Tax Assessment Appeal Templates

Are you facing issues with your tax assessment? Do you feel that the value assigned to your property or motor vehicle for tax purposes is inaccurate or unfair? Don't worry, we are here to help! Our tax assessment appeal services provide you with the necessary tools and guidance to challenge and appeal your tax assessment.

Our team of experts has years of experience assisting individuals in disputing their tax assessments. We understand the complexity of the process and the importance of presenting a compelling case to the authorities. Our goal is to help you navigate through the legal procedures and increase your chances of a successful appeal.

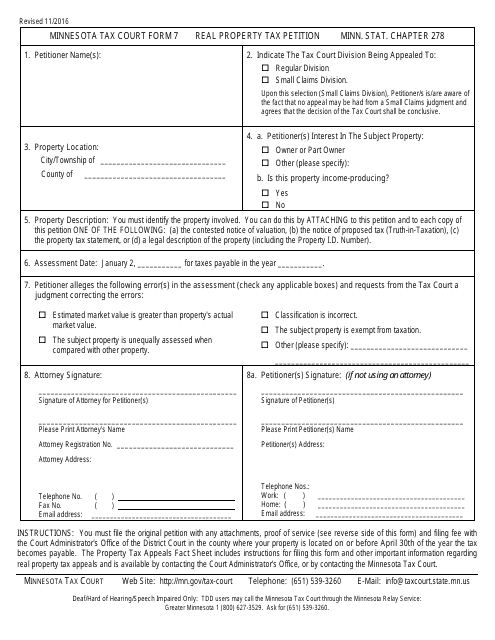

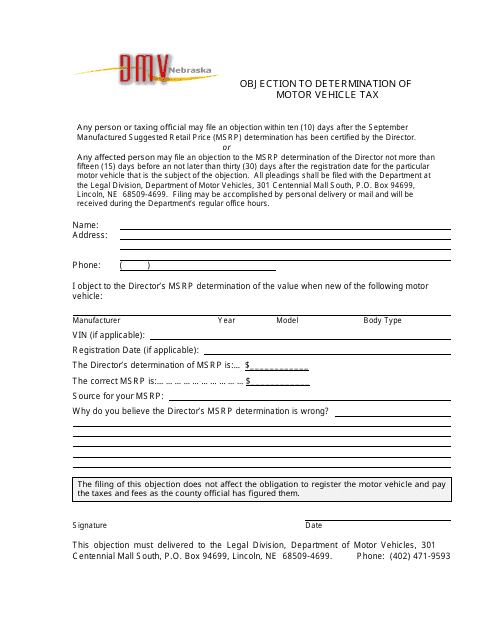

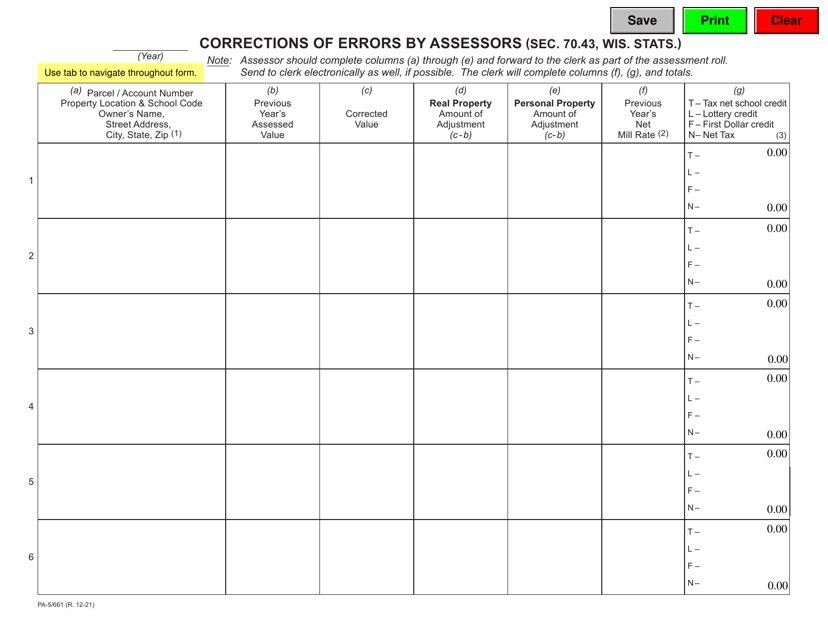

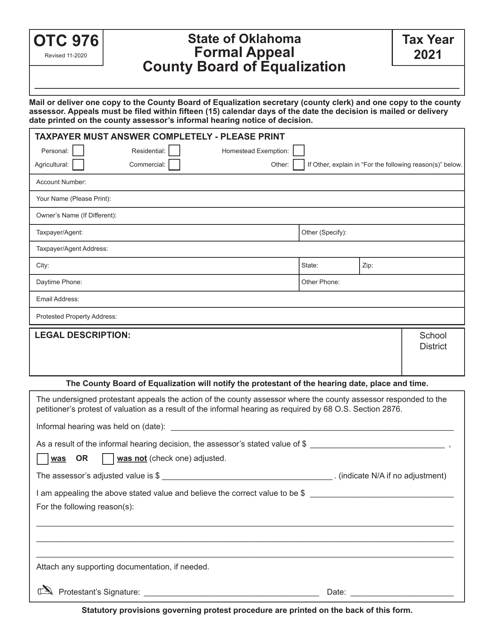

With our tax assessment appeal services, you gain access to a wide range of resources, including relevant forms and applications specific to your state. Whether it's the Form 7 Real PropertyTax Petition in Minnesota, or the Objection to Determination of Motor Vehicle Tax in Nebraska, we have you covered. We also provide assistance with corrections of errors made by assessors through forms like PA-5/661 in Wisconsin and OTC Form 976 Formal Appeal County Board of Equalization in Oklahoma.

Our services extend beyond individual cases to cover various types of properties and locations. For example, we can assist you in filing a Real Property Tax Abatement Application in Washington, D.C. These documents play a vital role in initiating the appeal process and ensuring that your case receives the attention it deserves.

Appealing your tax assessment is your right as a taxpayer, and we are here to support you every step of the way. Our user-friendly platform and expert guidance make the process as seamless as possible. Don't let an inaccurate or unfair tax assessment burden you any longer - take action and exercise your right to appeal. Contact us today to get started on your tax assessment appeal journey.

Documents:

7

This form is used for petitioning a real property tax assessment in the state of Minnesota.

This document is used to object to the determination of motor vehicle tax in the state of Nebraska. It allows individuals to challenge the calculation or assessment of their tax liability for their motor vehicle.

This Form is used for applying for a tax abatement on real property in Washington, D.C.

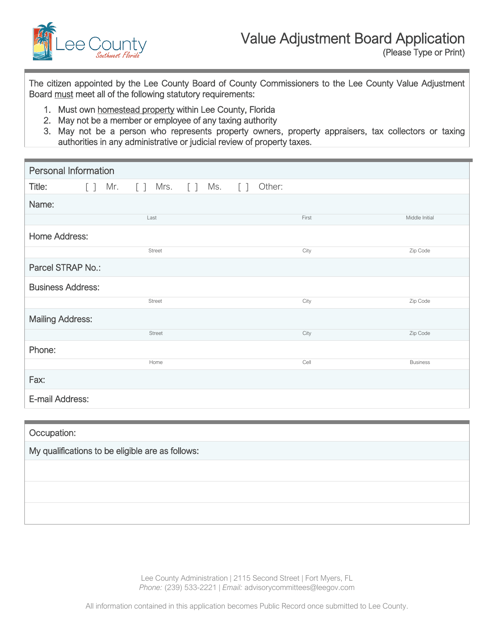

This document is for applying to the Value Adjustment Board in Lee County, Florida.

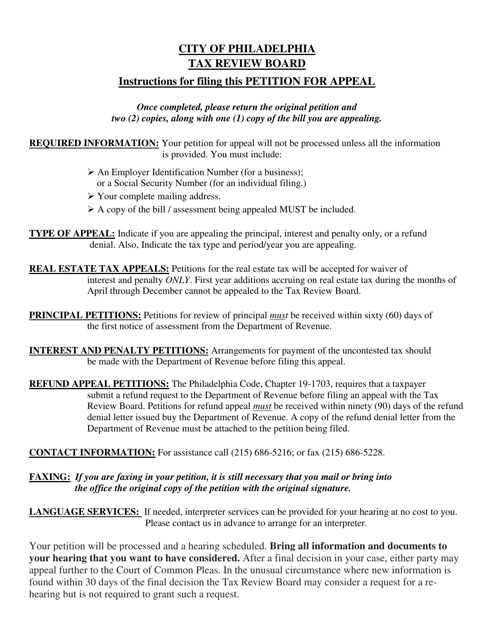

This document is for individuals in Philadelphia, Pennsylvania who wish to appeal a tax assessment made by the Tax Review Board. It provides instructions on how to complete a petition for appeal to challenge the assessment.