Tax Negotiation Templates

Are you looking for a way to resolve your tax concerns with ease? Look no further than our comprehensive collection of tax negotiation documents. With a variety of forms and resources available, you can navigate the complexities of tax negotiation quickly and efficiently.

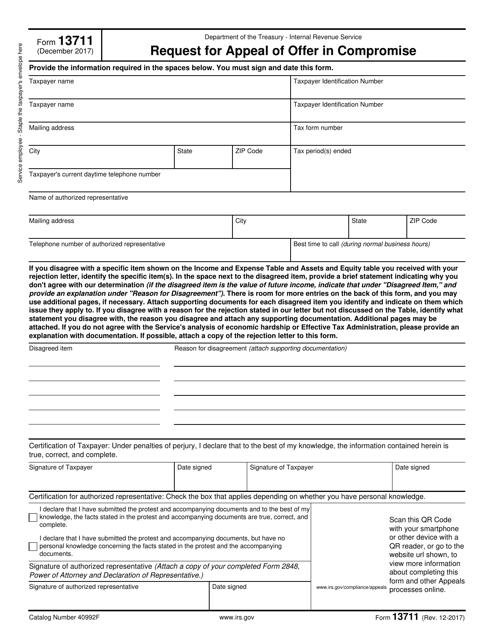

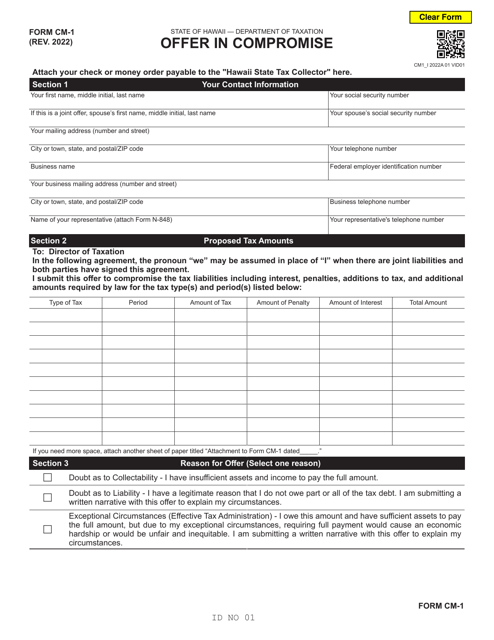

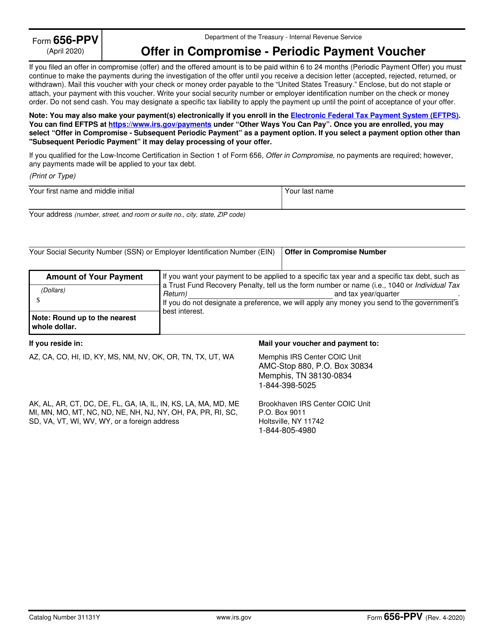

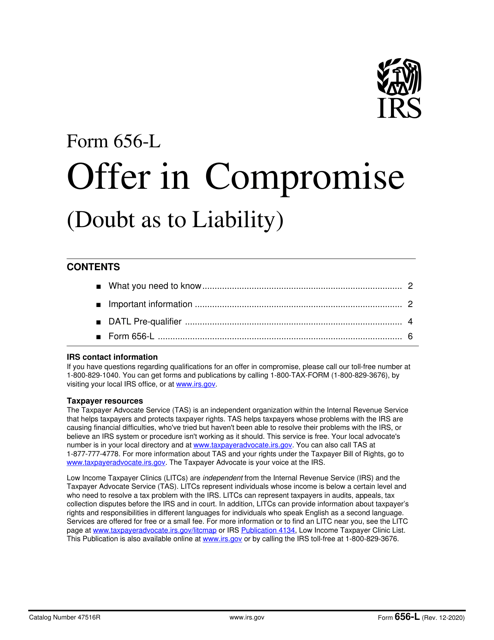

Our tax negotiation collection, also known as tax negotiations or tax negotiation forms, provides you with the necessary tools to address your tax issues. Whether you're seeking an Offer-In-Compromise in Arizona, navigating the process in Philadelphia, or looking for a waiver in Missouri, we have the forms you need. From IRS Form 656 to the Form ADOR11005 Offer-In-Compromise and more, our documents cover a wide range of tax negotiation needs.

Don't let tax issues weigh you down. Take advantage of our tax negotiation collection and gain peace of mind. Our documents can help streamline the process, ensuring you have all the necessary forms and resources at your fingertips. Trust in our expertise to guide you through your tax negotiations, no matter where you're located.

Stay ahead of your tax negotiations and resolve your concerns effectively. Explore our tax negotiation documents today and take the first step towards a worry-free tax resolution.

Documents:

27

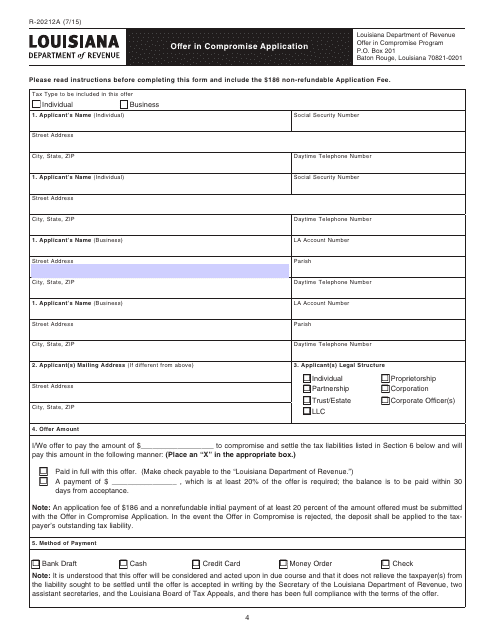

This Form is used for filing an Offer in Compromise Application in the state of Louisiana.

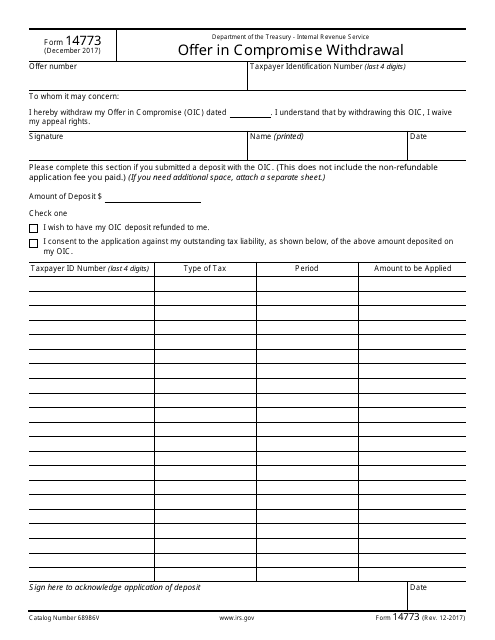

This Form is used for withdrawing an offer in compromise with the Internal Revenue Service (IRS).

This form is used for the Offer in Compromise Program in the state of Louisiana. It allows taxpayers to settle their tax debts with the state for a reduced amount.

This form is used for submitting an offer-in-compromise to the Arizona Department of Revenue. It allows taxpayers to propose a settlement for their outstanding tax liabilities with the state of Arizona.

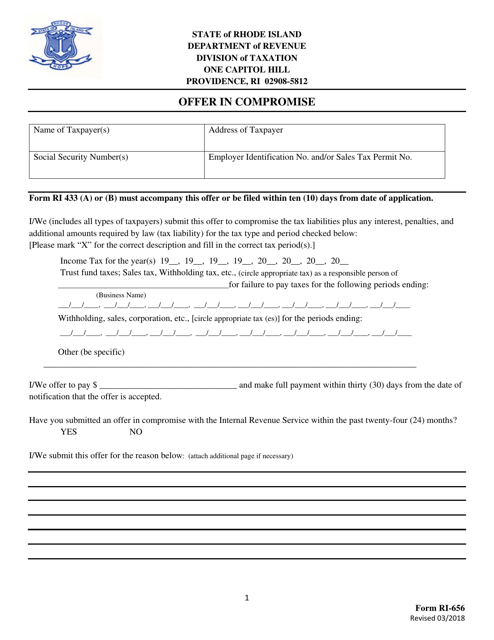

This form is used for making an offer in compromise to the state of Rhode Island to settle a tax debt.

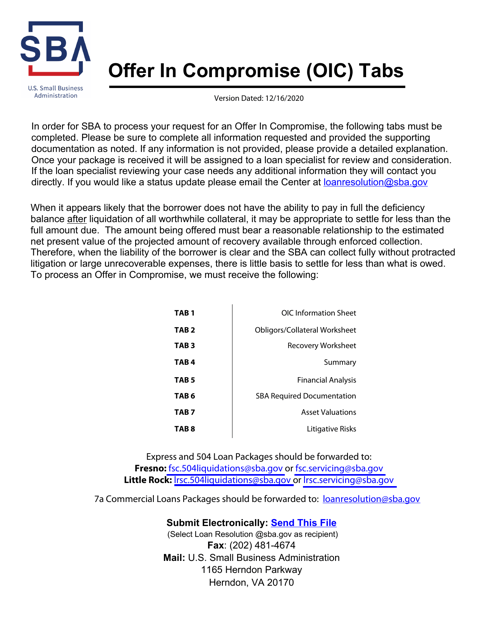

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.

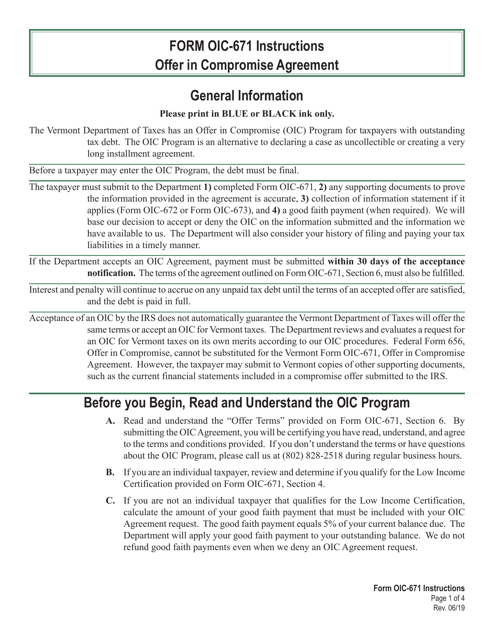

This form is used for making an offer in compromise to the state of Vermont. It is an agreement to settle a taxpayer's debt for less than the full amount owed.

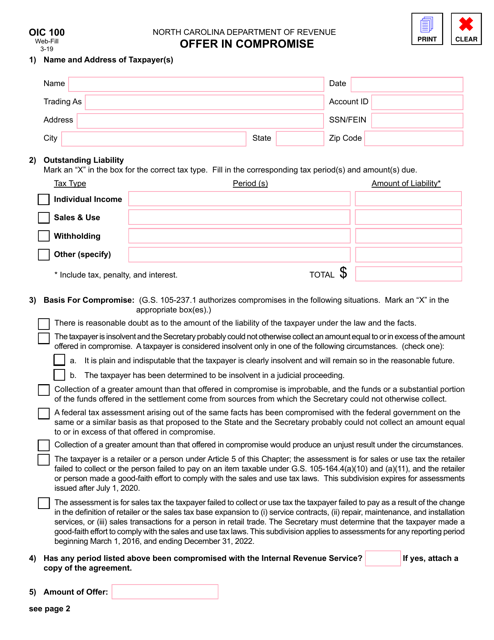

This document is used for submitting an Offer in Compromise to the state of North Carolina. It is a request to settle a tax liability for less than the full amount owed.

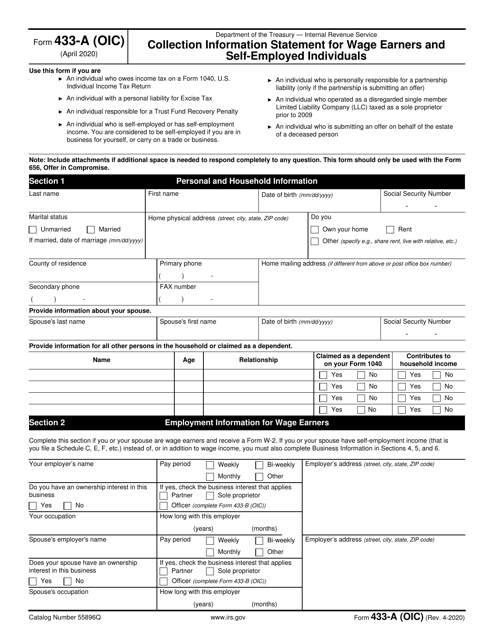

This Form is used for individuals who owe taxes to provide detailed financial information to the IRS in order to request an offer in compromise (OIC) and settle their tax debt.

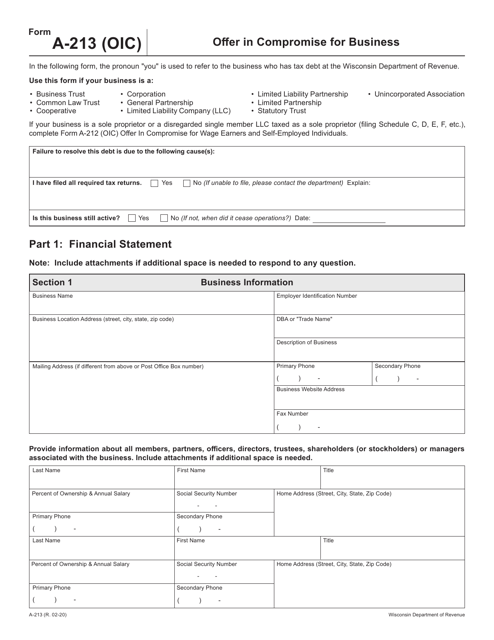

This form is used for making an offer in compromise for a business located in Wisconsin.

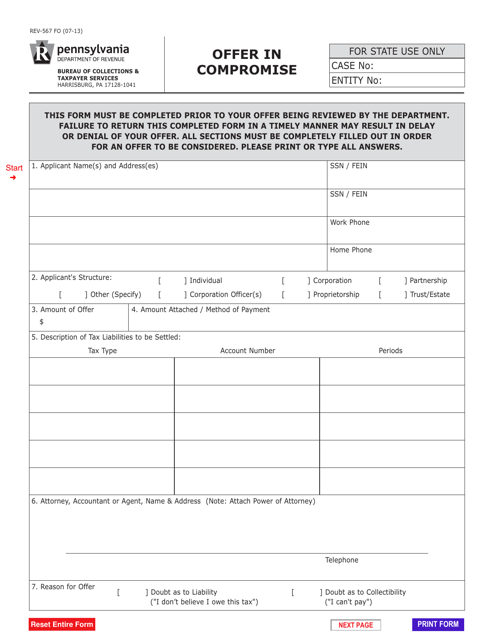

This Form is used for making an offer in compromise with the state of Pennsylvania to settle your tax debt for less than the full amount owed.

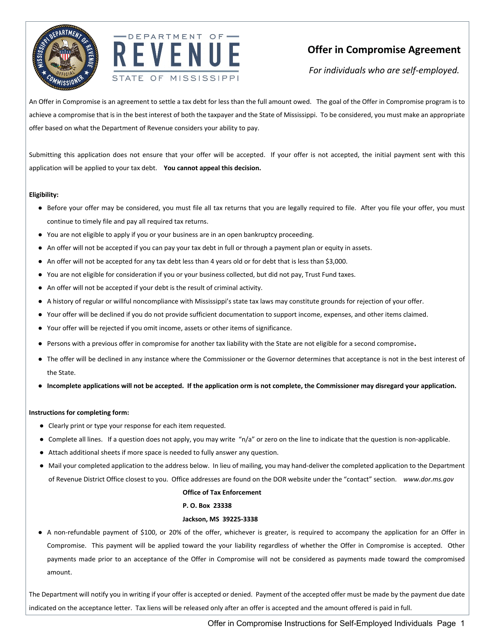

This Form is used for self-employed individuals in Mississippi who want to apply for an Offer in Compromise to settle their tax debt with the state. It provides instructions on how to complete the application process.

This Form is used for individuals in Mississippi to apply for an Offer in Compromise, which is a potential solution for taxpayers who are unable to pay their tax debt in full.

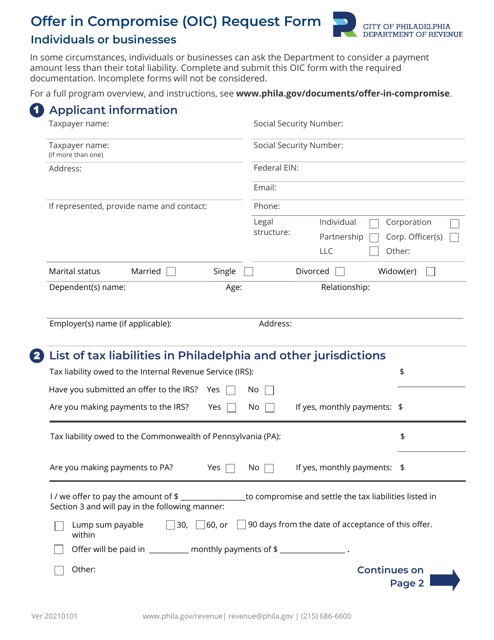

This form is used for requesting an Offer in Compromise (OIC) from the City of Philadelphia, Pennsylvania. An OIC is a way for taxpayers to settle their tax debt for less than the full amount owed.

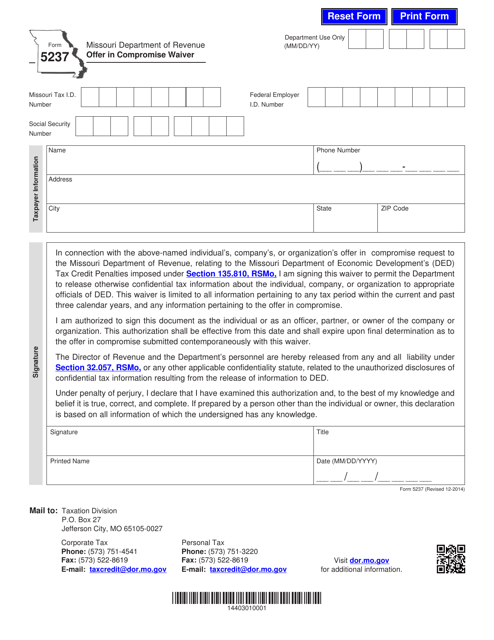

This form is used for applying for an offer in compromise waiver in the state of Missouri.