Apportionment Percentage Templates

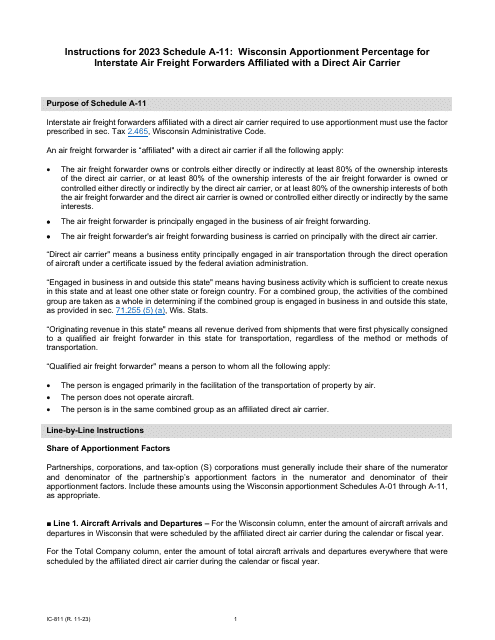

Are you looking for guidance on determining the apportionment percentage for your business? Look no further, as we have comprehensive resources available to help you navigate this process with ease. Whether you are an interstate financial institution, telecommunications company, air carrier, or pipeline company, our instructions and forms are tailored to meet your specific needs.

Our apportionment percentage documents provide step-by-step instructions on how to calculate the portion of your income that is subject to taxation in various states. This vital information ensures that you comply with state regulations and avoid any potential penalties or disputes.

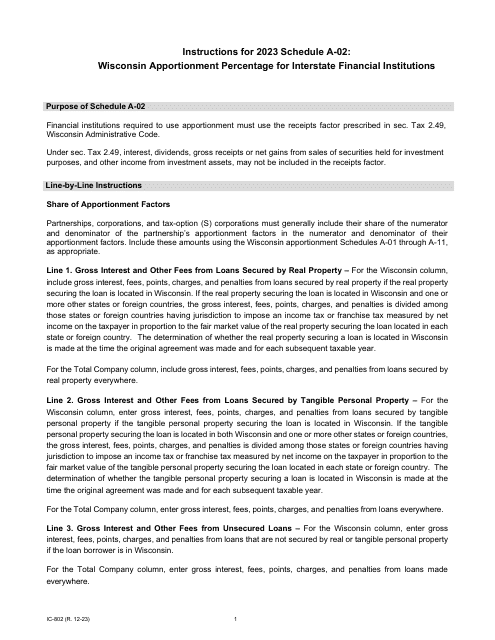

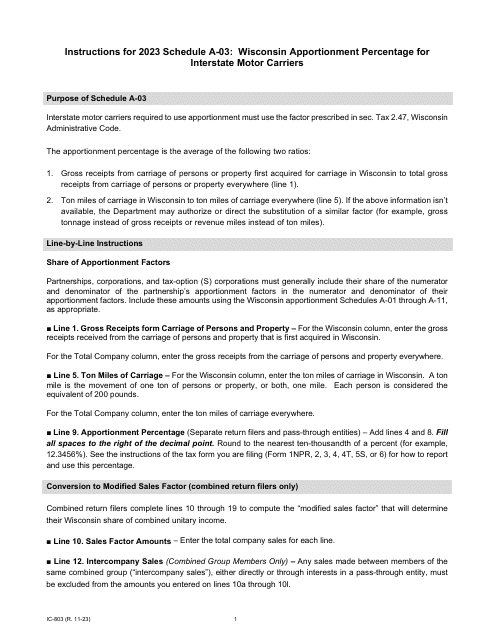

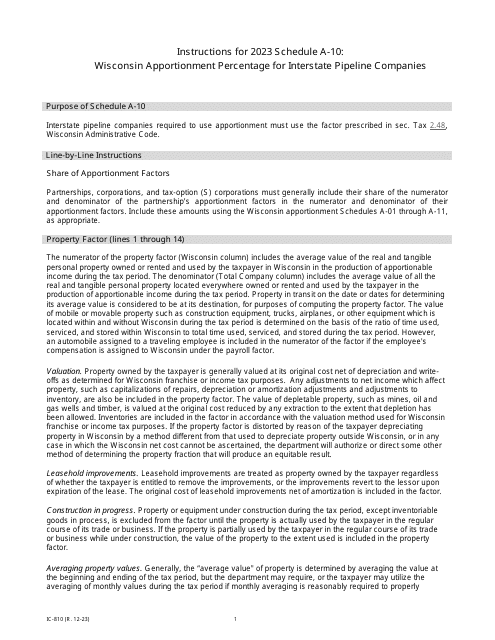

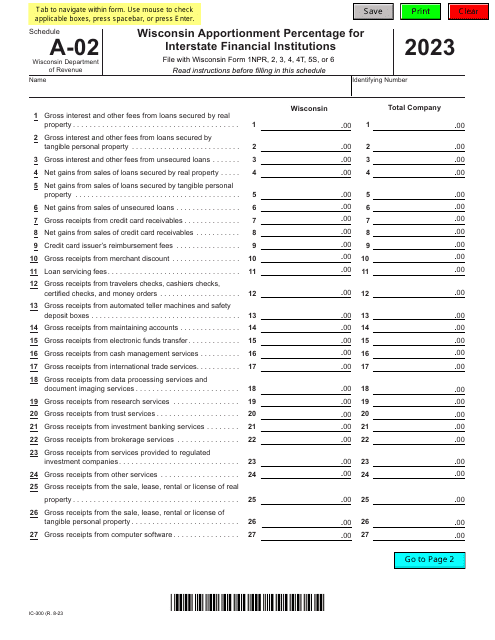

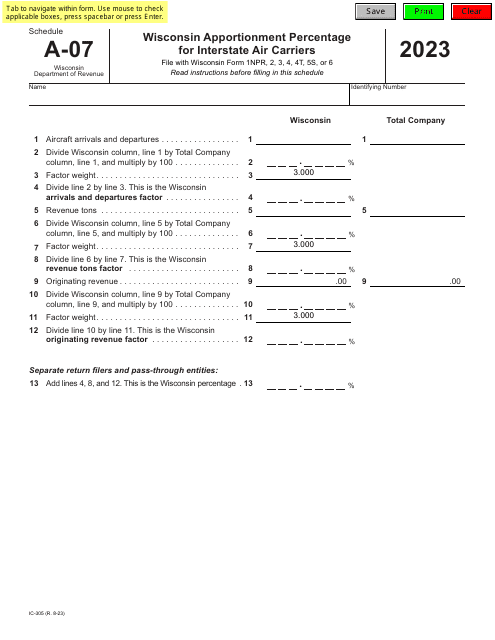

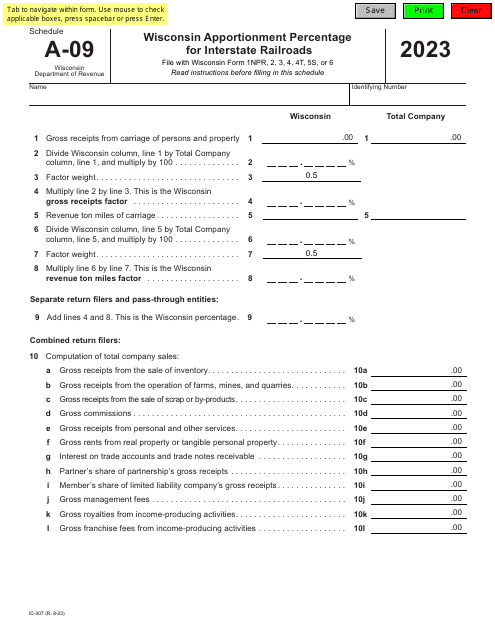

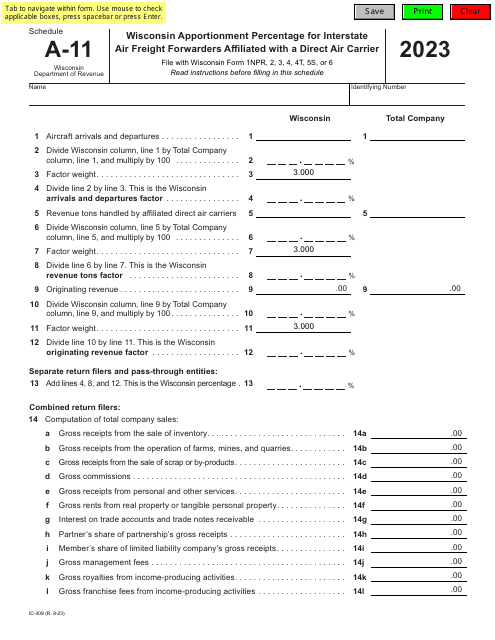

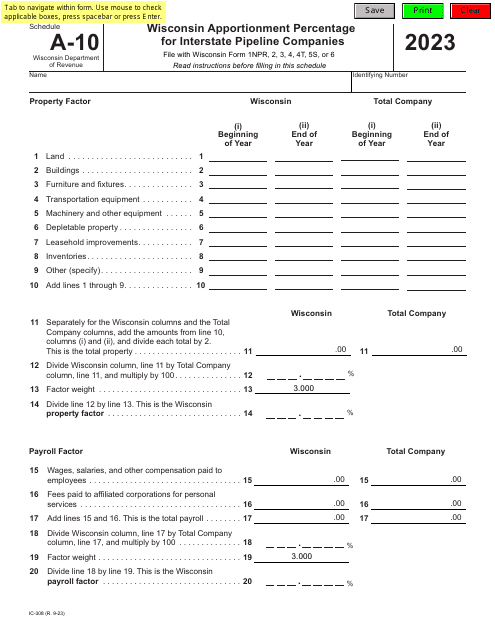

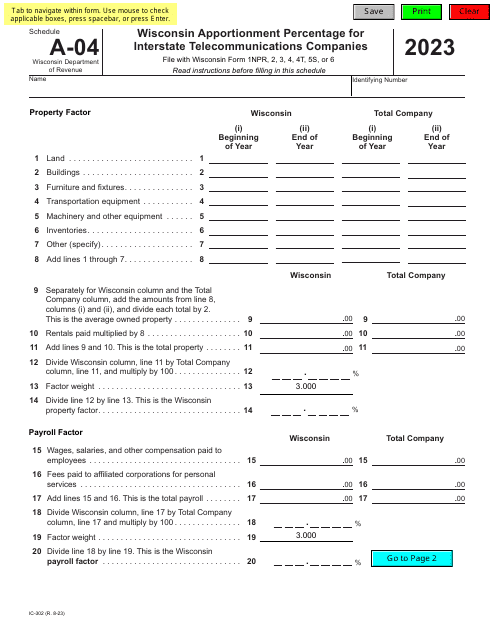

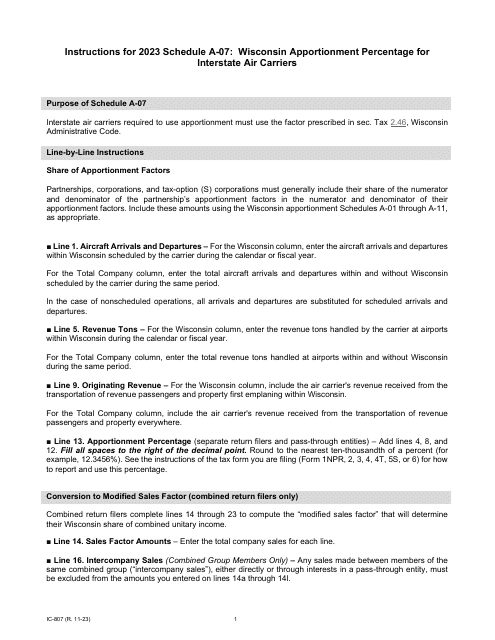

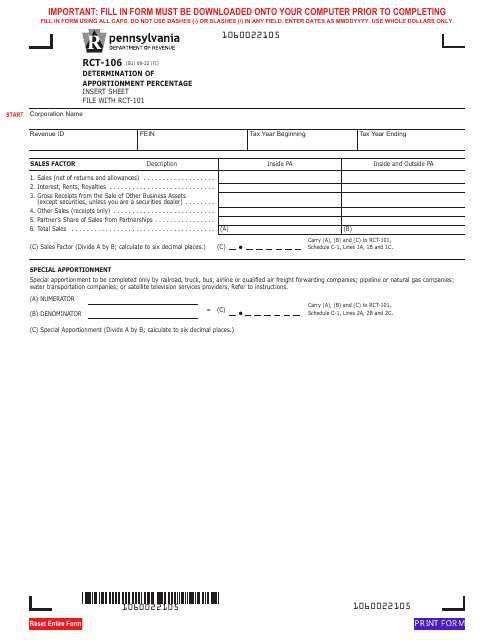

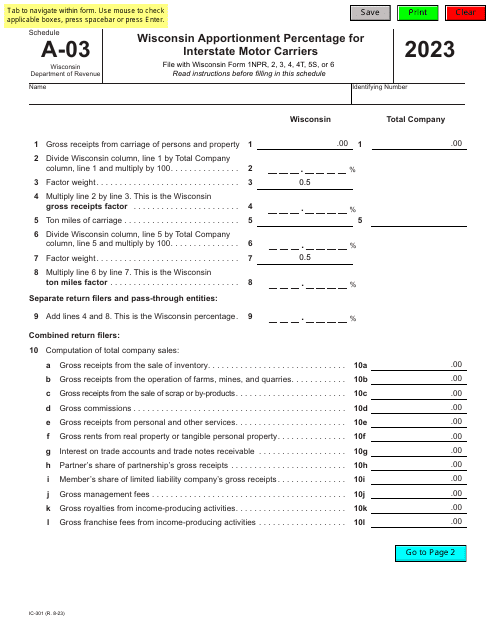

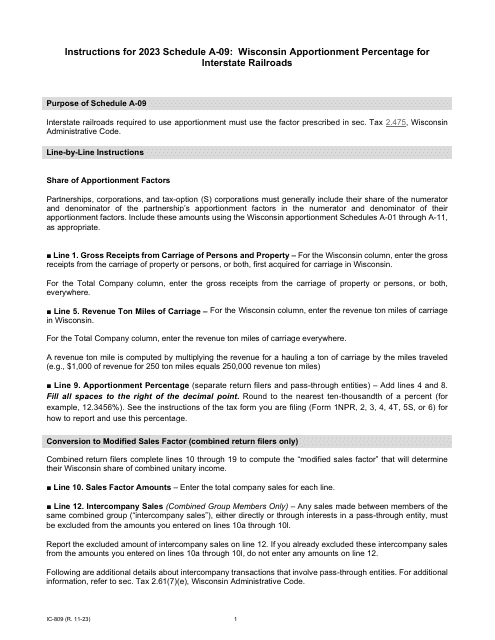

With our user-friendly forms, such as the Form IC-300 Schedule A-02 for Wisconsin Apportionment Percentage for Interstate Financial Institutions, or the Form IC-308 Schedule A-10 for Wisconsin Apportionment Percentage for Interstate Pipeline Companies, you can easily input your financial data and get accurate results in no time.

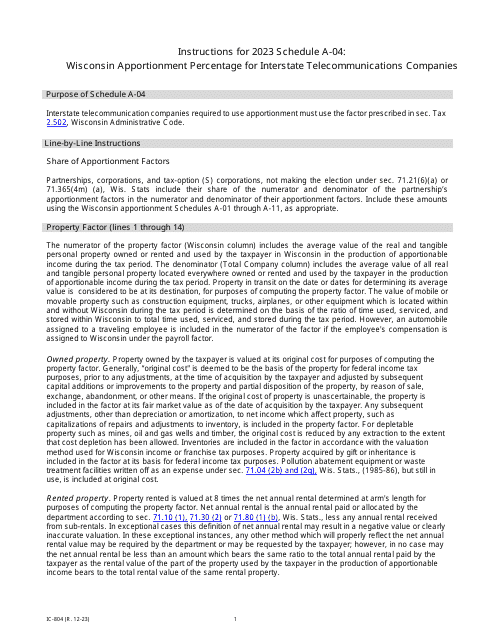

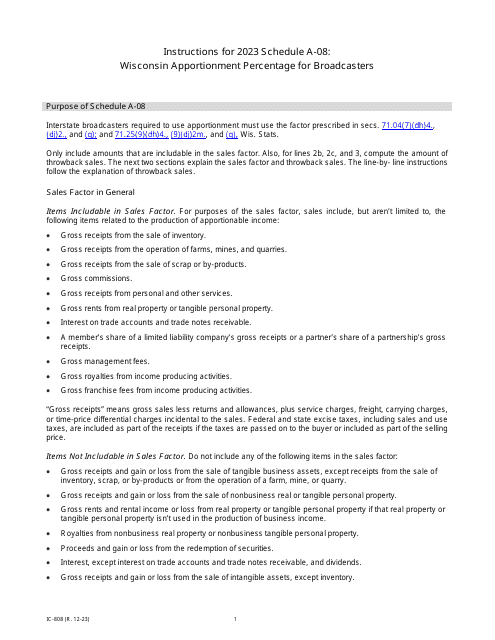

We understand that each business has unique circumstances and requirements. That's why our apportionment percentage resources are designed to cater to specific industries such as telecommunications, air carriers, and more. Our vast collection of documents ensures that you have access to the information you need, regardless of the nature of your business.

So, if you're in need of valuable guidance and practical tools to determine your apportionment percentage, explore our extensive selection of instructions and forms. Our user-friendly resources will empower you to navigate the complexities of apportionment with confidence. Don't leave your tax obligations to chance – rely on our trusted documents to ensure compliance and streamline your financial processes.

Documents:

31