Partnership Statement Templates

A partnership statement is a crucial document that establishes the existence, authority, income, and status of a partnership. It serves as a legal declaration that outlines the rights, responsibilities, and obligations of each partner within the business.

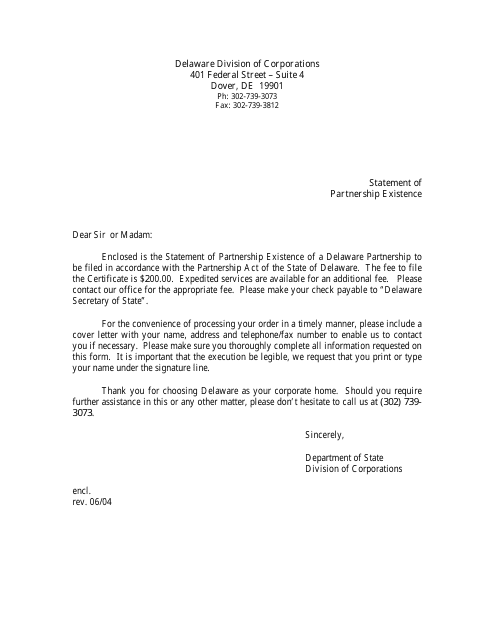

The Statement of Partnership Existence, also known as Form 220303 in Delaware, is a key document that confirms the presence of the partnership in the state. This statement provides important details such as the partnership's name, principal place of business, registered agent, and duration.

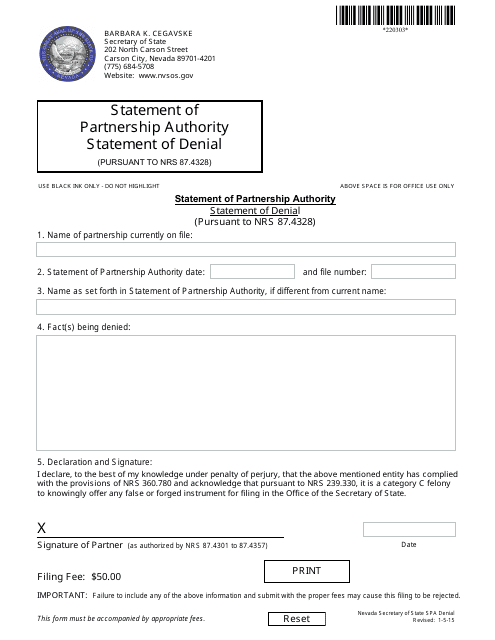

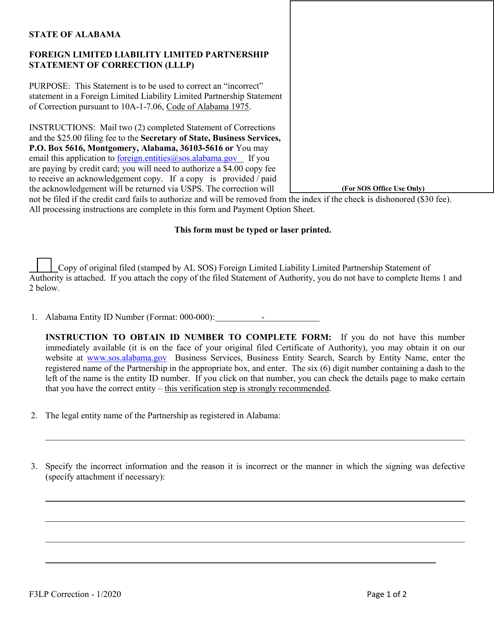

In Nevada, the Statement of Partnership Authority Statement of Denial is an essential document that conveys the partnership's authority and denies any claims that may interfere with its operations. This statement is crucial in protecting the partnership from unauthorized activities or challenges to its authority.

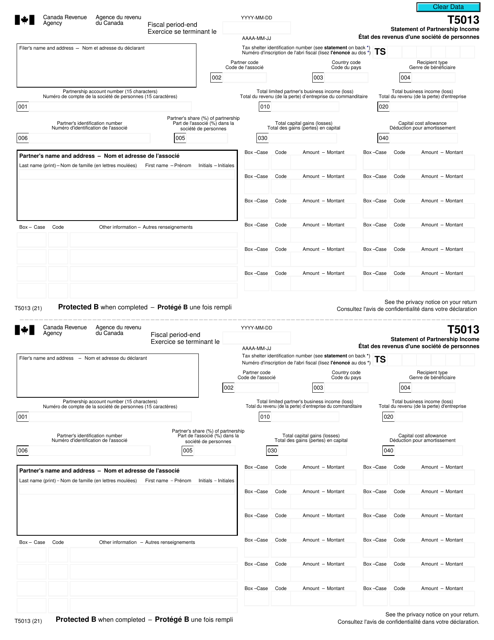

For partnerships in Canada, the Form T5013 Statement of Partnership Income plays a significant role in reporting the partnership's income to the Canada Revenue Agency. This detailed form is available in both English and French and must be completed accurately to comply with taxation laws.

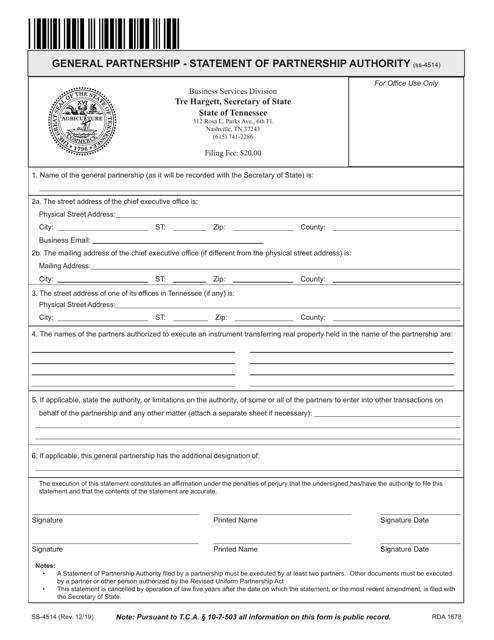

In Tennessee, the Form SS-9419 Statement of Withdrawn or Rescinded Dissolution of Limited Partnership is a crucial document that outlines the process of dissolving a limited partnership. This statement ensures that all necessary steps and legal requirements are followed, allowing for a smooth dissolution.

Ohio's Form 545 Amendment/Cancellation of Partnership Statement is an important document for partnerships and limited liability partnerships. It allows for amendments or cancellations to be made to the original partnership statement, reflecting any changes in the business's structure or operations.

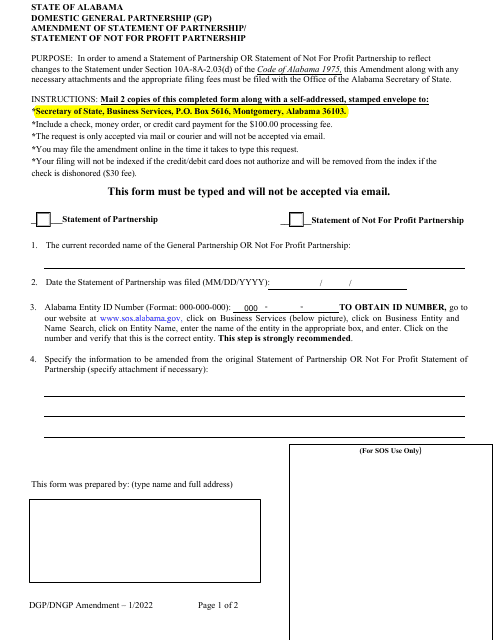

Whether establishing a partnership, reporting income, or making changes to a partnership agreement, a partnership statement is essential to ensuring legal compliance and clarity within the business. These documents protect the interests of partners, provide transparency to stakeholders, and facilitate smooth partnerships operations.

Documents:

20

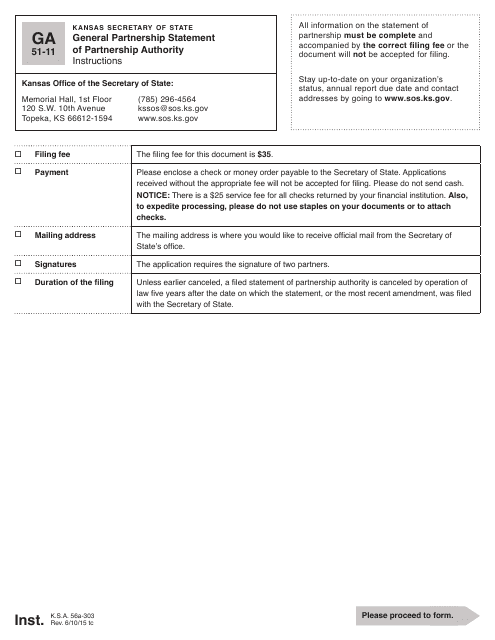

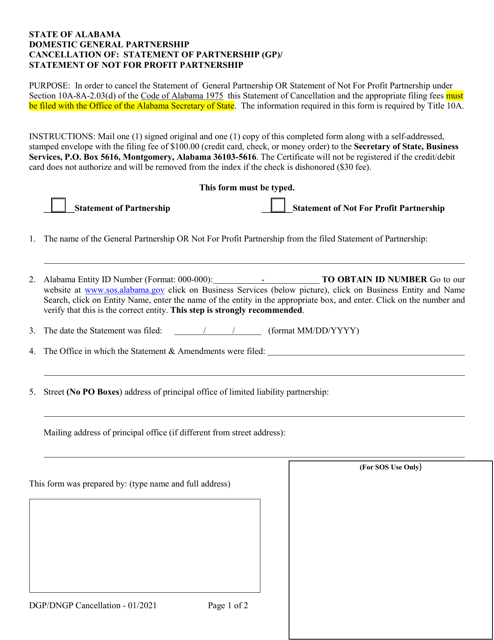

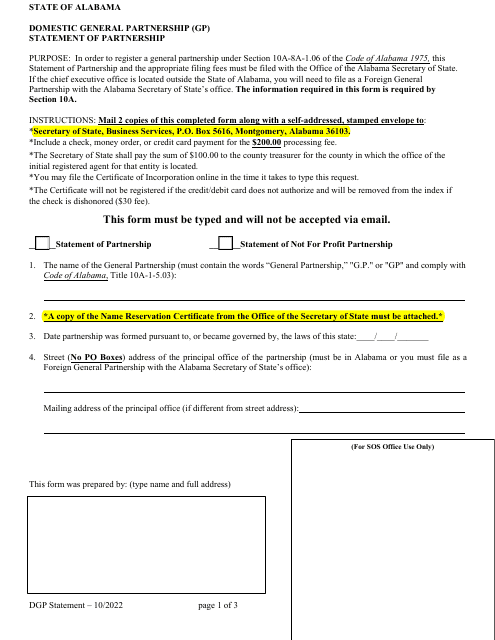

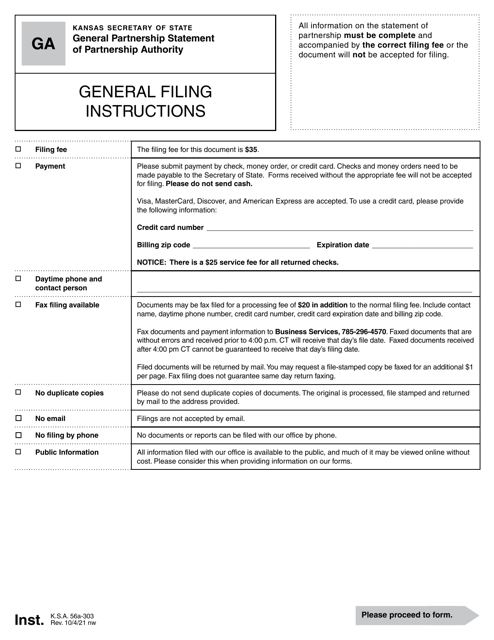

This form is used for a general partnership in Kansas to submit a statement of partnership authority. It is used to provide information about the partnership's authority and its members.

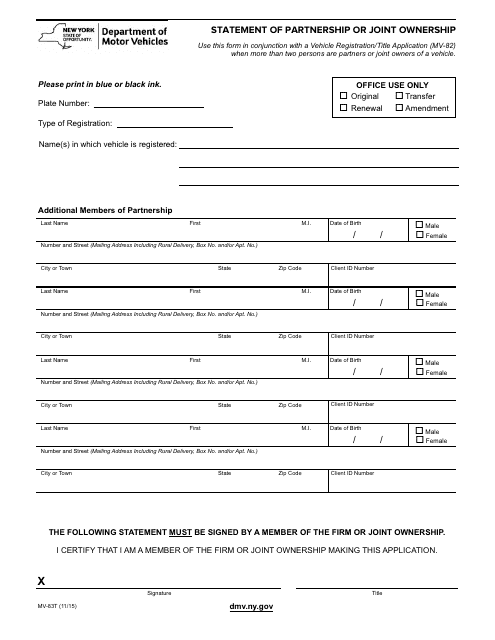

This Form is used for declaring a partnership or joint ownership in the state of New York. It allows individuals to provide relevant details about their partnership or shared ownership to the Department of Motor Vehicles.

This document confirms the existence of a partnership in the state of Delaware. It provides proof that a partnership has been formed and is recognized by the state.

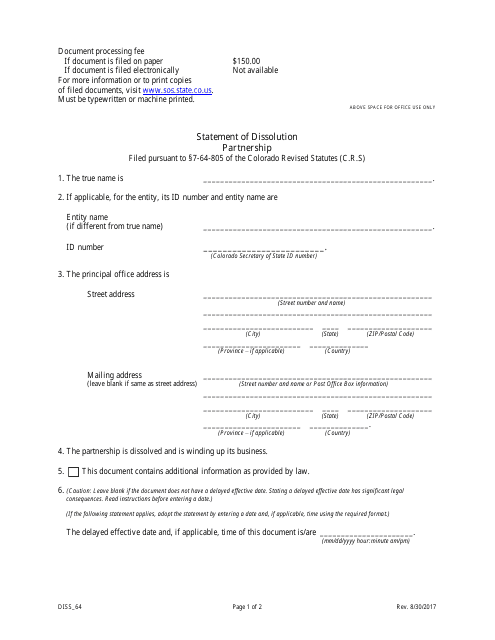

This document is used for officially declaring the dissolution of a partnership in the state of Colorado. It outlines the details and terms of the partnership's dissolution, including the distribution of assets and liabilities.

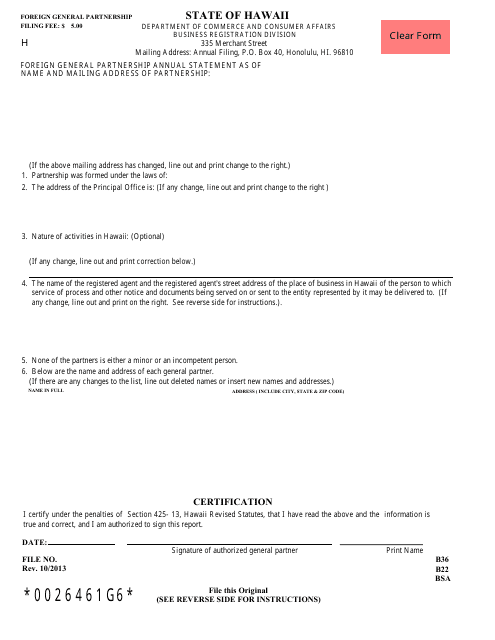

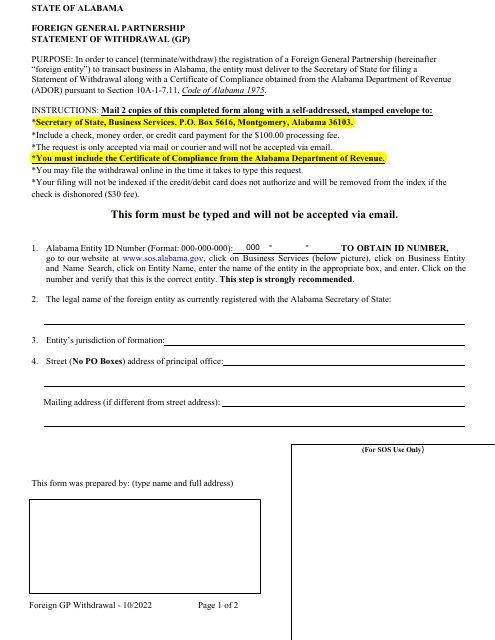

This document is used for submitting the annual statement of a foreign general partnership in the state of Hawaii. It provides information about the partnership's activities and financial status.

This Form is used for filing a Statement of Partnership Authority or a Statement of Denial in the state of Nevada.

This form is used for filing a statement of withdrawn or rescinded dissolution of a limited partnership in the state of Tennessee.

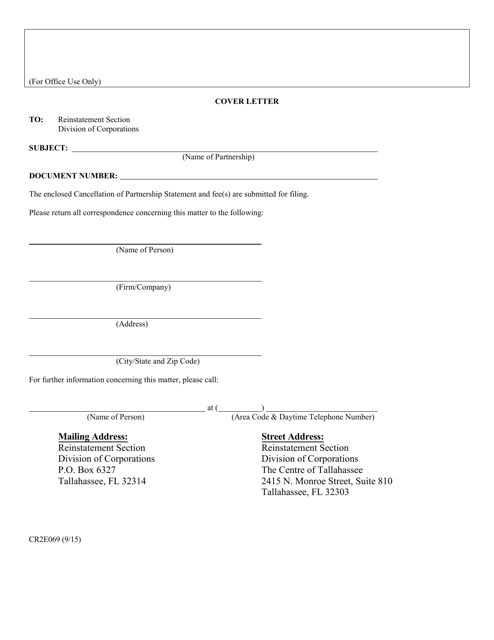

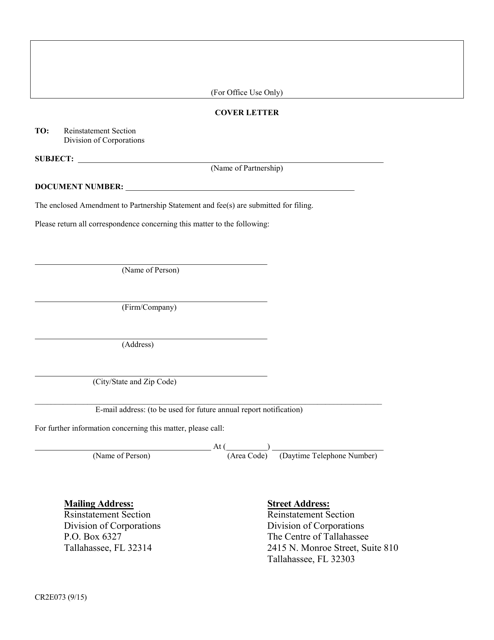

This Form is used for cancelling a partnership statement in the state of Florida.

This form is used for making amendments to a partnership statement in the state of Florida.

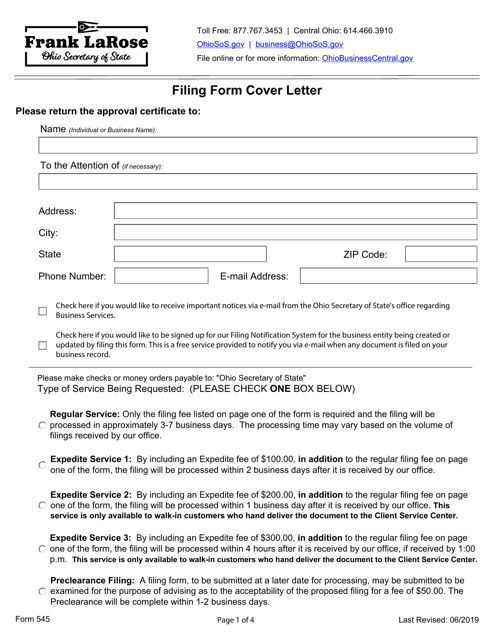

This Form is used for making amendments or cancelling a partnership statement for a partnership or limited liability partnership in Ohio.

This form is used for registering a general partnership in the state of Kansas and declaring the authority and responsibilities of each partner.

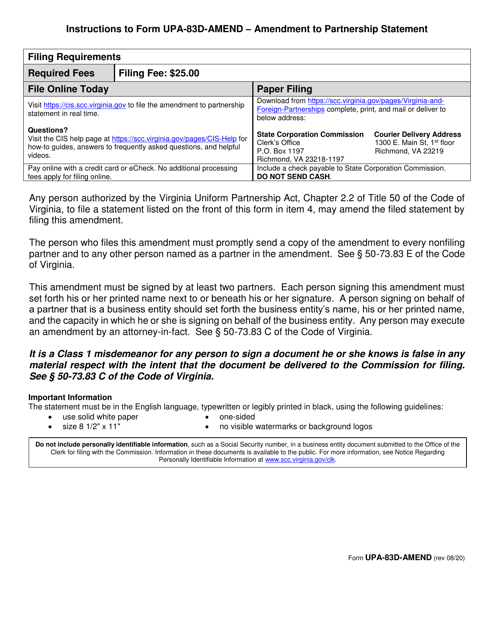

This form is used for making amendments to a partnership statement in the state of Virginia. It allows partners to update their partnership information or make changes to the existing partnership agreement.

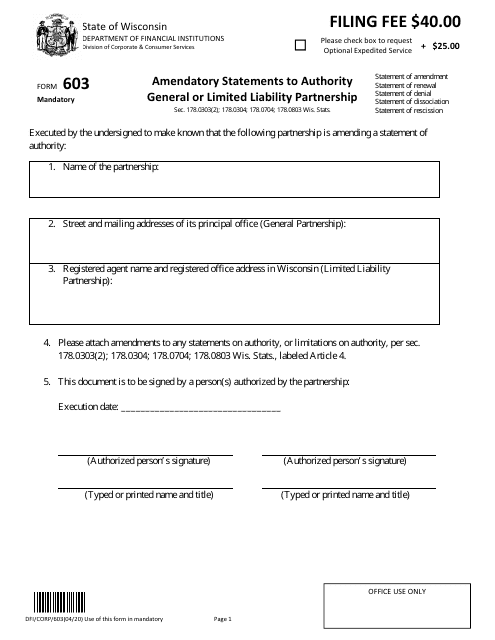

This type of document is used for filing amendatory statements to the authority for general or limited liability partnerships in the state of Wisconsin.