Alternative Motor Vehicle Credit Templates

Are you looking to save money while reducing your environmental footprint? Consider taking advantage of the Alternative Motor Vehicle Credit. This tax credit is designed to incentivize individuals and businesses to purchase alternative motor vehicles that are more fuel-efficient and produce lower emissions.

The Alternative Motor Vehicle Credit, also known as the AMVC, encourages the adoption of eco-friendly transportation options by providing a tax credit to those who purchase qualified vehicles. By reducing the amount of tax owed to the IRS, this credit allows you to save money while promoting a cleaner and healthier environment.

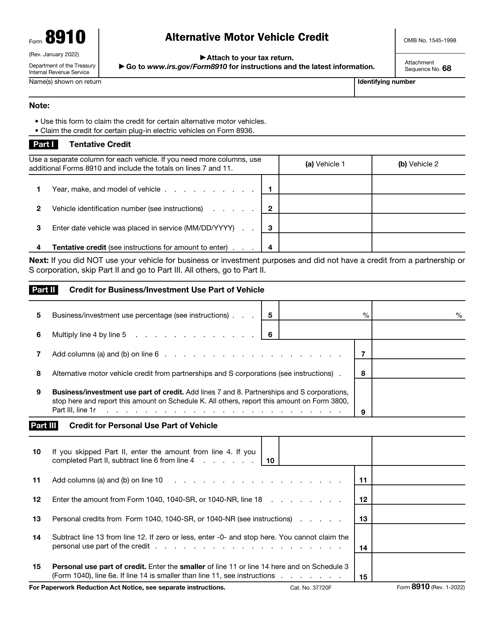

To claim the Alternative Motor Vehicle Credit, you'll need to fill out the IRS Form 8910, which is specifically tailored for this purpose. This form requires you to provide details about the vehicle you purchased, including its make, model, and year. You'll also need to provide documentation to support your eligibility for the credit, such as the purchase date and the manufacturer's certification.

To assist you in completing Form 8910 accurately, the IRS provides detailed instructions that accompany the form. These instructions explain the various eligibility criteria, calculation methods, and documentation requirements. By following these instructions, you can ensure that you take full advantage of the tax credit.

In addition to the IRS Form 8910 and its accompanying instructions, the Alternative Motor Vehicle Credit is sometimes referred to by other names, such as the AMVC or the Green Vehicle Credit. Regardless of the name, the purpose remains the same – to reward individuals and businesses for choosing environmentally friendly transportation options.

If you're interested in learning more about the Alternative Motor Vehicle Credit and how it can benefit you, be sure to consult the IRS resources available. Take a step towards a greener future while enjoying potential savings – claim your Alternative Motor Vehicle Credit today.