Local Property Tax Templates

Local Property Tax Guide: Everything You Need to Know About Local Property Taxes

Are you a homeowner or property owner looking to understand the ins and outs of local property taxes? Look no further! Our comprehensive local property tax guide is here to help you navigate through the complexities of local property taxes.

Local property taxes, also known as local property tax or local property taxes, are taxes imposed by local governments on real estate properties within their jurisdiction. These taxes play a vital role in financing local government services such as education, infrastructure, and public safety.

Our local property tax guide covers a wide range of topics, including:

-

Understanding the Basics: Dive into the fundamentals of local property taxes, including how they are calculated, assessed, and collected. Learn about the factors that influence property tax rates and how you can estimate your own property tax liability.

-

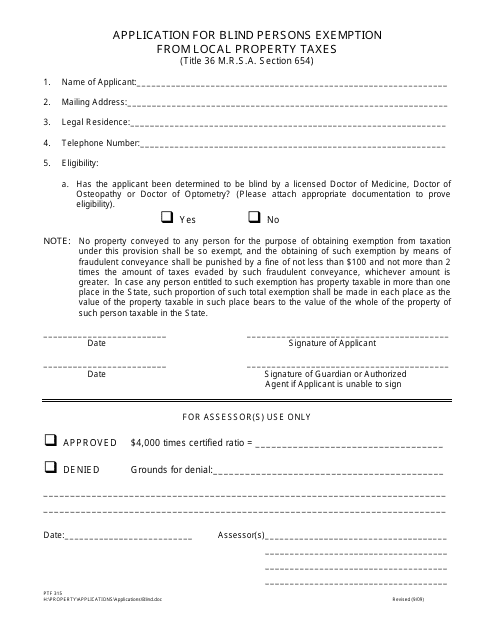

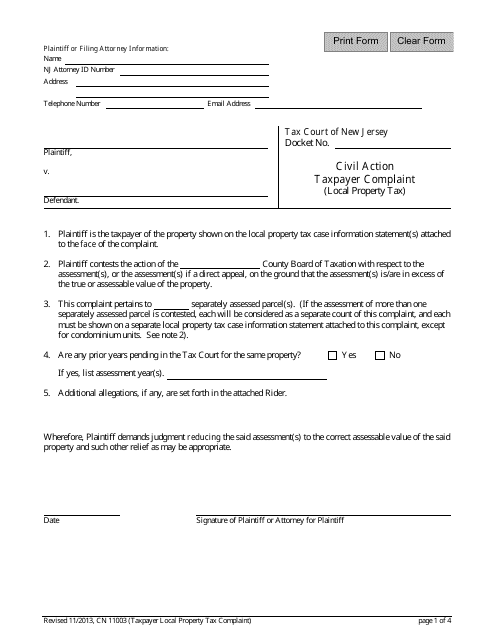

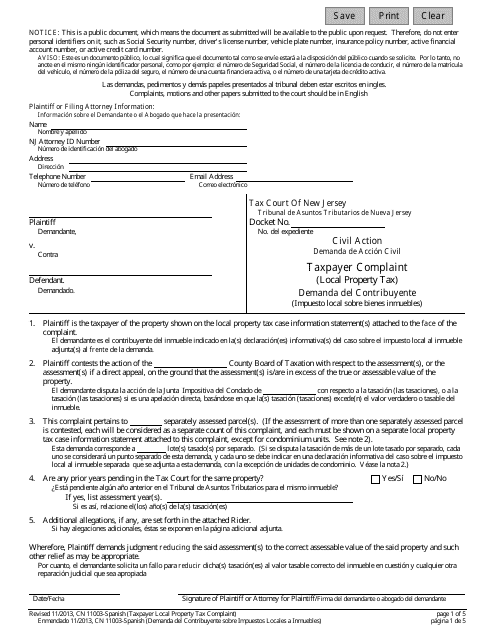

Exemptions and Relief Programs: Discover the various exemptions and relief programs available to homeowners and property owners. Explore options such as the Application for Blind Persons Exemption From Local Property Taxes in Maine or the Taxpayer Complaint (Local Property Tax) in New Jersey.

-

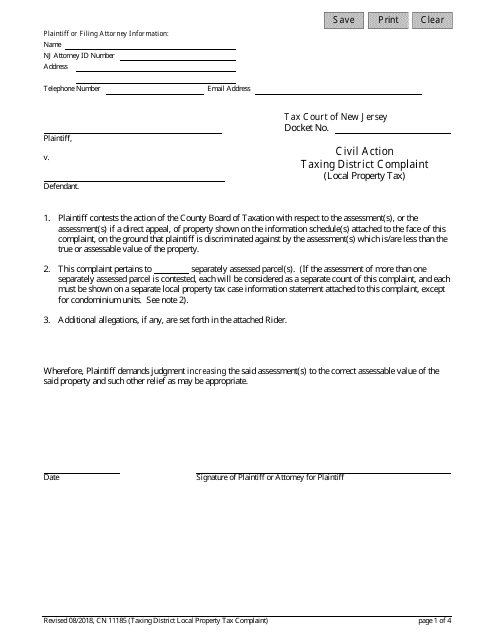

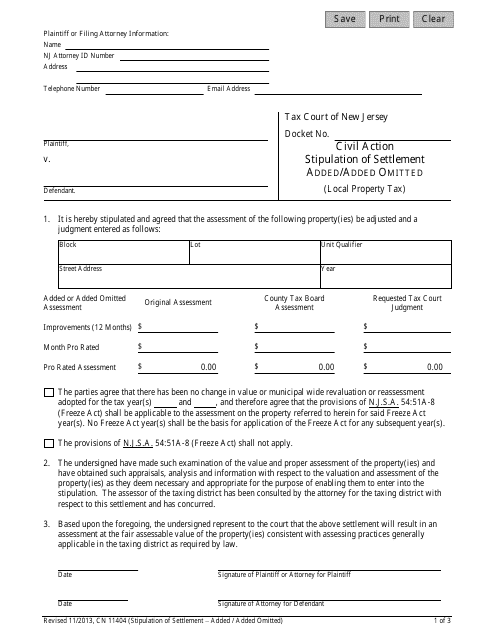

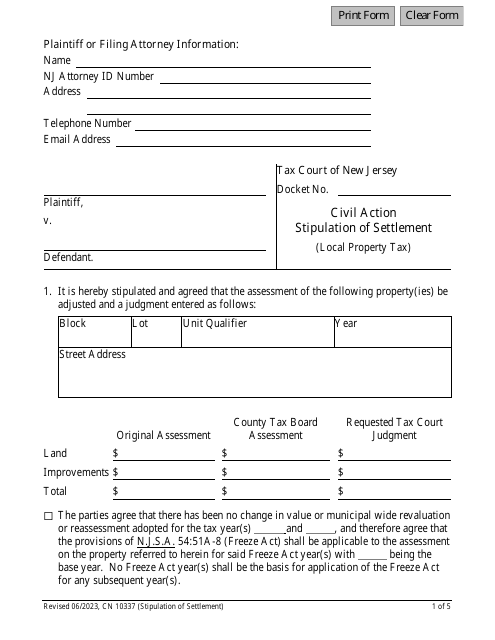

Appeals and Complaints: Uncover the process for challenging your property tax assessment or filing a complaint. Familiarize yourself with forms like the Stipulation of Settlement Added/Added Omitted (Local Property Tax) and the Civil Action - Stipulation of Settlement (Local Property Tax) in New Jersey.

-

State-Specific Information: Gain insights into state-specific regulations and guidelines related to local property taxes. Whether you're in Maine, New Jersey or any other state, our guide provides essential information tailored to your location.

Empower yourself with the knowledge needed to make informed decisions about your local property taxes. Our local property tax guide is designed to simplify the complexities and help you navigate through the maze of regulations and forms associated with local property taxes.

Trust our expertise and make the most of our comprehensive local property tax guide. Whether you're a homeowner, aspiring homeowner, or real estate investor, our guide will equip you with the valuable information you need for a successful property tax management strategy.

Documents:

6

This form is used for applying for an exemption from local property taxes in Maine for blind persons.

This Form is used for filing a complaint regarding local property tax issues in New Jersey.

This form is used for taxpayer complaints related to local property tax in New Jersey. It is available in English and Spanish.

This form is used for filing a complaint about local property tax in New Jersey.

This form is used for stipulating an agreement to settle issues related to local property tax in New Jersey.