Special Depreciation Templates

Special Depreciation is a crucial aspect of tax planning and management. It encompasses a set of guidelines and instructions provided by tax authorities to help businesses and individuals correctly calculate and claim depreciation on certain assets. Without a comprehensive understanding of special depreciation rules, taxpayers may potentially miss out on valuable tax deductions or inadvertently overstate their depreciation expenses.

Our website is here to provide you with valuable resources and information on special depreciation. Whether you are a small business owner looking for guidance on how to claim special depreciation on your assets, or an individual taxpayer seeking to maximize your tax savings, we have the expertise and knowledge to assist you.

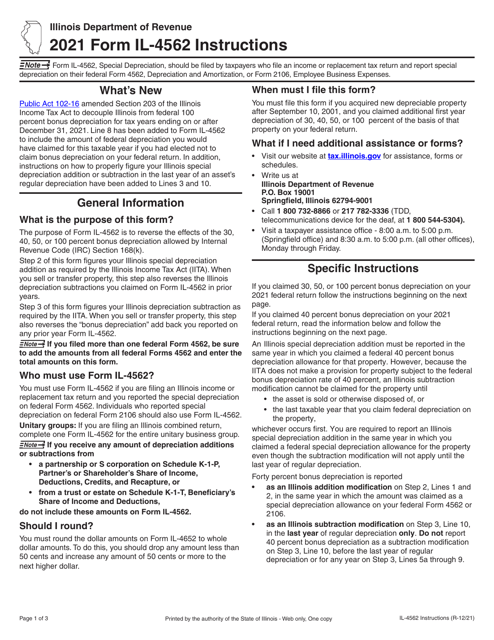

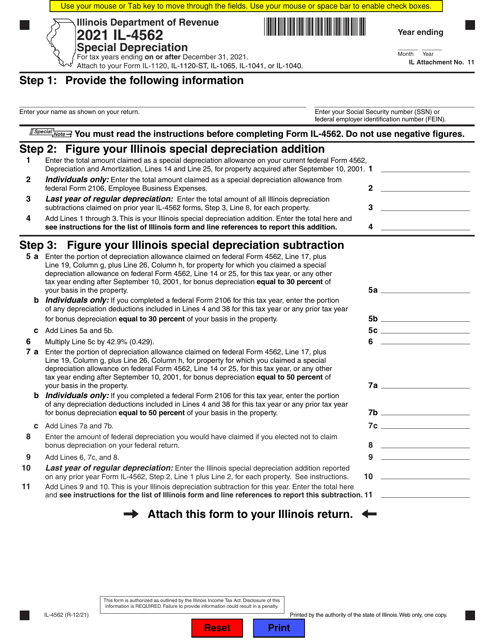

Our collection of documents includes instructions and forms specific to your jurisdiction, such as the Instructions for Form IL-4562 Special Depreciation - Illinois and Form IL-4562 Special Depreciation - Illinois. These resources will walk you through the process of identifying qualifying assets, determining the appropriate depreciation method, and calculating the allowable deductions.

Furthermore, our website offers a variety of helpful tools and resources to simplify your special depreciation calculations. From depreciation calculators to frequently asked questions, we strive to provide you with the necessary tools and information to ensure accurate and compliant special depreciation claims.

Whether you are an experienced tax professional or a taxpayer navigating special depreciation for the first time, our website is your go-to resource for all things special depreciation. Trust in our expertise and take advantage of our comprehensive collection of documents and resources to optimize your tax savings and ensure compliance with all relevant regulations.