Last Will Templates by State

A Will - often referred to as a Last Will or Will and Testament - is one of the most important legal documents in an individual's lifetime. A Will allows a person to control what happens to their property after their passing away by designating beneficiaries that will receive all or parts of their possessions (referred to as the "Estate").

Fillable free Will forms and templates organized by type and state are available for download and digital filing through the links below.

What Is a Will?

A Will is a legal document that regulates who your property will go to after you pass away. It commonly includes a set of instructions on your preferences concerning medical treatment at the end of your life and names an executor - the person who will be tasked with ensuring that those instructions are complied with.

The document may be used in a number of different situations: if you need to leave a specific gift for a certain person, want to clear up a misunderstanding regarding the sharing of your Estate, or wish to designate a guardian for your children or pets.

What Types of Wills Are There?

There are several main types of Wills, with the three most common ones being the following:

- **Last Will and Testament.

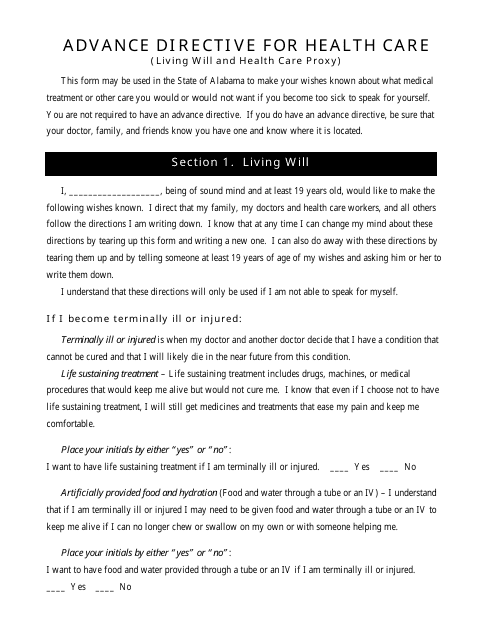

- Living Will. This document allows the Testator to ex[press their wishes regarding end-of-life treatment and palliative care (i.e.: articular breathing tubes, feeding, pain relief, etc.). A Living Will is, in essence, a more limited type of Advance Directive, and is often included as a separate part of Advance Directive paperwork.

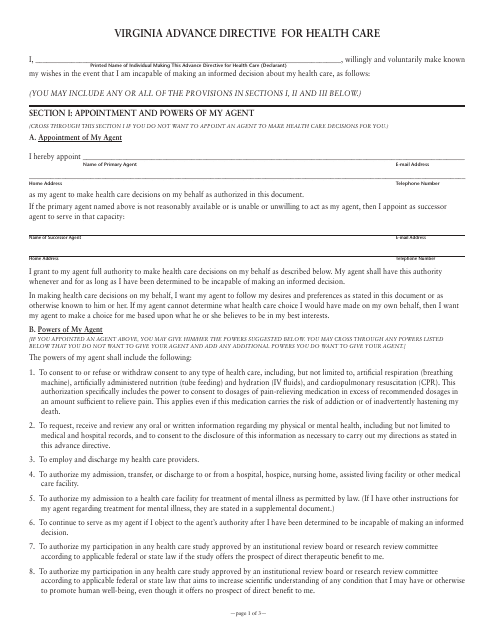

- Advance Directive. Advance Directives are oral and written instructions about future medical care that enter into effect if the Testator becomes incapable of making decisions (for example, due to falling unconscious or being too ill to communicate). This is a legal document that, along with the provisions of a Living Will, contains clauses that allow the Testator to elect a health care proxy. This proxy is designated via medical power of attorney and will be tasked with making medical decisions for the Testator based on the wishes expressed in the Living Will.

How to Write a Will?

Writing your own Will is not difficult, but there are a few things to consider. Start by figuring out what to include in your Will:

- Create a list of assets including investments, property, cars, artwork, jewelry, retirement plans of pensions and such like things;

- Consider your debts if you have any. Think about the ability of the beneficiary to afford it, the cost of a will probate and a funeral;

- Elect beneficiaries;

- Pick an executor who will carry out your wishes regarding the legal and financial matters of your property;

- Select guardians for your children in the case both you and the other parent passes away. Discuss the possibility of a future responsibility with them.

While writing a Will is not difficult for the majority of people who have loved ones and material possessions, other situations may arise when advice from an attorney can come in handy in order to make sure necessary legal measures regarding your Estate, tax return and assets have been taken. For example:

- If you have a large property (over $5.43 million) the state allows for its estate or inheritance tax. In this case, you should do the property planning with an attorney to reduce your property tax;

- If you have a spouse and want to disinherit him or her in a Will;

- In a situation when you think some of your relatives may dispute your Will or you assume there will be a person trying to say you were not of sound mind while making your Will;

- You have a small business or you own a part of business;

- You have a disabled child;

- You have a Living Trust.

Living Trust Vs. Will

Living Trusts (specifically, Revocable Living Trusts) and Wills are two estate-planning options designed specifically to help the Testator prepare for passing away. Both may be used for the following purposes:

- To elect beneficiaries that will receive the Testator's Estate.

- Name guardians for surviving children and pets.

- Elect an Executor tasked with carrying out the Testator's wishes.

- Provide guidance on the distribution of taxes and donations after the Testator's death.

Both are revisable, legally binding and require witnesses in order to be considered legal. There are, however, several things that can only be accomplished through a Revocable Living Trust:

- Beneficiaries will avoid probate. Property left through a Living Trust does not pass through probate.

- Helps preserve privacy. A Revocable Living Trust does not become public after the Testator's death.

- Must be witnessed in front of a Notary Public. Unlike Wills, Living Trusts must be signed and stamped by a Notary Public.

- Requires transfer of property. The Estate must be transferred into the Trust.

Documents:

159

This document is used for planning your medical care in advance, specifying your preferences and appointing a healthcare proxy to make decisions on your behalf. It is specific to the state of Alabama.

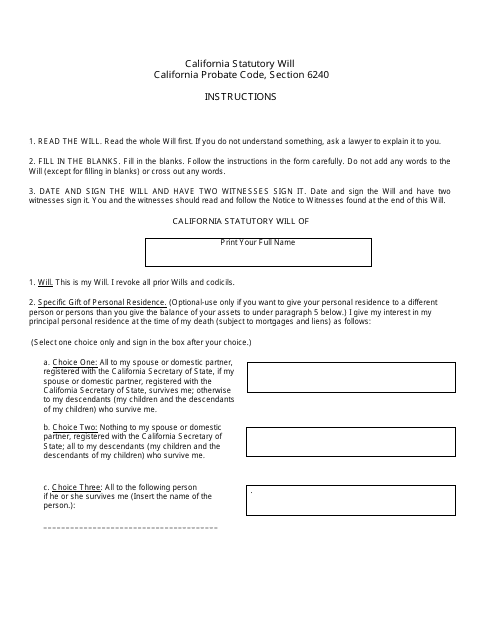

This document is a standardized form for creating a will in the state of California. It is prescribed by the California Probate Code, Section 6240.

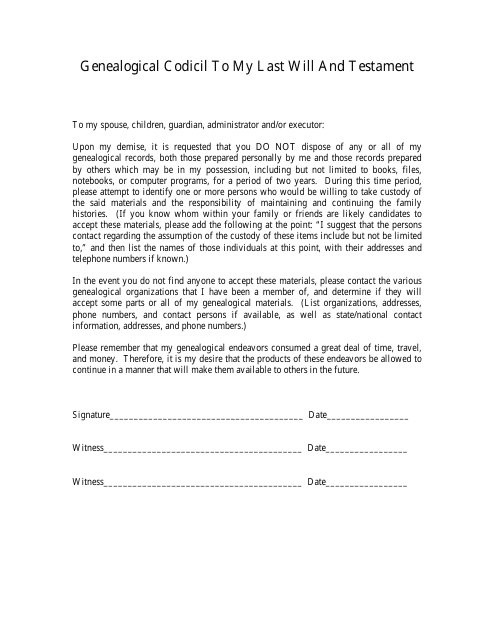

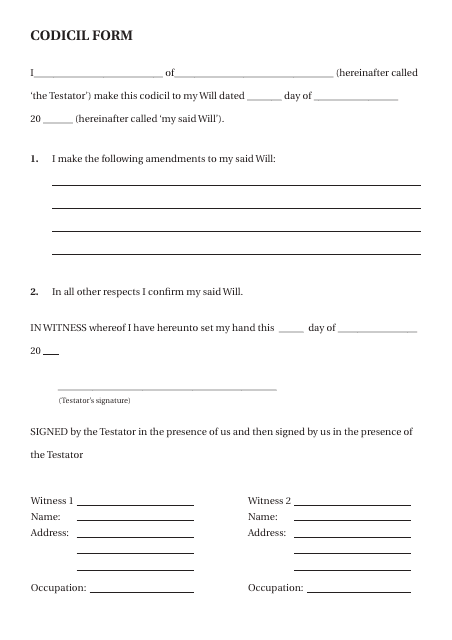

This document is a template for a genealogical codicil to a last will and testament. It is used to make changes or additions to the will regarding family relationships and inheritances.

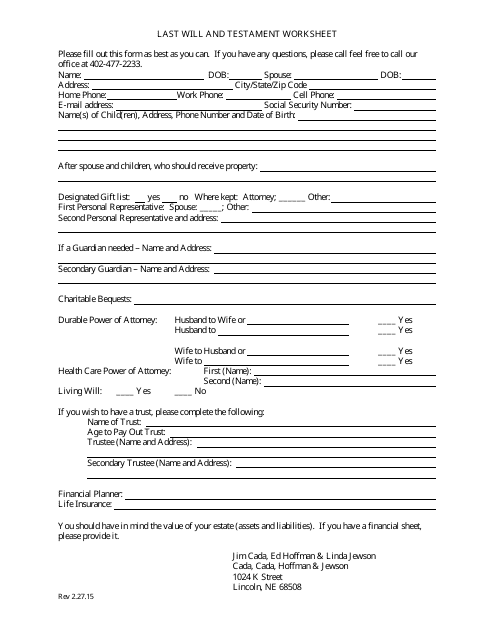

This document is a template worksheet for creating a Last Will and Testament. It helps individuals organize their wishes and distribute their assets after their death.

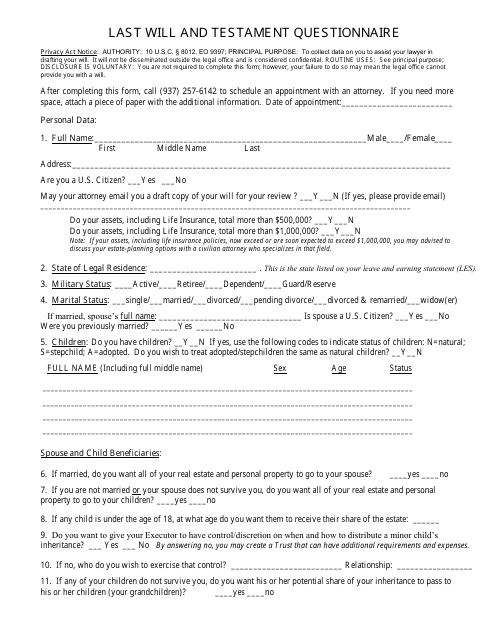

This document is a template for a questionnaire that helps gather the necessary information when creating a last will and testament.

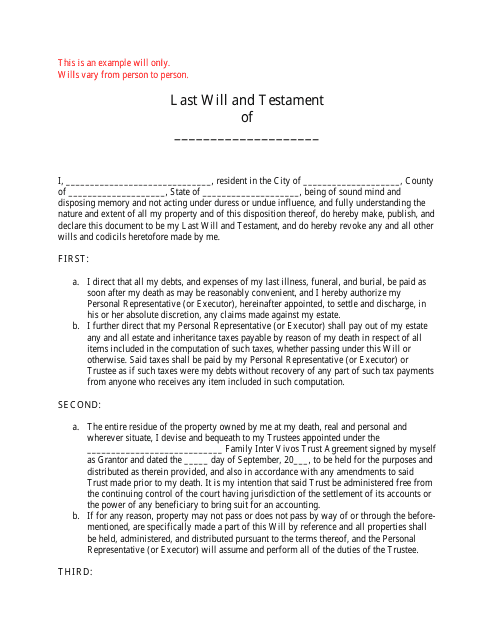

This document is used for creating a legally binding will that outlines how a person's assets and property should be distributed after their death. It allows individuals to specify their wishes regarding guardianship of minor children, funeral arrangements, and the appointment of an executor.

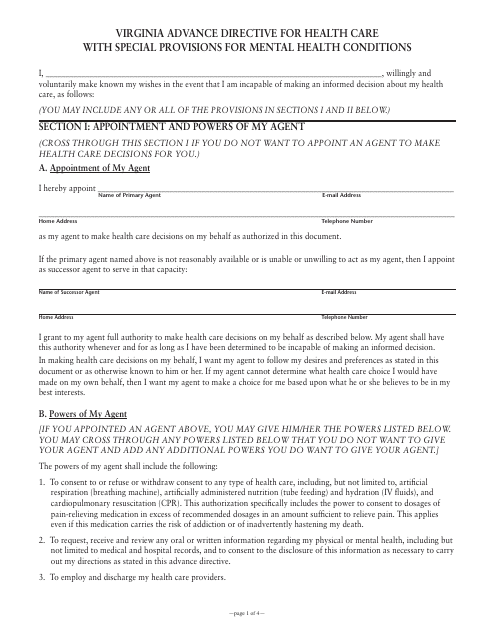

This Form is used for creating an Advance Directive for Health Care in the state of Virginia. It allows individuals to make decisions about their medical treatment in the event they become unable to communicate their wishes.

This type of document is used to modify or make changes to an existing will. It allows the testator to update their wishes regarding the distribution of their assets, appointment of executors, or other provisions outlined in the will.

This document provides a comprehensive advance directive for healthcare in Virginia, with specific provisions for mental health conditions. It allows individuals to outline their healthcare preferences and designate a trusted person to make decisions on their behalf, taking into account their mental health needs.

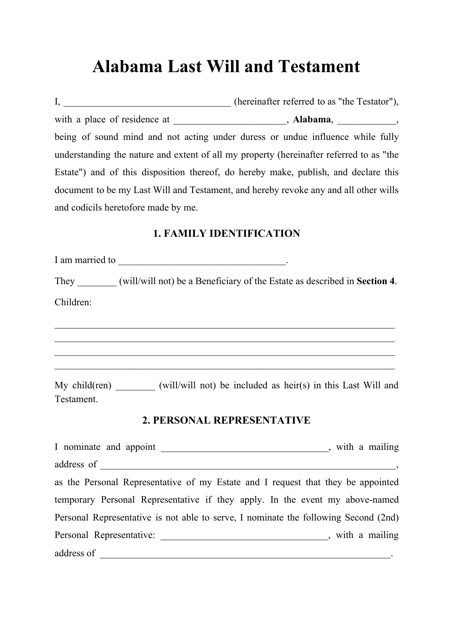

This is a form that describes the terms for distribution of the deceased person's personal and residential property in the state of Alabama.

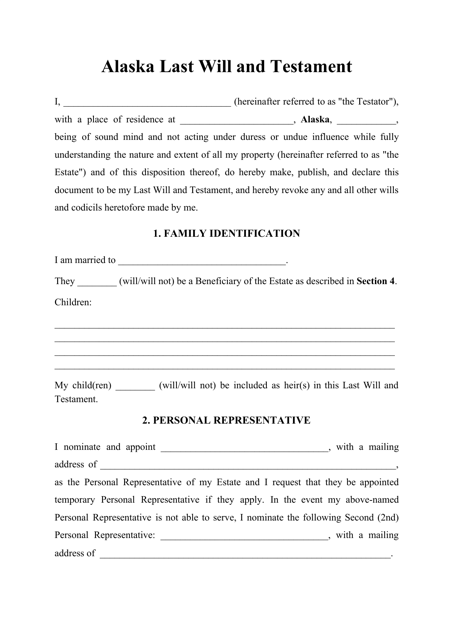

This document describes the terms for distribution of the deceased person's personal and residential property in the state of Alaska.

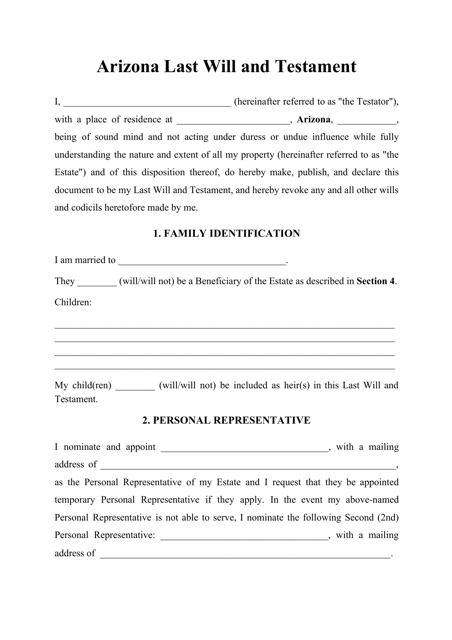

This Arizona-specific form lists the terms for distribution of the deceased person's property in the state.

Download this Arkansas-specific form that is used for determining how a person's possessions and property should be distributed after their death.

This is a document that is used in California to describe the distribution of the personal and residential property of the deceased.

This Colorado-specific form lists the terms and conditions for the distribution of the deceased person's property in the state.

Use this Connecticut-specific form that is created for determining how a person's possessions and property should be distributed after their death.

This form is used in the state of Delaware and serves the purpose of determining the distribution of the property of the deceased person.

Download this Florida-specific form if you need to create a document that would outline the terms and conditions for the distribution of the deceased person's possessions and property.

Download this Georgia-specific form if you need a document that determines the distribution of the deceased person's possessions and property.

This is a document that describes the terms for distribution of the deceased individual's personal and residential property in the state of Hawaii.

This document describes the conditions for the disposition of the deceased person's property (Estate) in the state of Kansas.

This Idaho-specific will template lists the terms for the disposal of a deceased person's possessions in the state.

Download this Maine-specific document that is used for defining how a person's possessions and property should be distributed after their death.

This is a form used in the state of Illinois to describe the distribution of the personal and residential property of the deceased.

This Indiana-specific form lists the provisions for the distribution of the deceased person's property and belongings.

Download this Iowa-specific form that is created for determining how a person's possessions will be distributed after their death.

This is a form that is used in the state of Louisiana and overlooks the distribution of the property of a deceased person.

Download this Kentucky-specific form if you need to create a document that would outline the terms and conditions for the distribution of the deceased person's possessions and property.

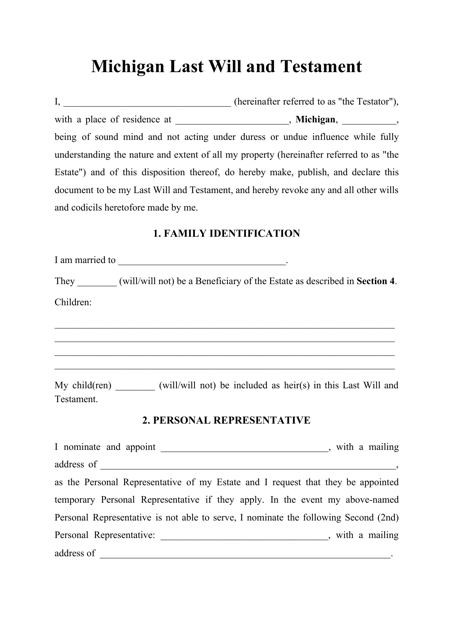

Download this form if you need a document that determines the distribution of the deceased person's possessions and property in the state of Michigan.

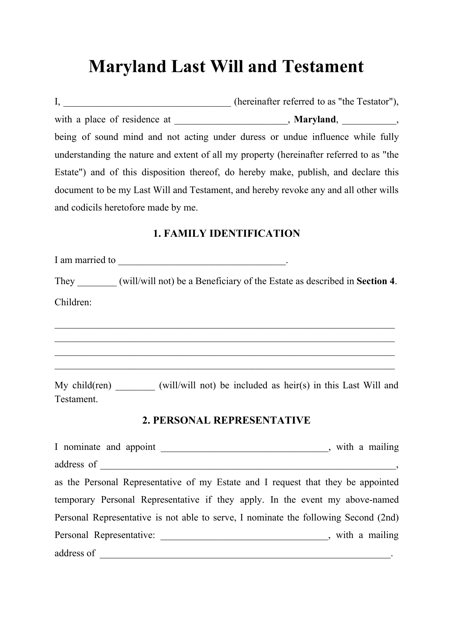

This document describes the terms for distribution of the deceased person's personal and residential property in the state of Maryland.

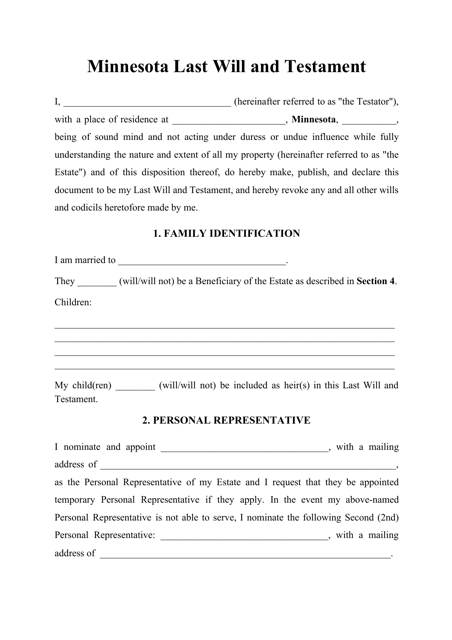

This is a document that is used in the state of Minnesota to describe the distribution of the property of the deceased.

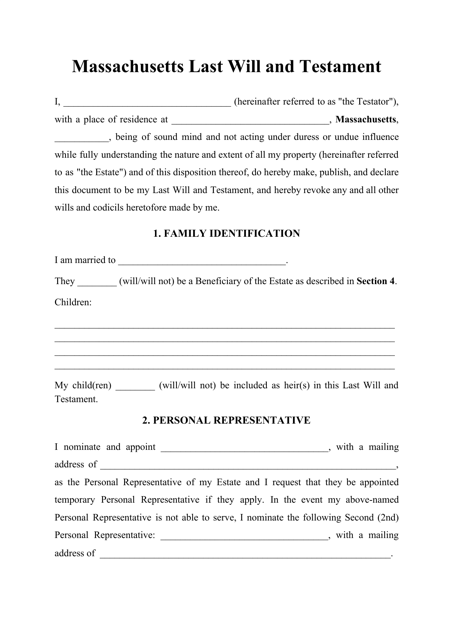

Fill out and print this Massachusetts-specific form if you need a document that determines the distribution of a deceased person's Estate.

This form is used in the state of Mississippi and serves the purpose of determining the distribution of the property of the deceased person.

This document is used in Missouri for the purposes of describing the distribution of the personal and residential property of the deceased.

Use this Pennsylvania-specific form if you need a document that determines the distribution of the deceased person's possessions and property.

This is a form that describes the terms for distribution of the deceased person's personal and residential property in the state of Montana.

Use this New York-specific form that is created for determining how a person's possessions and property should be distributed after their death.

This Rhode Island-specific form lists the terms for distribution of the deceased person's property in the state.

This Virginia-specific form lists the terms for distribution of the deceased person's property in the state.

This document describes the terms for distribution of the deceased person's personal and residential property in the state of Nebraska.