Mortgage Interest Templates

Are you a homeowner looking for information about mortgage interest? Look no further! Our comprehensive collection of documents on mortgage interest is here to help. From tax forms to credit applications, we have everything you need to navigate the world of mortgage interest.

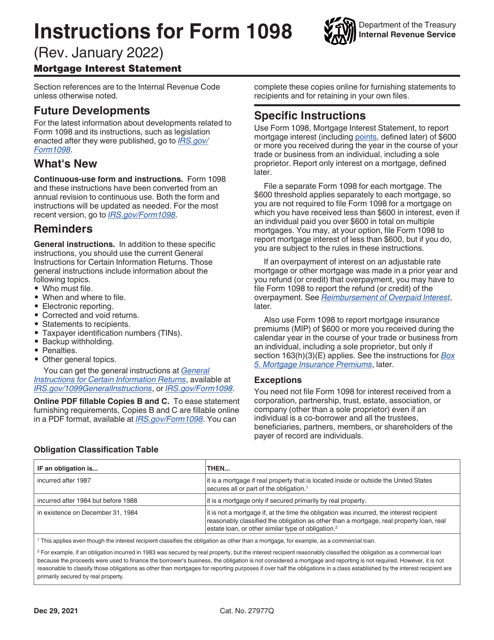

Our collection includes essential documents like the IRS Form 1098 Mortgage Interest Statement. This form is crucial for both homeowners and lenders as it provides a detailed breakdown of the mortgage interest paid during the tax year. With this form, you can accurately report your deductible mortgage interest on your tax return.

If you're unsure about how tofill out the IRS Form 1098, don't worry! We also provide detailed instructions for this form. Our step-by-step guide will walk you through the process, ensuring that you accurately report your mortgage interest and maximize your potential deductions.

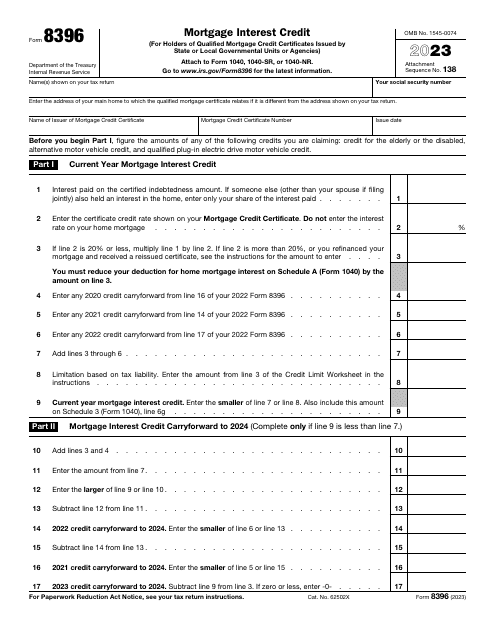

But that's not all. We also offer the IRS Form 8396 Mortgage Interest Credit, specifically designed for holders of qualified mortgage credit certificates issued by state or local governmental units or agencies. This credit can help reduce your overall tax liability, providing additional financial relief for homeowners.

Whether you're a first-time homebuyer or a seasoned homeowner, understanding mortgage interest is essential. Our collection of documents on mortgage interest will equip you with the knowledge and resources you need to make informed decisions about your home finances.

So, don't stress about the complexities of mortgage interest. Explore our collection of documents today and gain the confidence to tackle your mortgage interest obligations.

Documents:

11

This form is used to report a mortgage interest paid by an individual or sole proprietor during a tax year to the government, in order to receive a mortgage interest deduction on the borrower's federal income tax return.

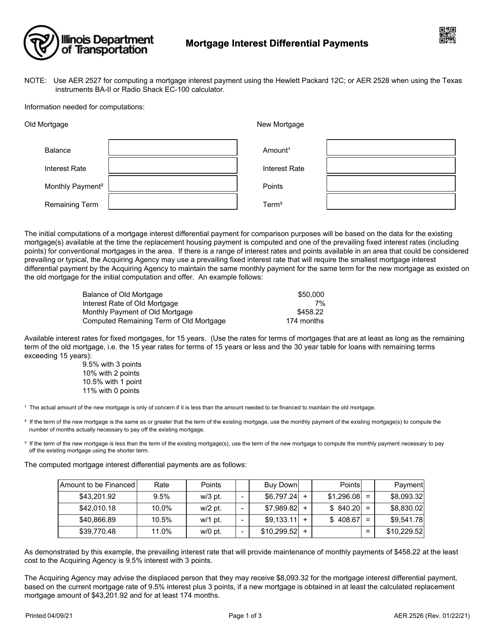

This form is used for reporting mortgage interest differential payments in the state of Illinois.

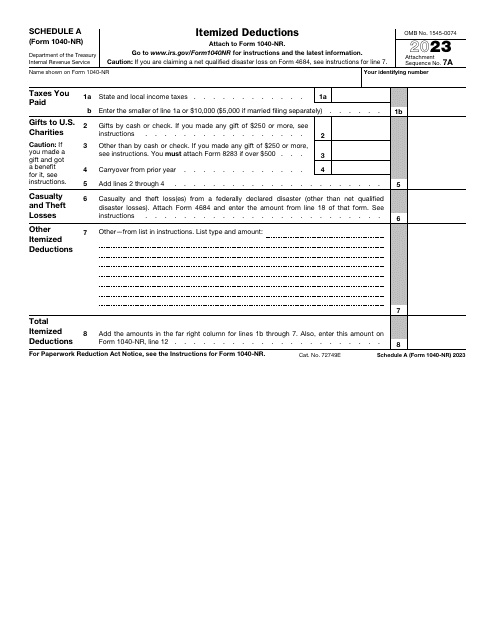

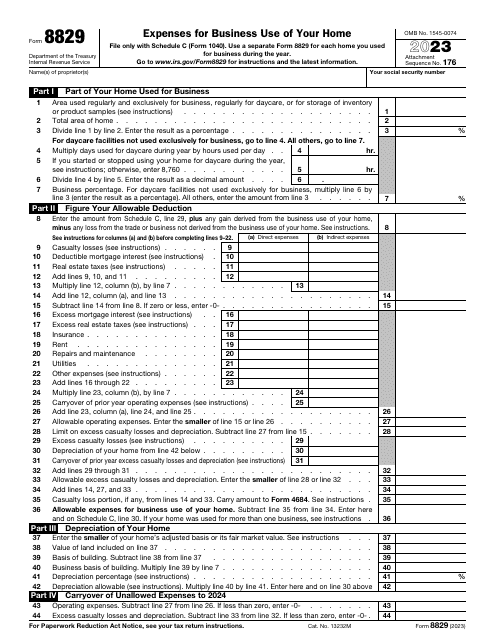

This is an IRS form used by taxpayers who work from home and want to inform tax organizations about the business expenses they wish to deduct from their taxes.

This is a formal document filled out by taxpayers in order to compute the amount of mortgage interest credit over the course of the year and report the information to fiscal authorities.