Taxable Value Templates

Are you looking for information about taxable value or need assistance with navigating through taxation documents? We understand that dealing with taxes can be complex and overwhelming. That's why we are here to help simplify the process for you.

Our website provides comprehensive information and resources on taxable value, also known as the assessed value or assessed property value. Taxable value refers to the value assigned to a property for the purpose of calculating taxes. It is an essential component in determining how much property tax you owe.

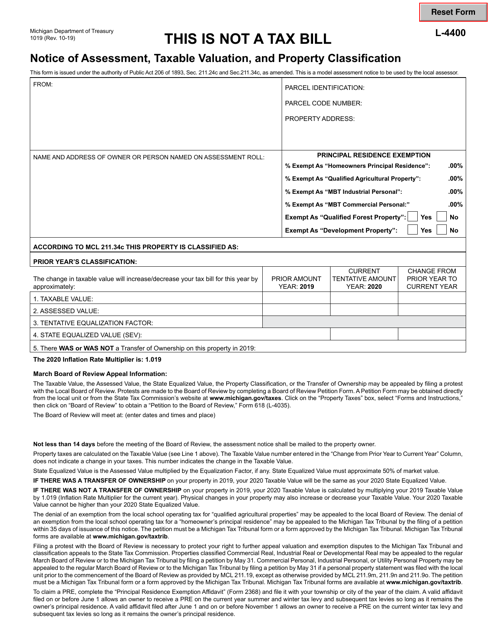

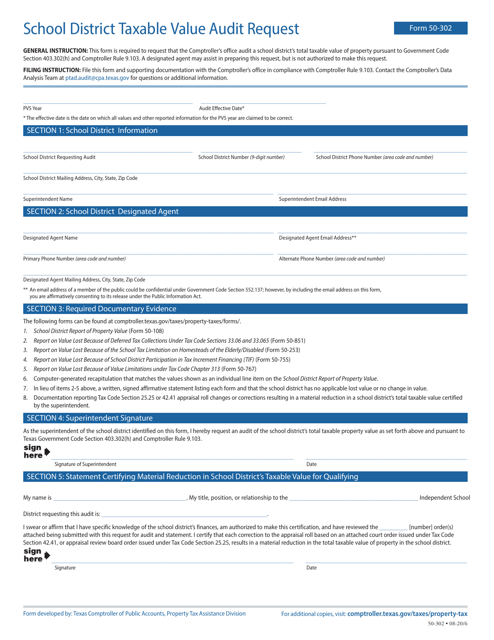

Our website offers a wide range of documents that can assist you in understanding and managing your taxable value. For example, you can find forms like the "Assessor Affidavit Regarding the Recalculation of Taxable Value Following an Mtt Order for a Prior Year" in Michigan, or the "School District Taxable Value Audit Request" in Texas.

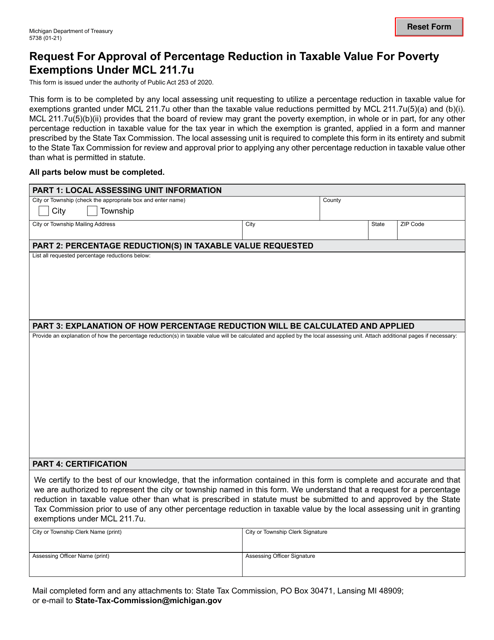

Furthermore, our platform hosts a variety of other useful resources, such as the "Request for Approval of Percentage Reduction in Taxable Value for Poverty Exemptions Under Mcl 211.7u" in Michigan. This document can help eligible individuals apply for a reduction in their taxable value based on their financial circumstances.

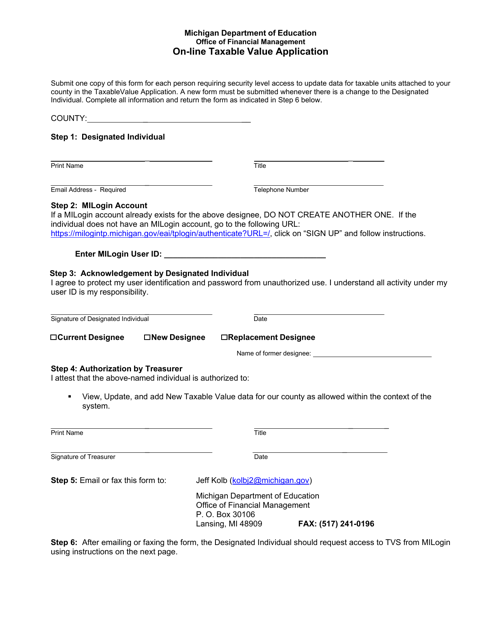

We also offer an Online Taxable Value Application specifically designed for residents in Michigan. This user-friendly tool allows you to calculate and estimate your taxable value easily and accurately.

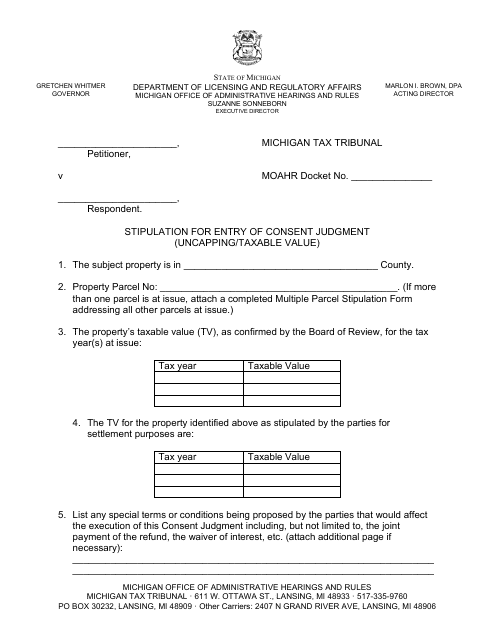

In addition to the various documents available, you can access the "Stipulation for Entry of Consent Judgment (Uncapping/Taxable Value)" in Michigan. This document covers aspects related to the uncapping of taxable values for certain property transactions.

We strive to be your go-to resource for all things related to taxable value. Whether you need information, assistance, or access to specific taxation documents, our website has you covered. Save time and reduce stress by using our platform to stay informed and up-to-date with your taxable value obligations.

Note: The above text is a sample SEO text and does not contain accurate or factual information about the documents in question.

Documents:

11

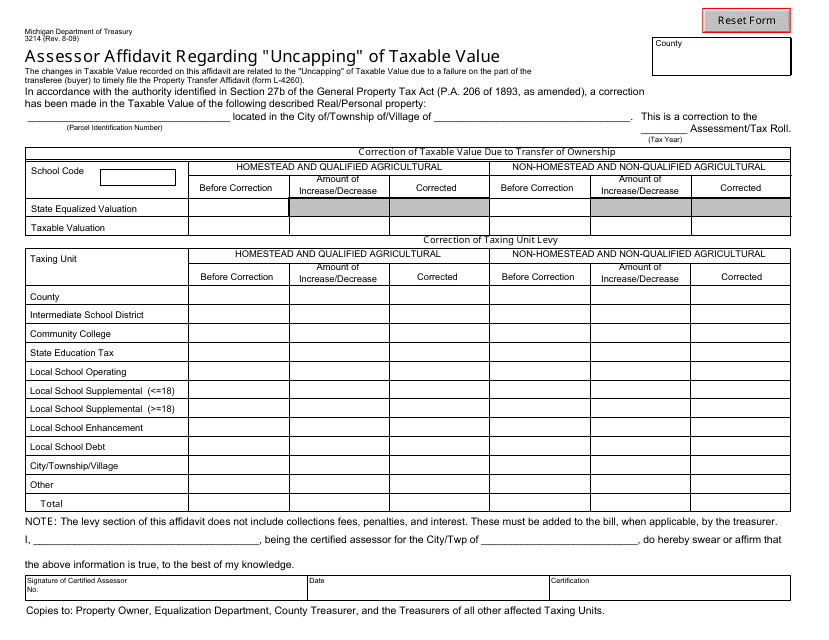

This form is used for submitting an Assessor Affidavit in Michigan regarding the "uncapping" of taxable value for property taxes.

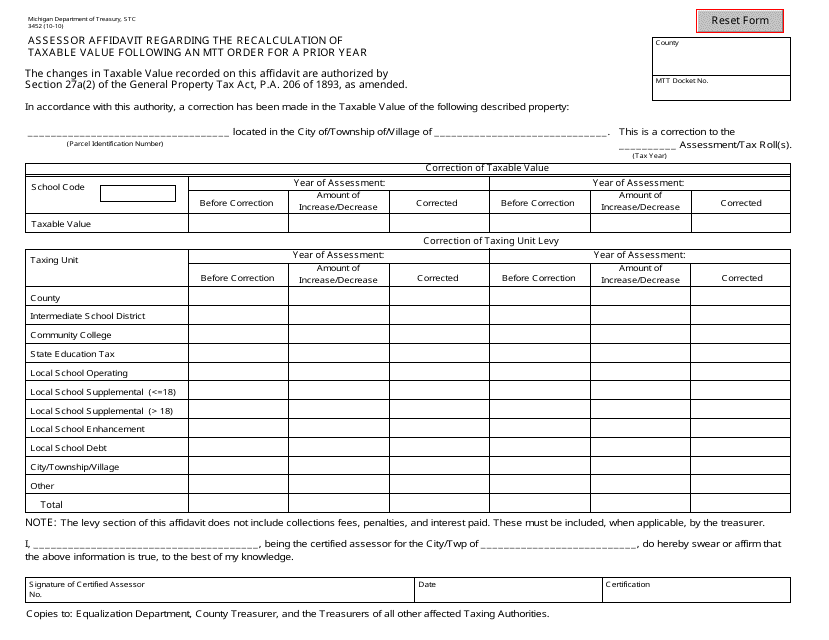

This form is used for submitting an Assessor Affidavit in Michigan for the recalculation of taxable value after an MTT (Michigan Tax Tribunal) order for a previous year.

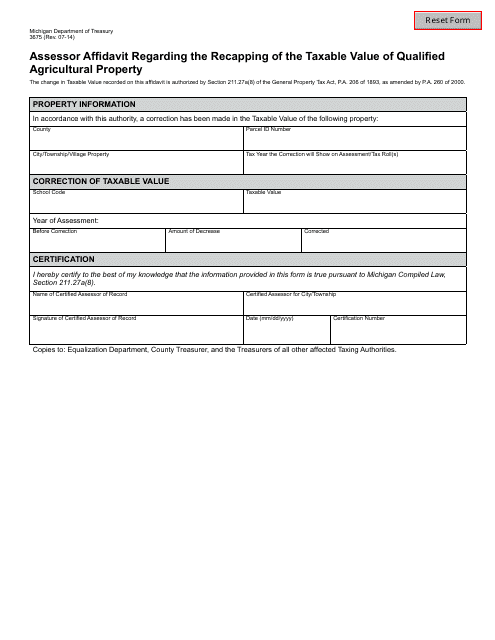

This form is used for assessor affidavit regarding the recapping of the taxable value of qualified agricultural property in the state of Michigan.

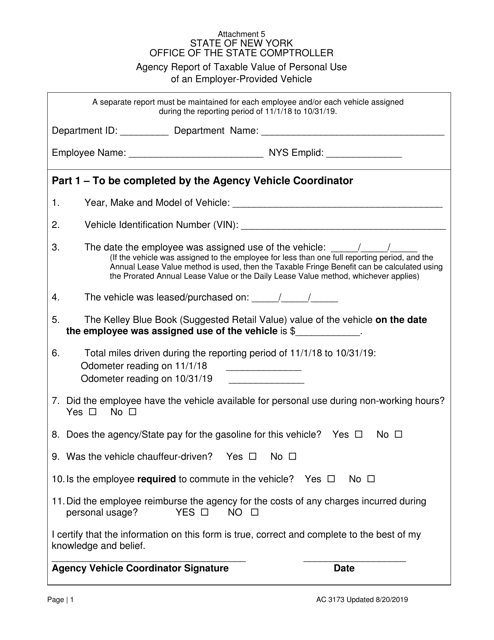

This form is used for reporting the taxable value of personal use of a vehicle provided by an employer in New York.

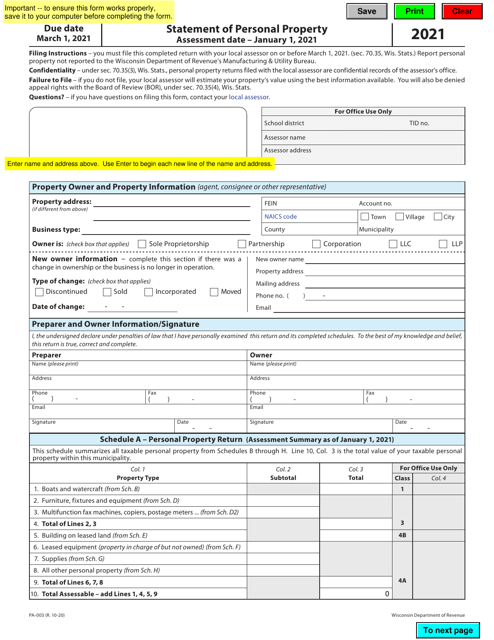

This Form is used for reporting personal property in the state of Wisconsin. It is used to provide information on items such as furniture, equipment, and vehicles owned by individuals or businesses.

This form is used for requesting approval for a percentage reduction in taxable value for poverty exemptions under Michigan law MCL 211.7u.

This document allows residents of Michigan to apply for the on-line taxable value of their property for tax purposes.