Qualified Business Income Deduction Templates

The Qualified BusinessIncome Deduction is a tax benefit provided by the Internal Revenue Service (IRS) to eligible businesses. This deduction allows small businesses and self-employed individuals to deduct a portion of their qualified business income on their tax returns, reducing their overall taxable income.

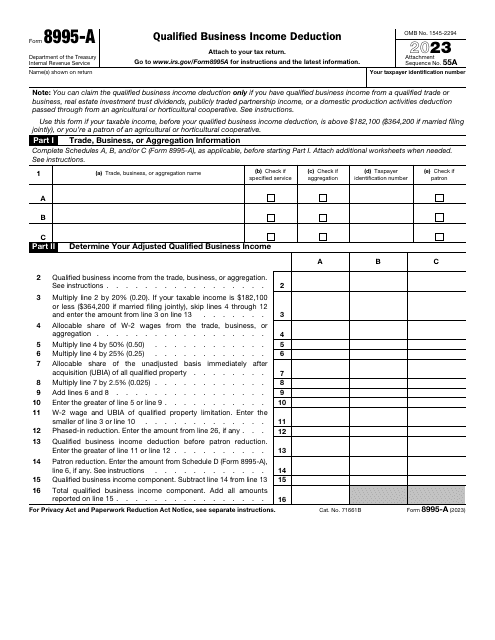

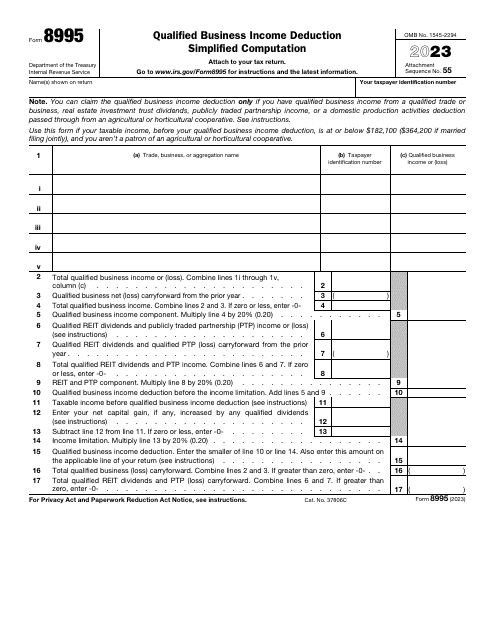

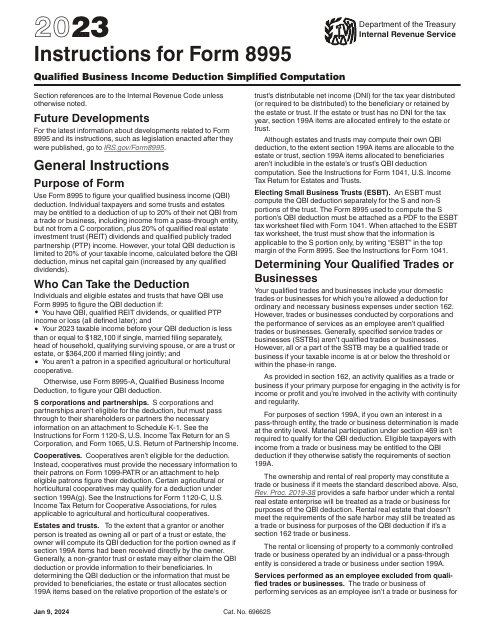

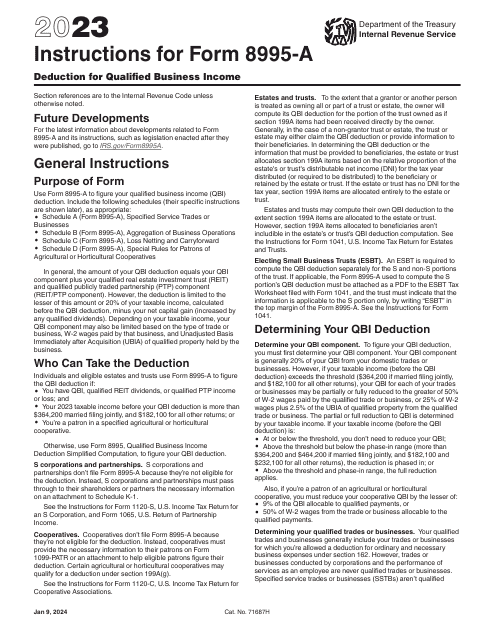

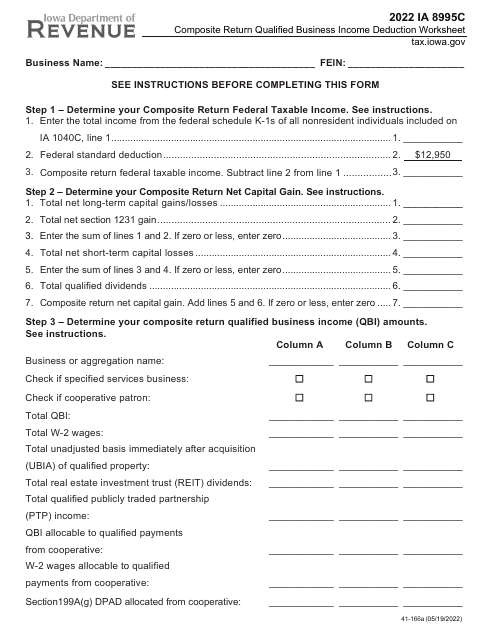

The Qualified Business Income Deduction can be a complex topic, but it is an important aspect of tax planning for businesses. The IRS provides various documents and forms to help taxpayers understand and compute their qualified business income deduction. These documents include the IRS Form 8995 Qualified Business Income Deduction Simplified Computation, IRS Form 8995-A Qualified Business Income Deduction, and the Instructions for IRS Form 8995 Qualified Business Income Deduction Simplified Computation.

Additionally, some states, such as Iowa, also have their own forms and worksheets related to the qualified business income deduction. For example, businesses in Iowa may need to use Form IA8995C Composite Return Qualified Business Income Deduction Worksheet.

Understanding and calculating the Qualified Business Income Deduction can be challenging, especially for those who are new to tax laws and regulations. That's why it's essential to consult with a tax professional or review the official IRS documents to ensure accurate reporting and maximum tax savings.

So, whether you're a small business owner or a self-employed individual, familiarizing yourself with the Qualified Business Income Deduction and the corresponding forms and instructions is crucial for optimizing your tax situation and minimizing your tax liability.

Documents:

16