Motor Vehicle Tax Templates

Motor Vehicle Tax: Ensuring Compliance and Accurate Reporting

Welcome to our comprehensive resource for motor vehicle tax information. Whether you're a business owner, a vehicle owner, or a tax professional, this site provides all the necessary guidance and documentation for understanding and fulfilling your motor vehicle tax obligations.

Motor vehicle tax, also known as motor vehicle tax form, motor vehicle taxes, or motor vehicle tax documentation, is a vital component of revenue generation for states across the country. It helps fund essential services such as road and infrastructure maintenance, public transportation, and law enforcement.

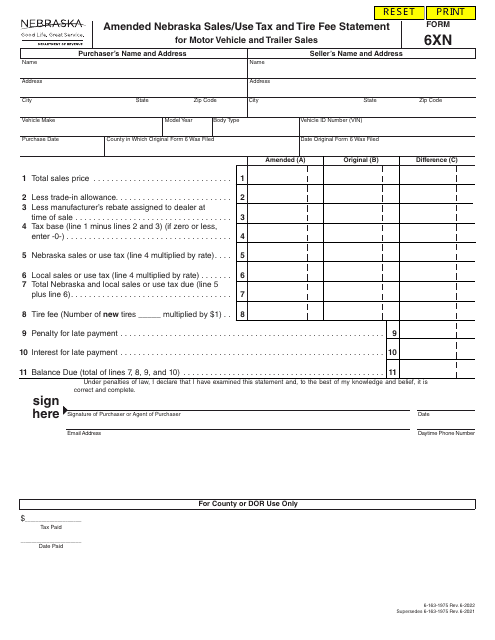

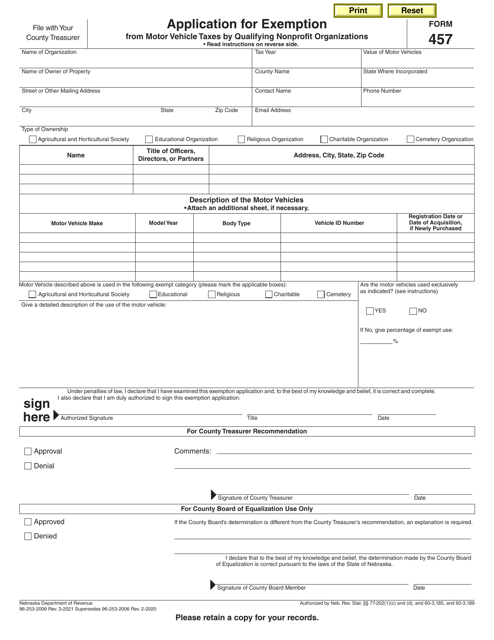

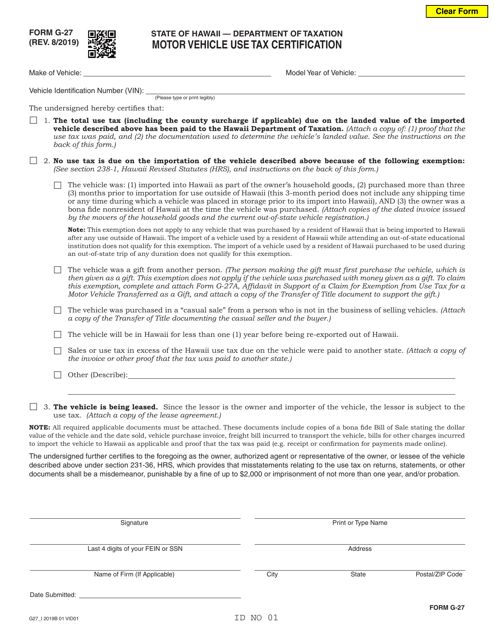

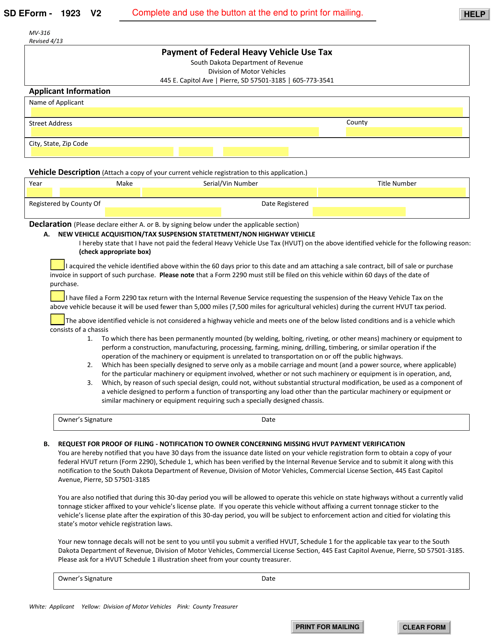

At our website, you will find a wide range of documents and forms to assist you in navigating the complex world of motor vehicle tax. From Form E-500F Motor Vehicle and Lease Rental Tax Return in North Carolina, to SD Form 1923 (MV-316) Payment of Federal Heavy Vehicle Use Tax in South Dakota, we have the resources you need to accurately report your taxes and stay in compliance with state regulations.

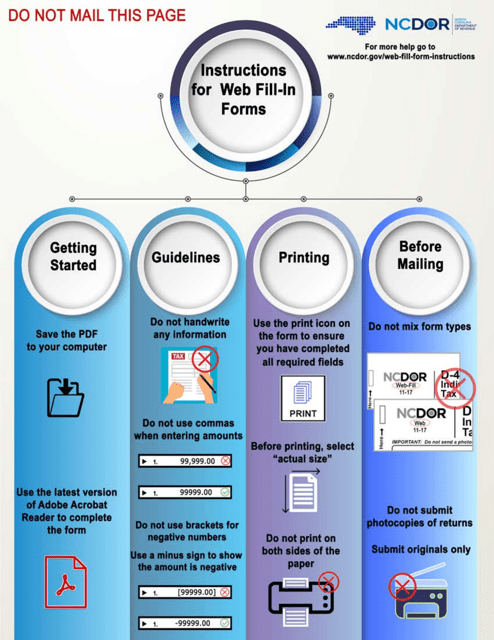

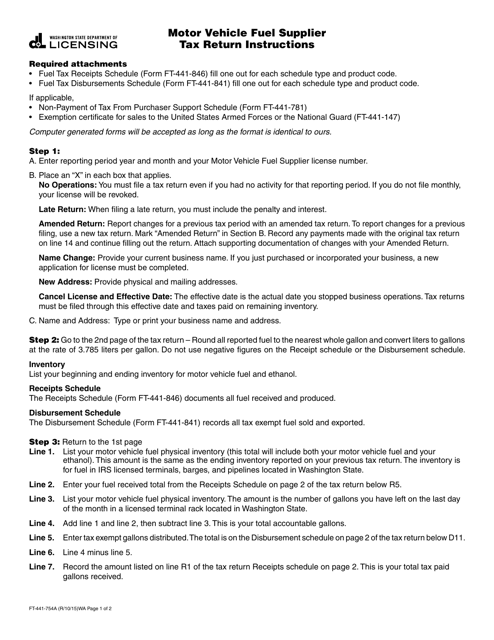

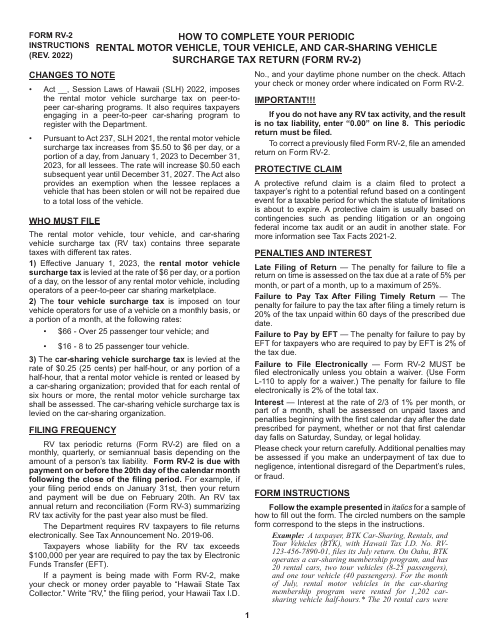

Tax returns, such as Instructions for Form FT-441-753 Motor Vehicle Fuel Supplier Tax Return in Washington, are available to fuel suppliers and other related entities for proper tax reporting. We understand that navigating the tax landscape can be challenging, so we have provided detailed instructions to guide you through the process and ensure accuracy.

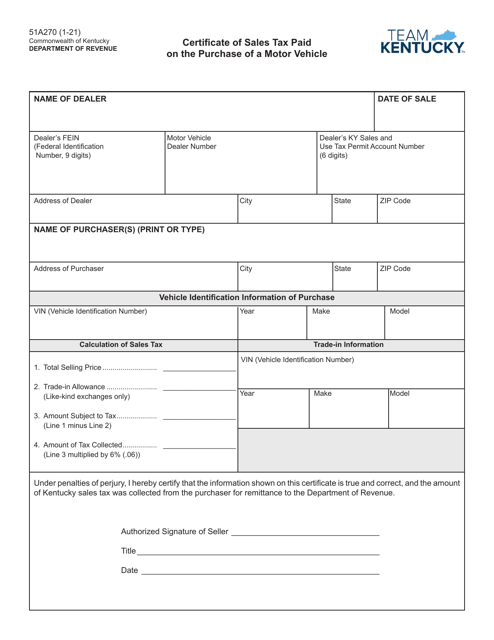

For individuals who have recently purchased a motor vehicle, we offer Form 51A270 Certificate of Sales Tax Paid on the Purchase of a Motor Vehicle in Kentucky. This document allows you to provide proof of sales tax payment, which may be required when registering your vehicle.

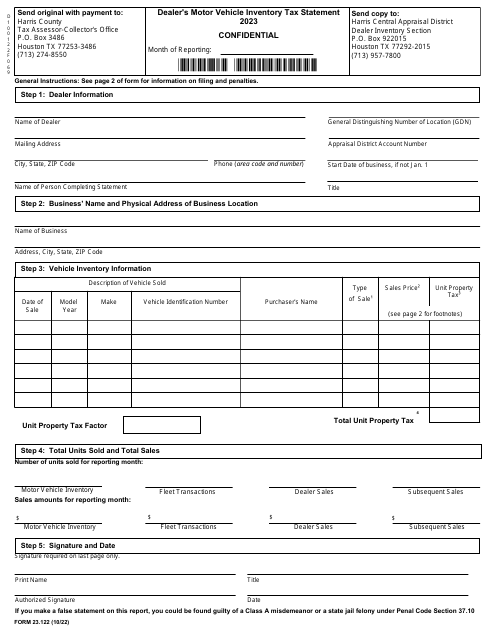

Dealerships and businesses involved in the sale of motor vehicles will find useful documents like Form 23.122 Dealer's Motor Vehicle InventoryTax Statement in Harris County, Texas. This statement aids in the calculation and reporting of inventory tax, ensuring compliance with local tax regulations.

Whether you're an individual vehicle owner or a business operating in the motor vehicle industry, understanding and meeting your motor vehicle tax responsibilities is crucial. Our website offers all the necessary documents, instructions, and resources to help you navigate the intricacies of motor vehicle tax and stay compliant with state regulations.

Trust in our expertise and rely on our comprehensive collection of motor vehicle tax forms, guidance, and alternate names for this important area of taxation. Let us be your go-to resource for all your motor vehicle tax documentation needs. Start exploring our site today to streamline your tax reporting process and ensure compliance with ease.

Documents:

22

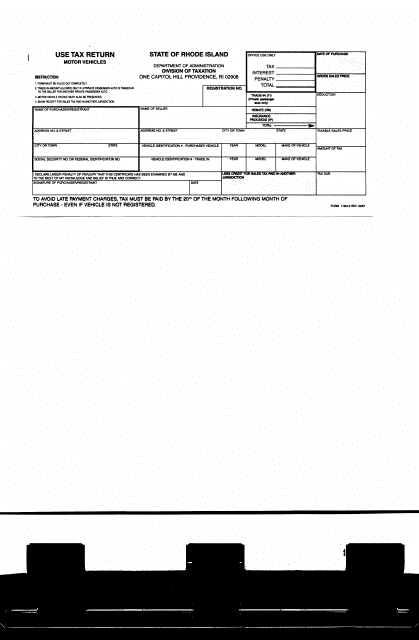

This form is used for filing tax returns related to motor vehicles in Rhode Island.

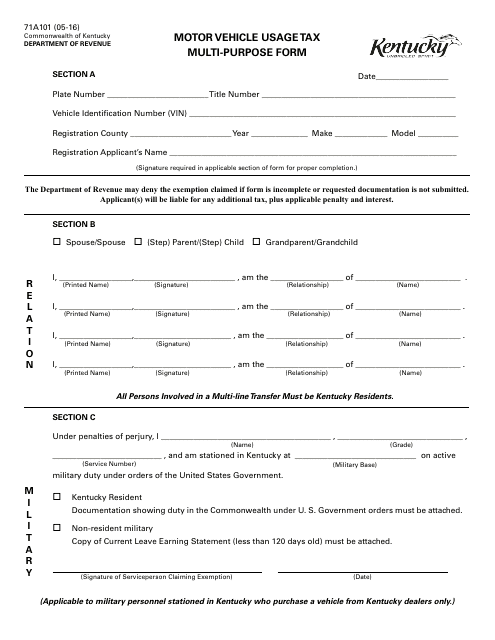

This form is used for reporting and paying motor vehicle usage tax in Kentucky. It is a multipurpose form that can be used for various purposes related to motor vehicle taxation.

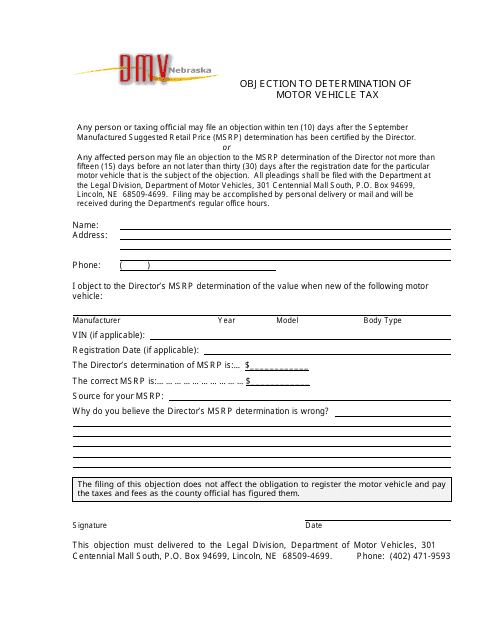

This document is used to object to the determination of motor vehicle tax in the state of Nebraska. It allows individuals to challenge the calculation or assessment of their tax liability for their motor vehicle.

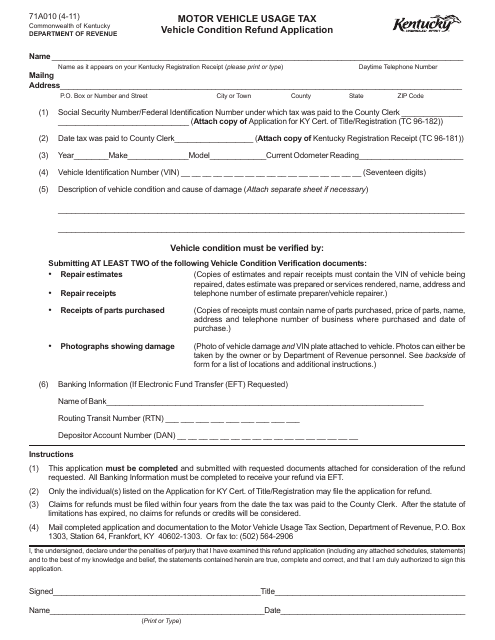

This form is used for applying for a refund on the motor vehicle usage tax in Kentucky if the vehicle is in a condition that makes it eligible for a refund.

This form is used for paying the federal heavy vehicle use tax in South Dakota.

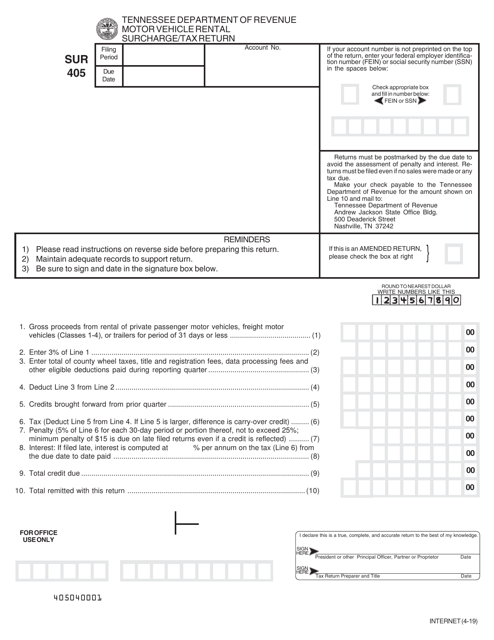

This Form is used for reporting and paying motor vehicle rental surcharge and tax in the state of Tennessee.

This Form is used for filing the Motor Vehicle Fuel Supplier Tax Return in the state of Washington. It provides instructions on how to complete and submit the form.

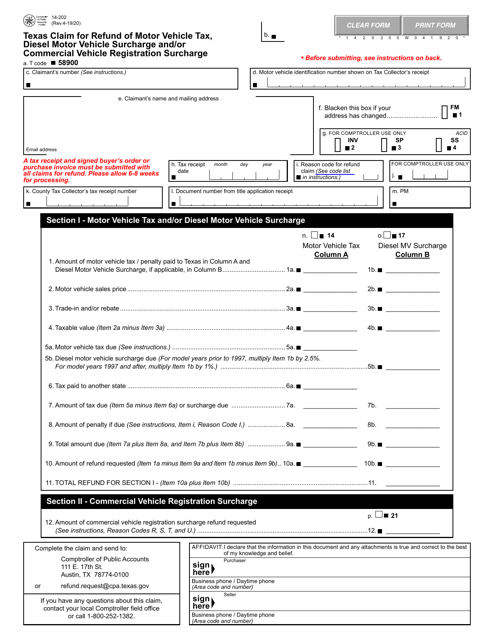

This Form is used for claiming a refund of motor vehicle tax, diesel motor vehicle surcharge and/or commercial vehicle registration surcharge in the state of Texas.

This document provides tax information for motor vehicle dealers in Florida. It covers topics such as sales tax, registration fees, and dealer licensing requirements.