Local Tax Templates

Are you a resident or a business owner in a specific city or state in the United States? If so, it's crucial to have a clear understanding of the local tax regulations and forms that apply to you. Local taxes, also known as local tax forms or local tax returns, are an essential part of fulfilling your financial obligations to your community.

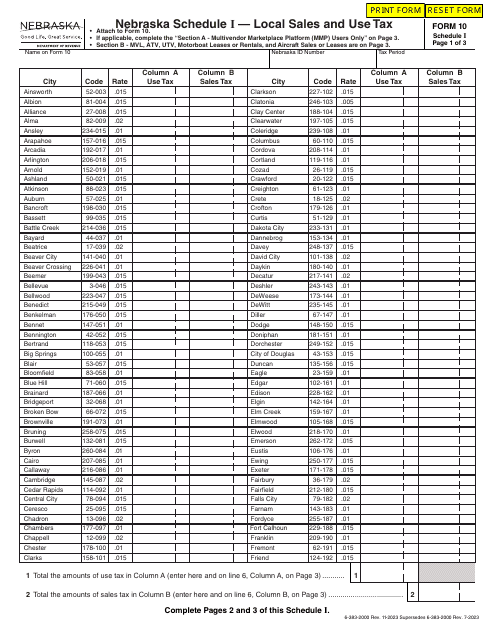

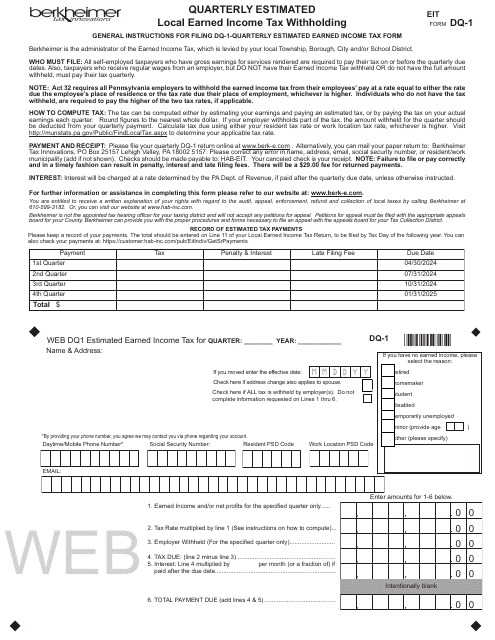

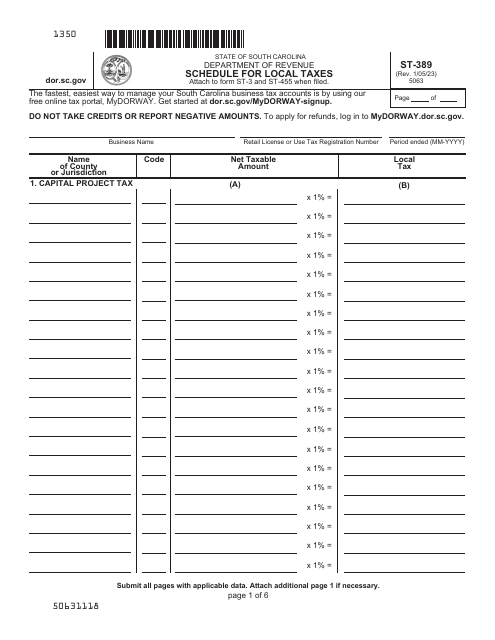

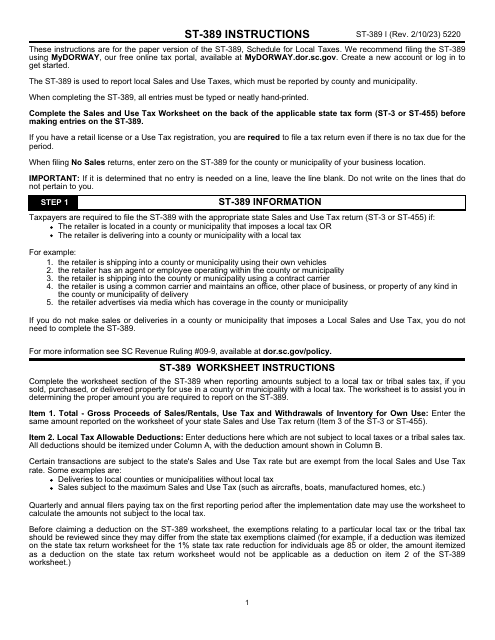

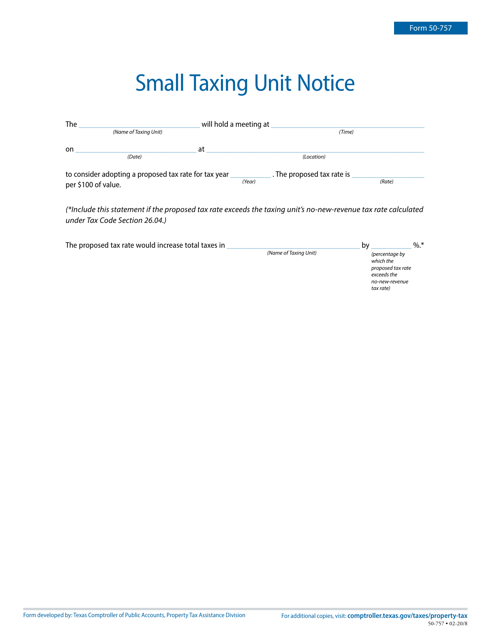

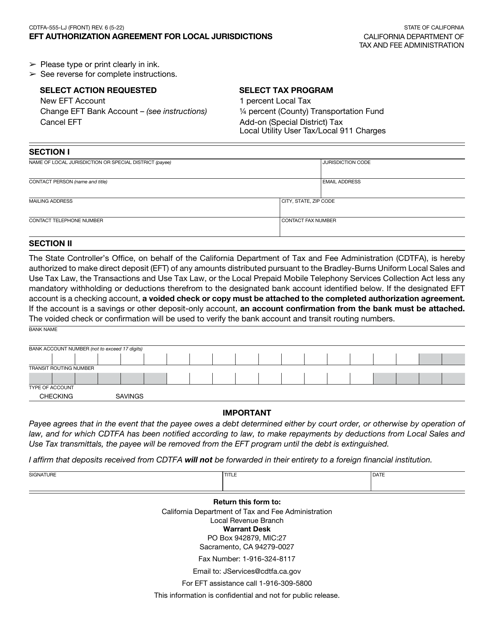

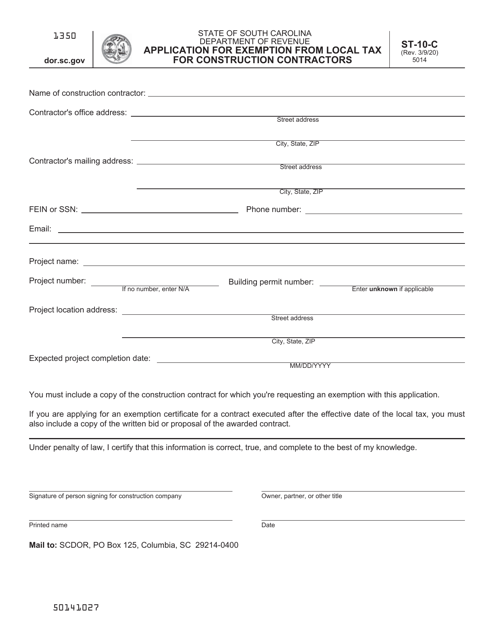

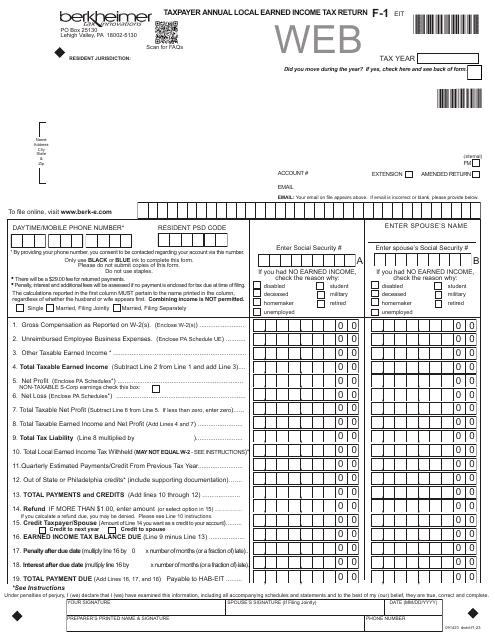

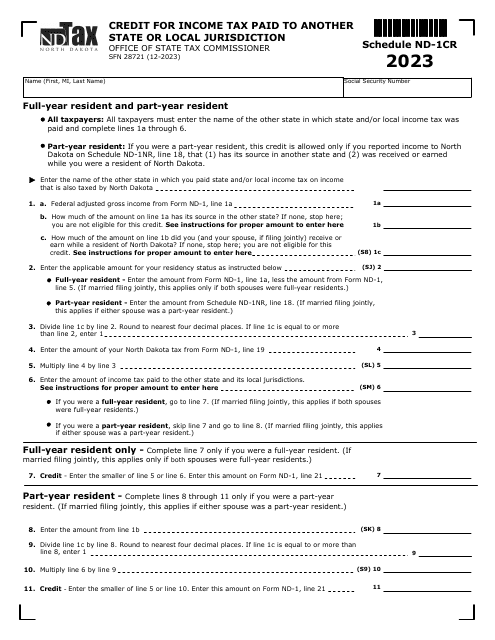

There are various types of local taxes that you may need to file, such as sales and use tax, business use tax, and school income tax. Each city or state may have its own set of local tax requirements, so it's vital to stay informed and ensure you comply with the specific regulations that apply to you.

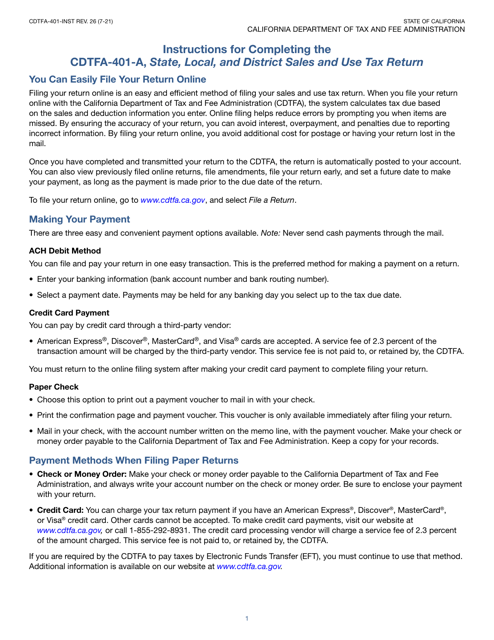

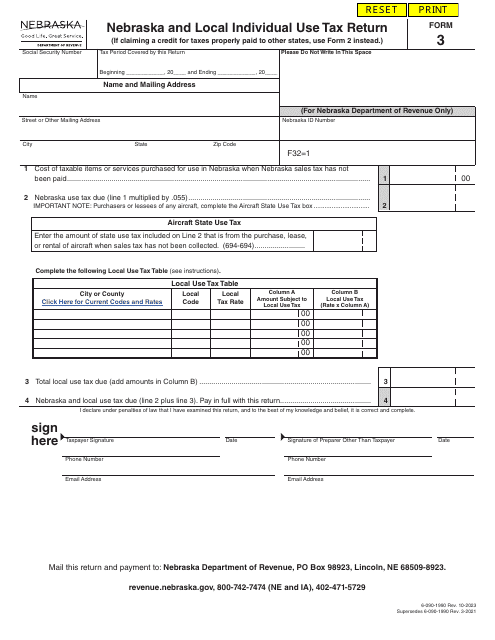

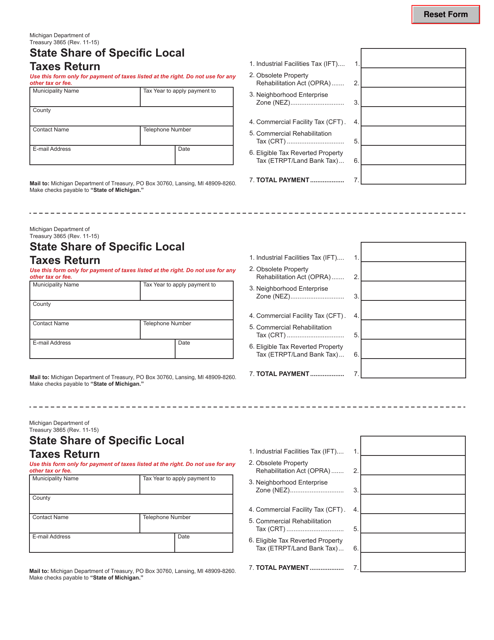

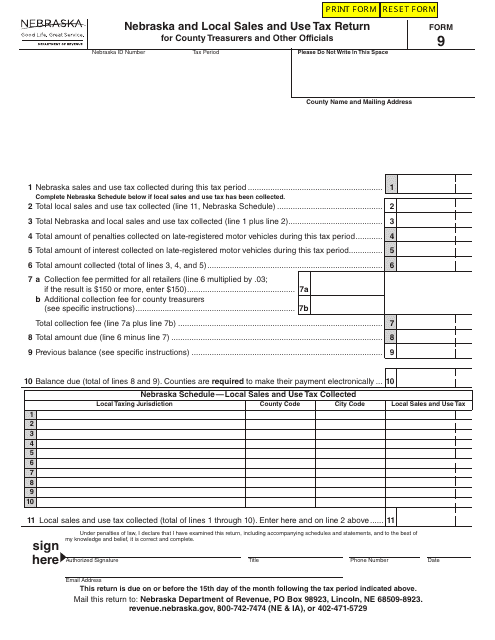

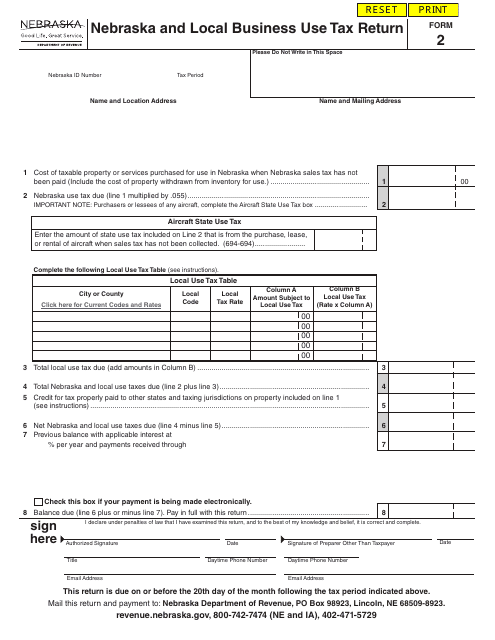

Filing your local tax forms accurately and on time is essential to avoid penalties and maintain a good standing with the local tax authorities. These forms, such as the Sales & Use Tax Return Form or Form 2 Nebraska and Local Business Use Tax Return, enable you to report your local tax liabilities accurately.

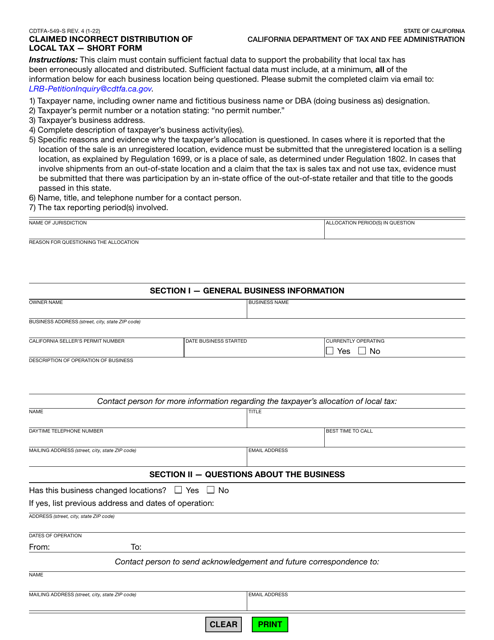

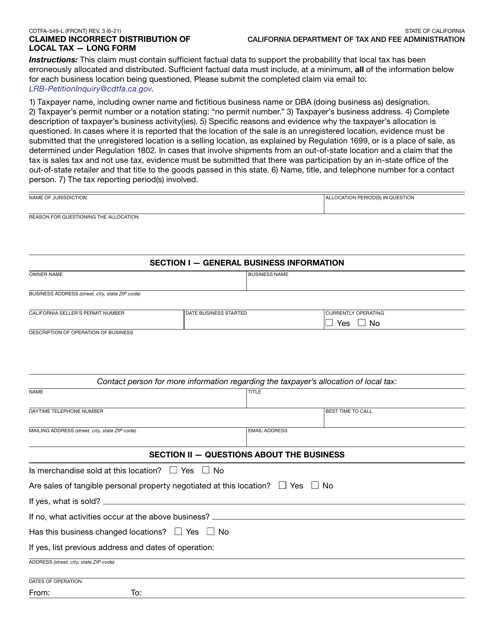

In some cases, you may need to submit additional forms, like the Form CDTFA-549-L Claimed Incorrect Distribution of Local Tax - Long Form, which allows you to address any discrepancies in the allocation of local tax funds.

If you are a non-resident or an international business owner, you might have unique tax considerations. The IRS Form 1040-NR Schedule OI provides vital information regarding your tax obligations as a non-resident taxpayer.

To ensure compliance with local tax laws and avoid any complications, it's advisable to seek professional tax advice or consult the resources provided by the relevant local tax authorities. They can provide guidance on the specific local tax forms and procedures that pertain to your situation.

Remember, staying informed about your local tax obligations and fulfilling them responsibly contributes to the smooth functioning of your community and helps support local projects and services. Don't underestimate the importance of local tax compliance; it's a reflection of your commitment to being a responsible citizen or business owner.

Documents:

70

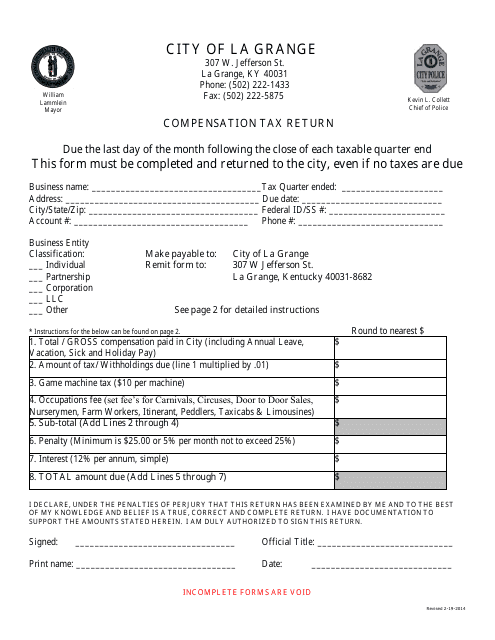

This document is used for reporting compensation tax returns to the City of La Grange, Kentucky.

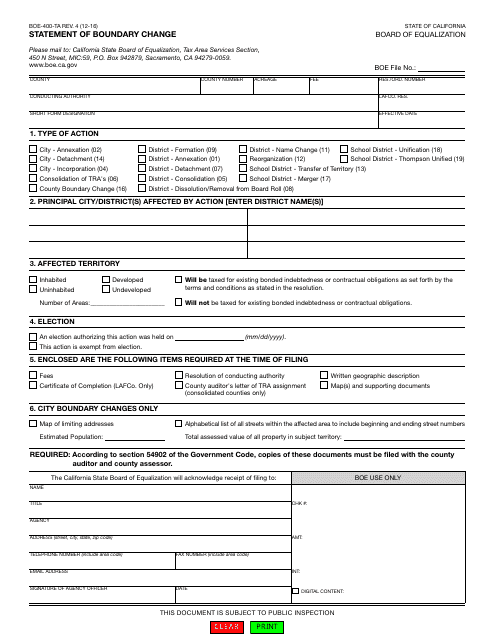

This form is used for reporting boundary changes in California.

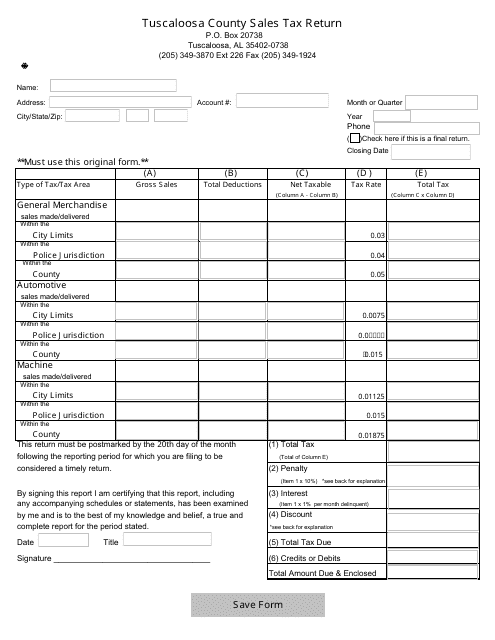

This form is used for submitting sales tax returns to the City of Tuscaloosa, Alabama.

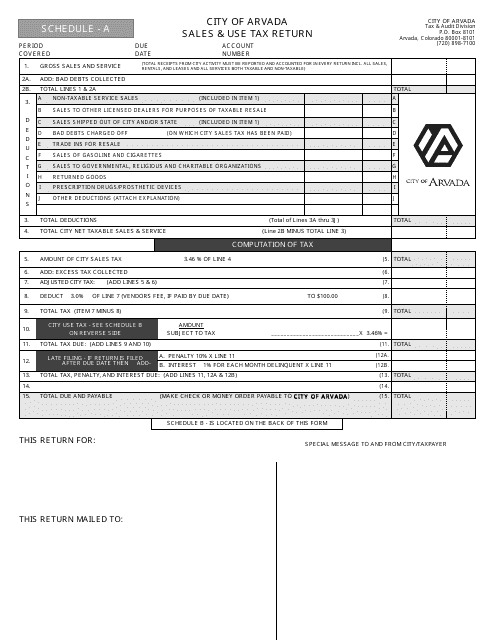

This document is used for filing Sales & Use Tax returns for businesses in the City of Arvada, Colorado.

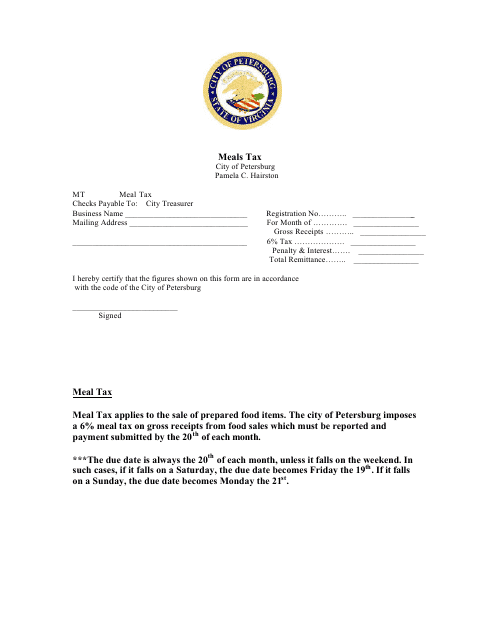

This form is used for reporting and paying the meals tax in Petersburg, Virginia. Businesses in the city that sell prepared meals are required to complete and submit this form to the local tax authority.

This form is used for reporting and remitting sales and use taxes to the City of Boulder, Colorado.

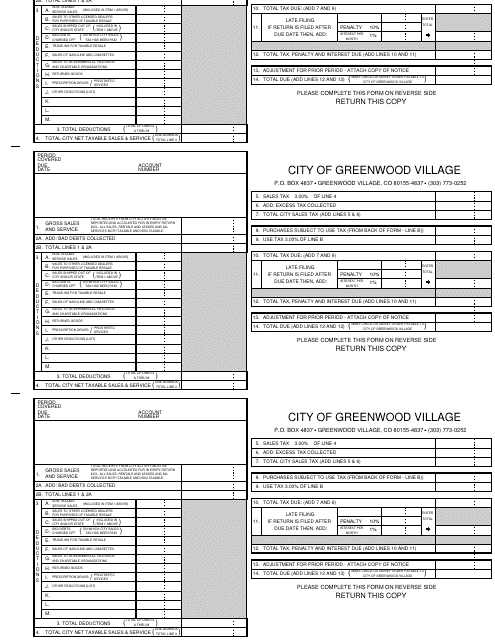

This form is used for reporting sales tax collected in the City of Greenwood Village, Colorado. It helps businesses comply with local tax regulations and submit the required payment to the city.

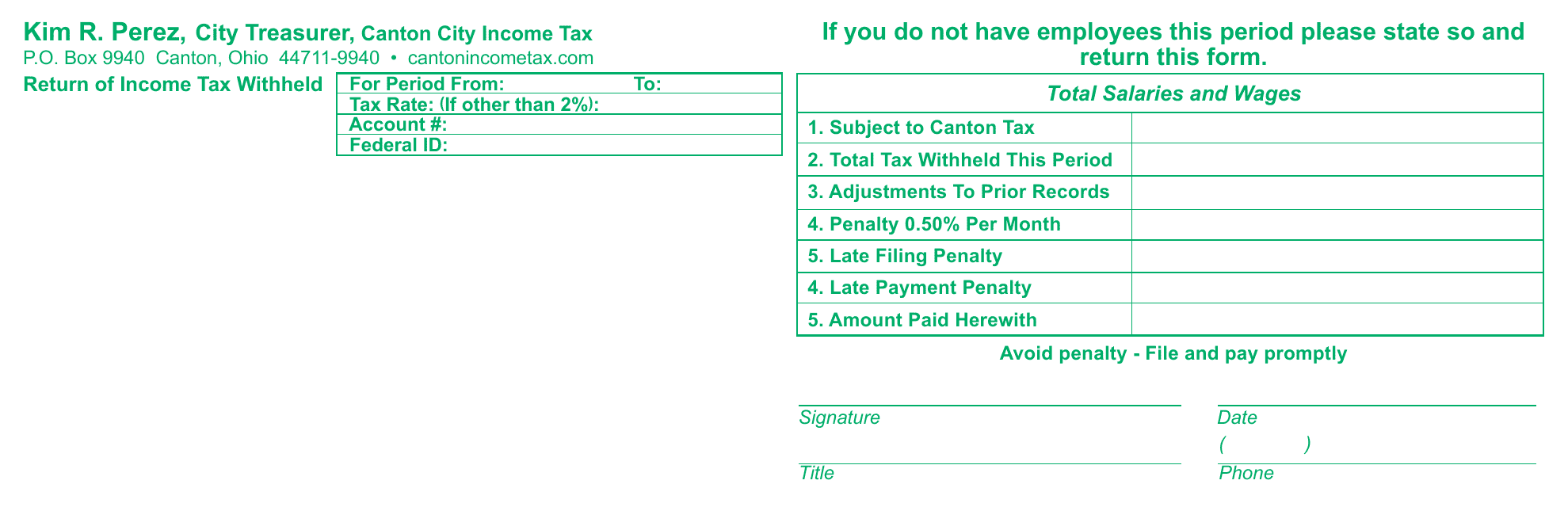

This Form is used for obtaining a withholding coupon from the City of Canton, Ohio.

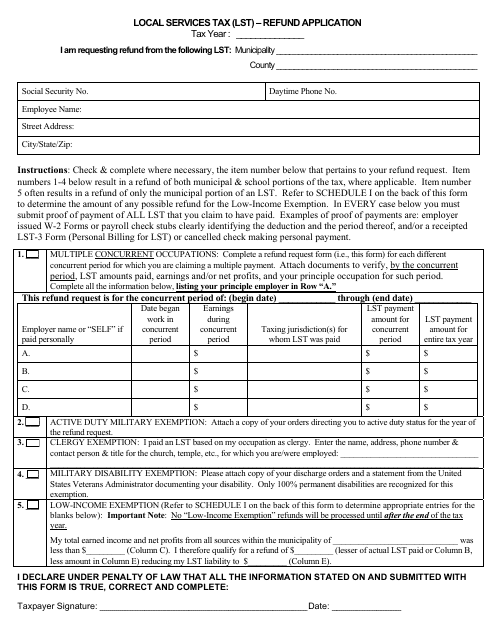

This Form is used for applying for a refund of the Local Services Tax (LST).

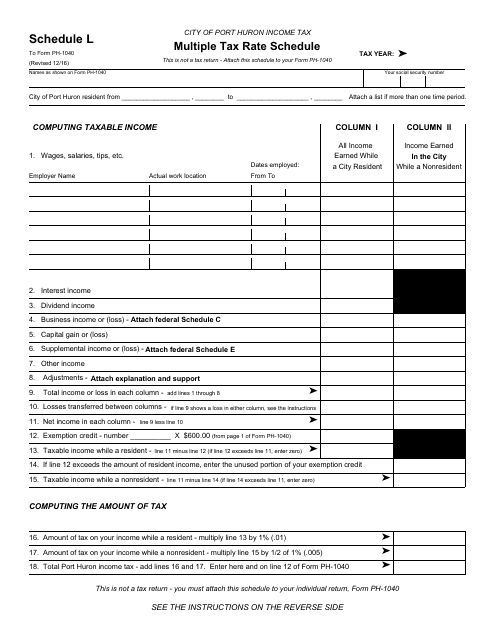

This form is used for determining the applicable tax rate for residents of the City of Port Huron, Michigan.

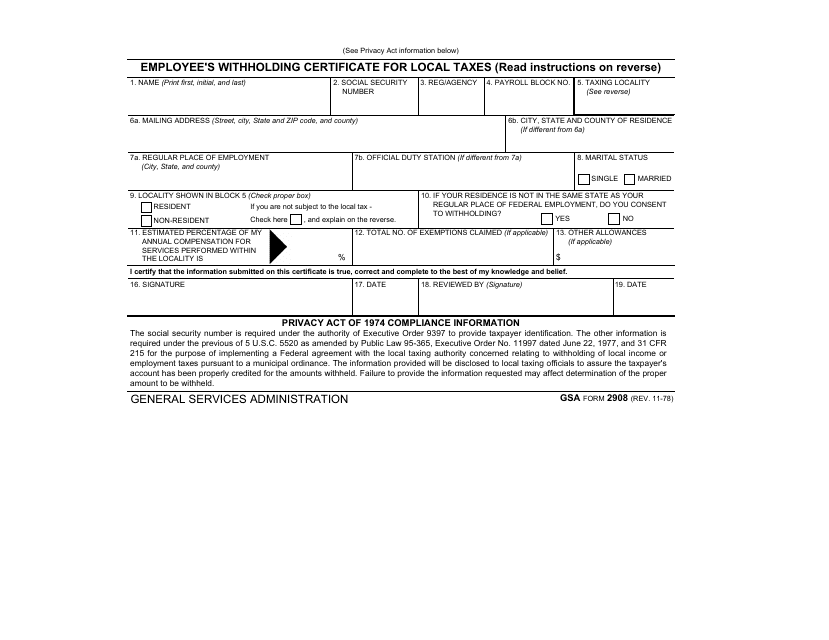

This form is used for employees to report their withholding for local taxes.

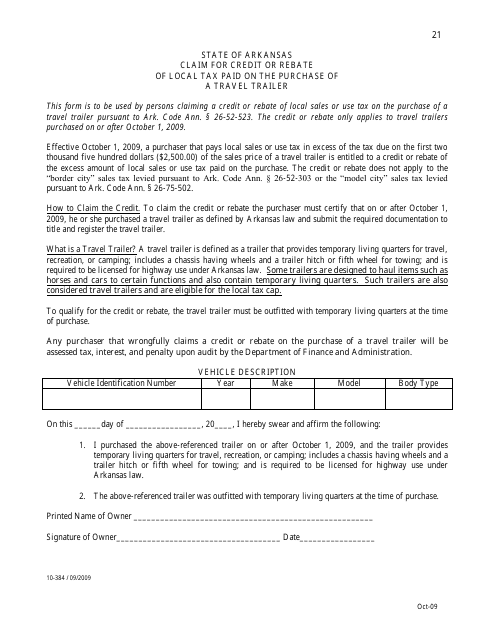

This form is used for claiming a credit or rebate for the local tax paid on the purchase of a travel trailer in Arkansas.

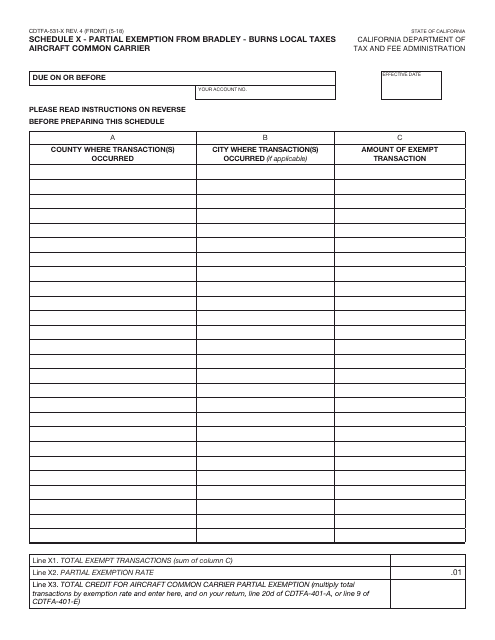

This form is used for claiming a partial exemption from Bradley-Burns local taxes for aircraft common carriers in California.

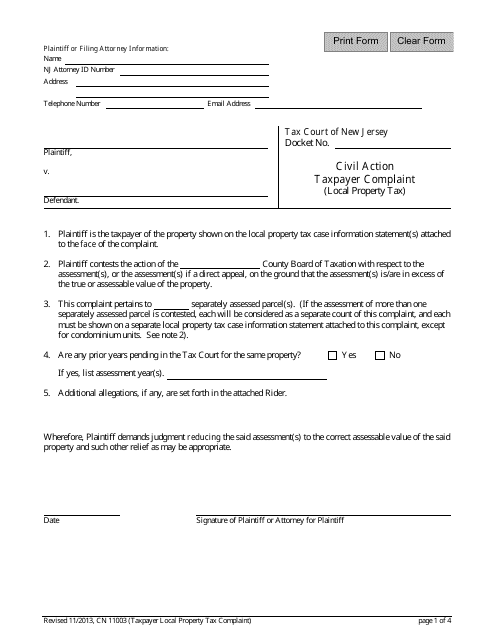

This Form is used for filing a complaint regarding local property tax issues in New Jersey.

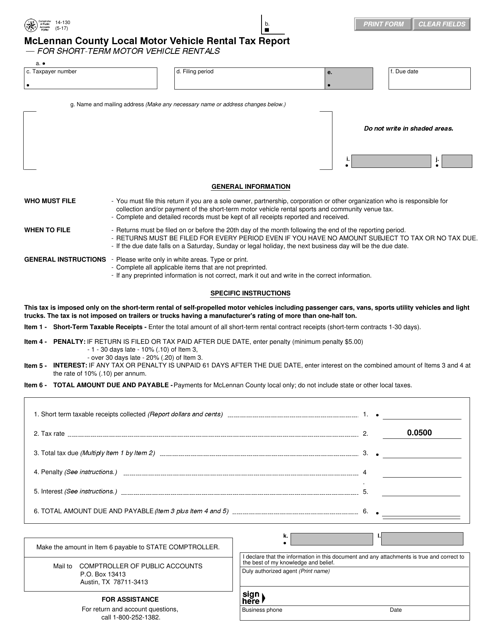

This form is used for reporting local motor vehicle rental tax for short-term vehicle rentals in McLennan County, Texas.

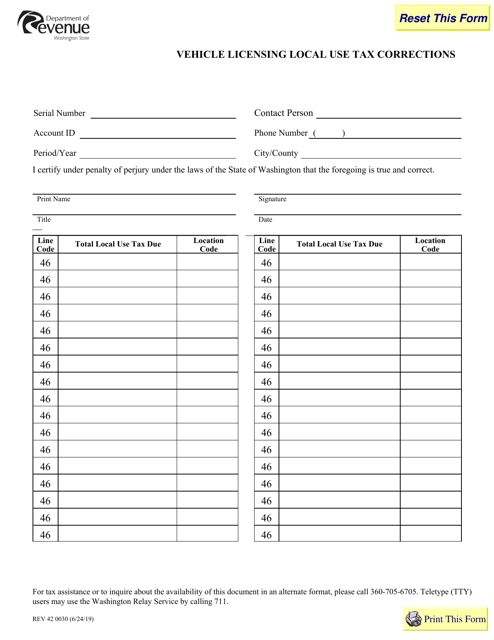

This Form is used for correcting local use tax information on vehicle licensing in Washington state.

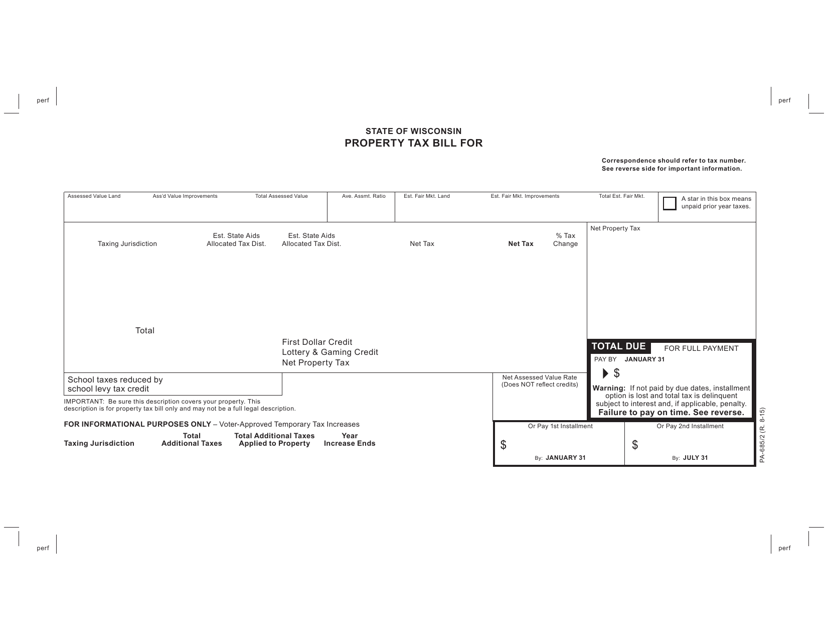

This document is used for paying property taxes in the state of Wisconsin. It provides a detailed bill of the amount owed for the property tax and instructions for payment.

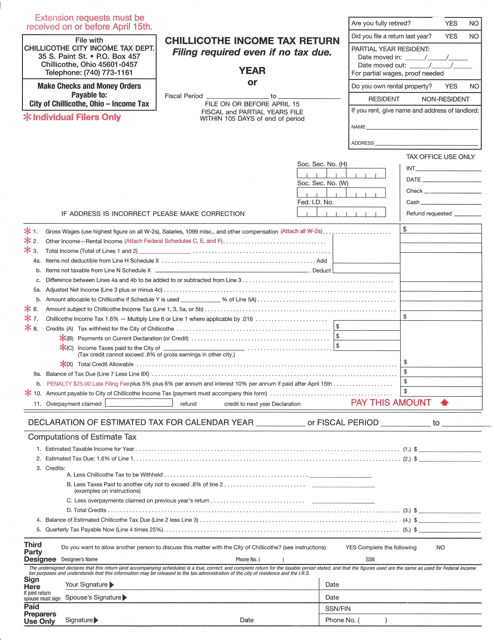

This document is used for filing your income tax return with the City of Chillicothe, Ohio.

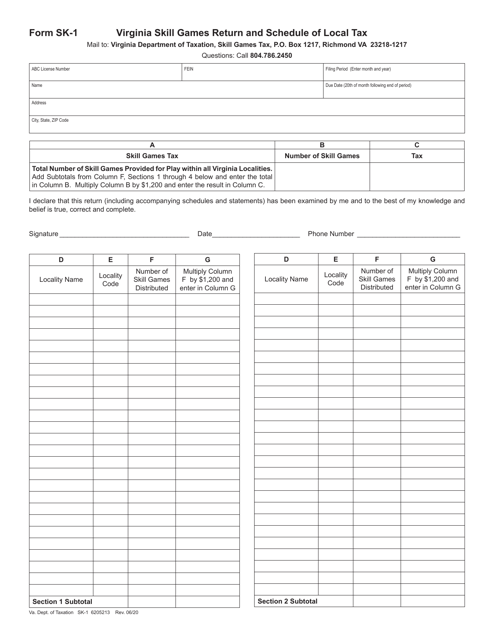

This document is used for reporting and paying taxes on skill games in Virginia.