New Additions Templates

Looking to add new equipment or personal property to your economic revitalization area or certified technology park? Our New Additions documents collection provides you with the necessary forms and equipment lists to help you navigate the process seamlessly.

With a variety of alternate names such as "New Additions" or "Equipment List for New Additions," this collection includes comprehensive forms for different types of deductions and locations. Whether you're a business owner in an economic revitalization area or a certified technology park, we have the specific forms to meet your needs.

By accessing our New Additions documents, you'll be able to ensure compliance with state regulations and benefit from the available deductions. Our forms are designed to streamline the process, making it easier for you to add new equipment or personal property to your designated area.

Don't waste time searching for the right forms elsewhere. Our New Additions documents collection provides everything you need to fulfill the necessary requirements. Simplify the process and maximize your benefits by utilizing our comprehensive collection of New Additions forms.

Documents:

5

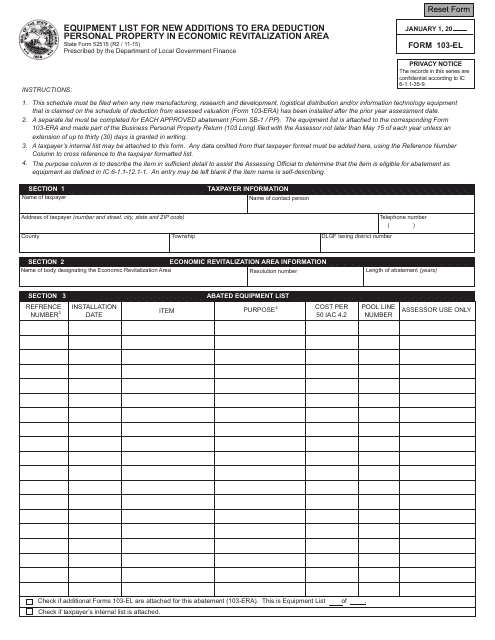

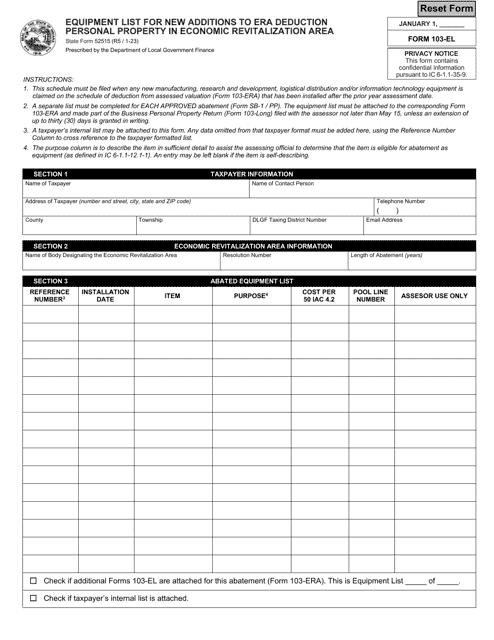

This Form is used for listing new equipment additions in the Economic Revitalization Area (ERA) for the purpose of deducting personal property taxes in Indiana.

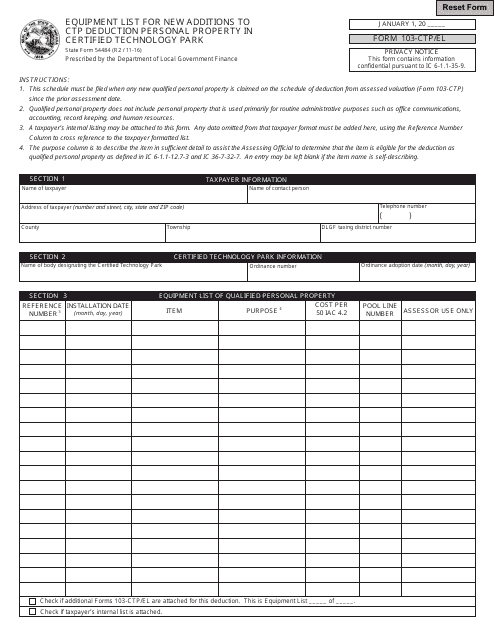

This form is used for providing an equipment list for new additions to CTP deduction personal property in a certified technology park in Indiana.

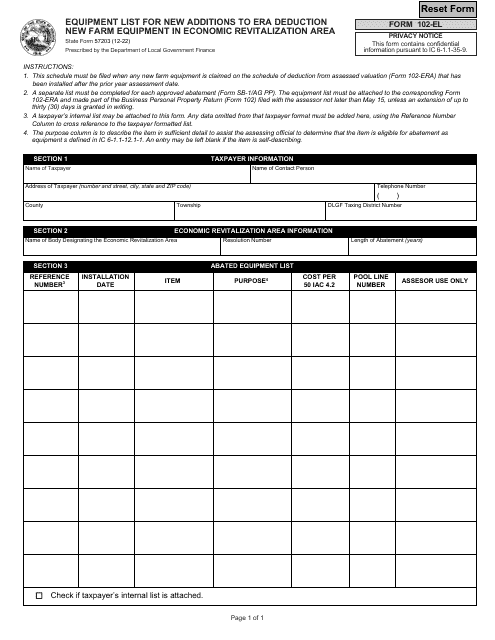

This form is used for listing new farm equipment additions in the Economic Revitalization Area in Indiana for the purpose of claiming an era deduction.