IRS Regulations Templates

If you're looking for information about IRS regulations, you've come to the right place. Our website provides a comprehensive collection of documents related to the Internal Revenue Service (IRS) regulations. These regulations are an essential resource for individuals and businesses who need to navigate the complexities of the tax system.

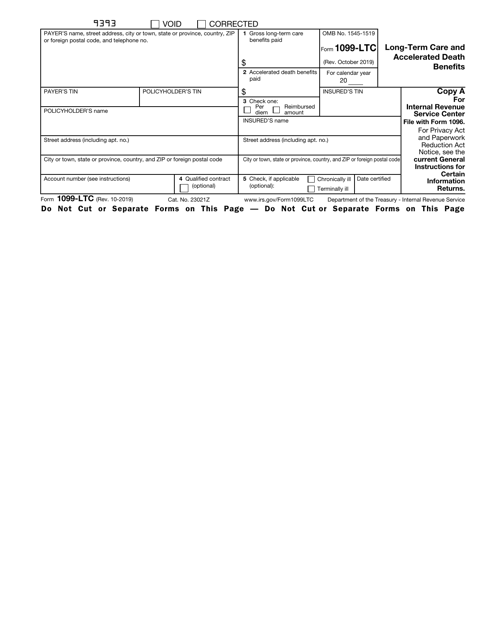

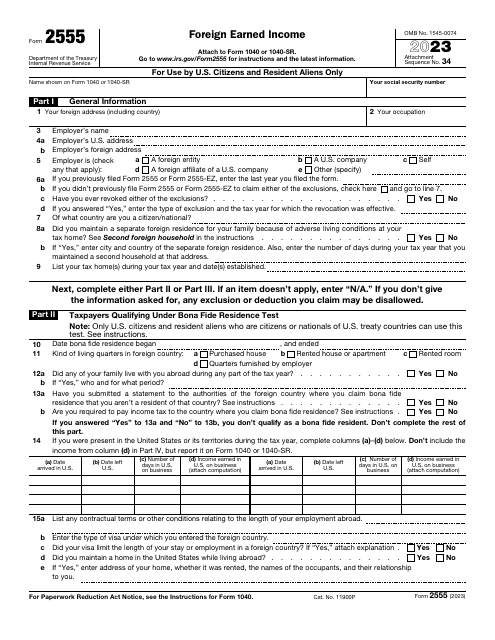

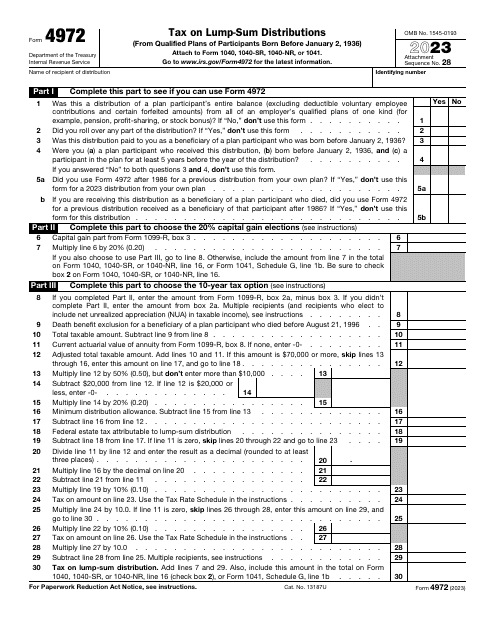

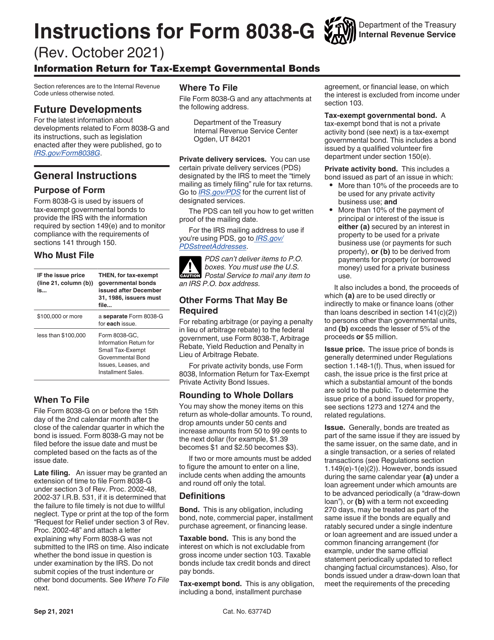

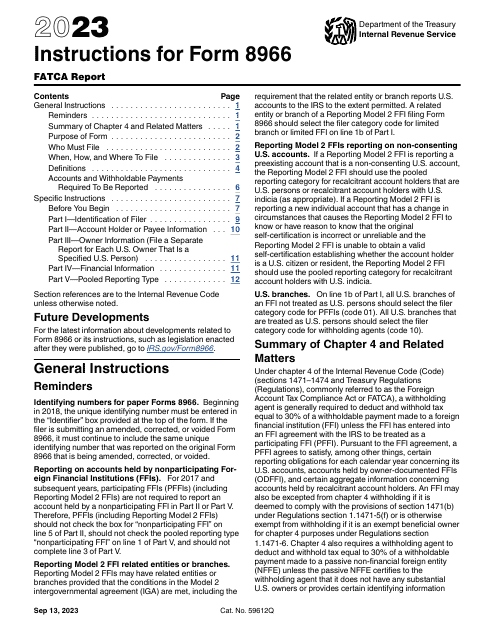

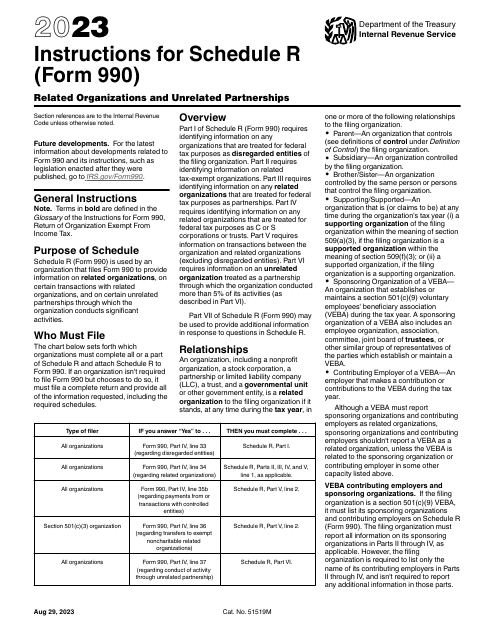

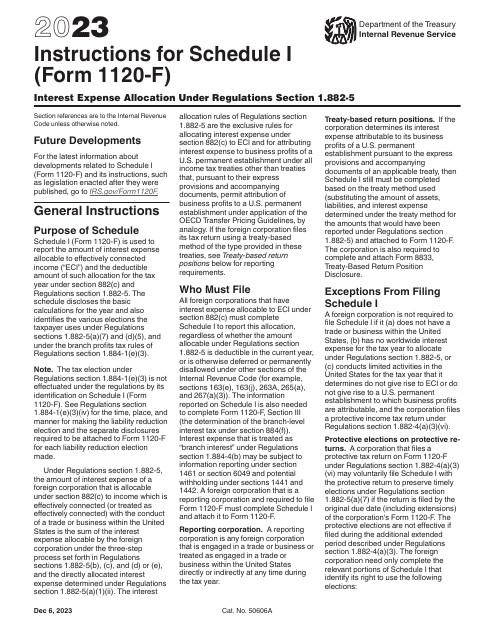

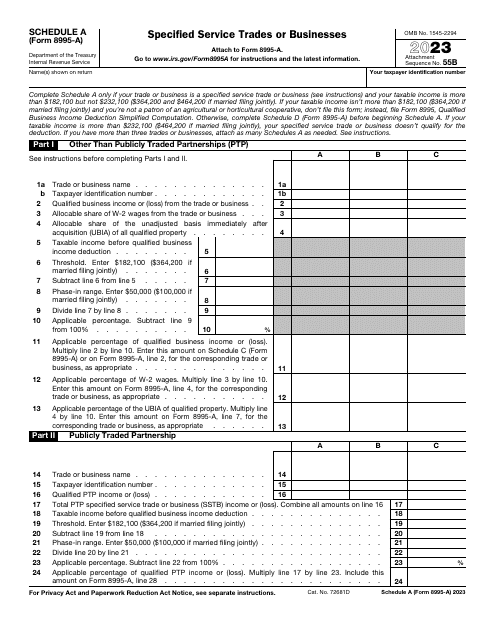

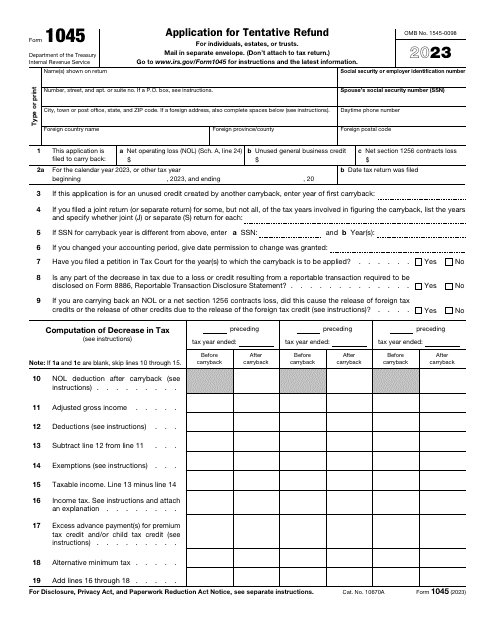

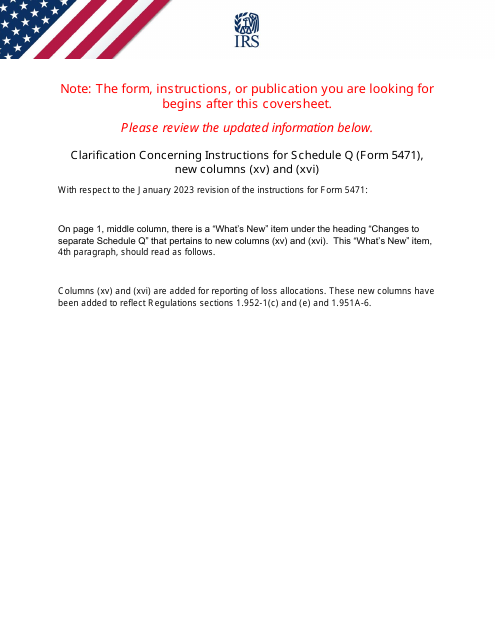

Our extensive collection of IRS regulations covers a wide range of topics, from application for recognition of exemption under Section 521 of the Internal Revenue Code to tax on lump-sum distributions. We also provide detailed instructions for various forms, such as IRS Form 1120-F Schedule S for the exclusion of income from the international operation of ships or aircraft under Section 883, and IRS Form 5498-ESA Coverdell ESA contribution information.

Whether you're a taxpayer, tax professional, or simply curious about the intricacies of the tax system, our collection of IRS regulations is a valuable resource. Our easy-to-navigate website allows you to access the information you need quickly and efficiently. Stay up-to-date with the latest changes and updates to IRS regulations and make informed decisions when it comes to your tax obligations.

Explore our collection of IRS regulations today and gain a deeper understanding of the tax laws that affect you. With our user-friendly interface and comprehensive documentation, you'll find the information you need to navigate the IRS regulations confidently. Stay compliant, minimize your tax liability, and make the most of the available exemptions and deductions. Start exploring our IRS regulations collection now and take control of your tax planning and compliance.

Documents:

96

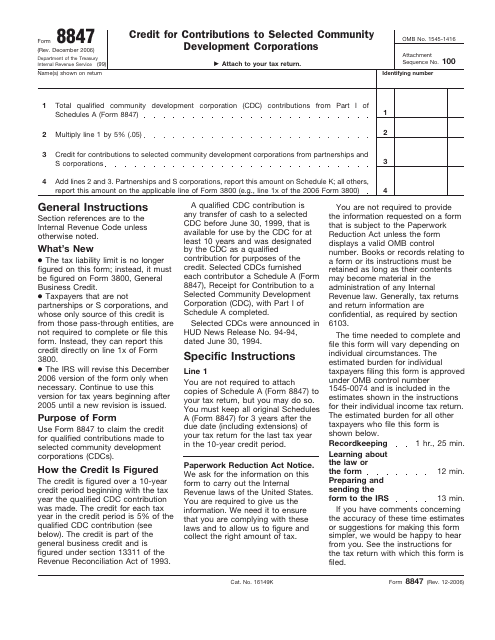

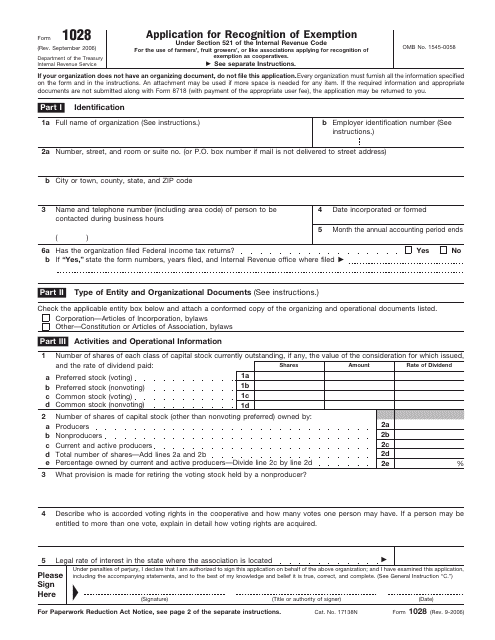

This form is used for applying recognition of exemption under Section 521 of the Internal Revenue Code.

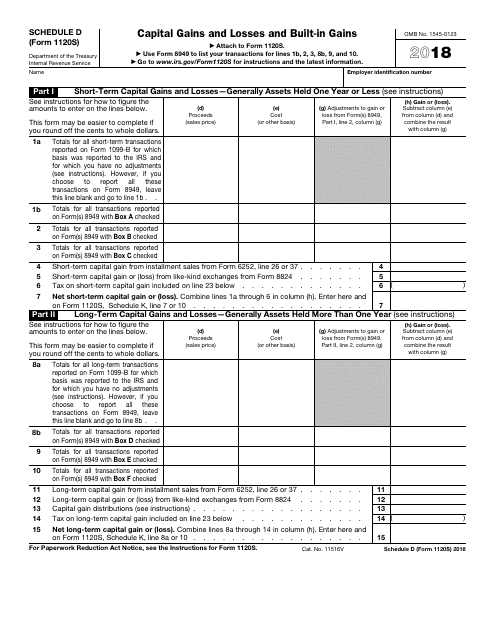

This document provides a schedule for reporting capital gains and losses, as well as built-in gains, on IRS Form 1120S. It is used by S corporations to report these financial transactions to the IRS.

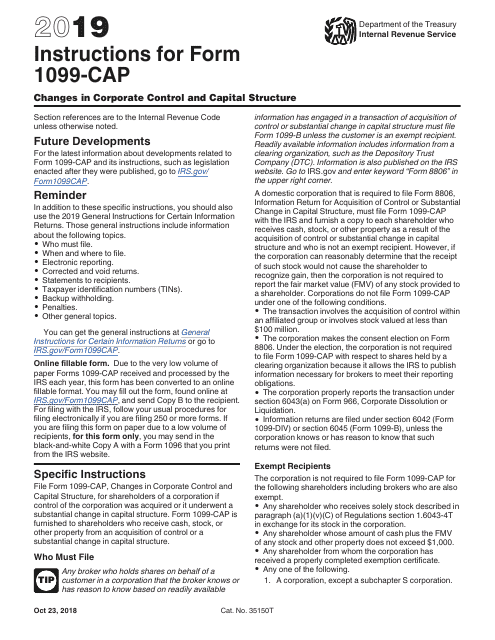

This type of document provides instructions for filling out IRS Form 1099-CAP, which is used to report changes in corporate control and capital structure.

This Form is used for reporting payments from qualified education programs for tax purposes.

This form is used for submitting a consent plan and apportionment schedule for a controlled group for tax purposes. It provides instructions on how to allocate and apportion income, deductions, and taxes among the members of the controlled group.

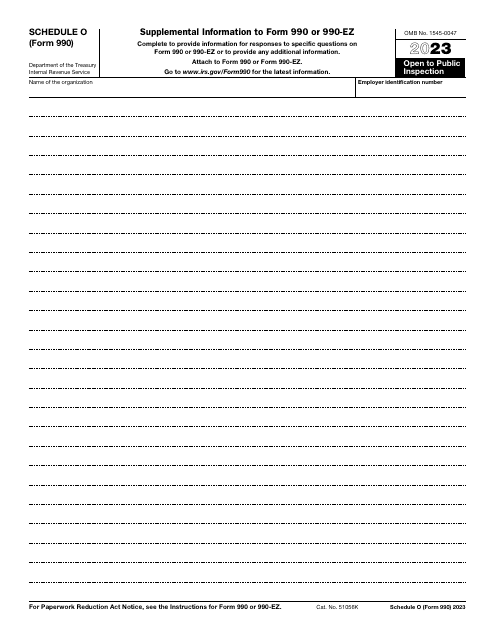

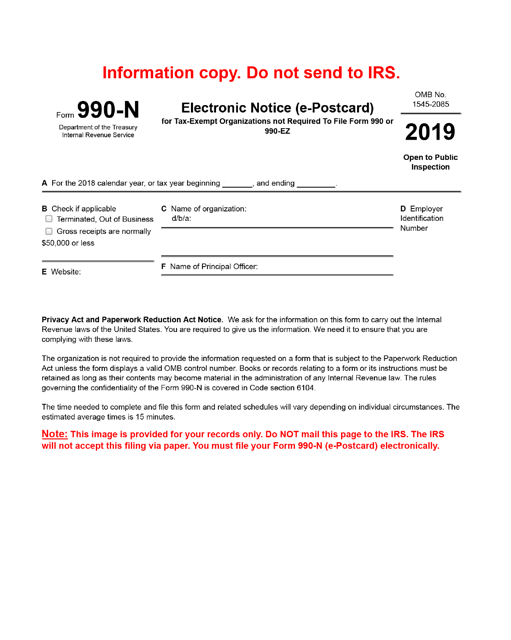

This is a fiscal document used by nonprofit organizations to report the main specifics of their operations to tax authorities.

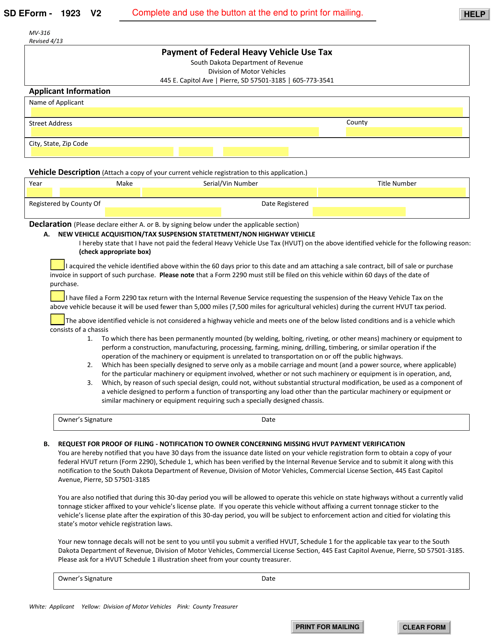

This form is used for paying the federal heavy vehicle use tax in South Dakota.

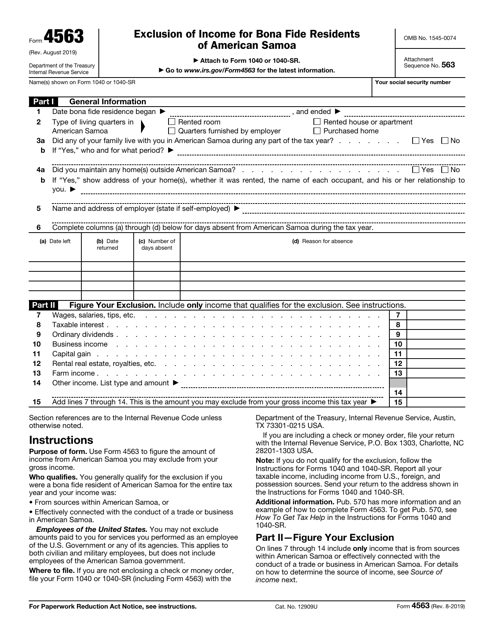

This is a tax form people permanently residing in American Samoa can use to exclude certain income from their gross income.

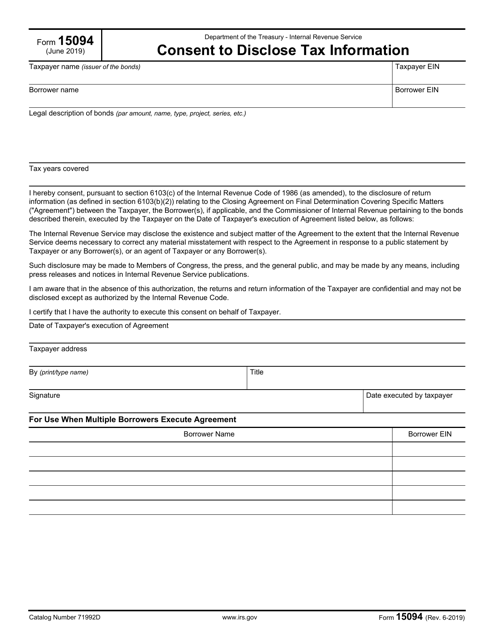

This form is used for giving consent to the IRS to disclose your tax information to another party.

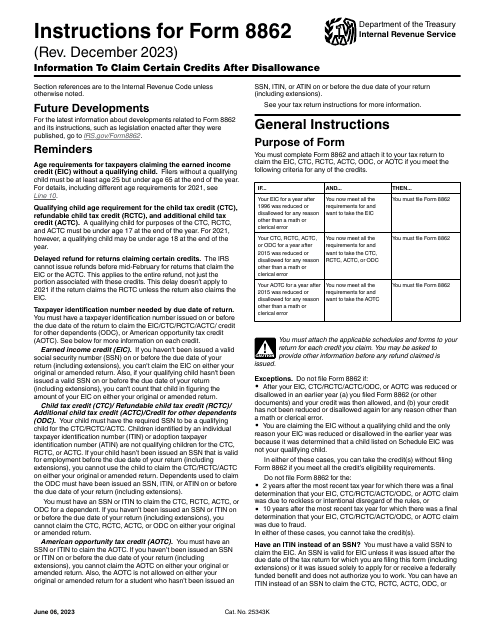

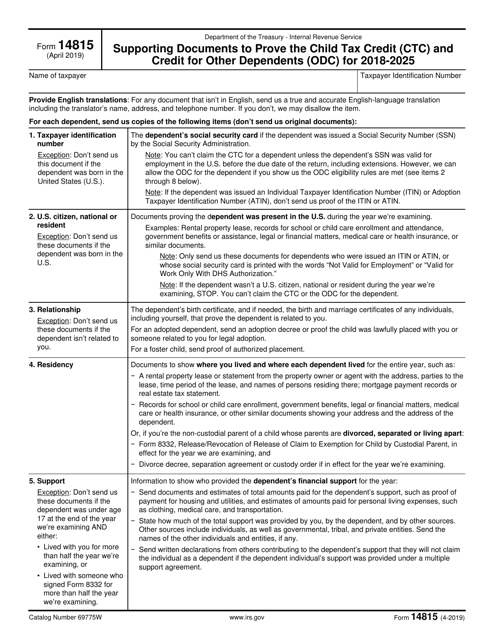

This Form is used for submitting supporting documents to prove eligibility for the Child Tax Credit (CTC) and Credit for Other Dependents (ODC) to the IRS.

This form is used for applying for a determination from the IRS for an employee benefit plan.

This is a supplementary IRS form used by taxpayers in order to claim a business deduction after reporting your business income.