Tax Dispute Resolution Templates

Tax dispute resolution is an essential process for individuals and businesses who find themselves at odds with tax authorities. Whether you're dealing with the IRS or state tax agencies like the California Department of Tax and Fee Administration (CDTFA), Michigan Department of Treasury, or South Carolina Department of Revenue, it's crucial to have the right tools and understanding to navigate the complexities of tax disputes.

Our tax dispute resolution services are specifically designed to assist taxpayers in resolving their money-related disagreements with the tax authorities. Our team of experienced professionals is well-versed in the intricacies of tax laws and regulations, providing you with the expertise you need to reach a fair and favorable resolution.

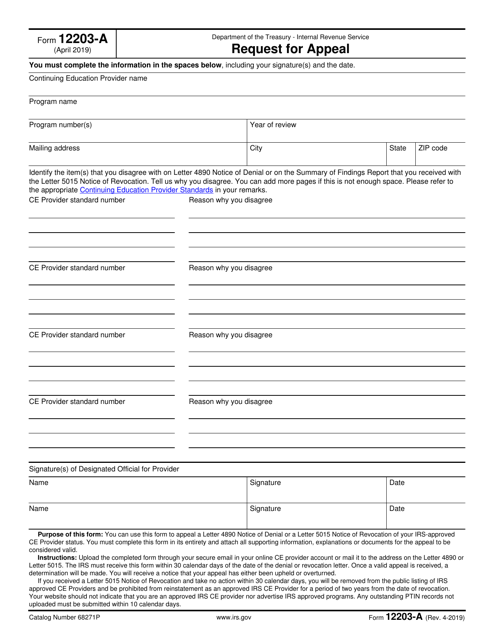

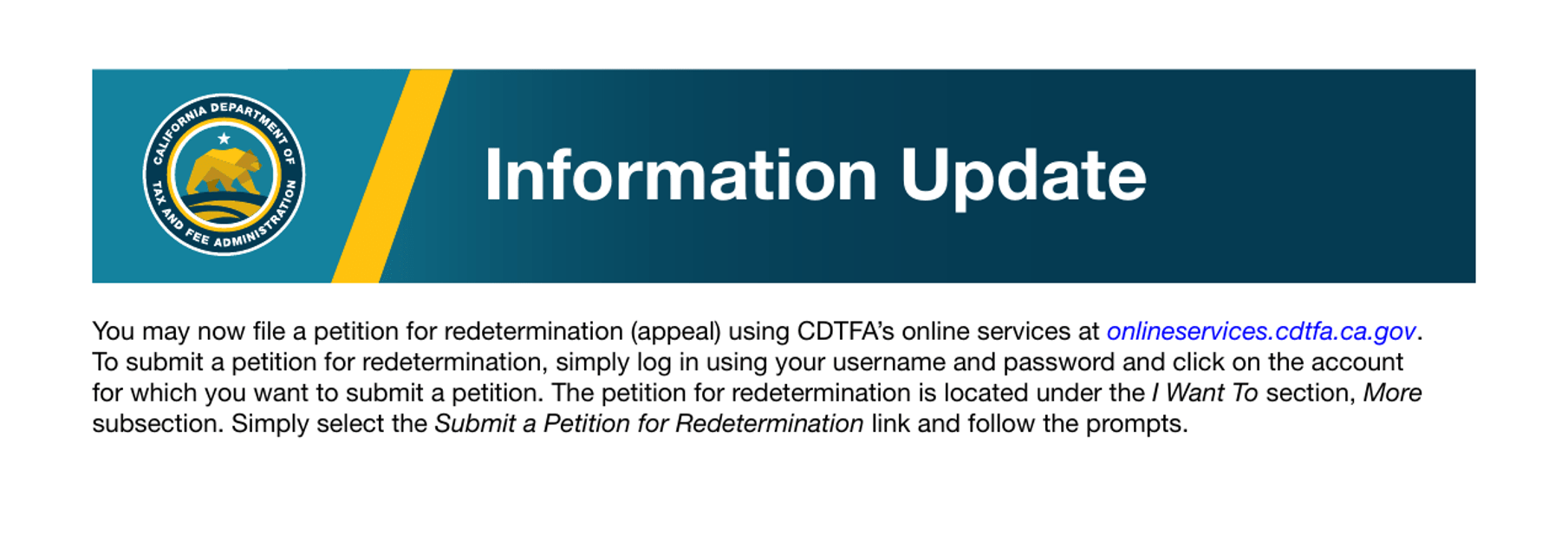

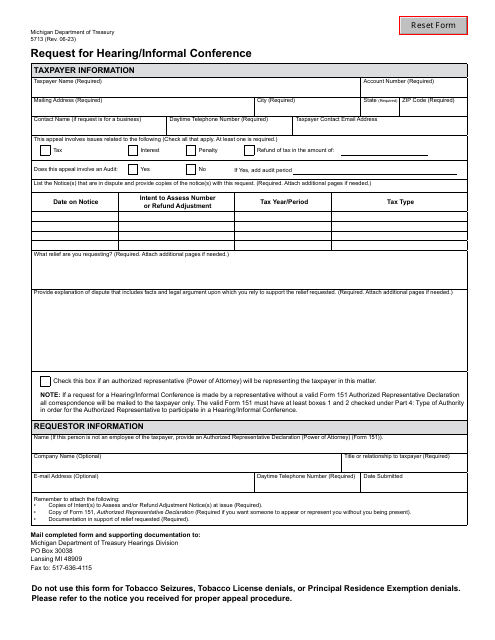

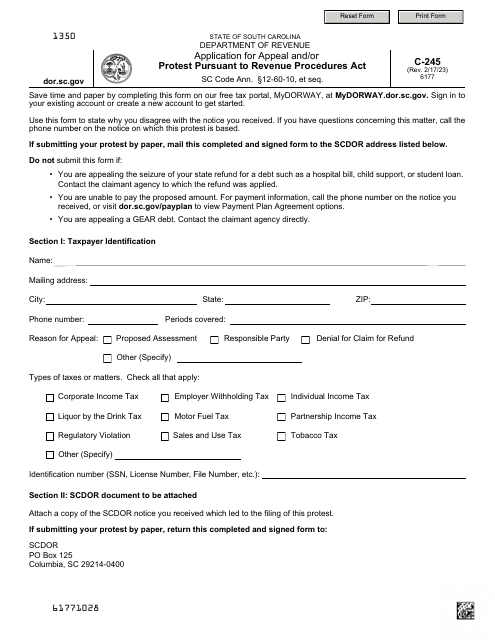

We offer comprehensive support throughout the entire tax dispute process, including assistance with applications, appeals, petitions, and protests. Whether you're seeking an offer in compromise with the CDTFA, appealing an IRS decision using Form 12203-A, or requesting a hearing/informal conference with the Michigan Department of Treasury, we have the knowledge and resources to help you achieve your desired outcome.

Our goal is to provide you with the guidance and representation necessary to navigate the often complex and intimidating world of tax disputes. With our expertise on your side, you can rest assured knowing that you have a dedicated team working diligently to protect your interests and minimize any potential financial burdens that may arise from tax-related conflicts.

When it comes to tax dispute resolution, we understand that time is of the essence. Delays in resolving tax disputes can lead to mounting penalties and interest, creating additional stress and financial strain. That's why we prioritize efficiency and effectiveness in our approach, striving to expedite the resolution process while ensuring the best possible outcome for our clients.

So, whether you're facing an offer in compromise application with the CDTFA, an appeal with the IRS, a petition for redetermination with the Michigan Department of Treasury, or a protest pursuant to the Revenue Procedures Act in South Carolina, our tax dispute resolution services are here to provide you with the support and expertise you need to effectively navigate the complexities of tax disputes and achieve a satisfactory resolution.

Contact us today to learn more about our tax dispute resolution services and how we can assist you in resolving your tax-related conflicts.

Documents:

7

This form is used for submitting an offer in compromise application to the California Department of Tax and Fee Administration.

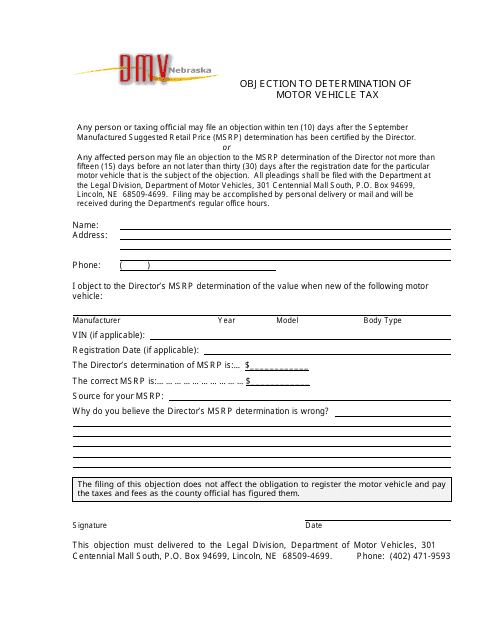

This document is used to object to the determination of motor vehicle tax in the state of Nebraska. It allows individuals to challenge the calculation or assessment of their tax liability for their motor vehicle.

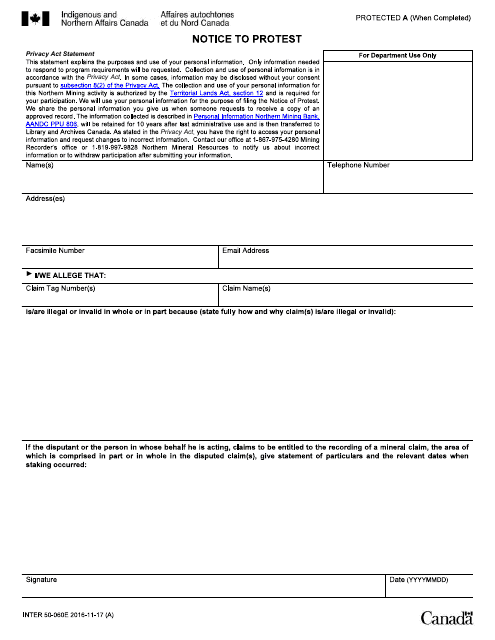

This form is used for providing a notice to protest in Canada. It is used to register a formal objection or disagreement regarding a specific matter.