Moist Snuff Templates

Moist Snuff: A Comprehensive Resource for All Things Tobacco

Welcome to our informational webpage dedicated to the world of moist snuff, also known as dipping tobacco or simply snuff. Here, you will find a wealth of knowledge and resources pertaining to this popular smokeless tobacco product.

Moist snuff is a finely cut tobacco product that is moistened and typically placed between the cheek and gum or lower lip for extended periods. It provides a convenient and discreet alternative to traditional smoking while still delivering the desired nicotine fix. Our collection of documents covers various aspects of moist snuff, including taxation, regulation, and interstate commerce.

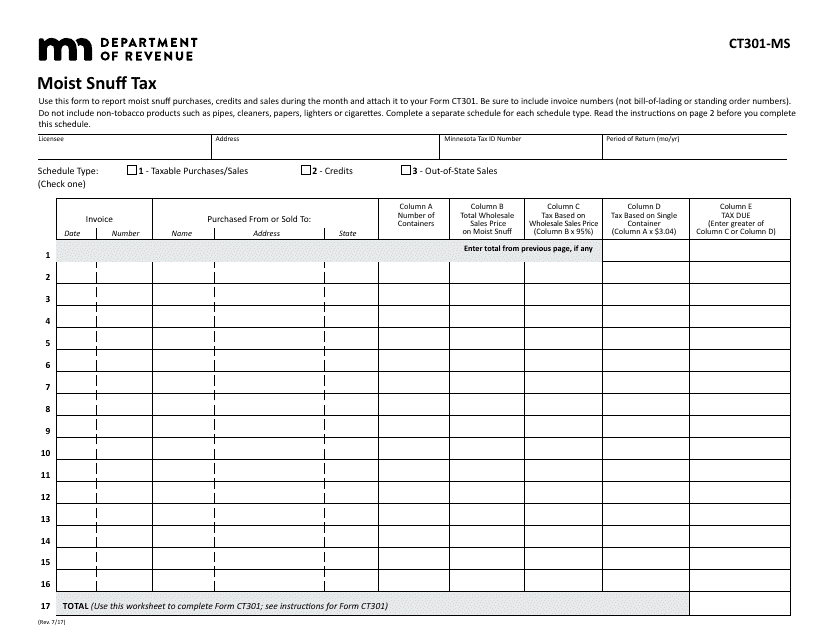

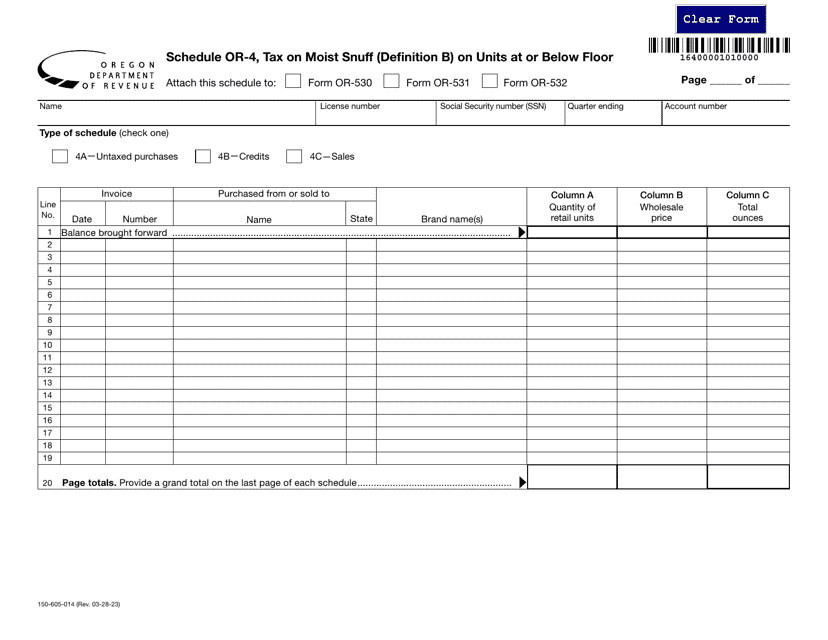

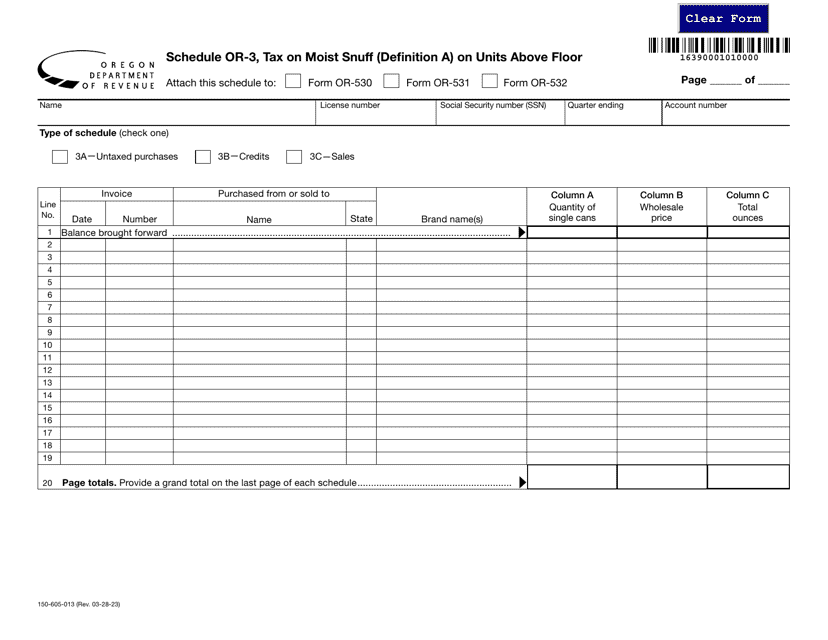

Within our documents, you will find forms specific to different states, such as the Form CT301-MS in Minnesota or the Form 150-605-014 Schedule OR-4 in Oregon, which address the taxation of moist snuff. These forms provide key information for individuals or businesses involved in the sale or distribution of this tobacco product.

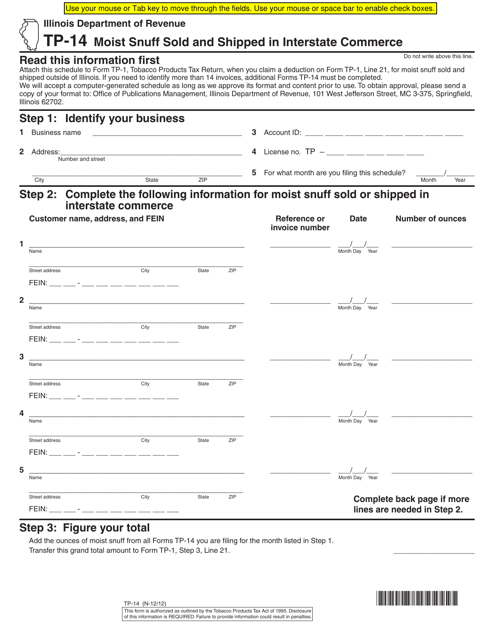

Furthermore, we offer resources like the Form TP-14 from Illinois, which focuses on the sale and shipment of moist snuff across state lines. This form ensures compliance with interstate commerce regulations and streamlines the documentation process for those engaged in this aspect of the moist snuff industry.

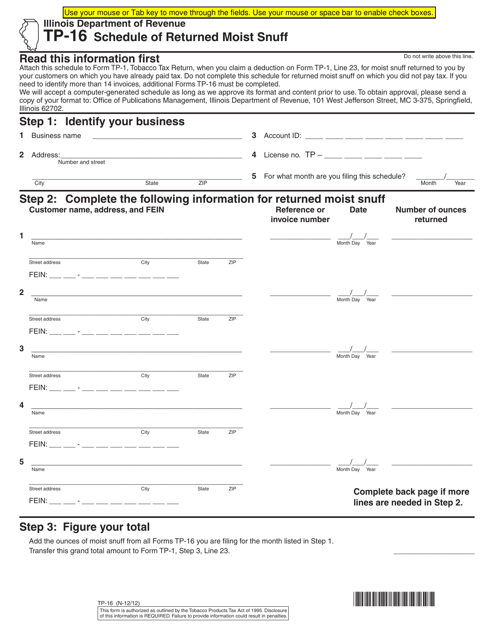

For those who handle returned or unsold moist snuff, our Schedule TP-16 from Illinois provides a clear framework for reporting and tracking these transactions. This document assists in maintaining accurate inventory records and facilitates proper reporting for tax purposes.

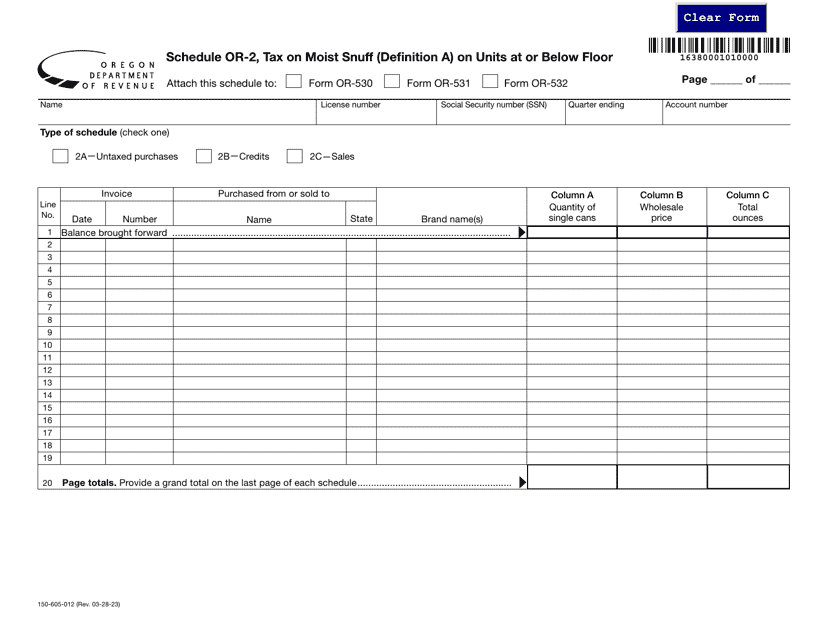

In addition to the aforementioned forms, we have the Form 150-605-012 Schedule OR-2 from Oregon that specifically addresses the taxation of moist snuff units at or below floor level. This document takes into account certain definitions and exemptions related to moist snuff taxation, ensuring adherence to state-specific regulations.

Our collection of documents pertaining to moist snuff serves as a valuable resource for individuals, businesses, and regulatory bodies involved in the tobacco industry. From tax forms to reporting schedules, our comprehensive compilation aims to provide clarity and assist with compliance.

Whether you are a moist snuff retailer, distributor, or simply someone interested in learning more about this smokeless tobacco product, our webpage is a one-stop destination that covers a wide range of topics within the moist snuff realm. Explore our extensive documents collection today and discover valuable insights into the world of moist snuff, all conveniently at your fingertips.

(Note: The documents mentioned in this text are fictional and are used for illustrative purposes only.)

Documents:

13

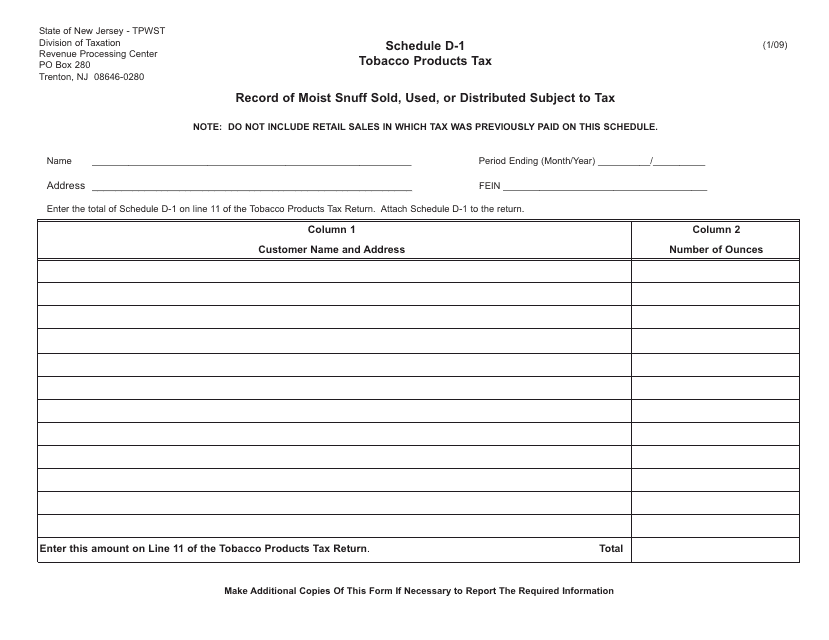

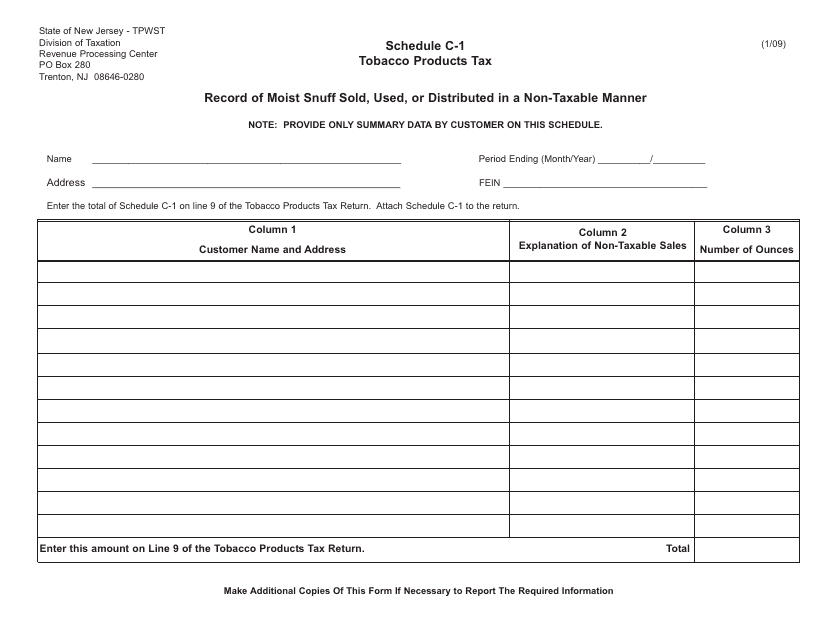

This document is used by businesses in New Jersey to keep a record of the sales, usage, or distribution of moist snuff that is subject to tax.

This form is used for reporting and paying the moist snuff tax in the state of Minnesota. It is required for businesses that sell moist snuff products to accurately calculate and remit the appropriate tax amount.

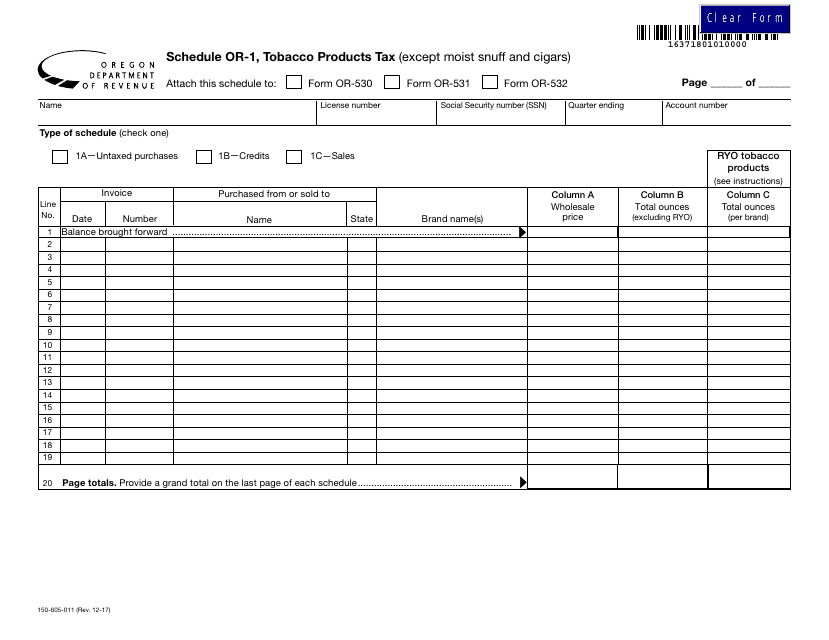

This Form is used for reporting and paying taxes on tobacco products, excluding moist snuff and cigars, in the state of Oregon.

Form 150-605-014 Schedule OR-4 Tax on Moist Snuff (Definition B) on Units at or Below Floor - Oregon

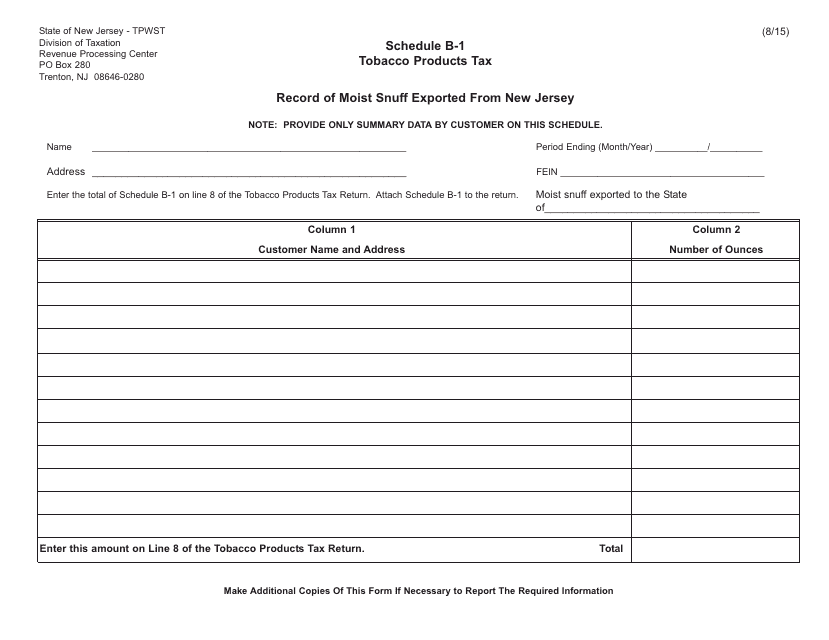

This document is used for keeping a record of moist snuff that is exported from New Jersey.

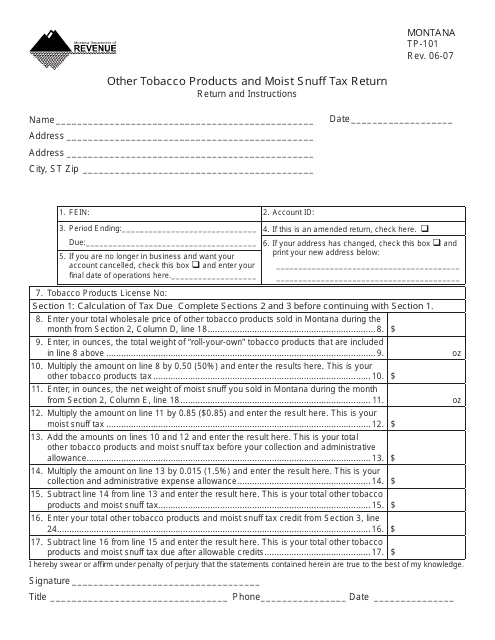

This form is used for reporting and paying taxes on other tobacco products and moist snuff in the state of Montana.

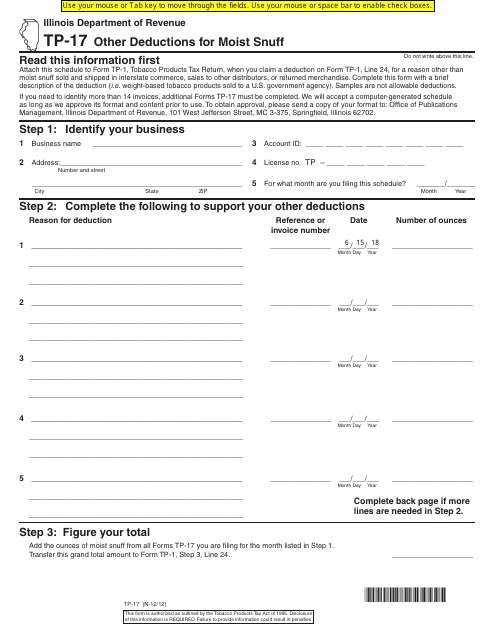

This Form is used for reporting other deductions related to the purchase of moist snuff in the state of Illinois.

This form is used for reporting the sale and shipment of moist snuff in Illinois that crosses state lines. It ensures compliance with interstate commerce regulations.

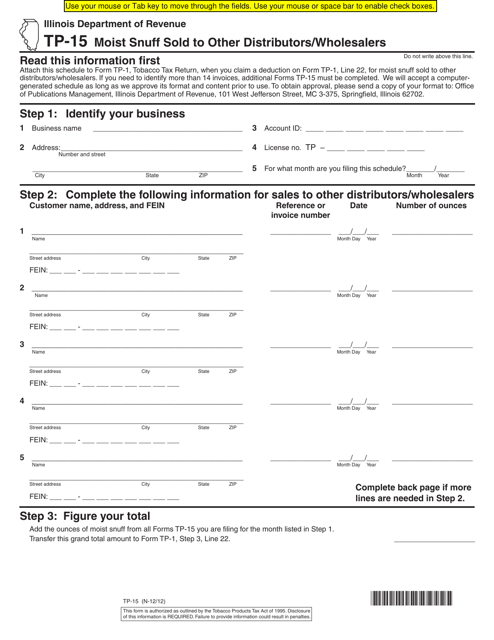

This form is used for reporting the sale of moist snuff products by distributors/wholesalers to other distributors/wholesalers in the state of Illinois.

This document is used to report the schedule of returned moist snuff in Illinois.

Form 150-605-012 Schedule OR-2 Tax on Moist Snuff (Definition a) on Units at or Below Floor - Oregon

This document is used to keep a record of the sales, usage, or distribution of moist snuff in a non-taxable manner in the state of New Jersey.