Equitable Relief Templates

Equitable Relief Documents - Request forInnocent Spouse Relief and Separation of Liability

When dealing with tax issues or financial responsibilities, it's not uncommon to find yourself in a situation where you need to seek equitable relief. Equitable relief, also known as separation of liability or innocent spouse relief, is a legal option that can help protect you from the financial burden caused by a spouse or ex-spouse's tax debts.

At Templateroller.com, we understand the complexities of equitable relief and the impact it can have on your financial well-being. Our goal is to provide you with the necessary resources and guidance to navigate this process with confidence.

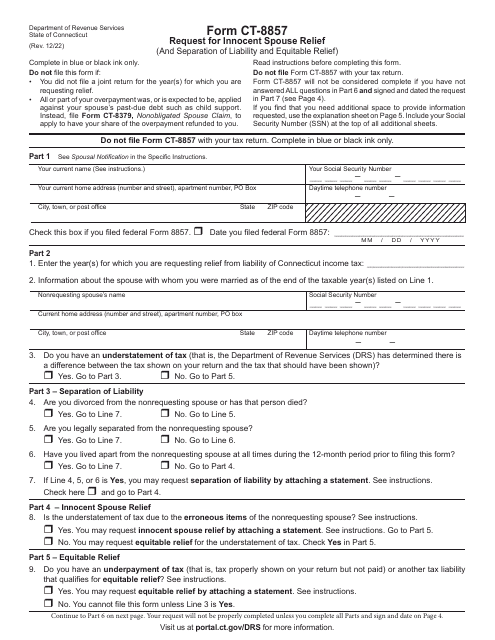

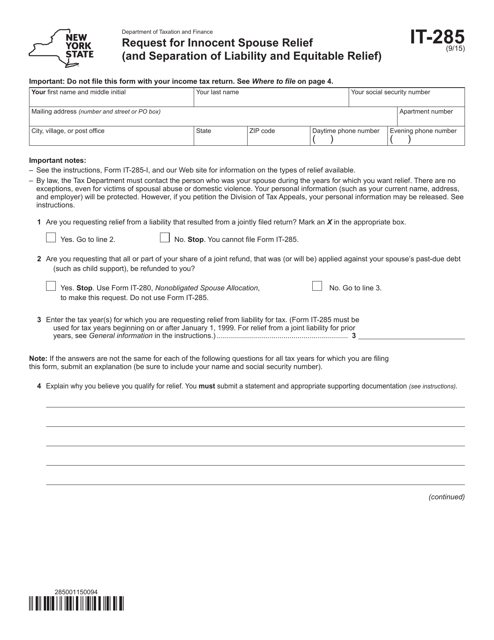

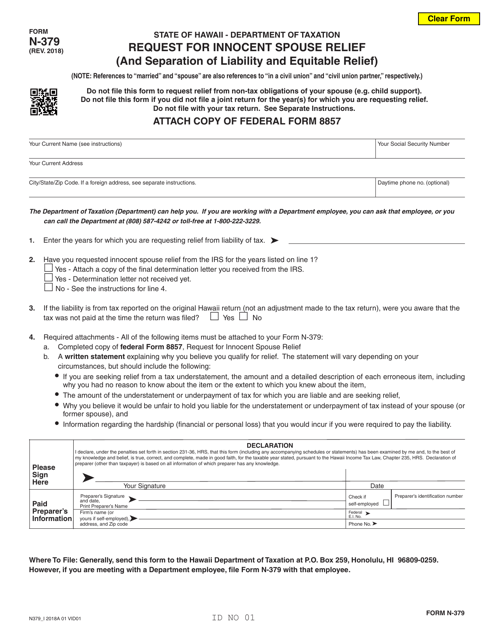

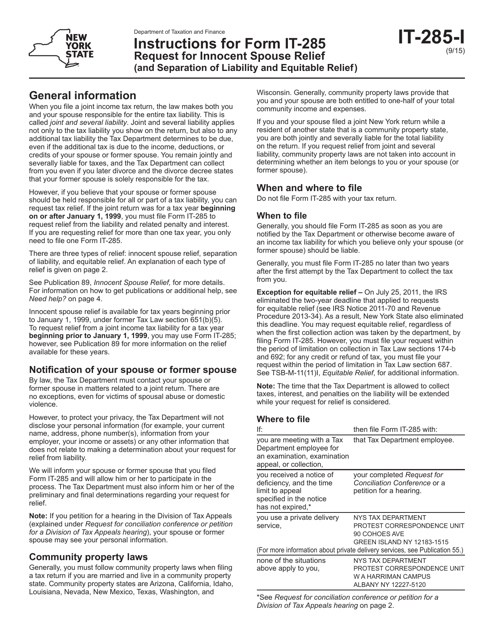

Our collection of equitable relief forms is designed to assist individuals who are seeking innocent spouse relief or separation of liability. These documents have been carefully curated to comply with the specific requirements of various states, such as Connecticut, New York, Hawaii, and Arizona.

By using our Equitable Relief Forms, you can request the appropriate relief that suits your unique circumstances. Whether you are facing an unjust tax debt due to your spouse's actions, or you are seeking to separate your liability from their tax obligations, our forms will guide you through the necessary steps.

Don't let the burden of someone else's tax debts weigh you down. Take control of your financial future with our Equitable Relief Documents. Our user-friendly forms simplify the process and ensure that you have the best chance of a successful outcome.

Trust Templateroller.com to provide you with the resources and support you need to seek equitable relief effectively. Our Equitable Relief Forms are tailored to meet your specific state's requirements, ensuring that your application is prepared accurately and efficiently.

Contact us today to learn more about our Equitable Relief Documents and how they can help you regain control over your financial situation. With our guidance, you can navigate the complexities of equitable relief with confidence, putting you on the path to a brighter, more secure future.

Documents:

8

This form is used for residents of New York who are seeking innocent spouse relief, as well as separation of liability and equitable relief. It allows taxpayers to request relief from certain tax liabilities that were caused by their spouse or former spouse.

This Form is used for requesting innocent spouse relief, separation of liability, and equitable relief in the state of New York.

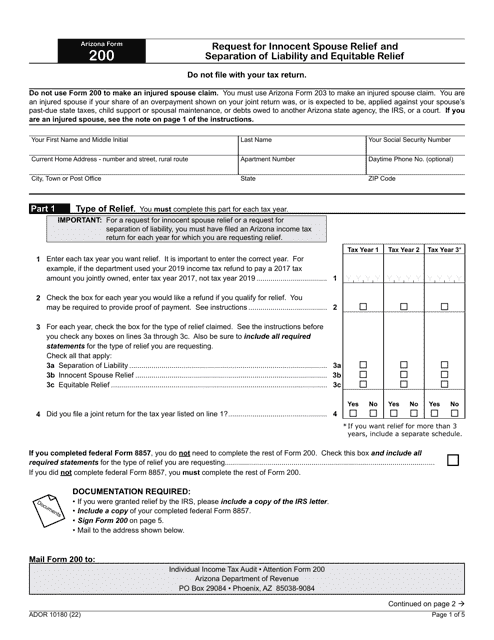

This form is used for requesting innocent spouse relief and separation of liability and equitable relief in the state of Arizona. It provides instructions on how to apply for relief from joint tax liability when one spouse can prove they are not responsible for the tax debt.