Deferred Compensation Templates

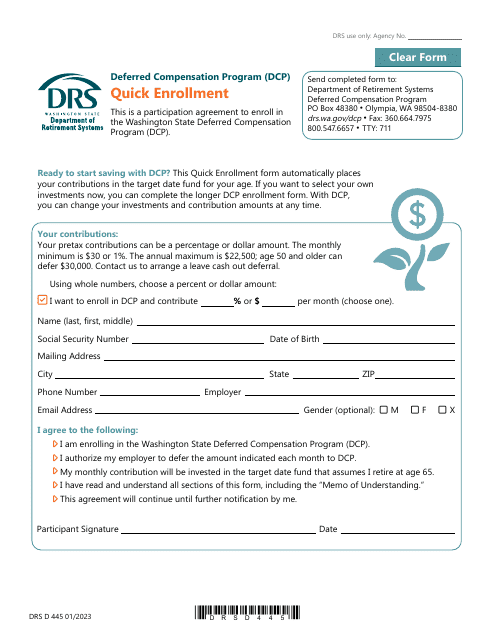

Are you considering your financial future and options for retirement? Deferred compensation plans are an excellent way to save for your later years while benefiting from potential tax advantages. Also known as salary deferral agreements, these plans allow you to set aside a portion of your income and defer it to a future date. This can give you peace of mind, knowing that you are taking proactive steps to secure your financial stability.

If you're a resident of Illinois, the Additional Retirement Benefits and Deferred Compensation (Financial Affidavit) is a document that can help you understand the potential benefits of participating in a deferred compensation plan. Similarly, if you live in Montana, the State of Montana 457(B) Deferred Compensation Plan can provide you with essential information on how to get started.

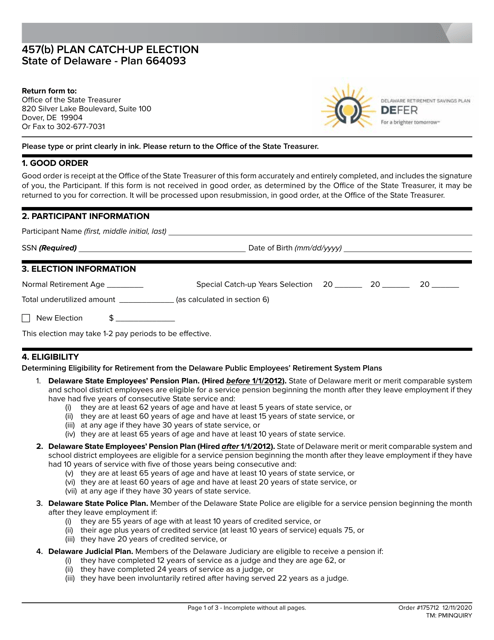

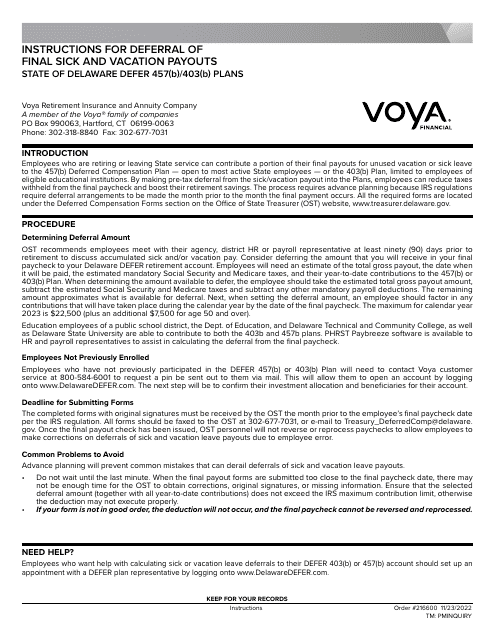

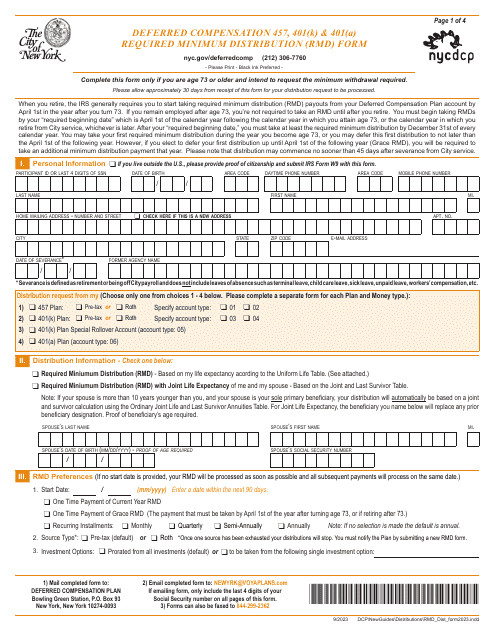

To participate in a deferred compensation plan, you may need to complete specific forms. In Delaware, for example, the 457(B) Plan Catch-Up Election form allows you to make additional contributions to your existing plan. In New York City, the Deferred Compensation 457, 401(K) & 401(A) Required Minimum Distribution (Rmd) Form is required for individuals who have reached the minimum age for distributions.

Taking advantage of a deferred compensation plan is a smart move towards securing your financial future. Start exploring the possibilities today and find out how you can benefit from these plans. Whether you refer to it as a deferred compensation plan or a salary deferral agreement, the essence remains the same – the chance to save, invest, and build a foundation for a comfortable retirement. Begin your journey towards financial freedom now.

Documents:

13

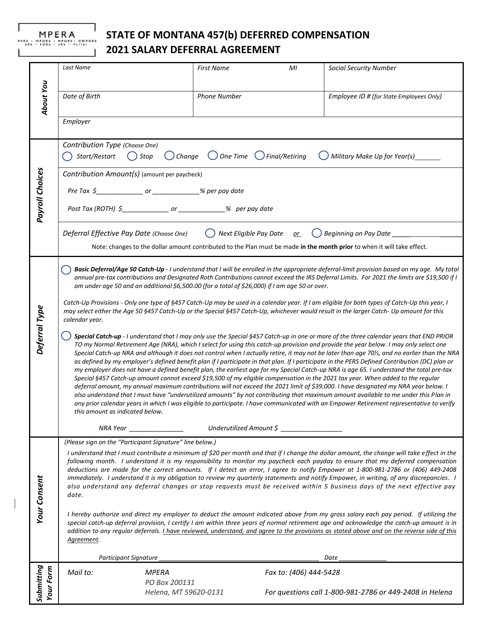

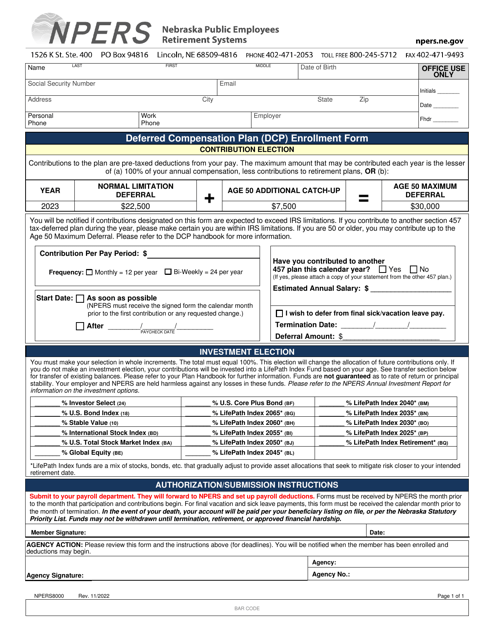

This document is used for a Salary Deferral Agreement in the State of Montana's 457(B) Deferred Compensation plan. It allows employees to defer a portion of their salary for retirement savings.

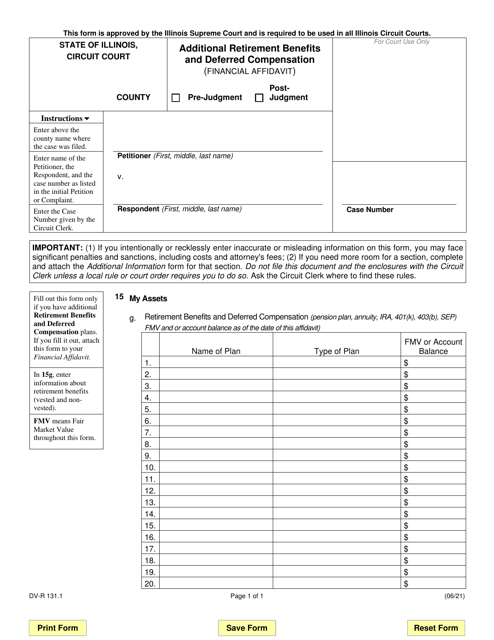

This form is used for disclosing additional retirement benefits and deferred compensation for the purpose of a financial affidavit in the state of Illinois.

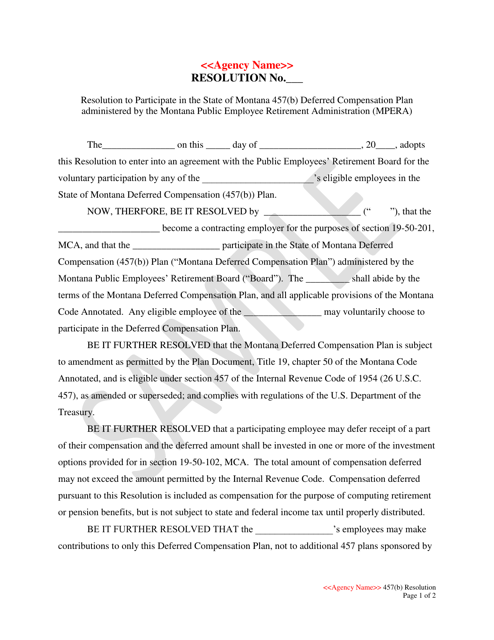

This document is a sample resolution that allows individuals in the state of Montana to participate in the Montana 457(B) Deferred Compensation Plan. It outlines the terms and conditions for employees to contribute towards their retirement savings.

This document is for making catch-up contributions to a 457(b) retirement plan in the state of Delaware. It allows individuals to contribute additional funds to their retirement account to "catch up" on missed contributions.

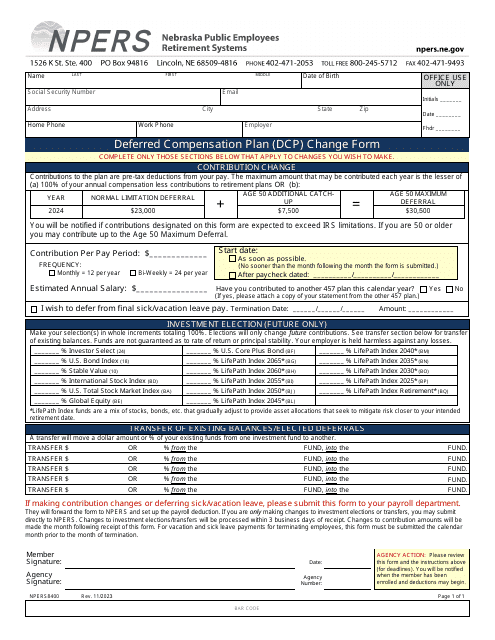

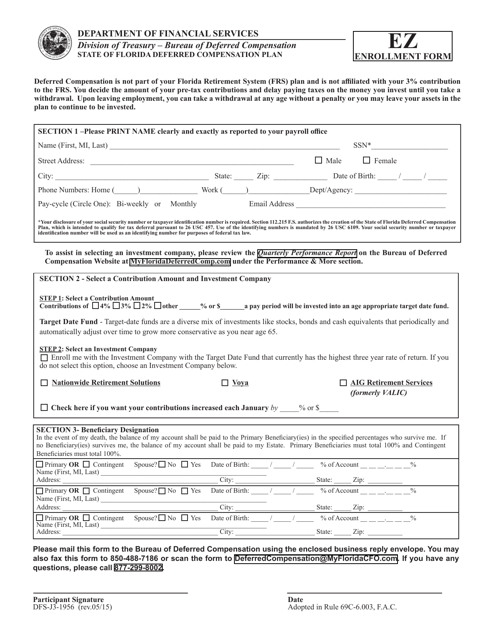

This form is used for enrolling in the Deferred Compensation Plan in Florida.

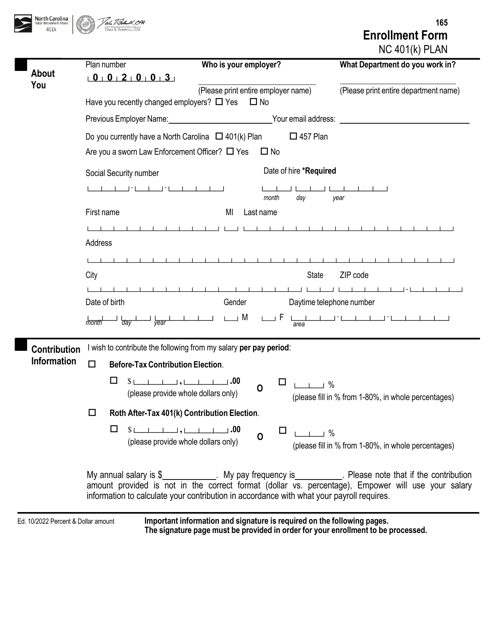

This form is used for enrolling in the Nc 401(K) Plan in North Carolina.

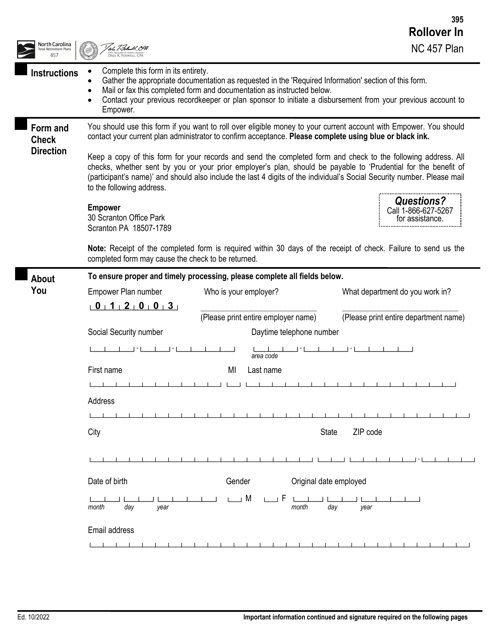

This document provides information about the rollover process in the North Carolina 457 Plan. Find out how you can transfer funds from another retirement account into your NC 457 Plan.