Pass Through Income Templates

Pass Through Income Documents

Welcome to our comprehensive collection of pass through income documents. These documents are essential for individuals, shareholders, partners, and beneficiaries who need to report their pass through income, losses, and credits. Our extensive selection of forms and schedules ensures that you have everything you need to accurately report your pass through income.

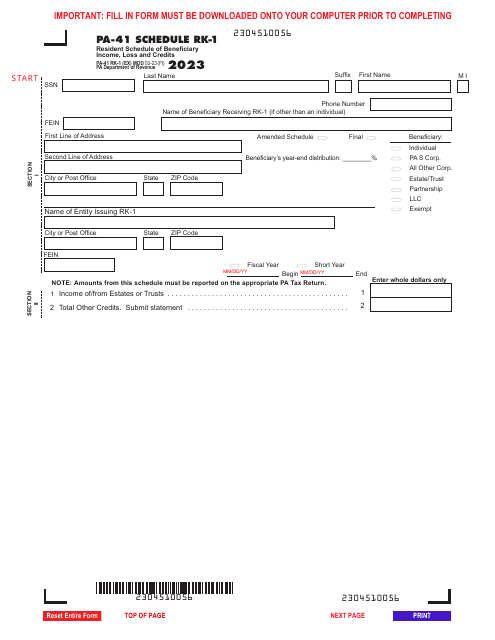

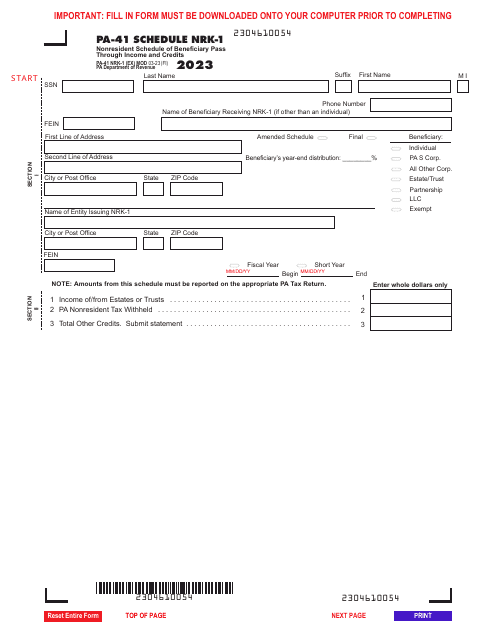

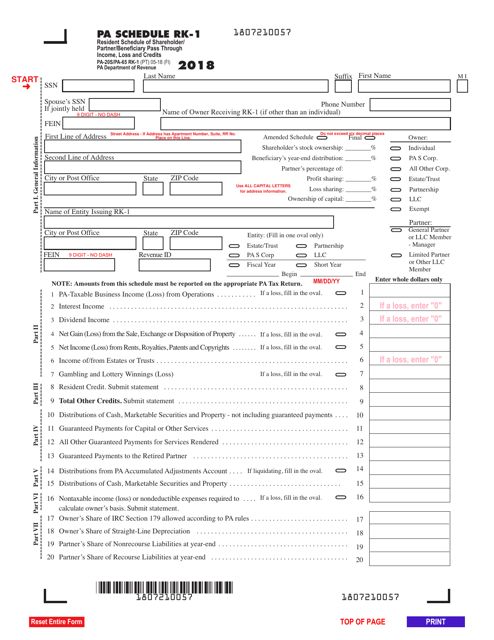

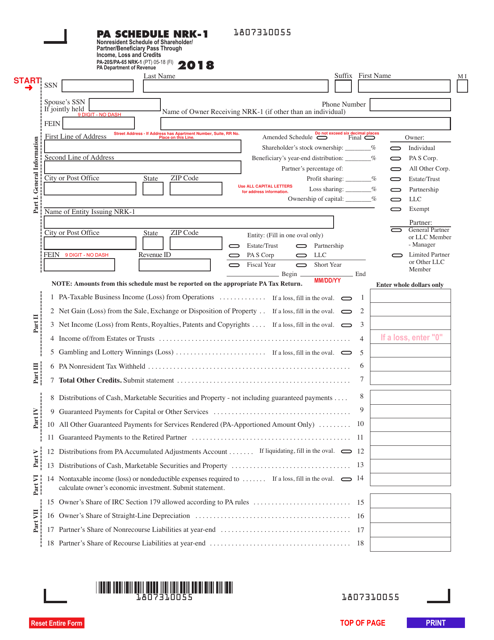

Also known as Form PA-41 Schedule RK-1 and Form PA-41 Schedule NRK-1 in Pennsylvania, our pass through income documents provide all the necessary information for both residents and nonresidents of the state. Whether you are a shareholder, partner, or beneficiary, our documents will guide you through the process of reporting your pass through income, ensuring compliance with tax regulations.

With our pass through income documents, you can confidently report your income, losses, and credits without any hassle. These documents are designed to make the process quick and efficient, saving you valuable time and effort. With our user-friendly forms and schedules, you can easily navigate through the complexities of pass through income reporting.

Don't let the intricacies of pass through income reporting overwhelm you. Our collection of pass through income documents provides the guidance and resources you need to streamline the reporting process. By using our forms and schedules, you can accurately report your pass through income and ensure compliance with the relevant tax laws.

Choose our pass through income documents for a seamless reporting experience. Take the guesswork out of reporting your pass through income, and rely on our comprehensive collection of forms and schedules. Trust us to provide you with the essential tools you need to accurately report your pass through income, losses, and credits. With our documents, you can stay compliant and focus on what matters most to you.

Documents:

12

This form is used for reporting the pass-through income, loss, and credits of shareholders, partners, and beneficiaries in Pennsylvania.

This Form is used for reporting nonresident shareholders/partners/beneficiaries pass through income, loss, and credits in Pennsylvania.