Withholding Statement Templates

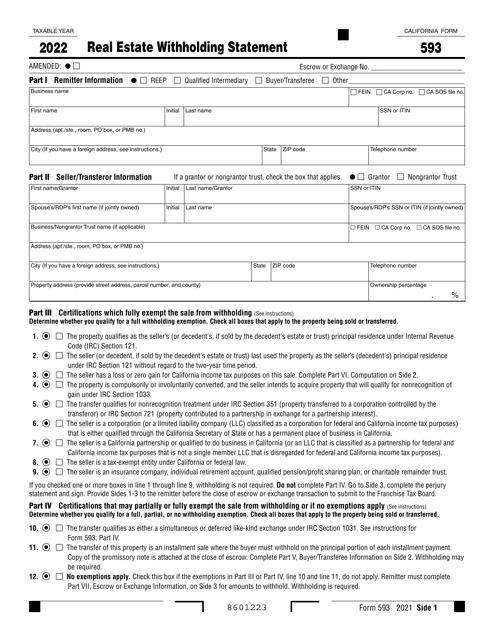

A withholding statement, also known as a withholding statement document or withholding statements, is a crucial document that provides information on the amount of income withheld for tax purposes. This document is used by various entities, including employers and financial institutions, to report the amounts of withholding to the relevant tax authorities.

The withholding statement helps individuals and businesses to accurately report their tax liabilities and ensure compliance with the tax laws of their jurisdiction. These statements are typically required to be submitted annually or on a specified schedule, depending on the specific tax regulations.

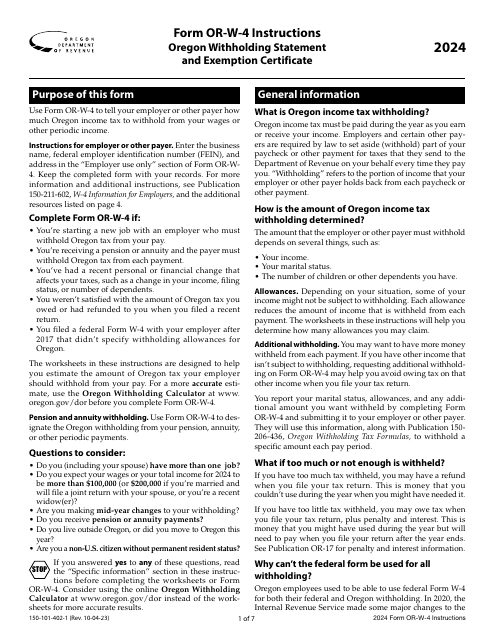

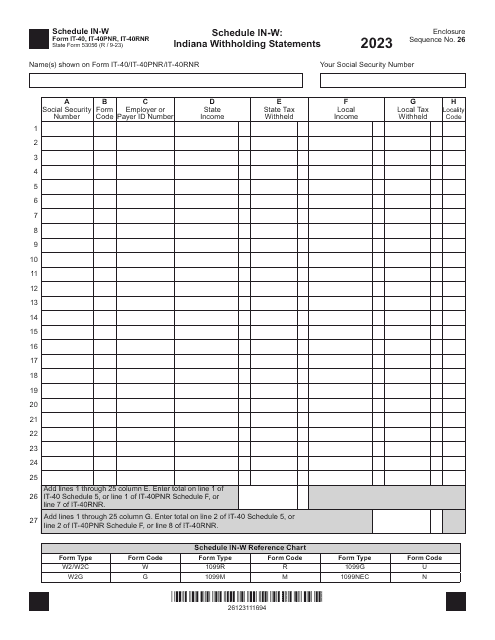

For individuals, a withholding statement helps to ensure that the correct amount of taxes is withheld from their income, including wages, pensions, and other sources of taxable income. This document is often used to support the taxpayer's annual income tax return, enabling them to accurately report their total income and claim any applicable deductions or credits.

Businesses also rely on withholding statements to report the amounts withheld on behalf of their employees. These statements are essential for reconciling payroll records and ensuring that the correct amounts are remitted to the tax authorities. Moreover, businesses may be required to provide withholding statements to their employees, enabling them to accurately report their income on their personal tax returns.

In addition to fulfilling tax reporting requirements, withholding statements are critical for individuals and businesses to maintain accurate financial records. These documents serve as a record of income and tax withheld, providing valuable information for financial planning, budgeting, and other financial decisions.

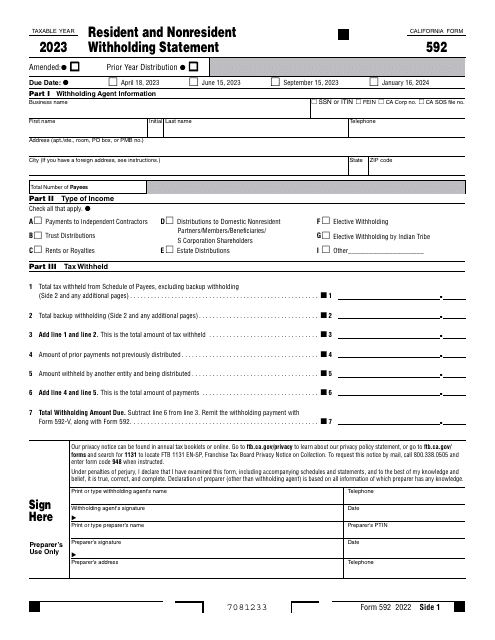

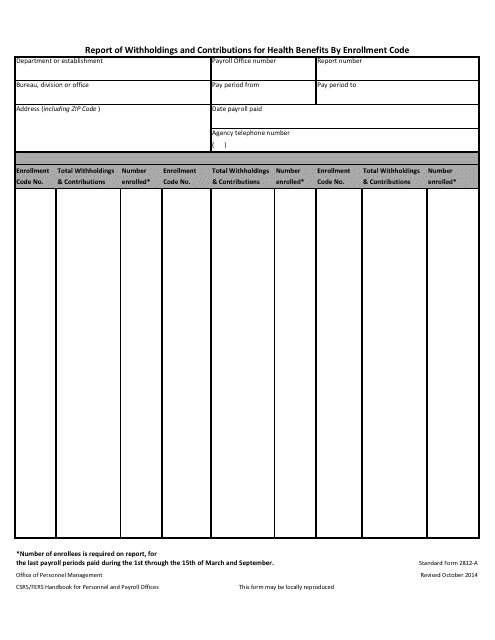

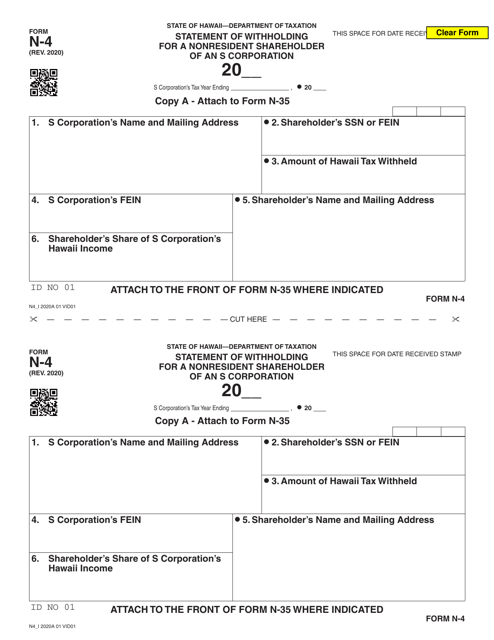

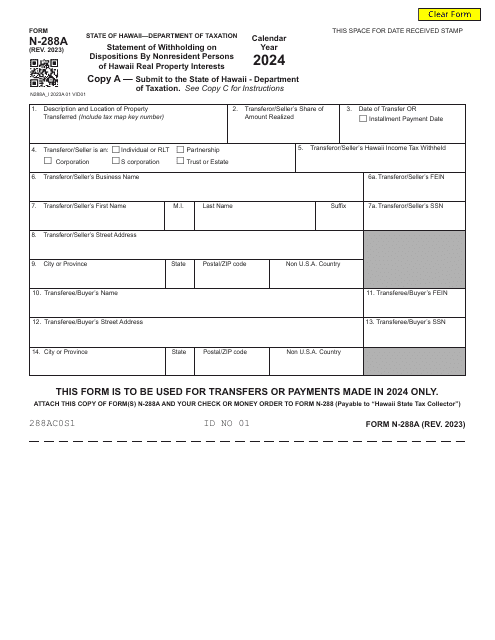

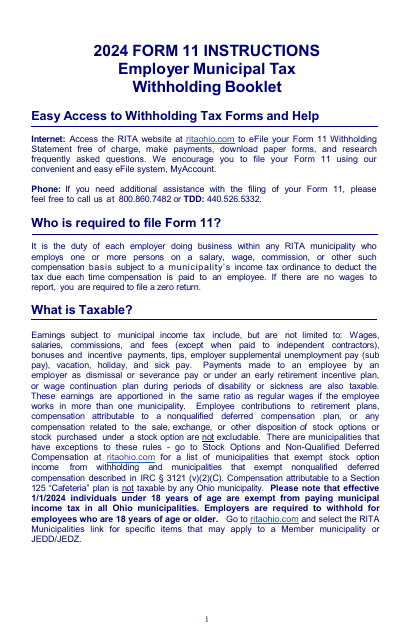

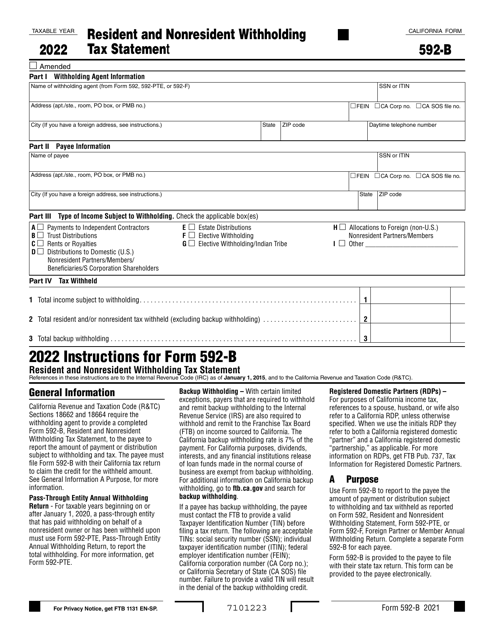

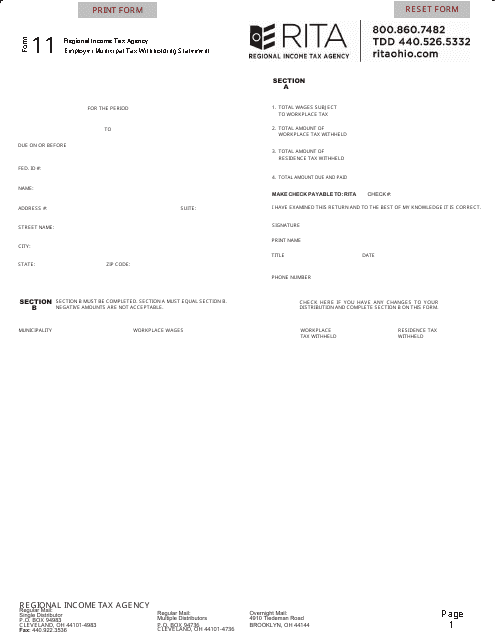

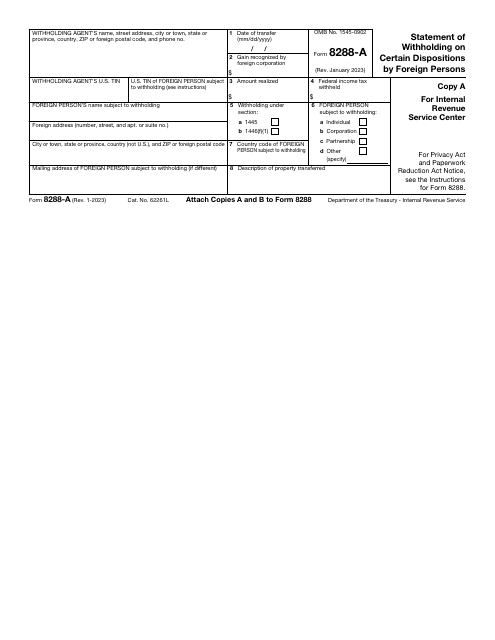

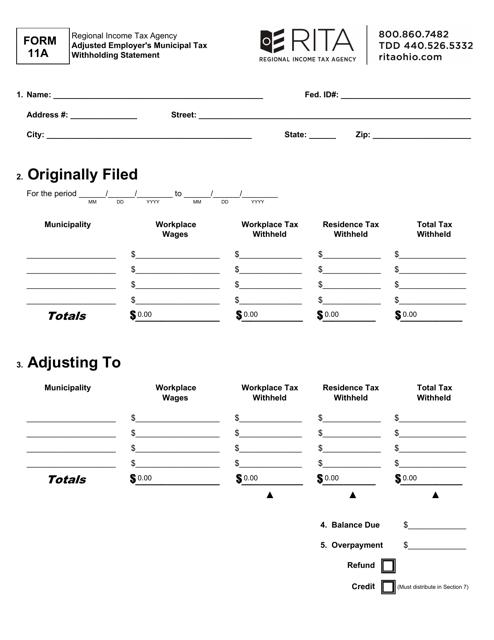

Whether you are an individual, employer, or financial institution, understanding and properly maintaining your withholding statements is essential to ensure compliance with tax laws and financial stability. Whether it is a Form 592 Resident and Nonresident Withholding Statement, a Form SF-2812-A Report of Withholdings and Contributions for Health Benefits by Enrollment Code, a Form N-288A Statement of Withholding on Dispositions by Nonresident Persons of Hawaii Real Property Interests, or a Form 11 Employer's Municipal Tax Withholding Statement, accurate and timely submission of these documents is crucial.

At Templateroller.com, we understand the importance of withholding statements and can assist you in properly preparing and submitting these documents. Our team of experts stays up to date with the latest tax regulations to ensure your compliance and provide you with peace of mind. Contact us today to learn more about how we can help you manage your withholding statements effectively.

Documents:

24

This Form is used for reporting withholdings and contributions for health benefits by enrollment code.

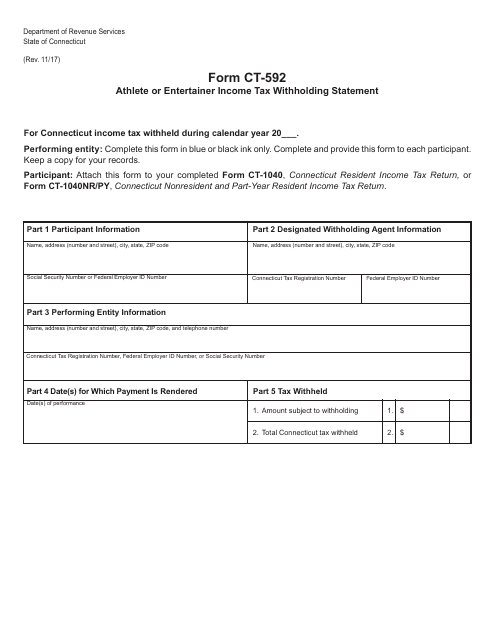

This form is used for reporting income tax withholding for athletes or entertainers in Connecticut.

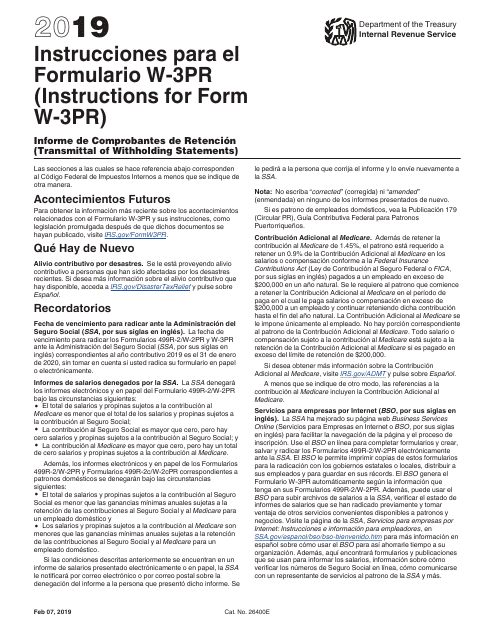

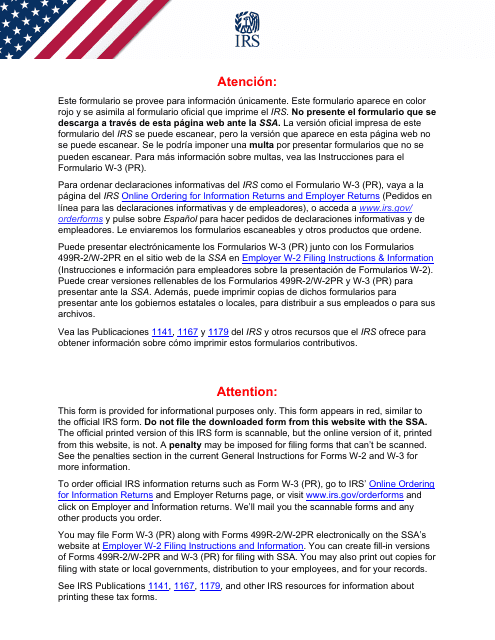

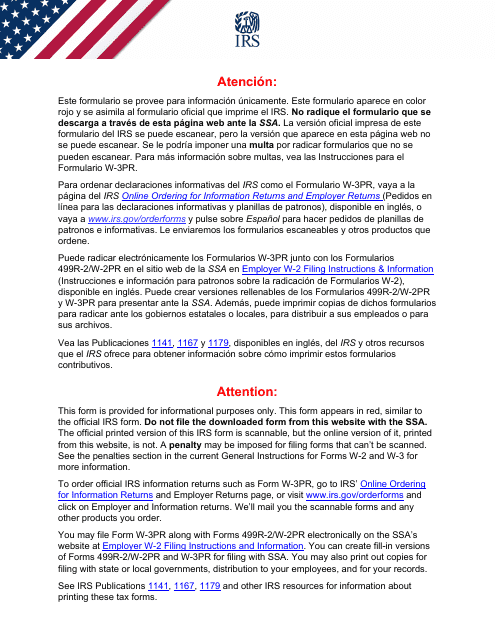

This document provides instructions for completing the IRS Form W-3PR, which is used to transmit withholding statements. The instructions are available in both English and Spanish.

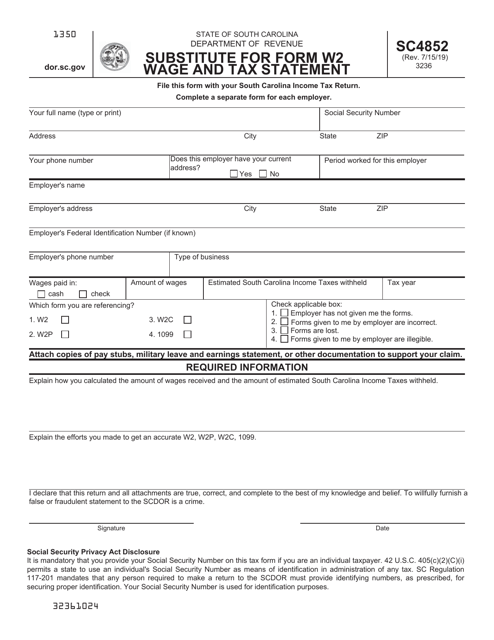

This form is used as a substitute for Form W2 Wage and Tax Statement in the state of South Carolina. It provides information on wages and taxes withheld by employers.

This is a supplementary document used by a withholding agent to describe the disposition of real property and report how much tax was withheld as a result of the transaction.

This form is used for reporting adjustments to an employer's municipal tax withholding statement in Ohio. It is required for accurately calculating and submitting municipal tax payments.