Tax Issues Templates

Are you experiencing tax issues or have questions about tax regulations? Look no further! Our comprehensive collection of documents covers a wide range of tax-related topics, helping you navigate through the complexities of taxation. Our vast assortment of resources includes guides, forms, and letters to address your specific needs. Whether you're a low-income taxpayer seeking assistance or require help with an IRS audit, we have you covered. Our documents are also known as tax issue resources, providing valuable information and solutions to ensure your compliance and peace of mind. Don't let tax matters overwhelm you - explore our selection of tax issue materials and find the answers you need today!

Documents:

8

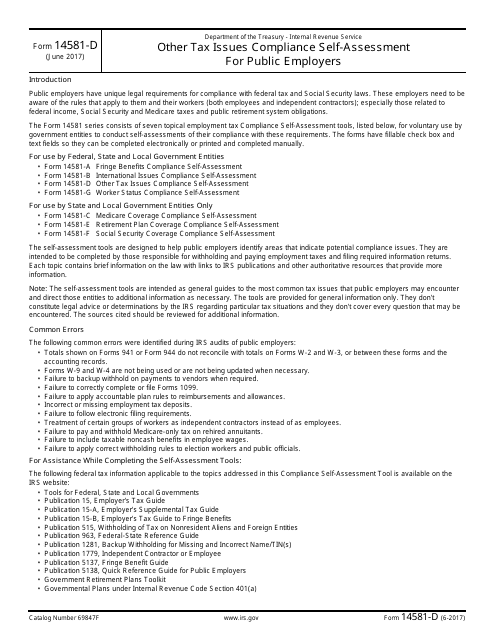

This Form is used for public employers to assess their compliance with other tax issues for the purpose of tax compliance.

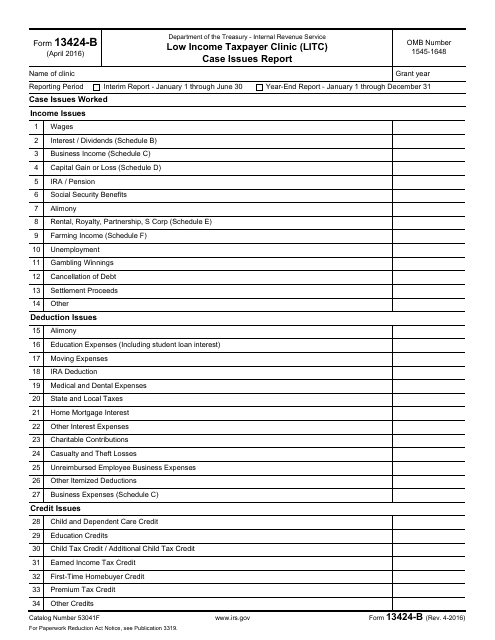

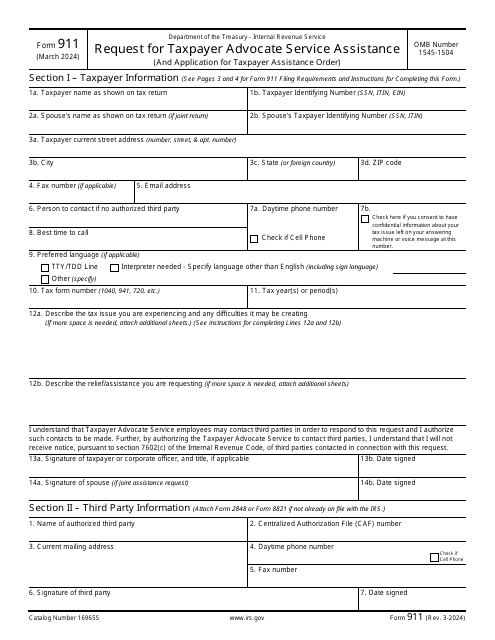

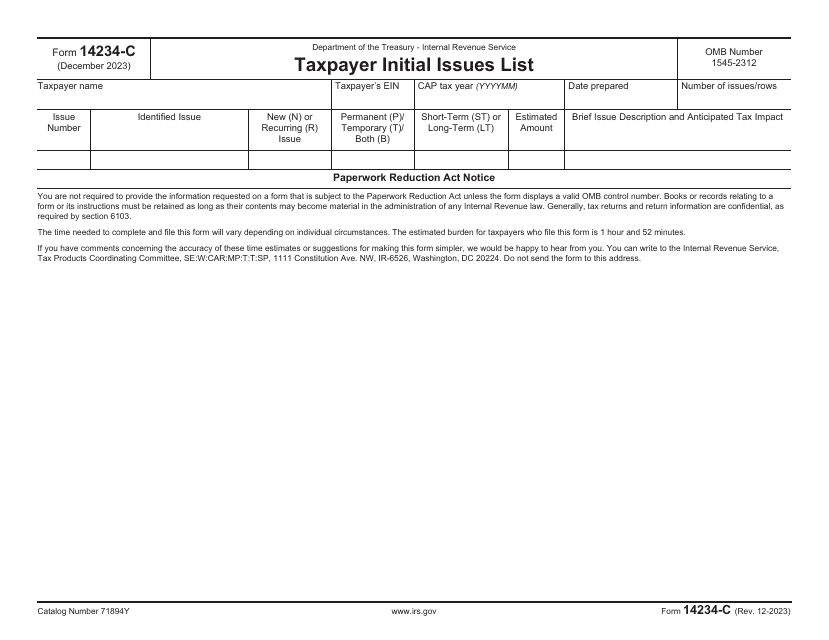

This is a fiscal form used by taxpayers that have already exhausted all other options when dealing with a tax issue.

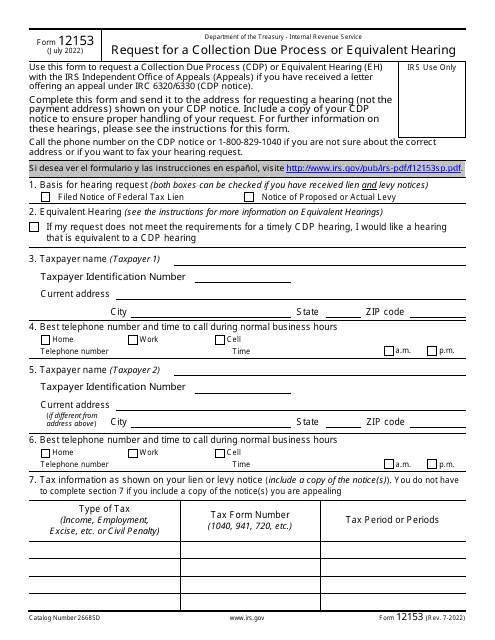

This is a fiscal form filled out by a taxpayer to appeal an upcoming tax levy or lien.

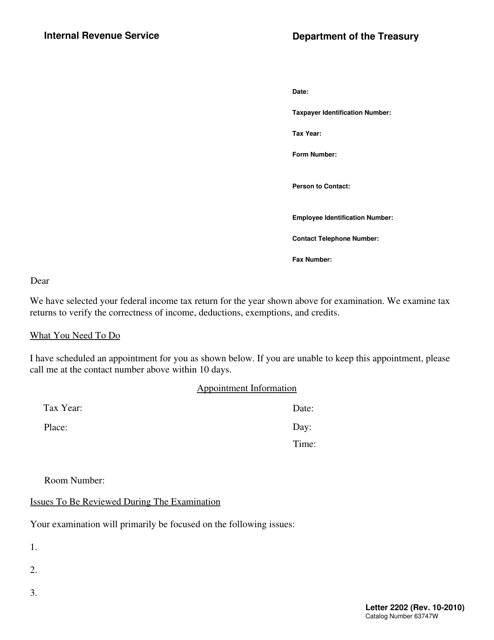

The IRS can initiate a review of the information you submit via your tax return by sending you an IRS Audit Letter in the mail.

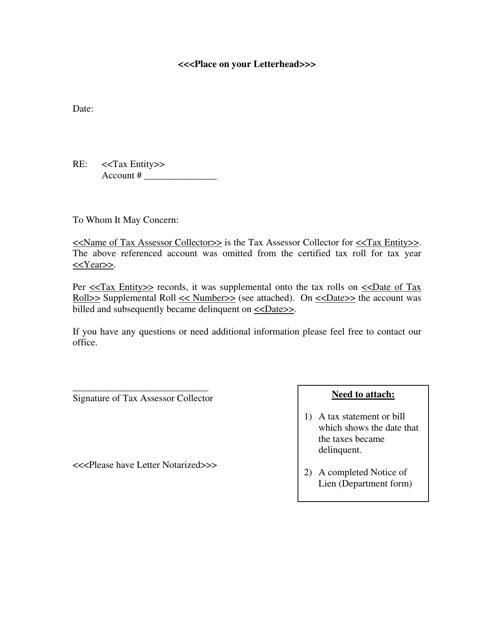

This document is a sample letter that can be used when filing taxes in Texas. It provides guidance on how to handle situations where certain taxes were omitted in previous filings.

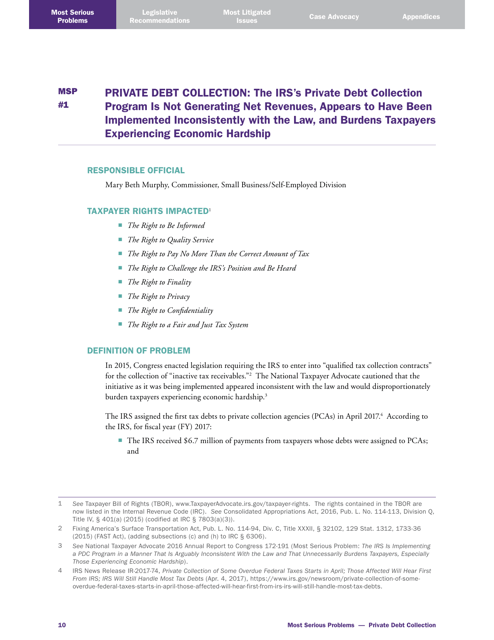

This document provides the Annual Report to Congress from the Taxpayer Advocate Service. It addresses various issues and concerns related to taxpayer rights and offers recommendations for improvement.