Tip Income Templates

Are you an employer in the United States? If so, you may need to familiarize yourself with the various documents related to tip income.

Tip income, also known as gratuity, refers to the additional money received by service industry workers on top of their regular wages. This additional income is often subject to certain tax obligations and reporting requirements.One important document is the IRS Form 8027 - Employer's Annual Information Return of Tip Income and Allocated Tips.

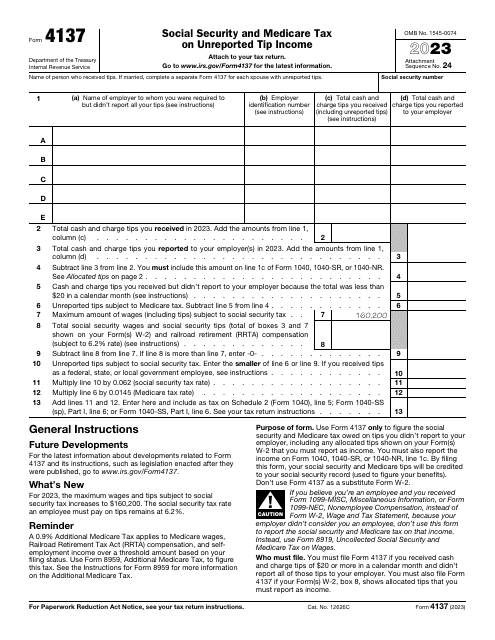

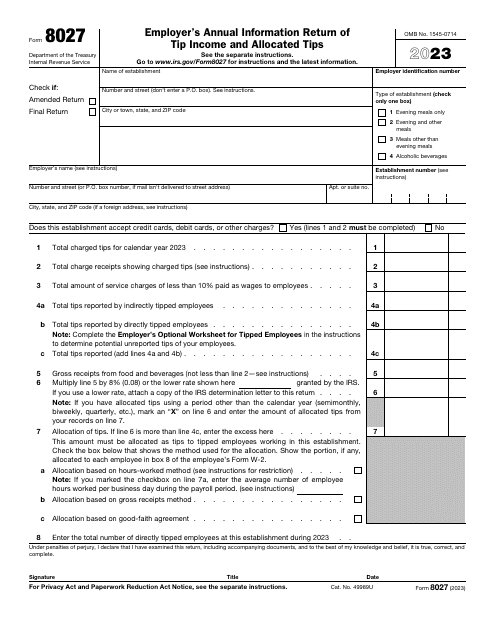

This form is typically used by employers in the food and beverage industry to report the total amount of tips received by their employees. It also allows the employer to report any allocated tips, which are tips that are distributed among eligible employees based on a tip-sharing policy.Another relevant document is IRS Form 4137 - Social Security and Medicare Tax on Unreported Tip Income.

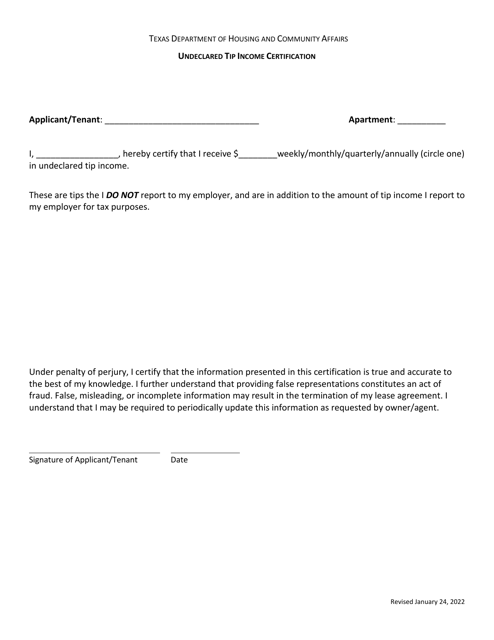

This form is used by individuals who receive cash tips and did not report all of their tip income to their employer. It helps calculate the Social Security and Medicare taxes owed on the unreported tip income.If you are an employer in the state of Texas, you may also come across the Undeclared Tip Income Certification.

This document is specific to Texas and is used by employers to certify that they have not collected any undeclared tip income from their employees.Understanding and complying with the rules and regulations surrounding tip income is crucial to avoid any penalties or legal issues.

These documents provide a comprehensive framework for employers to accurately report and manage tip income. By staying informed and using the correct forms, employers can ensure that they meet their tax obligations while maintaining transparency and fairness within their establishments..

Documents:

16

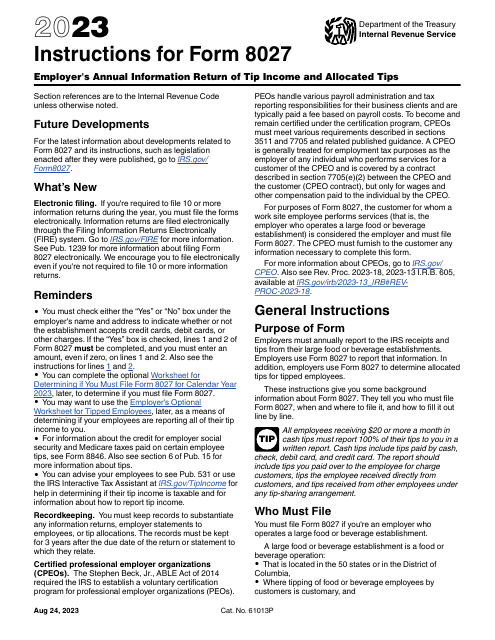

Every year, this form is filled out by employers wishing to report to the Internal Revenue Service (IRS) the receipts and tips their employee received, as well as to determine allocated tips.

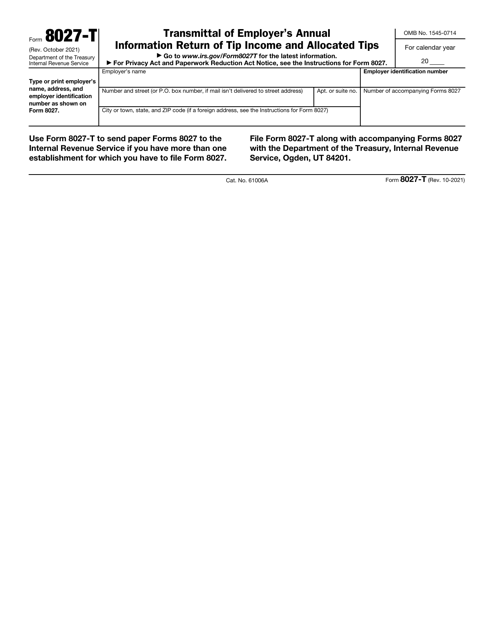

IRS Form 8027-T Transmittal of Employer's Annual Information Return of Tip Income and Allocated Tips

Download this supplemental form if you are an employer who owns one or more food or beverage establishments and wishes to submit Form 8027 in a paper format.

This document is for certifying undeclared tip income in the state of Texas. It is used by individuals who earn tips and need to disclose their income accurately for tax purposes.