IRS Rules Templates

Are you looking for information on IRS rules? Look no further! Our comprehensive collection of IRS rules provides you with the guidance you need to navigate the complex tax landscape. Whether you're an individual taxpayer or a corporation, our library of IRS forms, instructions, and resources will ensure that you stay in compliance with the latest tax regulations.

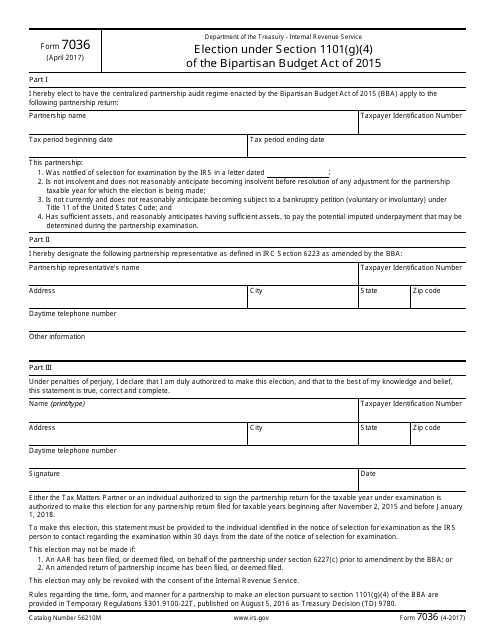

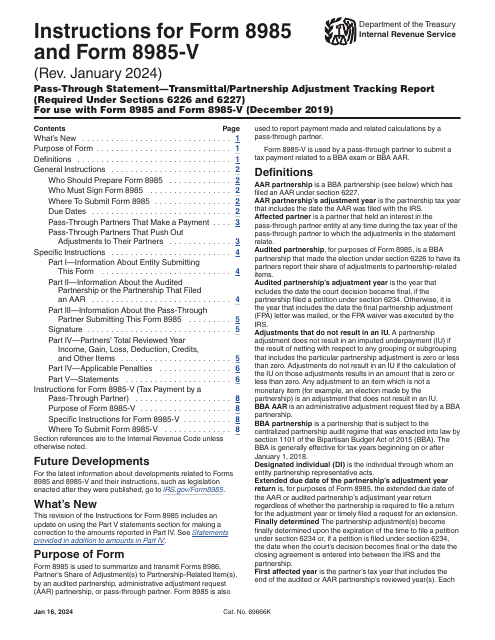

Our IRS rules collection includes a wide range of documents, such as the IRS Form 7036 Election Under Section 1101(G)(4) of the Bipartisan Budget Act of 2015 and the Instructions for IRS Form 8985, 8985-V. These forms will assist you in understanding and completing your tax obligations accurately and efficiently.

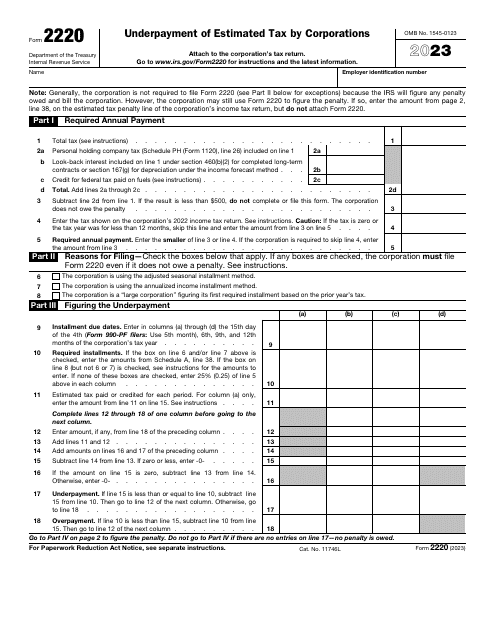

For corporations, we offer IRS Form 2220 Underpayment of Estimated Tax by Corporations, which helps ensure that your estimated tax payments align with your annual tax liability. Additionally, our collection features the Instructions for IRS Form 1040 Schedule B Interest and Ordinary Dividends, providing guidance on reporting investment income.

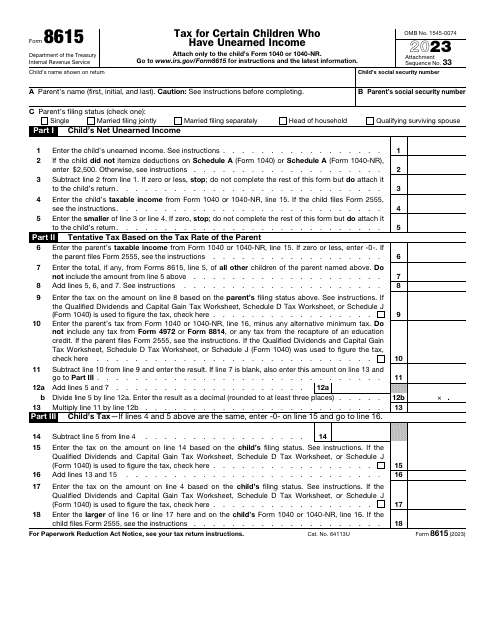

If you have children with unearned income, you'll want to familiarize yourself with IRS Form 8615 Tax for Certain Children Who Have Unearned Income. This form, along with its instructions, will help you determine the tax liability for your children's unearned income.

Stay informed and compliant with our comprehensive collection of IRS rules. Whether you need forms, instructions, or just some general tax guidance, our extensive resources are here to assist you. Take advantage of our wealth of knowledge to streamline your tax preparation process and ensure accurate reporting.

Documents:

5

This form is used for making an election under Section 1101(G)(4) of the Bipartisan Budget Act of 2015.