Venture Capital Templates

Venture Capital - Fueling Innovation and Growth

Welcome to our comprehensive resource center on venture capital, the lifeblood of innovation and entrepreneurship. Also known as risk capital or simply VC, venture capital plays a crucial role in financing and supporting high-potential startups and emerging companies.

Venture capital is a form of private equity investment that provides capital to young, promising companies with high growth potential. It's a partnership between investors, often known as venture capitalists, and the innovative entrepreneurs who are driving the next wave of groundbreaking technologies, products, and services.

At our venture capital resource center, we provide a wealth of information and insights into the world of venture capital. Whether you're an entrepreneur seeking funding for your bold ideas or an investor looking for exciting investment opportunities, you'll find valuable resources and guidance here.

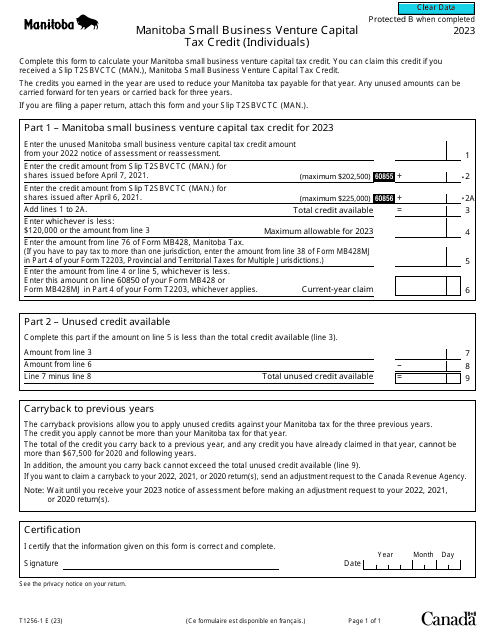

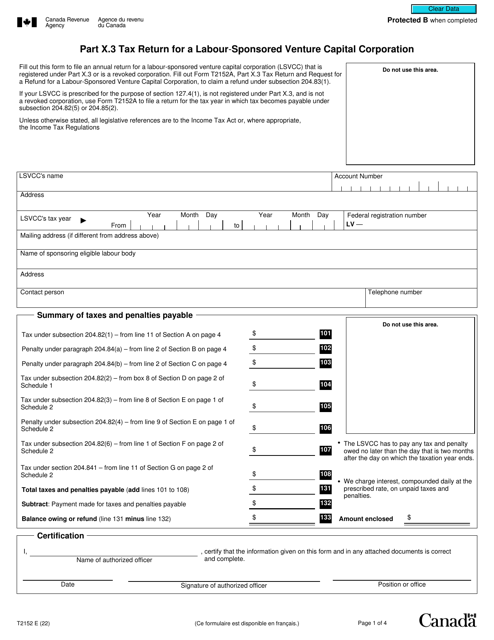

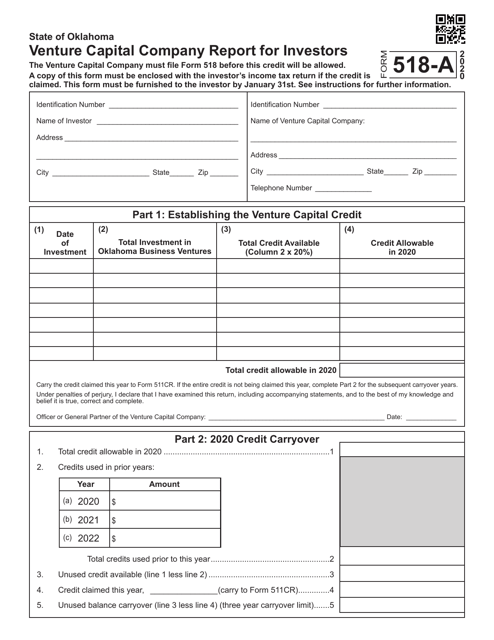

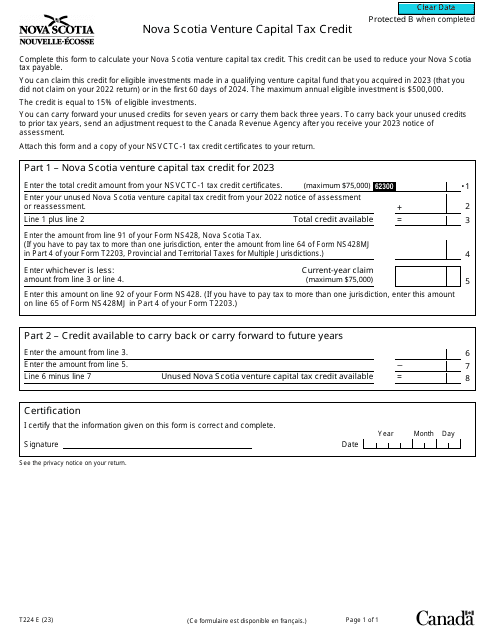

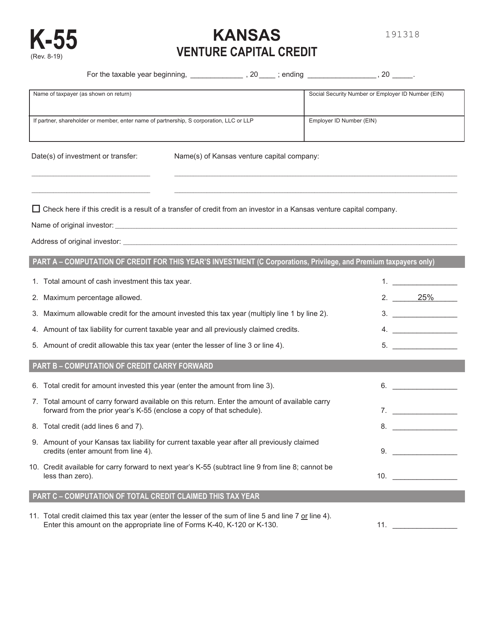

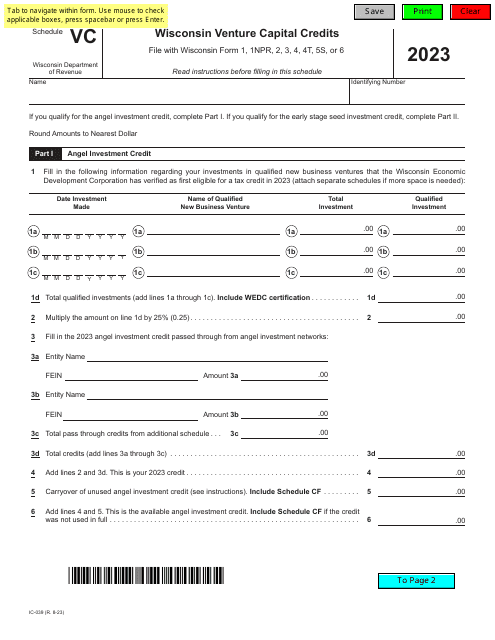

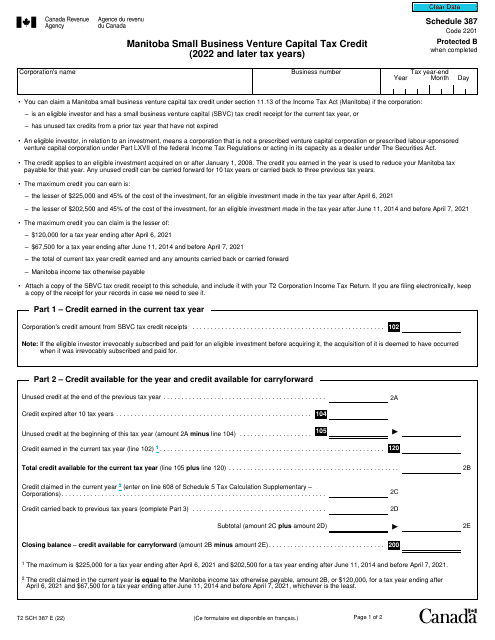

Our collection of documents, reports, and forms spans various jurisdictions, including the United States and Canada, and offers a diverse set of valuable information. From the Form 518-A Venture Capital Company Report for Investors in Oklahoma to the Schedule K-55 Kansas Venture Capital Credit in Kansas, our resource center covers a wide range of regulatory requirements, investor reports, and tax credits related to venture capital investments.

With a deep understanding of the challenges and opportunities in the venture capital landscape, our resource center aims to empower both entrepreneurs and investors alike. We provide insights into the latest trends, best practices, and strategies that can help entrepreneurs secure funding and navigate the complex venture capital ecosystem.

For investors, we offer valuable information on identifying promising investment opportunities, evaluating startups, mitigating risks, and maximizing returns. From understanding the intricacies of due diligence to deciphering term sheets, our resource center equips investors with the knowledge they need to make informed investment decisions.

Whether you're a seasoned investor or a budding entrepreneur, our venture capital resource center is your go-to place for valuable information, expert insights, and practical resources. Explore our diverse collection of documents and tap into the power of venture capital to drive innovation, growth, and success.

(Note: The SEO text above is a general representation of the venture capital documents group and does not incorporate the provided document titles. However, it captures the essence of venture capital, its importance, and the value our resource center provides.)

Documents:

22

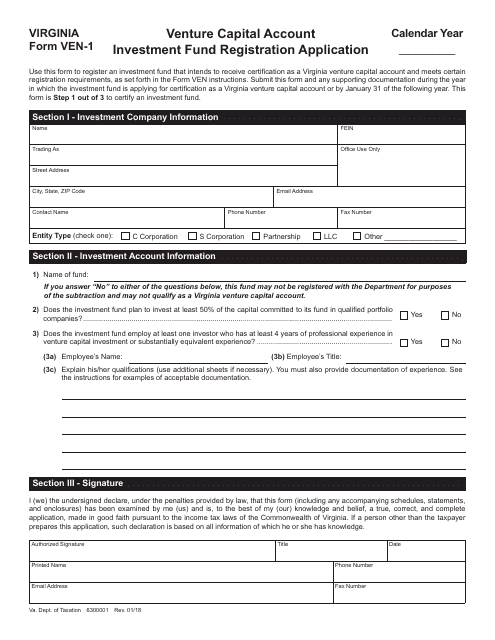

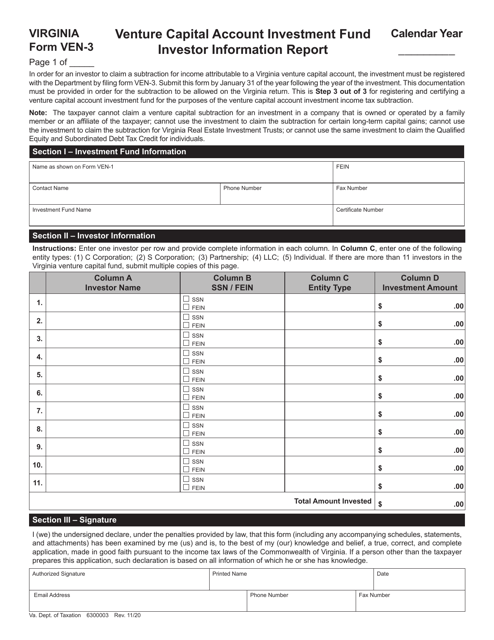

This form is used for registering a Venture Capital Account Investment Fund in the state of Virginia. It is necessary to complete this application in order to legally establish the fund in Virginia.

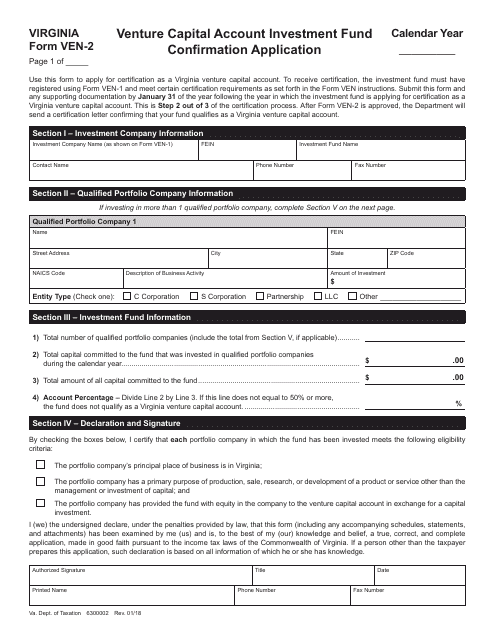

This form is used for applying for confirmation of a venture capital account investment fund in Virginia.

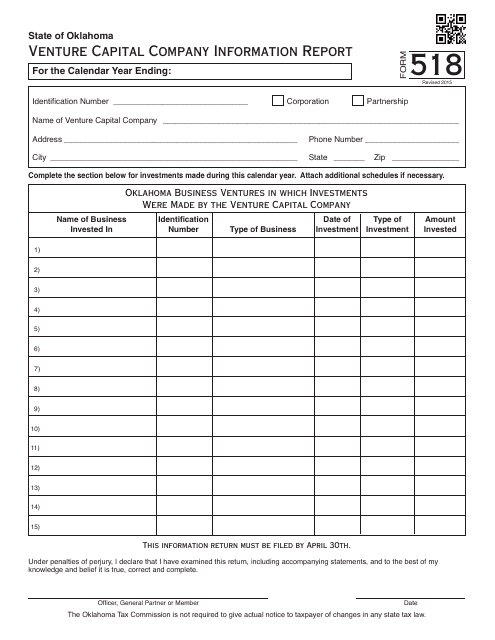

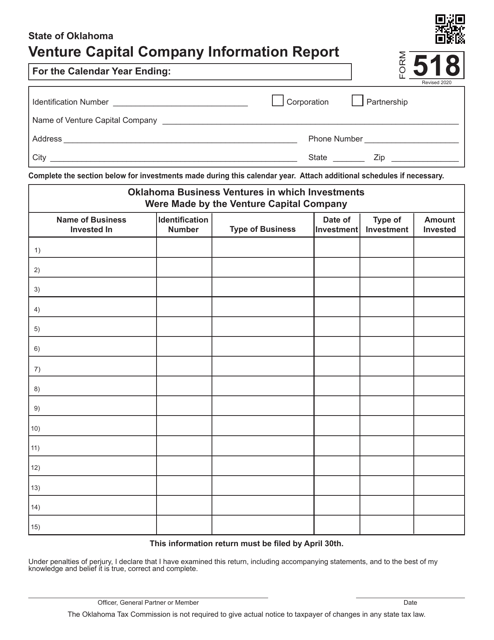

This document is used for reporting information about venture capital companies in Oklahoma.

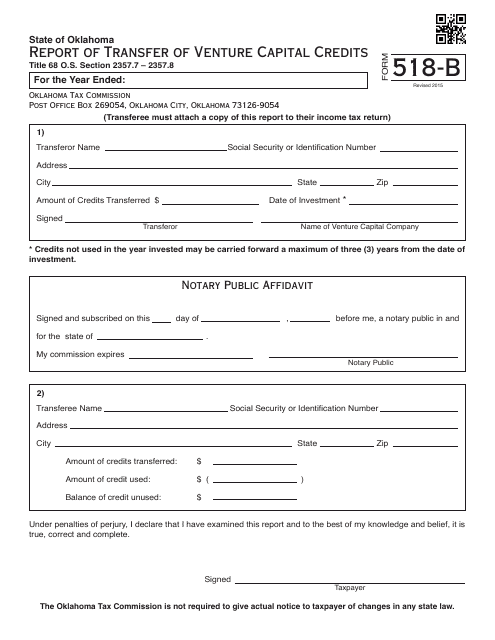

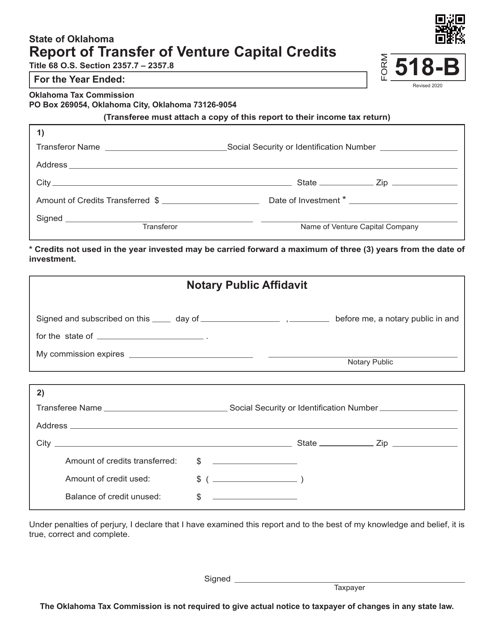

This Form is used for reporting the transfer of venture capital credits in Oklahoma.

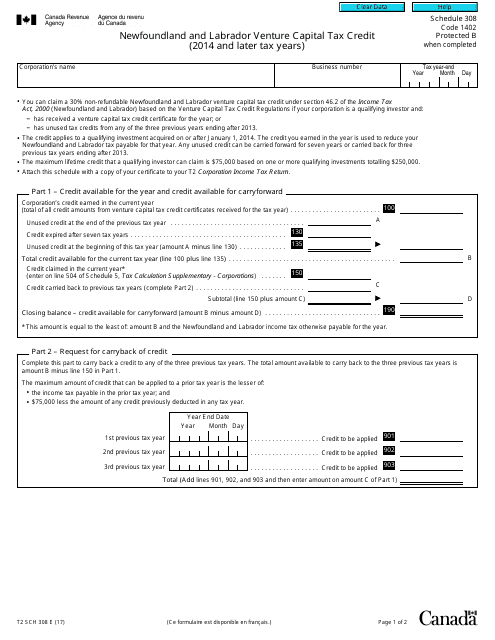

This form is used for claiming the Newfoundland and Labrador Venture Capital Tax Credit in Canada for tax years 2014 and later.

This document is used for reporting the transfer of venture capital credits in the state of Oklahoma.

This form is used for reporting information about venture capital companies in Oklahoma.

This form is used for claiming the Kansas Venture Capital Credit in the state of Kansas. It is available for individuals or businesses who have invested in qualified Kansas venture capital funds.

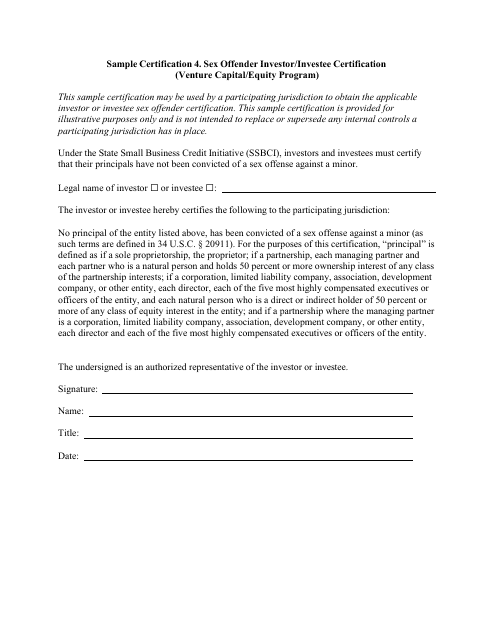

This document certifies that an investor or investee is not a sex offender and is eligible to participate in a venture capital or equity program in Minnesota. It is a sample certification form for reference.

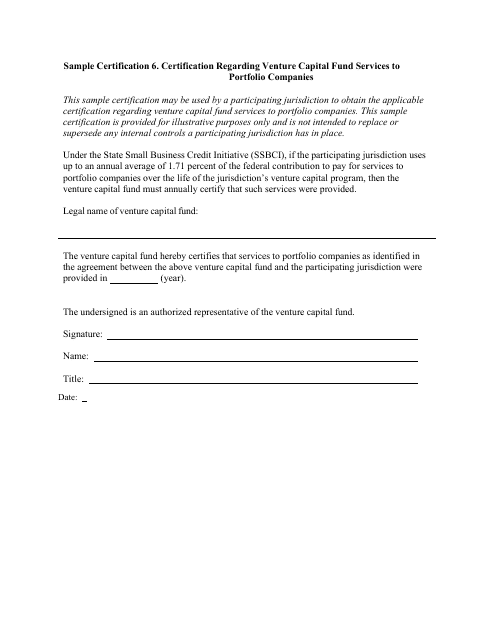

This document is a sample certification used in Minnesota for Venture Capital Fund Services to Portfolio Companies. It outlines the certification process and requirements for providing such services.