Employee Deductions Templates

Employee Deductions Employee Deductions, also known as employee deduction or voluntary recurring deductions, are a common practice in many workplaces. These deductions refer to the amounts withheld from an employee's salary or wages for various purposes, such as taxes, insurance premiums, or other voluntary contributions.

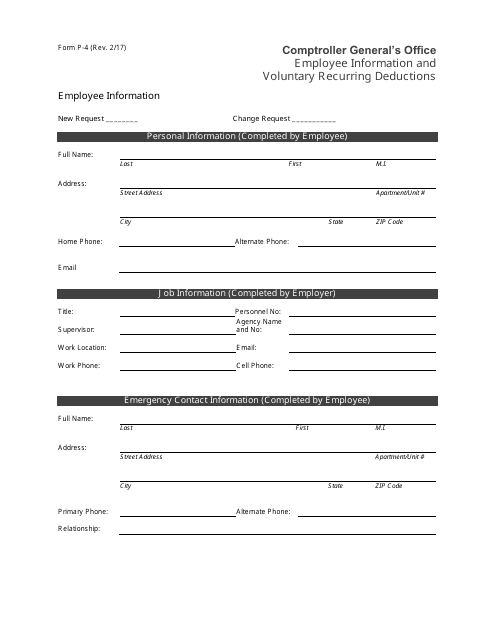

In order to ensure accurate and efficient deductions, businesses and organizations utilize specific forms and certificates. One example is Form P-4 Employee Information and Voluntary Recurring Deductions in South Carolina. This form allows employees to provide the necessary information and authorize recurring deductions from their paycheck.

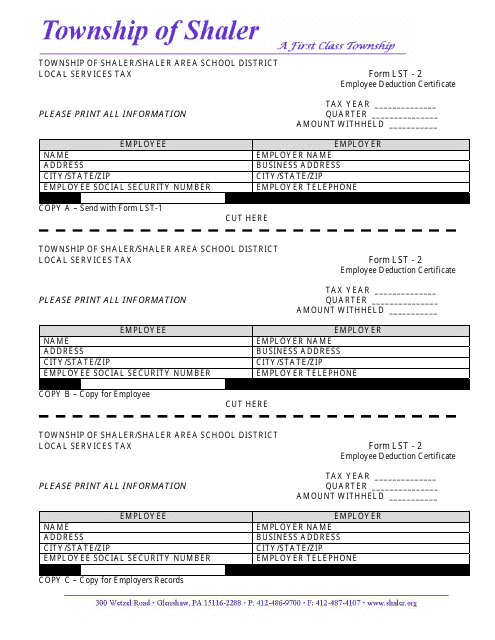

Another document frequently used is Form LST-2 Employee Deduction Certificate in the Township of Shaler, Pennsylvania. This certificate serves as an official authorization for specific deductions and ensures compliance with local regulations.

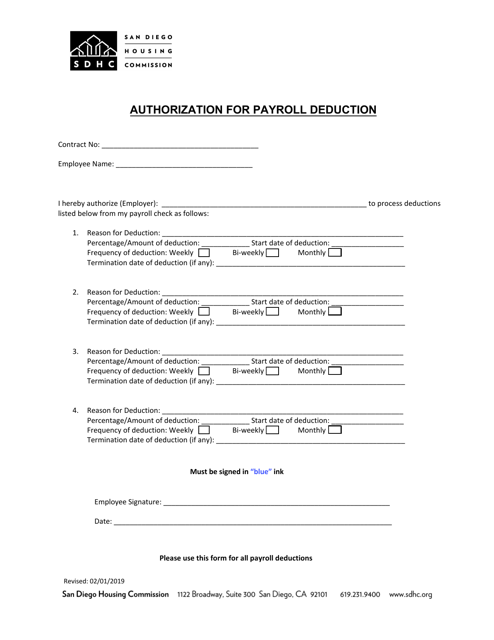

Various municipalities and government entities also have their own documents, such as the Authorization for Payroll Deduction in the City of San Diego, California. This form enables employees to set up voluntary deductions directly through the payroll system.

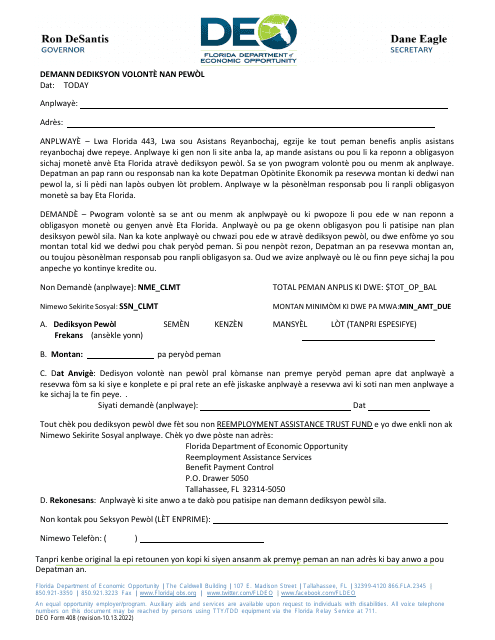

The DEO Form UCO-408 Voluntary Payroll Deduction Request in Florida is another example, and it provides a specific template for employees requesting voluntary payroll deductions in Haitian Creole.

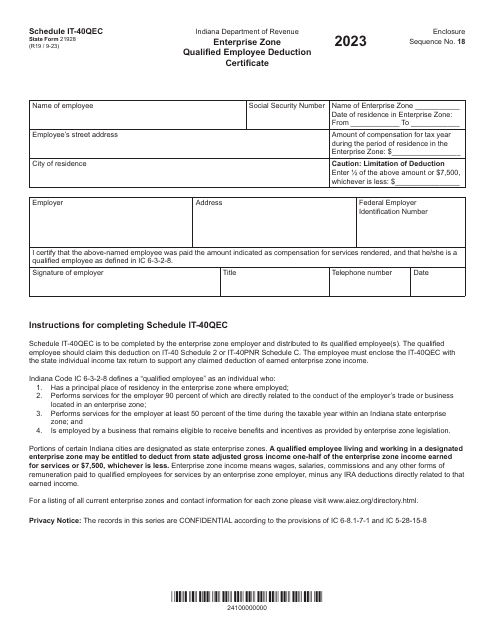

Furthermore, State Form 21928 Schedule IT-40QEC Enterprise Zone Qualified Employee Deduction Certificate in Indiana offers a way for eligible employees in the state to claim deductions related to enterprise zone activities.

Whether it's for tax purposes, insurance, charitable contributions, or other voluntary withholdings, employee deductions play an essential role in managing individual finances and supporting various causes. Employers and employees must work together to ensure accuracy and compliance with relevant laws and regulations.

Documents:

5

This Form is used for providing employee information and authorizing voluntary recurring deductions for employees in South Carolina.

This form is used for obtaining an Employee Deduction Certificate from the Township of Shaler, Pennsylvania.

This document is used by employees of the City of San Diego, California to authorize payroll deductions for various purposes such as taxes, retirement contributions, or other authorized deductions.