctly filing your self-employment taxes is crucial. The Schedule SE, also known as Schedule SE for self-employment tax, is a collection of documents provided by the IRS that guides individuals through the process of calculating and reporting their self-employment tax.

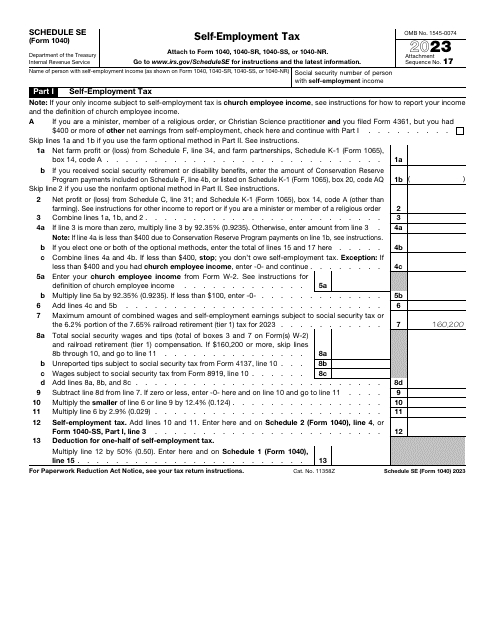

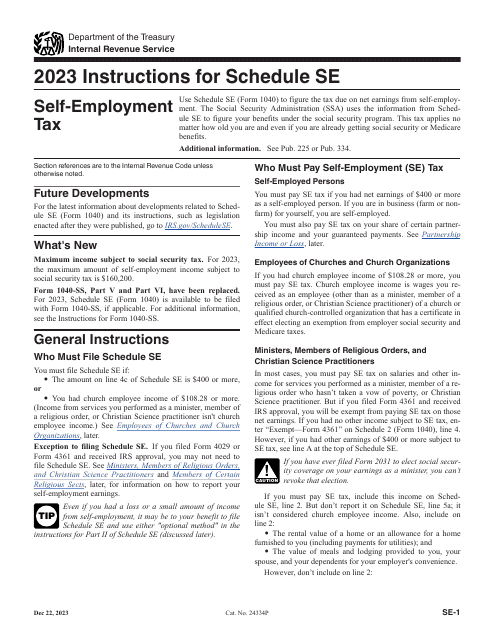

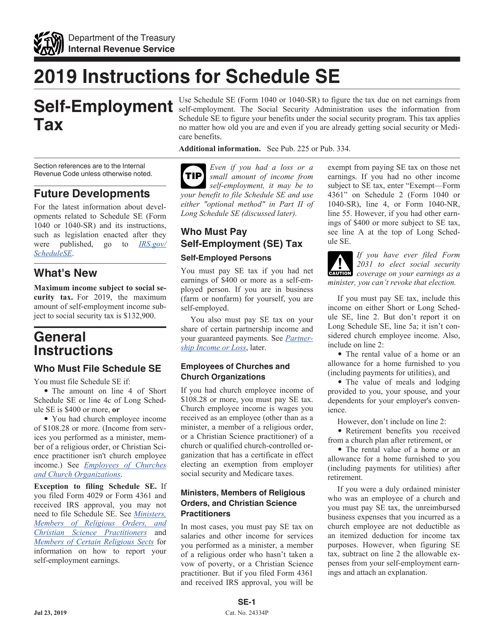

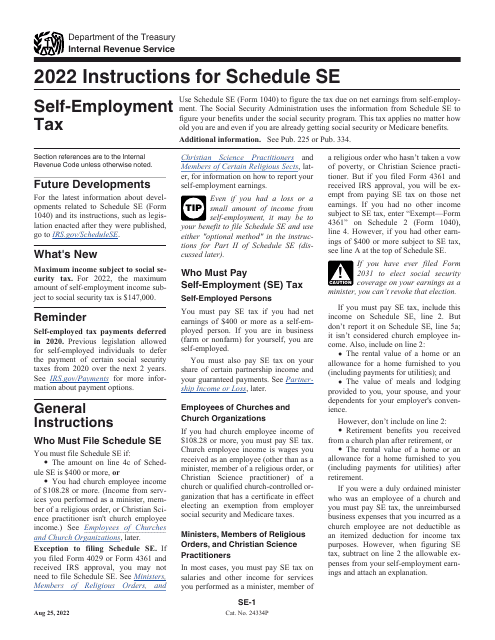

These documents include the IRS Form 1040 Schedule SE Self-employment Tax and its corresponding instructions, which outline the specific calculations and reporting requirements for self-employment tax. The Schedule SE helps individuals determine their self-employment tax liability based on their net earnings from self-employment.

By using the Schedule SE, individuals can accurately report their self-employment income and ensure compliance with tax laws. This collection of documents provides step-by-step instructions and helpful guidance to assist taxpayers in properly calculating and reporting their self-employment tax.

Understanding and completing the Schedule SE correctly is essential to avoid potential penalties or overpaying taxes. It is advised to consult these documents and follow the instructions carefully to ensure accurate reporting and to take advantage of any eligible deductions or credits.

Whether you're new to self-employment or have been running your own business for some time, the Schedule SE documents are an invaluable resource for navigating the complexities of self-employment tax. Be sure to familiarize yourself with these documents to stay compliant and make the most of your self-employment income.

Documents:

10

This is an IRS form that contains the breakdown of the self-employment tax the taxpayer figures out after analyzing their net earnings.

This document provides instructions for filling out and filing IRS Form 1040 and 1040-SR Schedule SE, which are used to calculate and report self-employment taxes. It includes step-by-step guidance on how to report income, deductions, and calculate the amount of self-employment tax owed.

This document provides instructions for filling out Schedule SE, which is used to calculate and report self-employment tax. It covers step-by-step guidance on how to accurately complete this form.