Tax Resolution Templates

Are you struggling with tax-related issues and looking for a way to resolve them? Look no further! Our tax resolution services are designed to help you settle your tax liabilities and find a solution that works for you. Whether you're an individual or a self-employed business owner, we have a range of options to help you achieve tax relief.

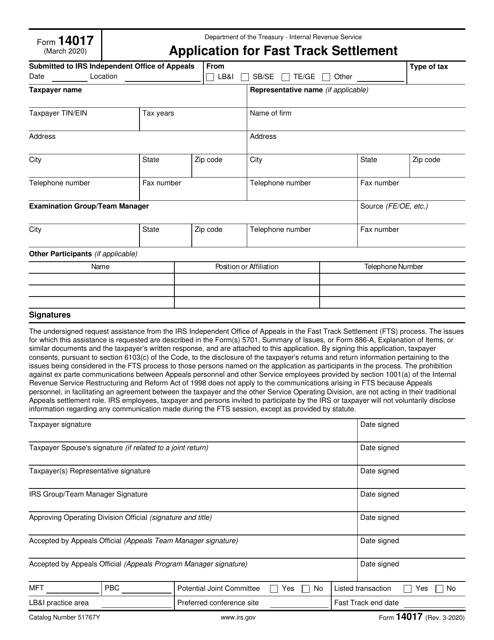

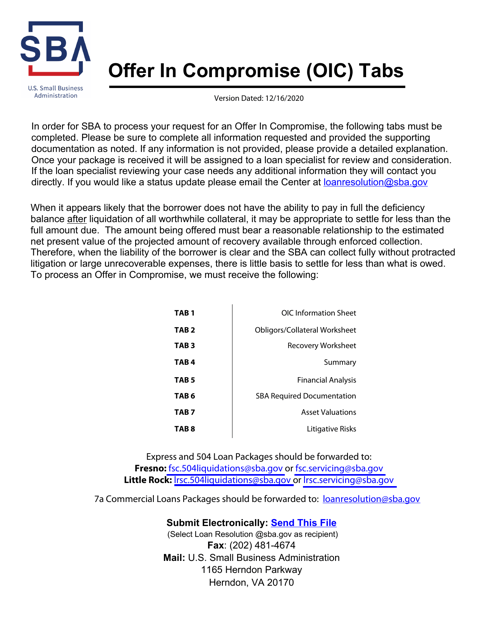

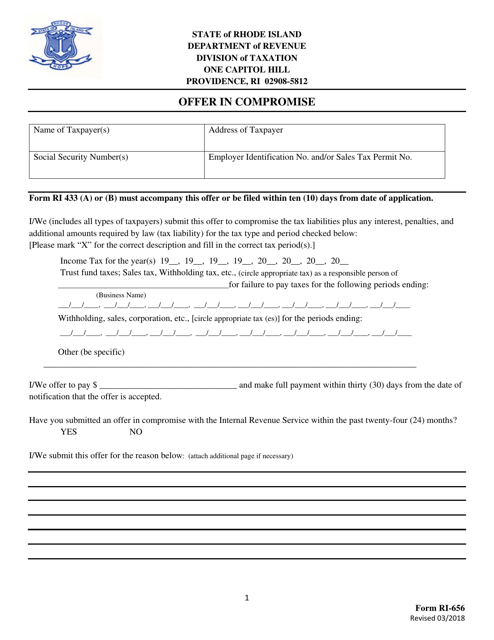

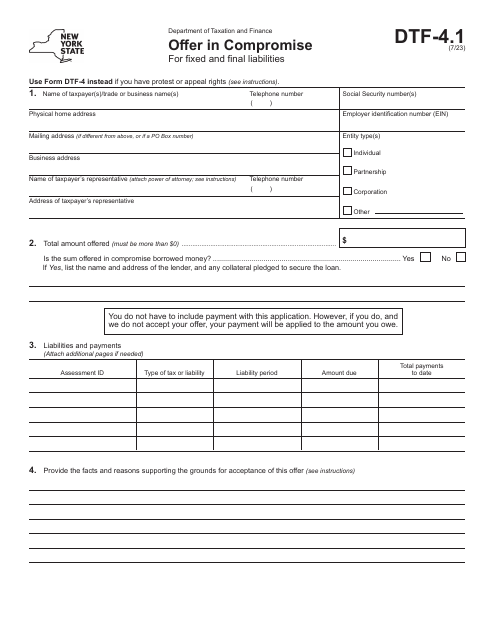

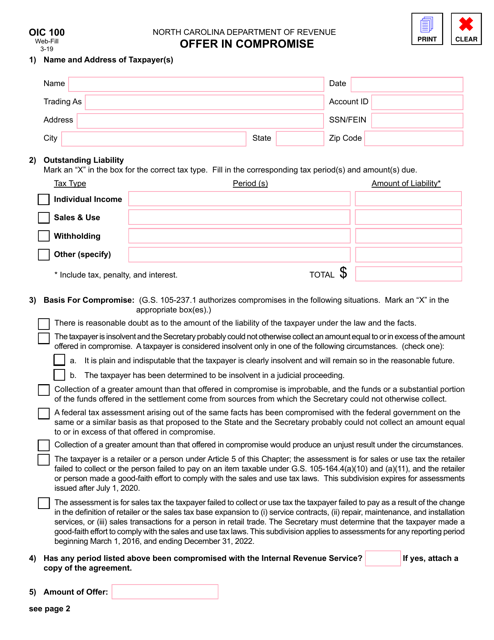

One of the ways we can assist you is by helping you navigate through the complex process of applying for an Offer in Compromise. This program allows you to settle your tax debt for less than the full amount owed. We have experienced professionals who can guide you through the application process, ensuring that all the necessary paperwork, such as Form CDTFA-490-C Offer in Compromise Application in California, IRS Form 14017 Application for Fast Track Settlement, or IRS Form 656 Offer in Compromise, is submitted correctly.

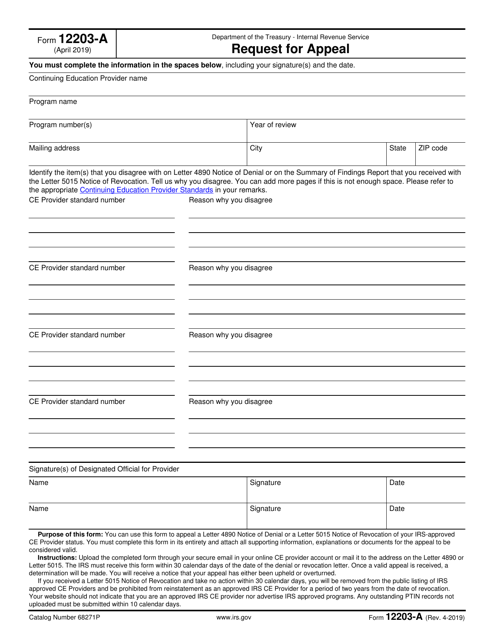

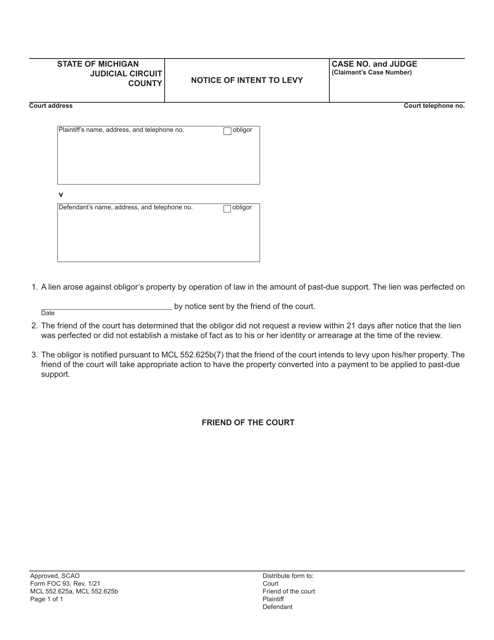

In addition to Offer in Compromise, we can also help you with other tax resolution strategies, such as requesting a hearing or an informal conference. If you're based in Michigan, for example, you might need to fill out Form 5713 Request for Hearing/Informal Conference. Our team is well-versed in the specific requirements of different states, so you can count on us to provide tailored guidance based on your location and situation.

Don't let your tax problems overwhelm you. With our tax resolution services, you can regain control of your financial situation and find the relief you need. Contact us today to learn more about how we can help you achieve tax resolution.

Documents:

52

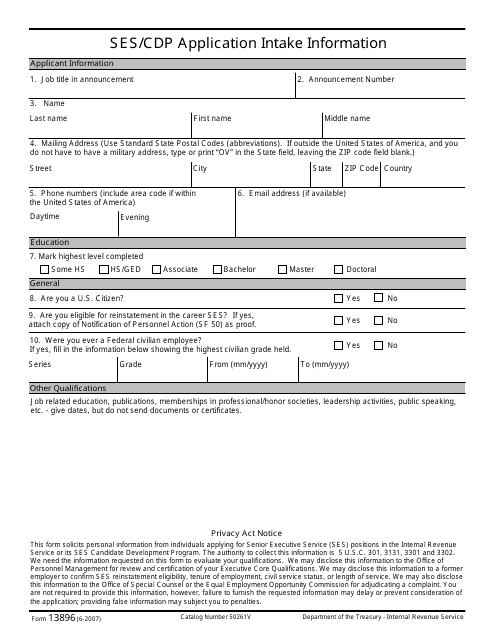

This form is used for applying for a Ses/Cdp Application Intake with the IRS.

This is a fiscal form used by taxpayers that have already exhausted all other options when dealing with a tax issue.

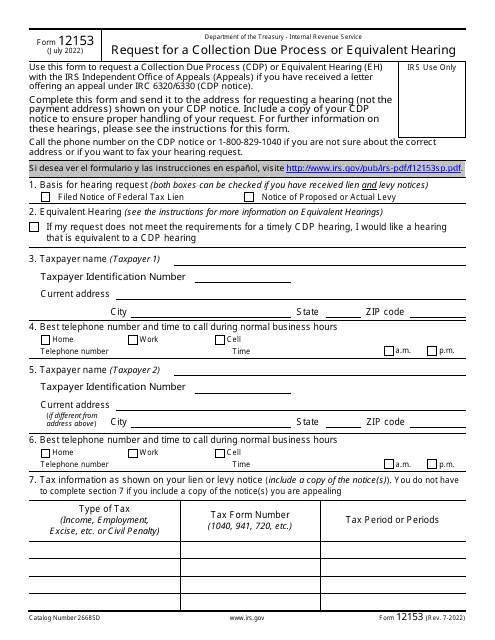

This is a fiscal form filled out by a taxpayer to appeal an upcoming tax levy or lien.

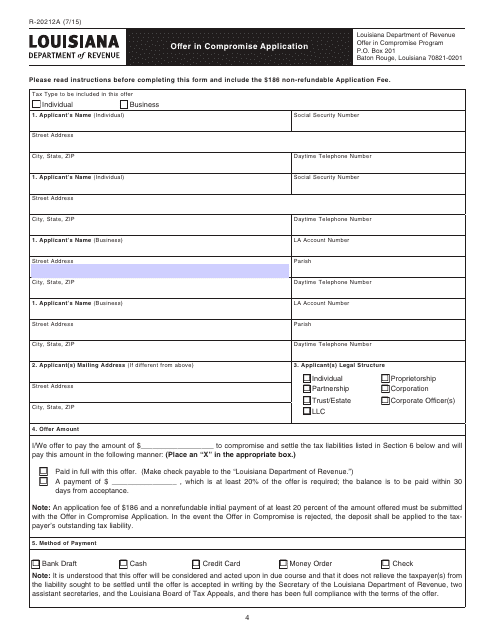

This Form is used for filing an Offer in Compromise Application in the state of Louisiana.

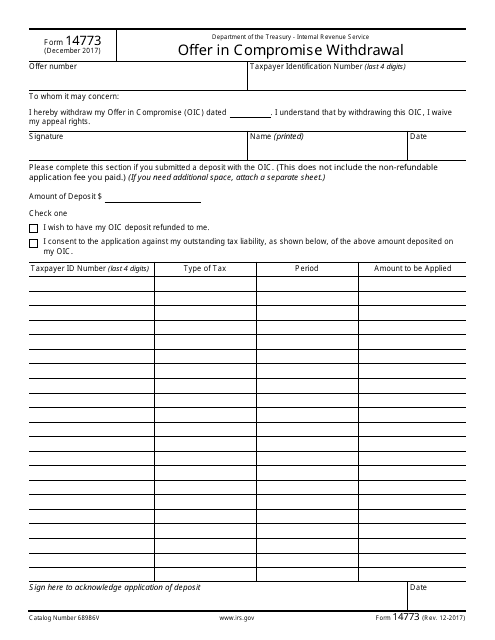

This Form is used for withdrawing an offer in compromise with the Internal Revenue Service (IRS).

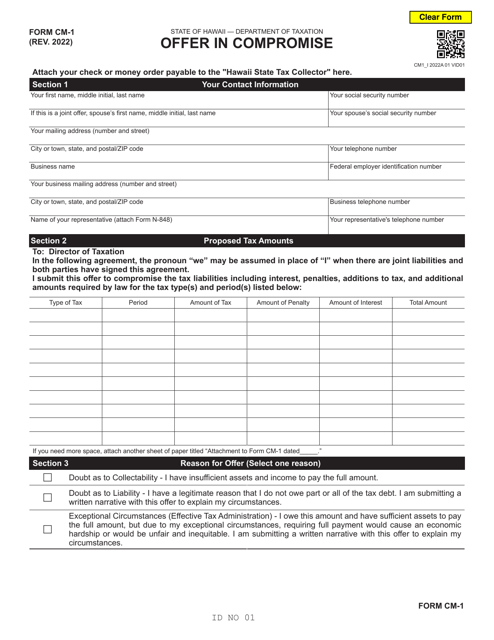

This form is used for the Offer in Compromise Program in the state of Louisiana. It allows taxpayers to settle their tax debts with the state for a reduced amount.

This Form is used for applying for a Voluntary Disclosure Agreement (VDA) in the state of California. A VDA allows taxpayers to voluntarily disclose and resolve past tax liabilities in exchange for potential penalty relief.

This form is used for submitting an offer in compromise application to the California Department of Tax and Fee Administration.

This form is used for making an offer in compromise to the state of Rhode Island to settle a tax debt.

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.

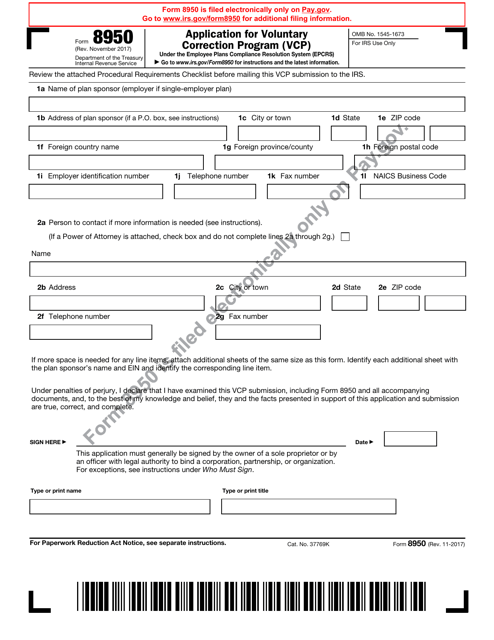

This form is used for applying to the IRS Voluntary Correction Program (VCP). The VCP allows employers to correct errors in their retirement plans and avoid penalties.

This document is used for submitting an Offer in Compromise to the state of North Carolina. It is a request to settle a tax liability for less than the full amount owed.

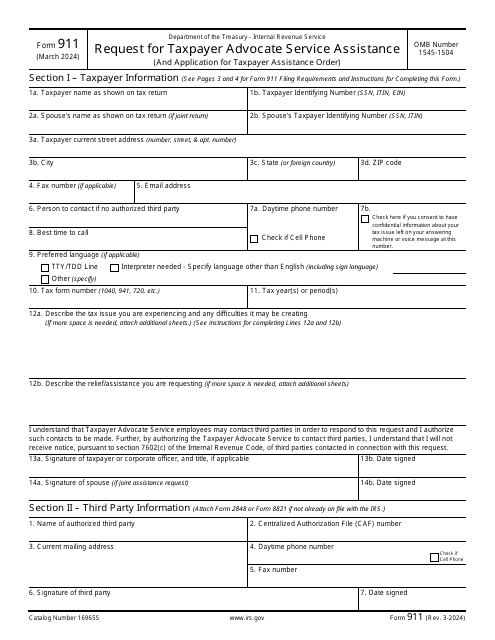

This document provides information about the Taxpayer Advocate Service, a resource available to help taxpayers with their tax-related issues and concerns.

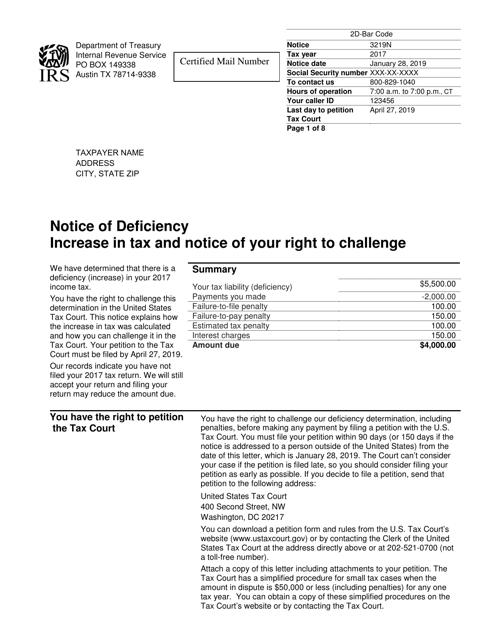

This document is a Notice of Deficiency from the Internal Revenue Service (IRS). It is sent to taxpayers who have underreported their income or have other tax liabilities. The notice provides information about the proposed changes to the tax return and the options available to the taxpayer to respond.

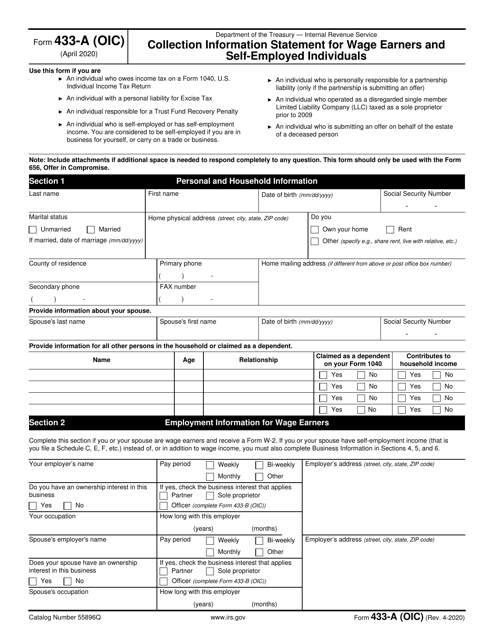

This Form is used for individuals who owe taxes to provide detailed financial information to the IRS in order to request an offer in compromise (OIC) and settle their tax debt.

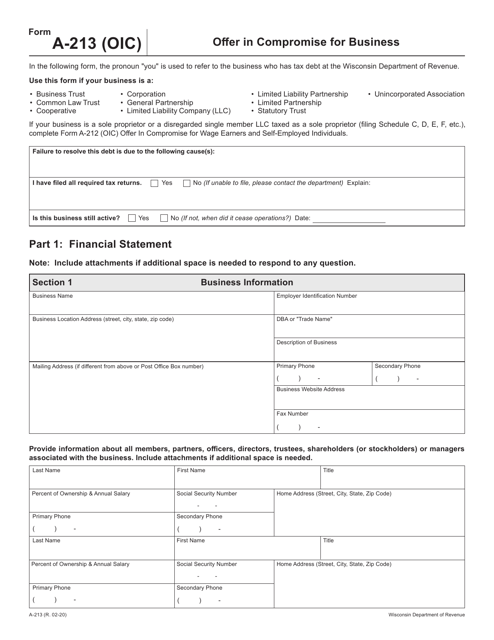

This form is used for making an offer in compromise for a business located in Wisconsin.

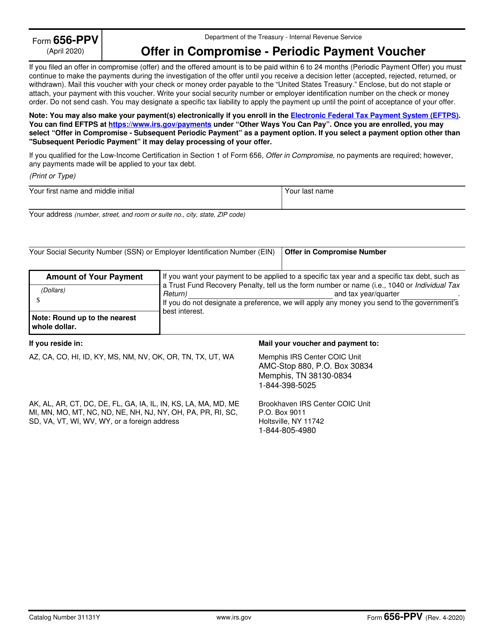

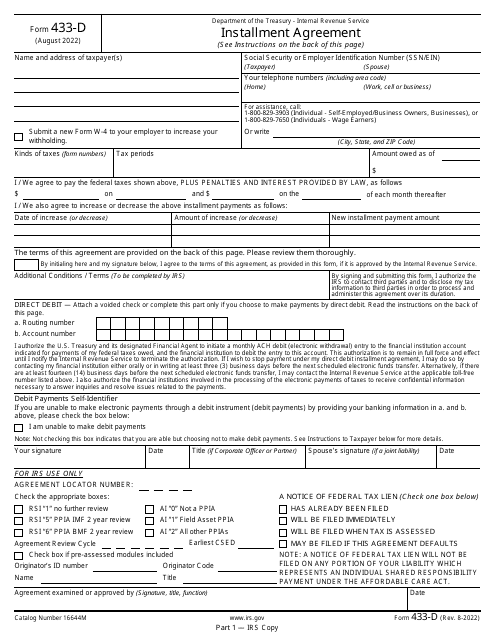

This is a fiscal form used by a taxpayer to express their intention to pay off their tax debt via a direct debit payment.

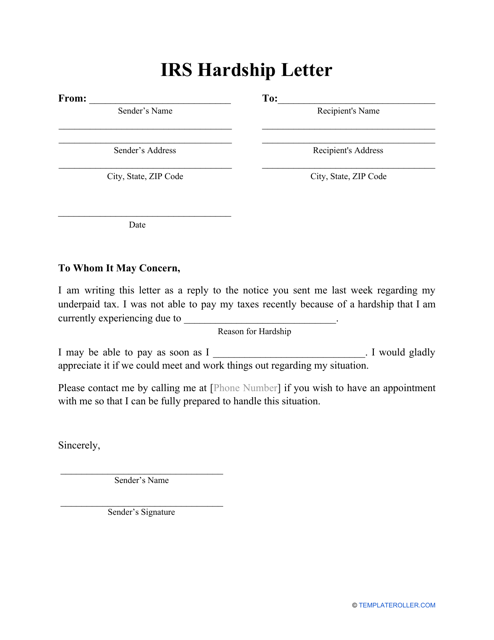

Complete this template and send it to the Internal Revenue Service (IRS) in order to describe a difficult financial situation you're experiencing, ask the IRS for leniency, or request a new payment deadline.

This is a formal IRS document that outlines the financial health of a business entity that owes a tax debt to the government.

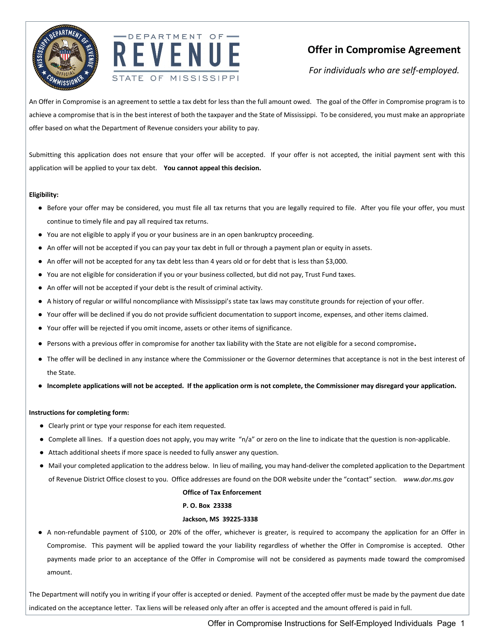

This Form is used for self-employed individuals in Mississippi who want to apply for an Offer in Compromise to settle their tax debt with the state. It provides instructions on how to complete the application process.

This Form is used for individuals in Mississippi to apply for an Offer in Compromise, which is a potential solution for taxpayers who are unable to pay their tax debt in full.

This document is for self-employed individuals in Mississippi who want to apply for an Offer in Compromise to resolve their tax debt.

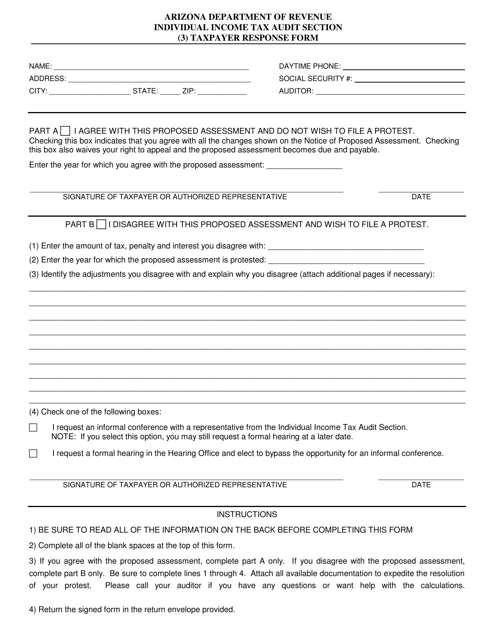

This Form is used for taxpayers in Arizona to respond to correspondence from the tax authorities.