Charitable Programs Templates

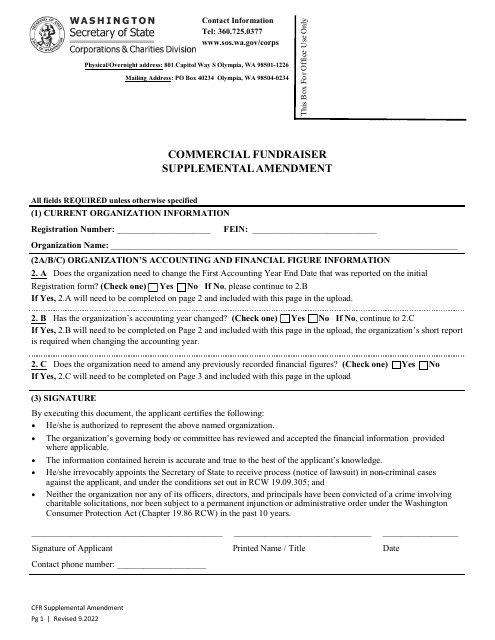

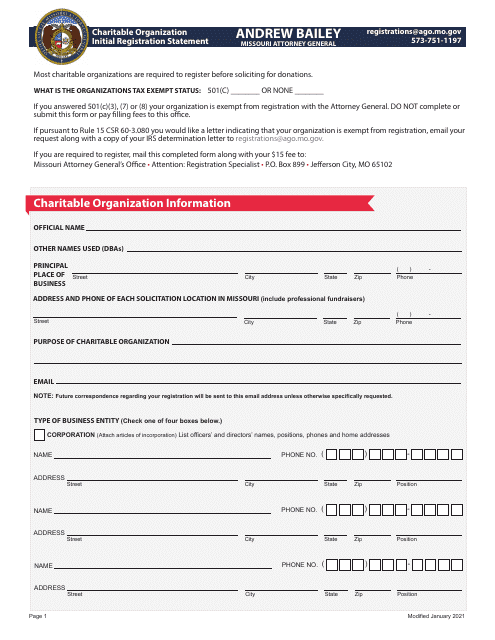

Looking to make a positive impact in your community? Explore our comprehensive collection of resources on charitable programs. Our diverse selection of documents includes everything you need to know about forming, registering, and operating charitable organizations. From required registration forms, such as the Charitable Organization Initial Registration Statement, to important filings, like the Commercial Fundraiser Supplemental Amendment, our documents provide valuable guidance for charitable activities.

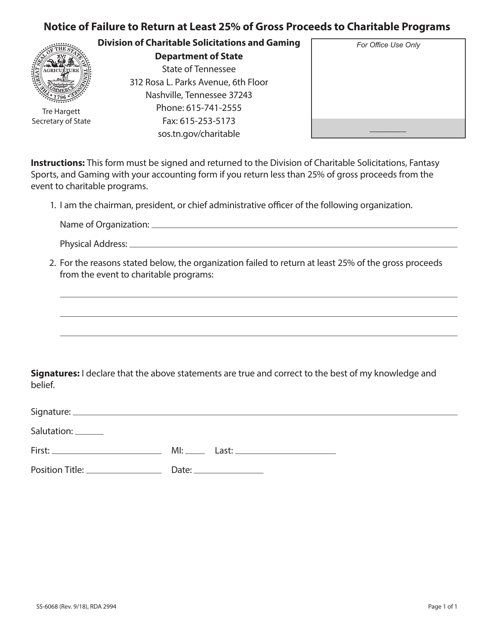

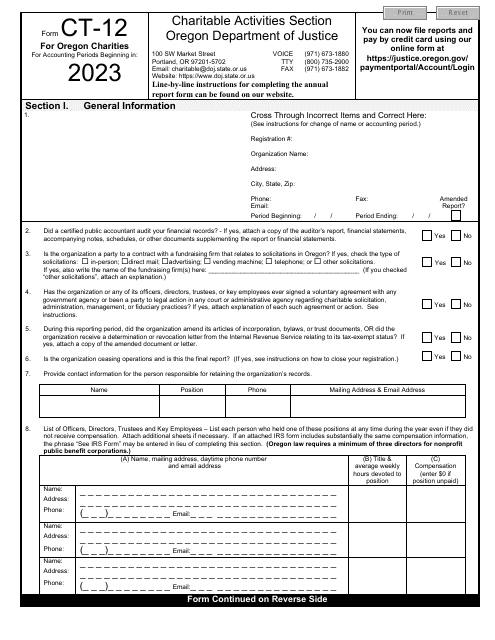

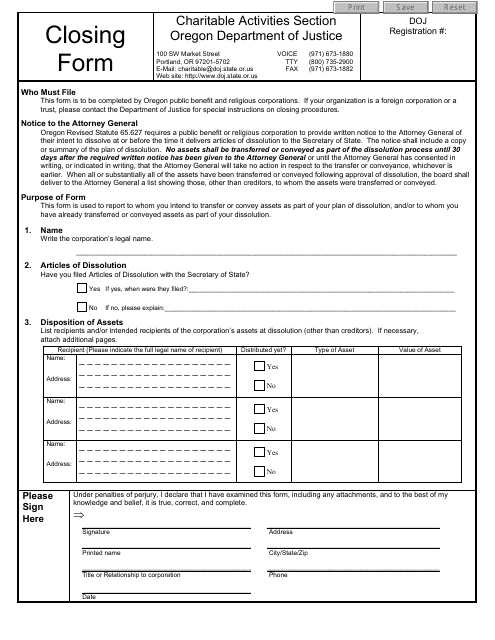

Don't miss our state-specific forms, like the Form SS-6068 Notice of Failure to Return at Least 25% of Gross Proceeds to Charitable Programs in Tennessee, and the Form CT-12 Charitable Activities Form for Oregon Charities. These documents cater to the unique regulations and requirements of each jurisdiction, ensuring that your charitable endeavors comply with local laws.

Whether you're a non-profit organization, a commercial fundraiser, or an individual looking to create a charitable program, our comprehensive collection has you covered. Stay informed and make a difference with our charitable programs documents. Start exploring today!

Documents:

5

This form is used for reporting the failure to return at least 25% of gross proceeds to charitable programs in Tennessee.

This form is used for submitting additional information to amend a commercial fundraiser registration in Washington state.

This document is used for the initial registration of a charitable organization in the state of Missouri. It is required to provide information about the organization's purpose, activities, and financial details in order to be recognized as a charitable entity in the state.