Streamlined Sales and Use Tax Agreement Templates

Are you looking to learn more about the Streamlined Sales and Use Tax Agreement? Look no further! This agreement, also known as the Streamlined Sales Tax, is designed to simplify and modernize sales tax collection and administration in participating states.

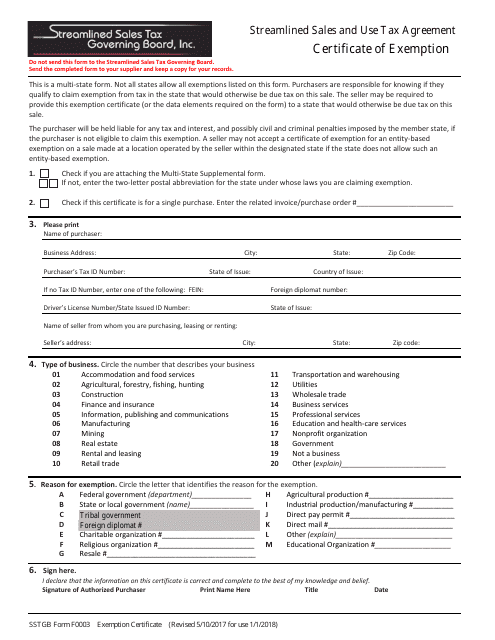

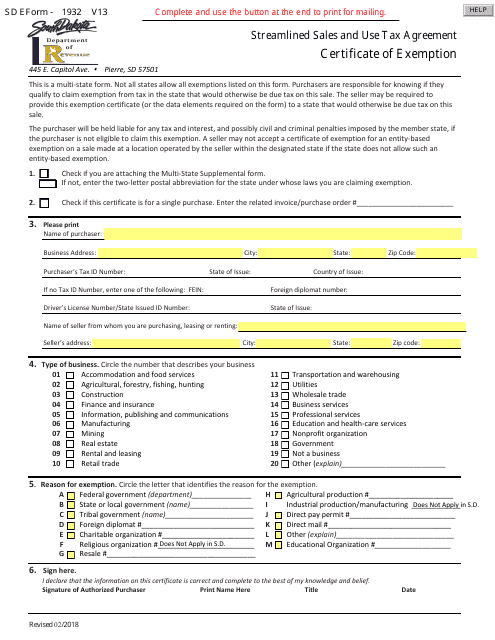

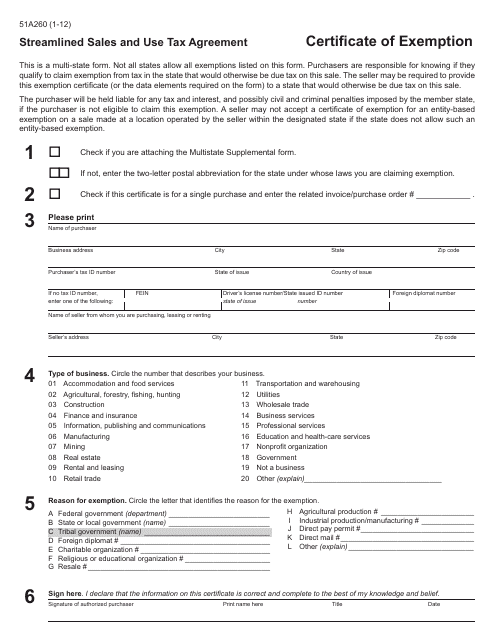

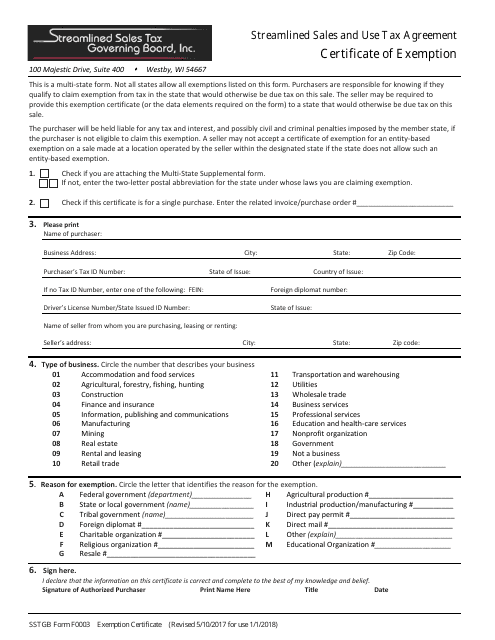

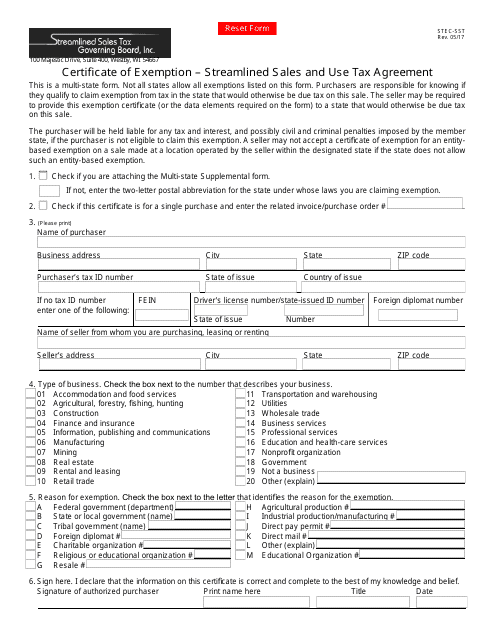

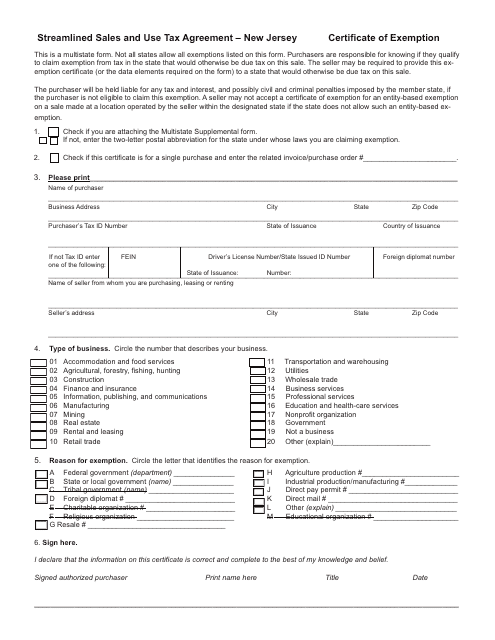

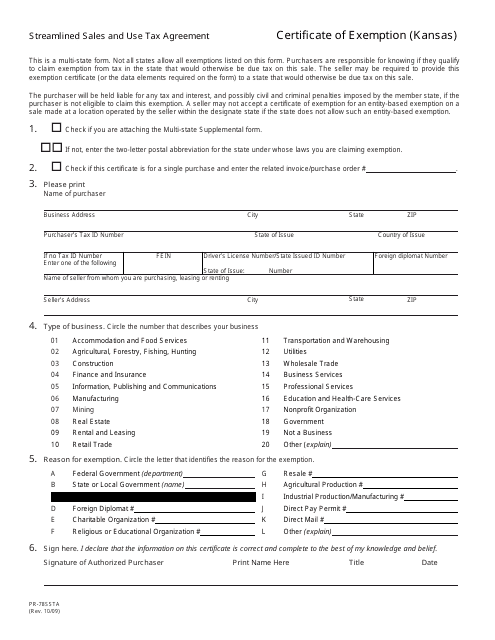

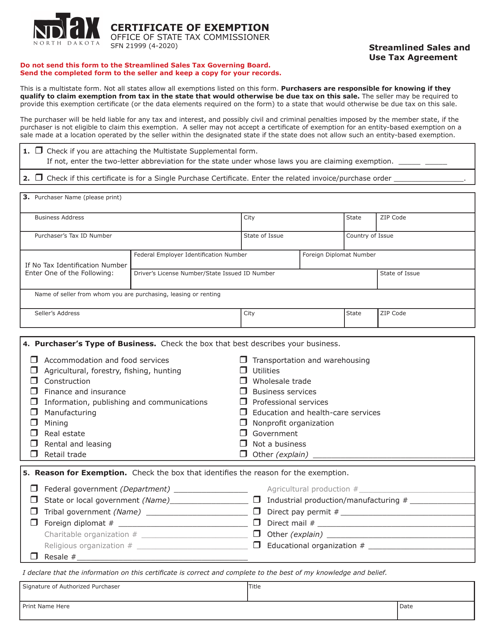

Under this agreement, certain documents are required to ensure compliance with the streamlined system. These documents, which may be referred to as Streamlined Sales and Use Tax Agreement Certificates of Exemption or Exemption Certificates, allow qualified businesses to make purchases without having to pay sales tax.

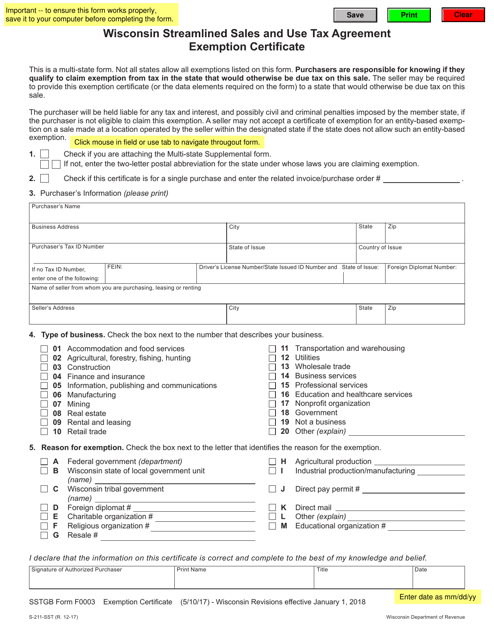

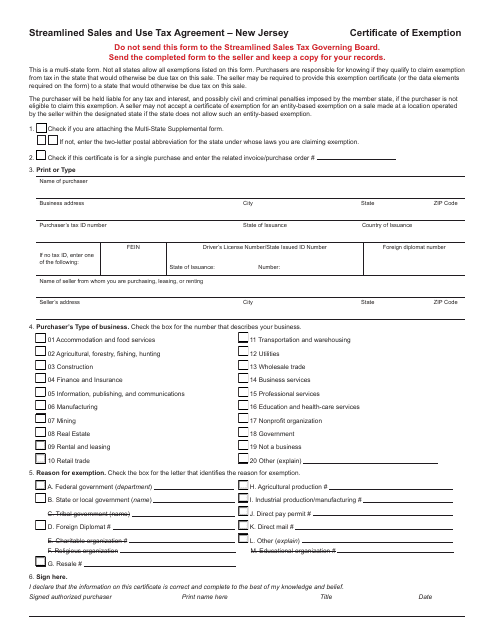

States like West Virginia, Ohio, Kansas, Wisconsin, and New Jersey have implemented their own versions of these certificates, such as the Form F0003 Certificate of Exemption - Streamlined Sales and Use Tax Agreement in West Virginia, or the Form PR-78SSTA Streamlined Sales and Use Tax Agreement Certificate of Exemption in Kansas. These certificates serve as proof that a business is eligible for exemption from sales tax in accordance with the Streamlined Sales and Use Tax Agreement.

If you're looking to better understand the ins and outs of this agreement or need assistance with obtaining the necessary certificates, our website is here to help. We provide detailed information and resources on the Streamlined Sales and Use Tax Agreement, ensuring that you have access to the information you need to navigate this complex system.

Don't let sales tax compliance become a headache. Explore our resources to learn more about the Streamlined Sales and Use Tax Agreement and how it can benefit your business.

Documents:

10

This form is used for applying for a Certificate of Exemption under the Streamlined Sales and Use Tax Agreement in West Virginia.

This form is used for claiming exemption from sales and use tax in Kentucky under the Streamlined Sales and Use Tax Agreement.

This form is used for obtaining a Certificate of Exemption under the Streamlined Sales and Use Tax Agreement in West Virginia. It allows certain businesses to claim exemption from sales and use tax on qualifying purchases.

This form is used for Ohio residents or businesses to request a certificate of exemption from sales and use tax under the Streamlined Sales and Use Tax Agreement.

This form is used for applying for an exemption from sales and use tax in the state of New Jersey as part of the Streamlined Sales and Use Tax Agreement.

This form is used for obtaining a certificate of exemption from sales and use taxes in Kansas under the Streamlined Sales and Use Tax Agreement.

This form is used for claiming exemption from sales and use taxes in North Dakota as part of the Streamlined Sales and Use Tax Agreement.

This document is used for claiming exemption from sales and use taxes in Wisconsin under the Wisconsin Streamlined Sales and Use Tax Agreement.

This document is a Certificate of Exemption specific to the state of New Jersey. It is used for streamlined sales and use tax purposes.