Tax Purposes Templates

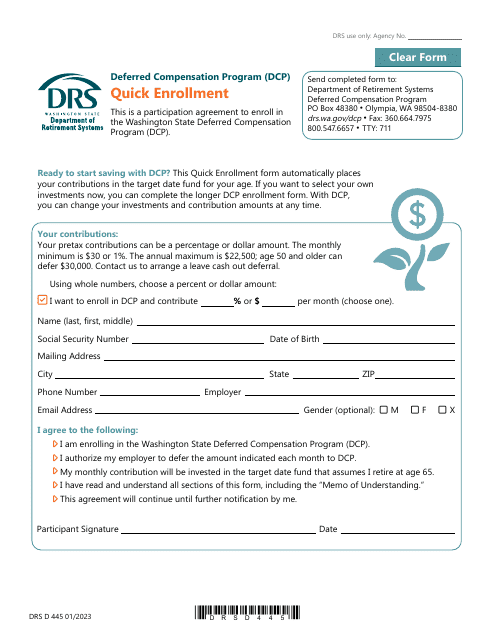

Are you looking for information about tax purposes? Our webpage is dedicated to providing you with all the essential resources you need to understand and navigate tax-related matters. Whether you are an individual, a business owner, or a financial institution, our comprehensive collection of documents and forms will assist you in meeting your tax obligations efficiently.

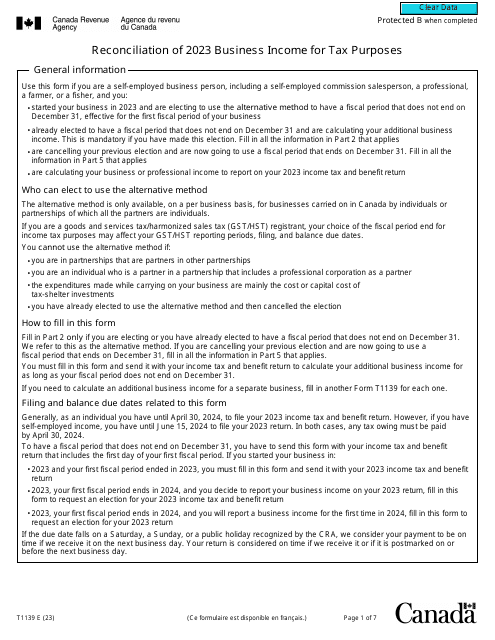

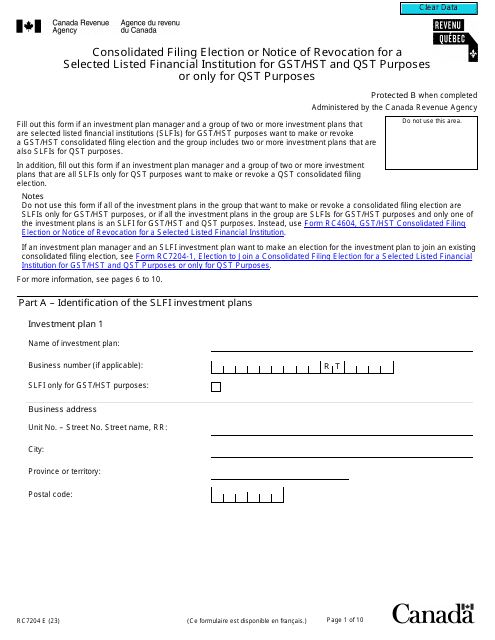

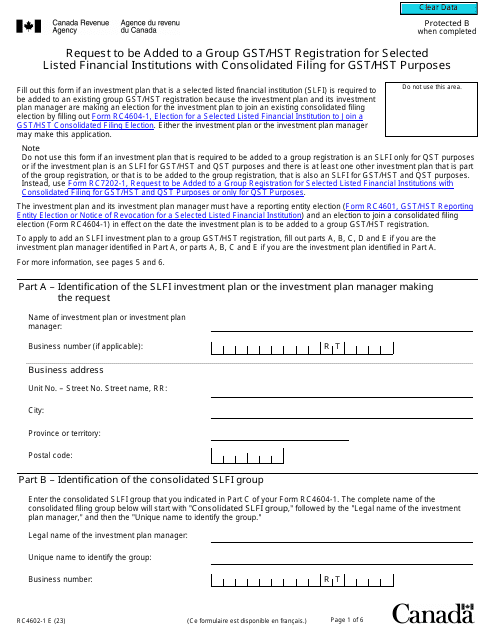

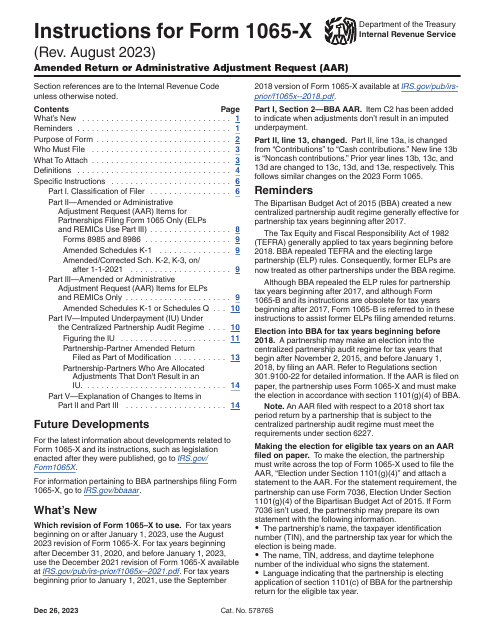

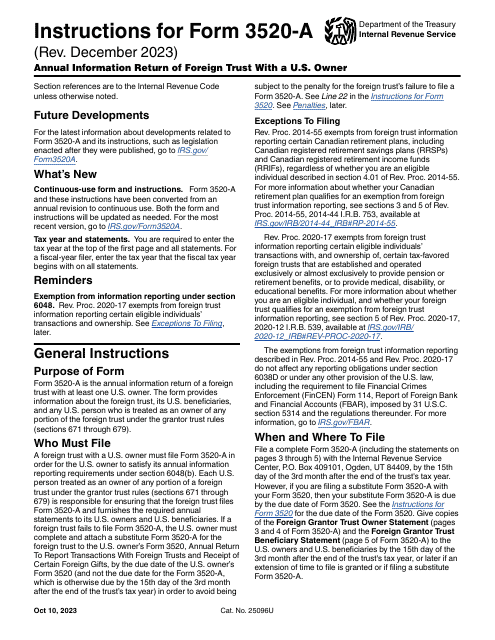

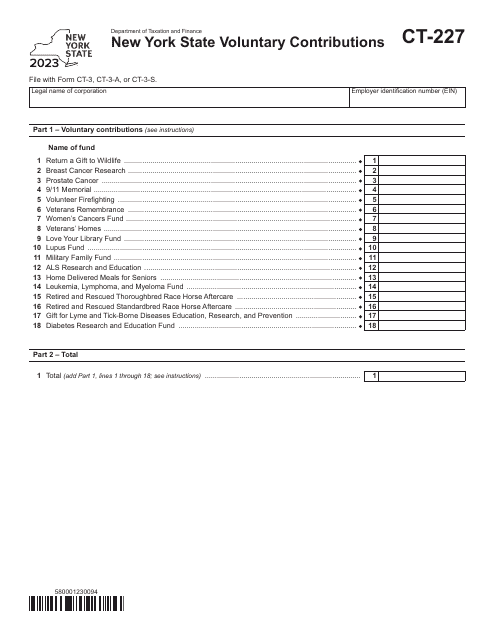

Our extensive selection of documents covers a wide range of tax purposes, including business income reconciliation, GST/HST registration requests for financial institutions, annual information returns for foreign trusts with U.S. owners, partner's shares of income and credits, and annual reports for limited liability companies.

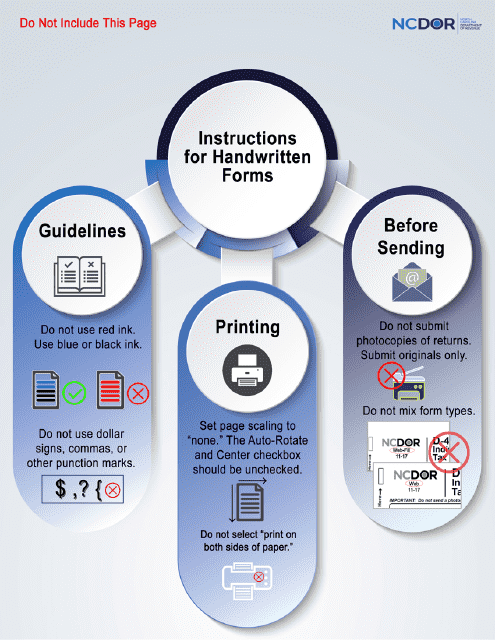

We understand that tax regulations can be complex and overwhelming. That's why we have gathered these documents and instructions to simplify the process for you. Our easy-to-use forms and guidelines will assist you in accurately reporting your financial information, ensuring compliance with tax laws, and maximizing your eligible deductions.

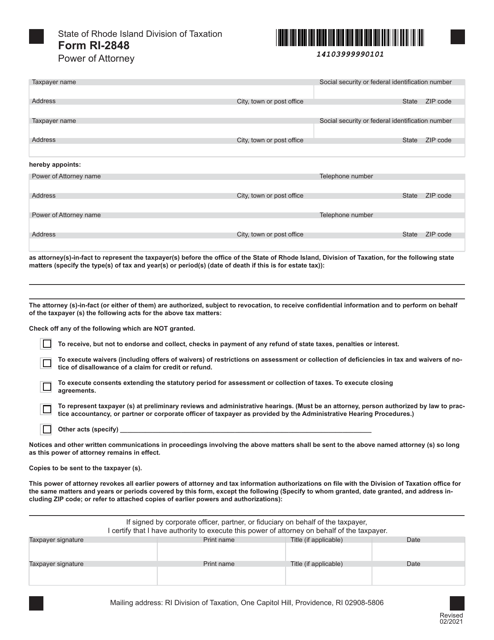

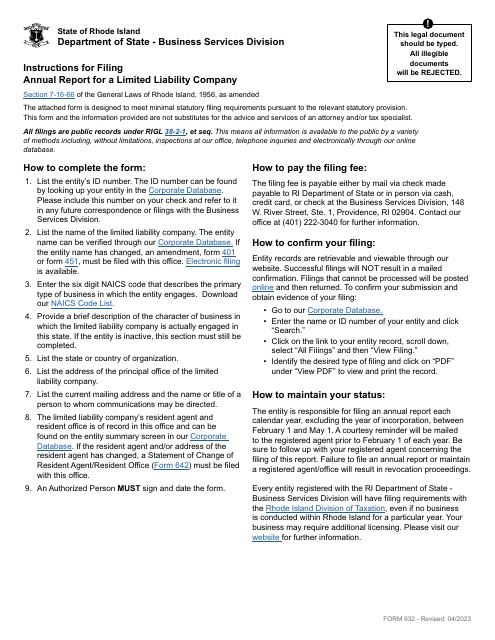

Whether you need to reconcile your business income for tax purposes in Canada or submit an annual report for your limited liability company in Rhode Island, our website provides you with everything you need. With our user-friendly interface and access to the most up-to-date tax forms, you can save time and effort by completing your tax-related tasks efficiently.

Stay compliant and avoid unnecessary penalties by accessing our vast collection of tax purpose documents. Our website is your one-stop destination for all your tax-related needs. Explore our comprehensive tax documents now to simplify your tax obligations and ensure accurate reporting for tax purposes.

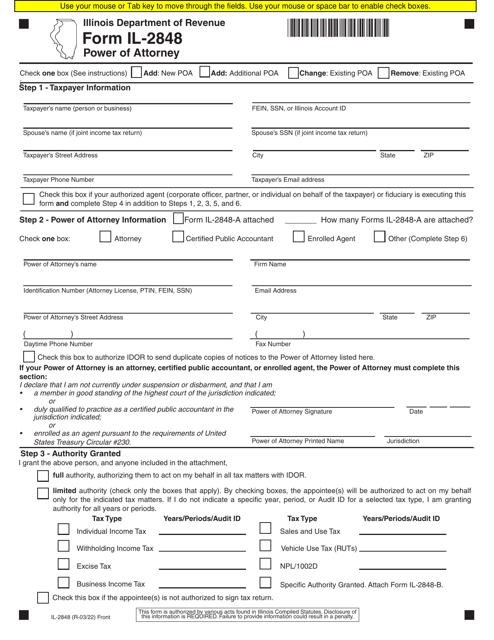

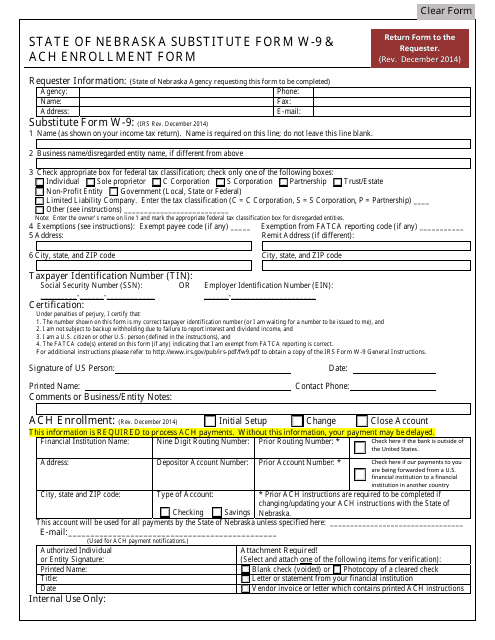

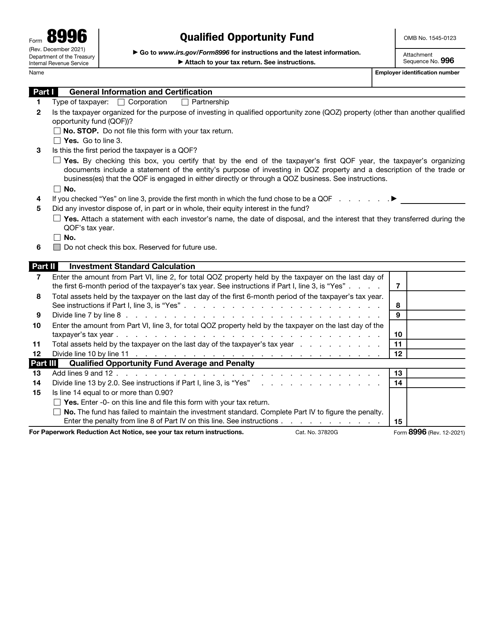

Documents:

36

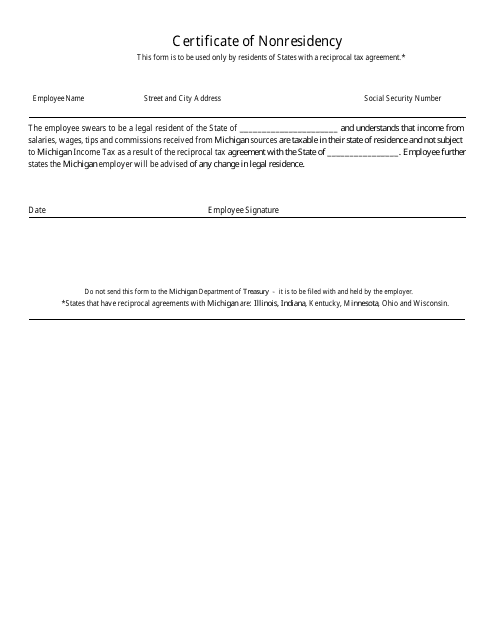

This document certifies that an individual does not reside in Michigan. It may be required for tax purposes or to show their nonresident status for certain benefits or privileges.

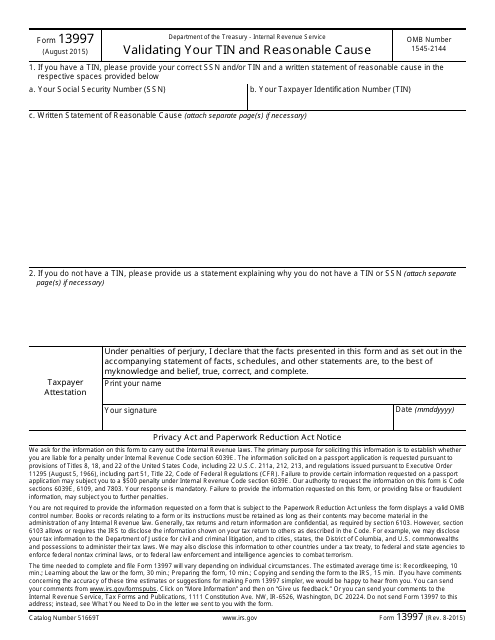

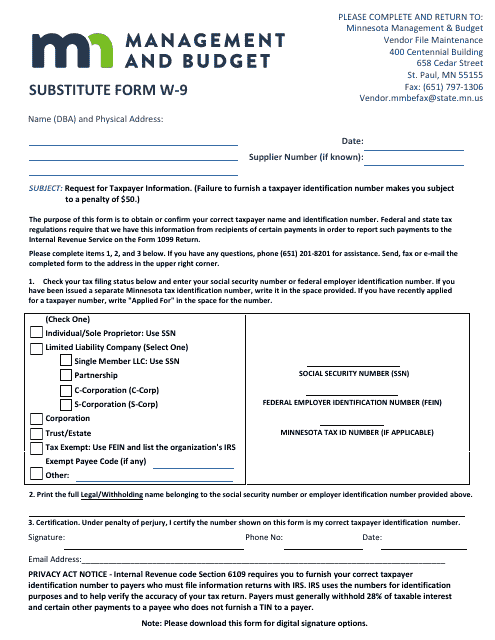

This Form is used for validating your Taxpayer Identification Number (TIN) and providing a reasonable cause explanation.

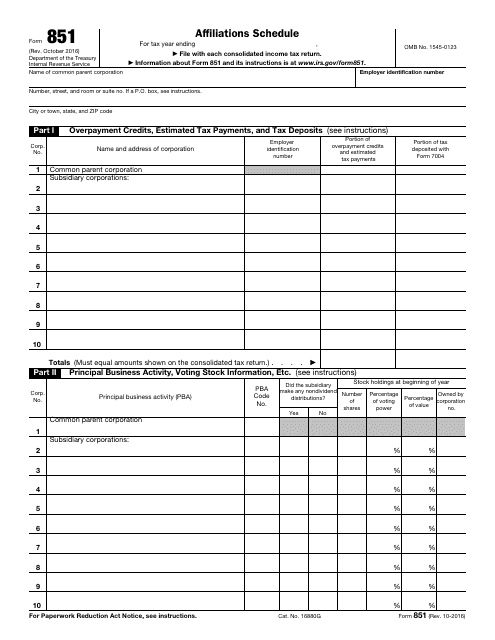

The purpose of submitting Form 851 is to report information about overpayment credits, estimated tax payments, and tax deposits, related to a common parent corporation and their subsidiary corporations.

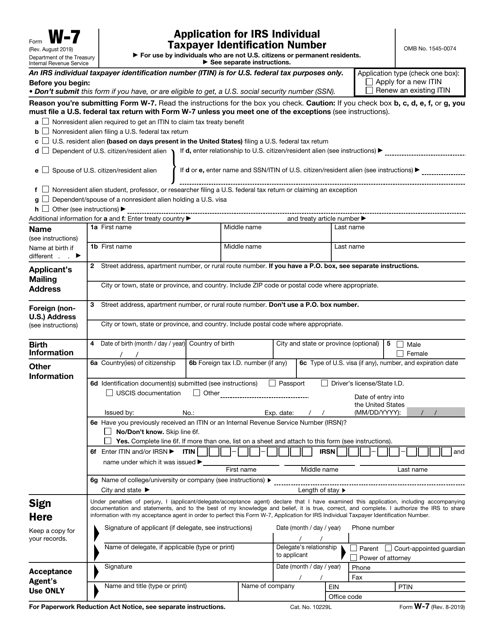

This is a formal statement filled out by individuals that want to obtain an identification number that will confirm their identity to fiscal organizations and let them communicate with the government as taxpayers. Additionally, it may be completed to renew a number they received before.

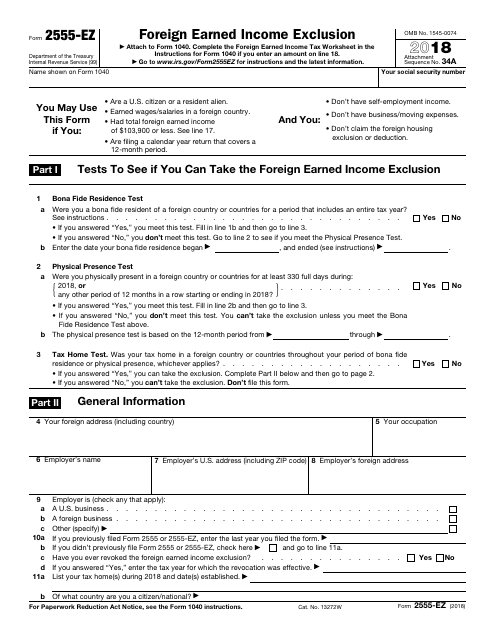

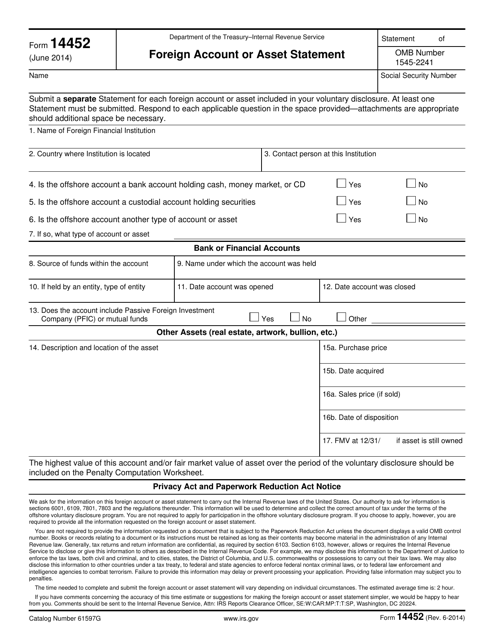

This document is used for claiming the Foreign Earned Income Exclusion on your taxes.

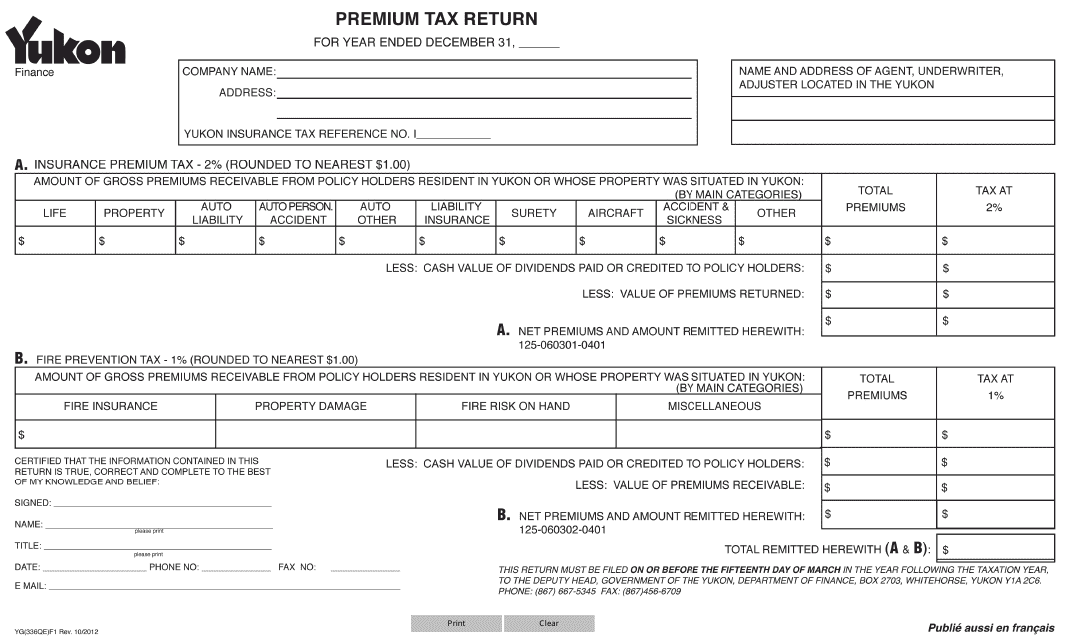

This form is used for filing premium tax returns in Yukon, Canada.

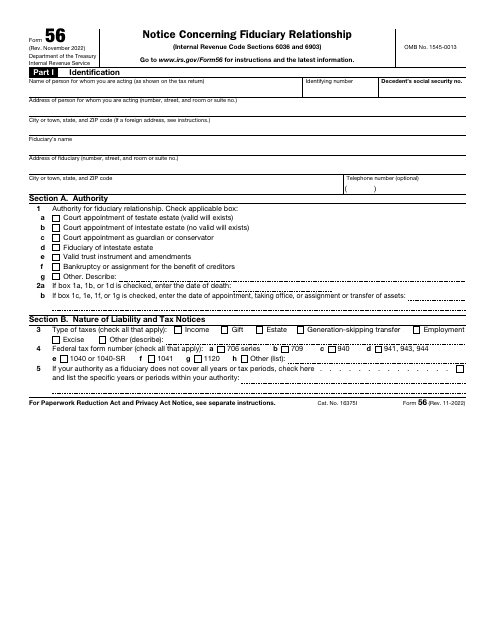

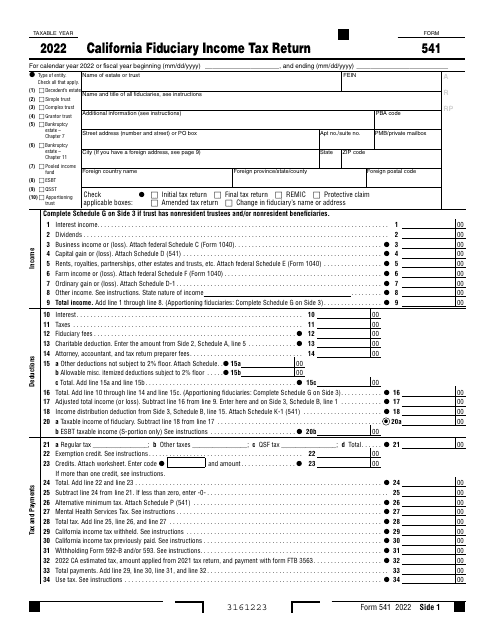

This is a fiscal statement prepared by a person or organization to tell the government about the fiduciary arrangement that was formed with them serving as a fiduciary.

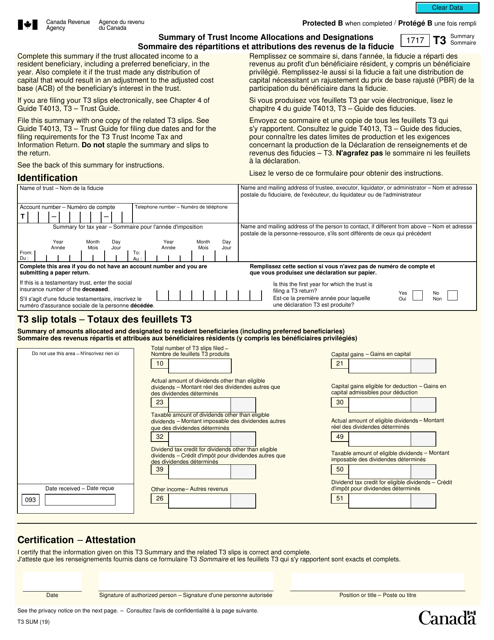

This form is used for summarizing trust income allocations and designations in Canada. It is available in both English and French.

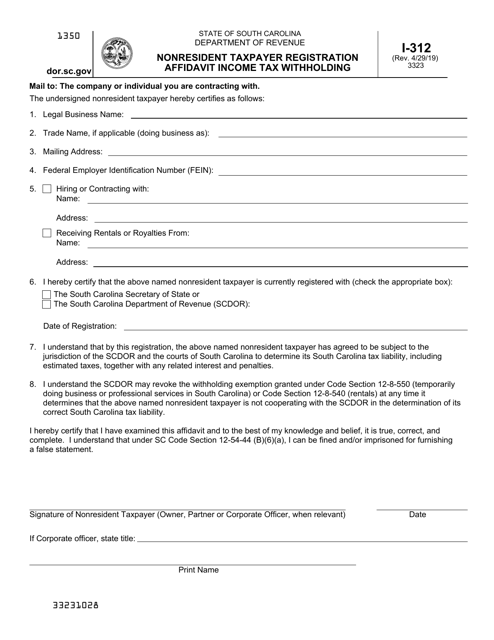

This form is used for nonresident taxpayers in South Carolina to register and declare their income tax withholding status.

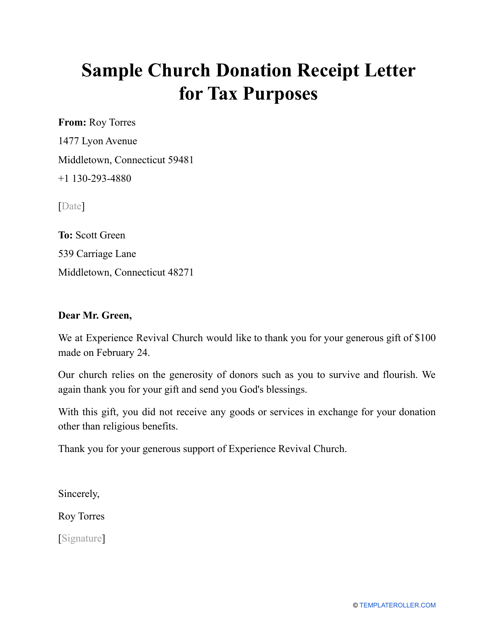

This is a formal document that certifies a charitable donation from an individual or organization to a church and allows the donor to claim a tax deduction on their tax return.

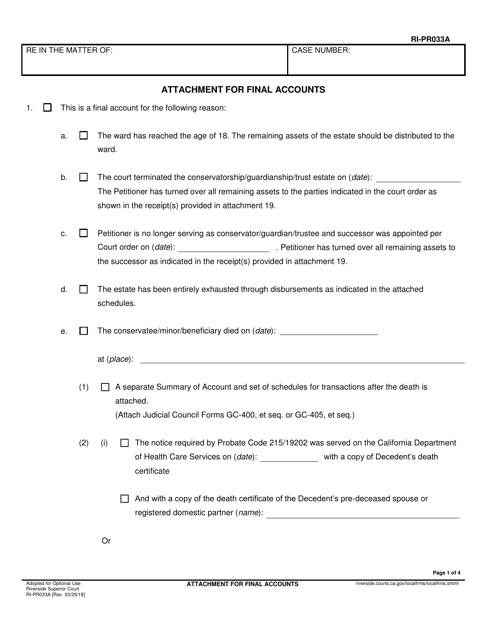

This form is used as an attachment for the final accounts in the County of Riverside, California.

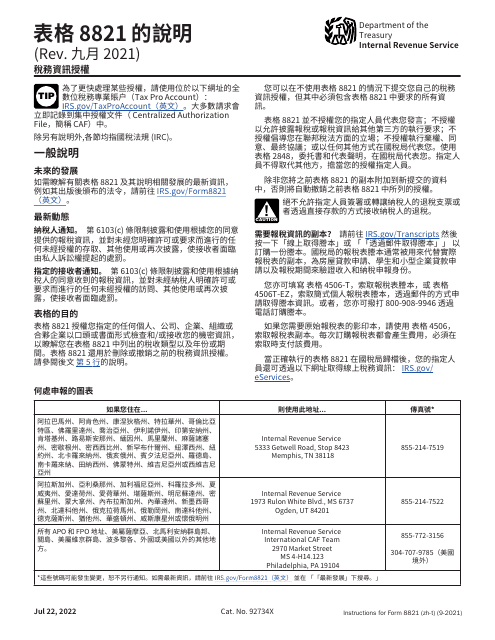

This document provides instructions for completing the IRS Form 8821 Tax Information Authorization in Chinese. It explains how to authorize someone to access your tax information and guide you through the form filling process.

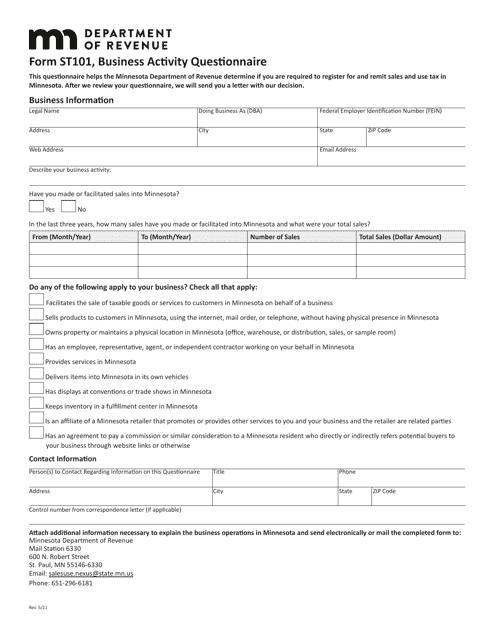

This form is used for reporting tax information for individuals or businesses in Minnesota.