Small Business Investment Companies Templates

Are you a small business looking for investment opportunities? Look no further than the Small Business Investment Companies (SBICs). SBICs are investment firms that provide financing to small businesses in the United States and other countries. As an alternative to traditional banks, SBICs offer flexible funding options and can be a valuable resource for entrepreneurs.

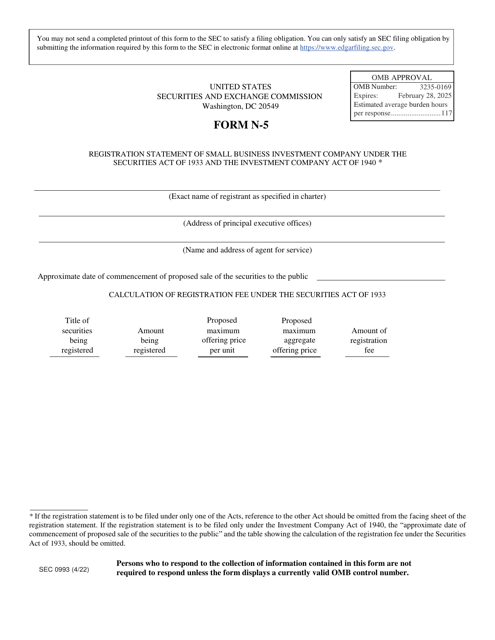

Whether you're starting a new venture or looking to expand your existing business, SBICs can provide the capital you need to succeed. From seed funding to growth capital, SBICs have a range of investment options to meet your specific needs. These investment companies are registered under the Investment Company Act of 1940 and are subject to regulations and oversight by the Securities and Exchange Commission (SEC).

By partnering with an SBIC, you gain access not only to financial resources but also to a network of industry experts and business advisors who can help guide and support your growth. SBICs often specialize in particular industries or sectors, which means they have the expertise to understand the unique challenges and opportunities your business may face.

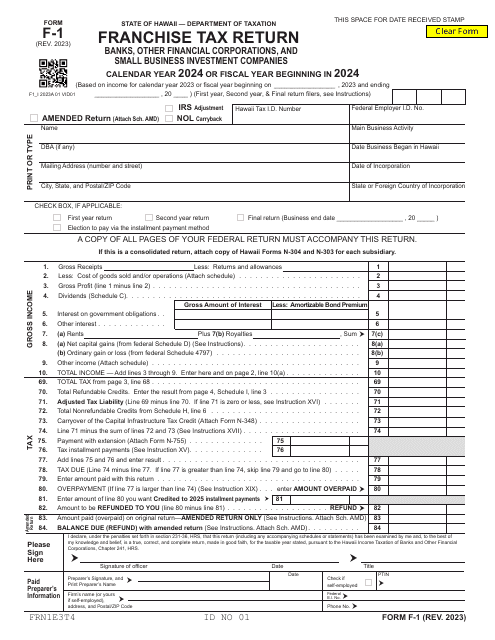

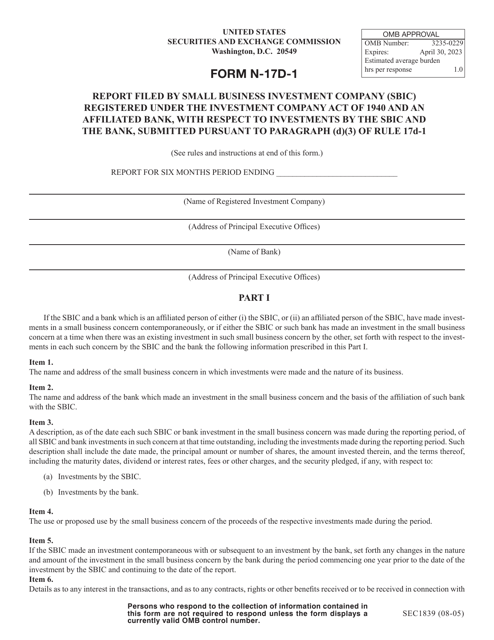

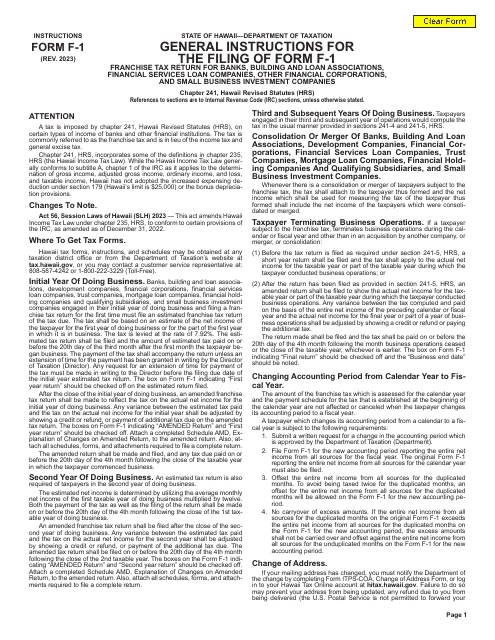

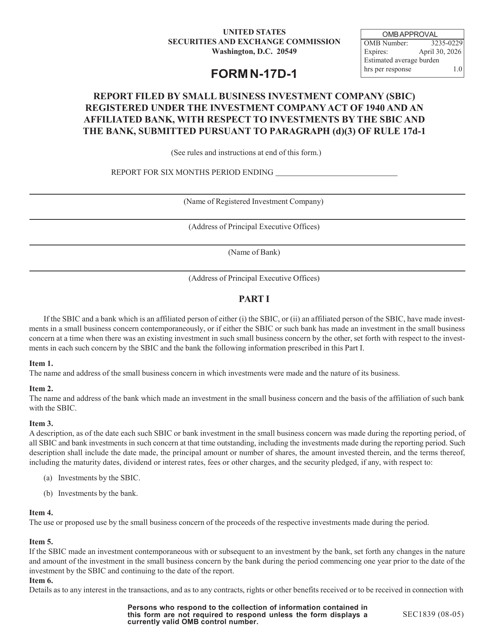

To ensure transparency and accountability, SBICs are required to file various reports with the SEC, such as Form N-17D-1 and Form N-5. These filings provide important information on the investments made by SBICs and their affiliated banks. Additionally, SBICs may be required to comply with state-specific tax regulations, such as the Form F-1 Franchise Tax Return in Hawaii.

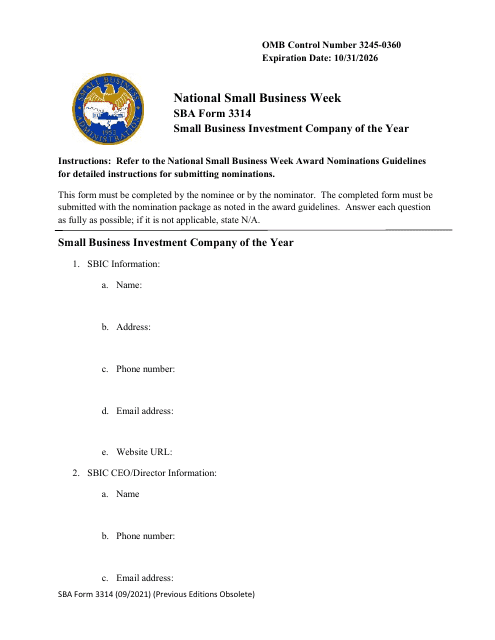

Each year, the Small Business Administration (SBA) recognizes outstanding SBICs through the Small Business Investment Company of the Year Award. This prestigious award highlights the contributions and achievements of SBICs in supporting small businesses and driving economic growth.

Don't miss out on the opportunities offered by SBICs. Explore the possibilities and find the right investment partner for your small business. Whether you're seeking funding for research and development, expansion into new markets, or working capital, SBICs can be a catalyst for your success. Contact an SBIC today and unlock the potential of your business.

Documents:

12

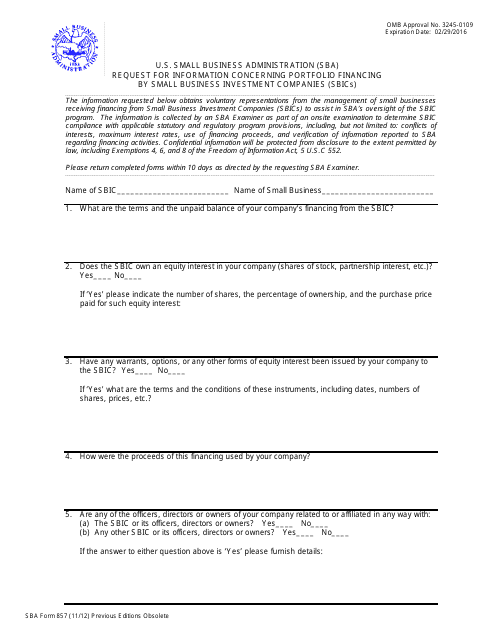

This form is used for requesting information about portfolio financing by Small Business Investment Companies (SBICs).

This document is a report filed by a Small Business Investment Company (SBIC) with the Securities and Exchange Commission (SEC). It provides information about the SBIC's investments and operations.

This form is used for reporting investments made by a Small Business Investment Company (SBIC) registered under the Investment Company Act of 1940 and an affiliated bank. It is a requirement under Paragraph (D)(3) of Rule 17d-1.