Self Employment Tax Templates

Documents:

69

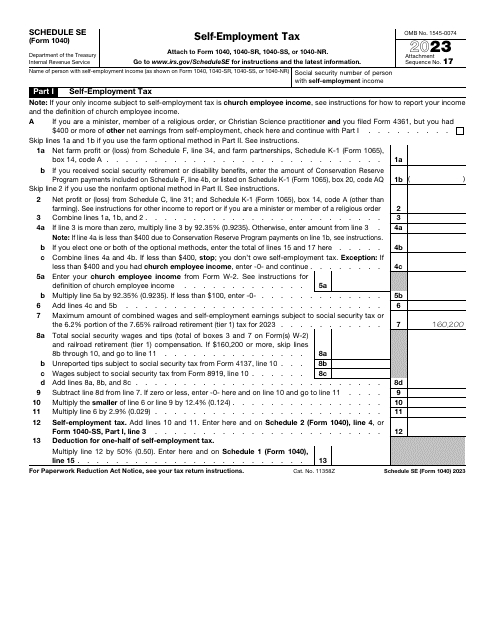

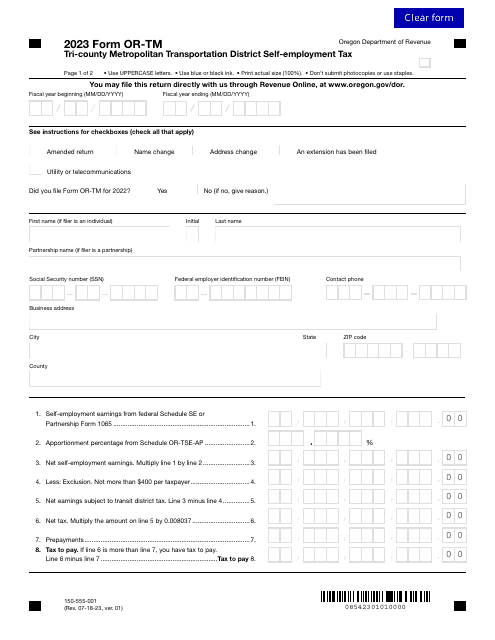

This is an IRS form that contains the breakdown of the self-employment tax the taxpayer figures out after analyzing their net earnings.

This is a fiscal IRS document business entities have to use to report compensation they have paid to individuals and companies they do not consider their employees.

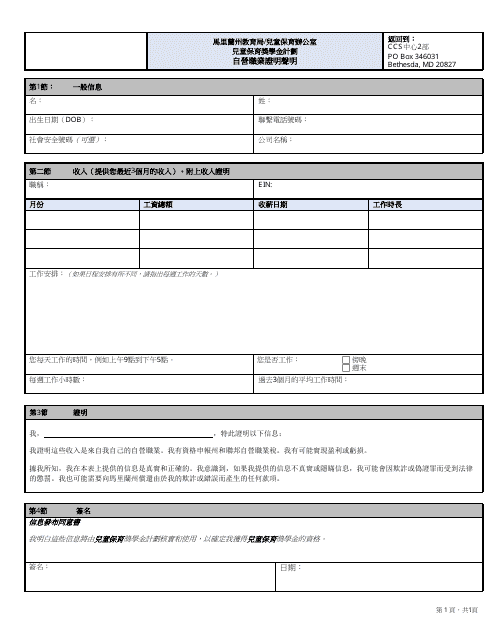

This document is for self-employed individuals in Maryland who are attesting to their employment status.

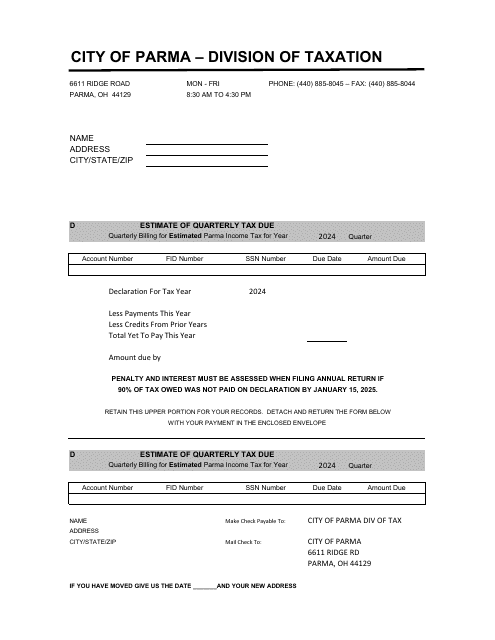

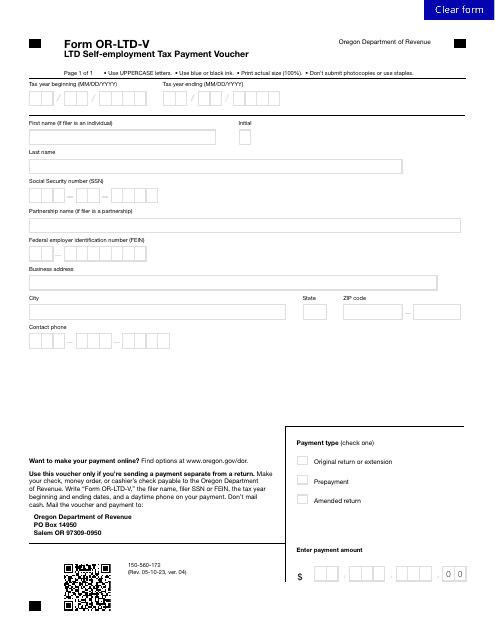

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

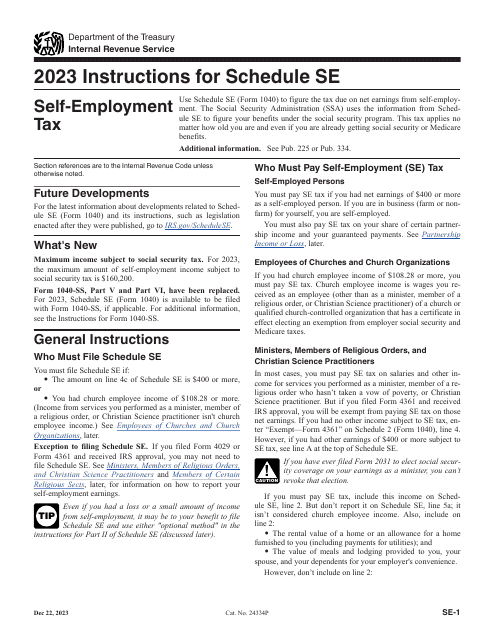

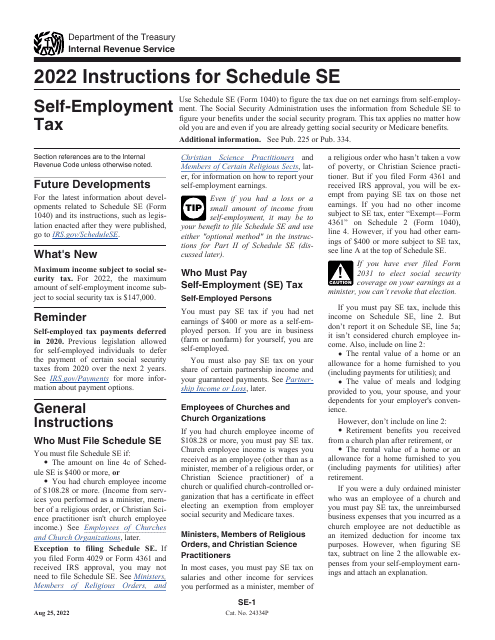

This document provides instructions for filling out Schedule SE, which is used to calculate and report self-employment tax. It covers step-by-step guidance on how to accurately complete this form.

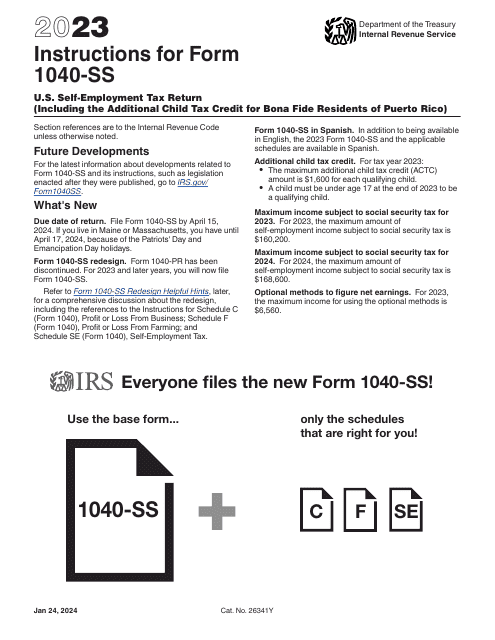

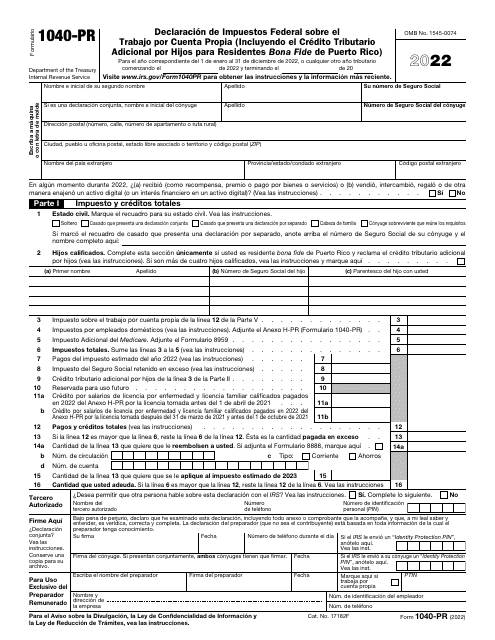

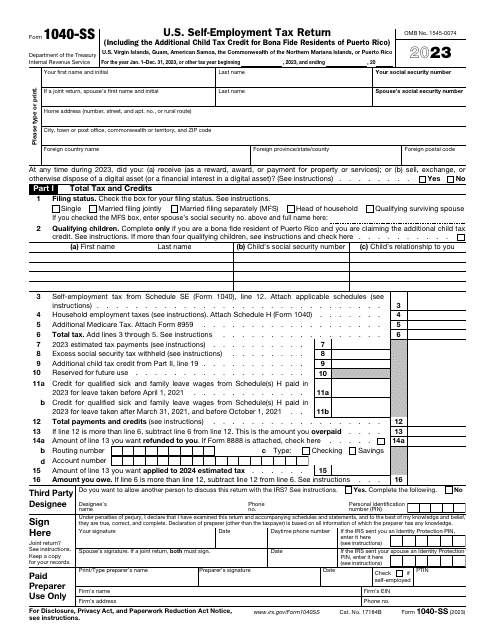

Use this document only if you are a resident of the United States Virgin Islands (USVI), Commonwealth of Puerto Rico, Commonwealth of the Northern Mariana Islands (CNMI), Guam, and American Samoa and wish to report your self-employment net earnings to the United States.

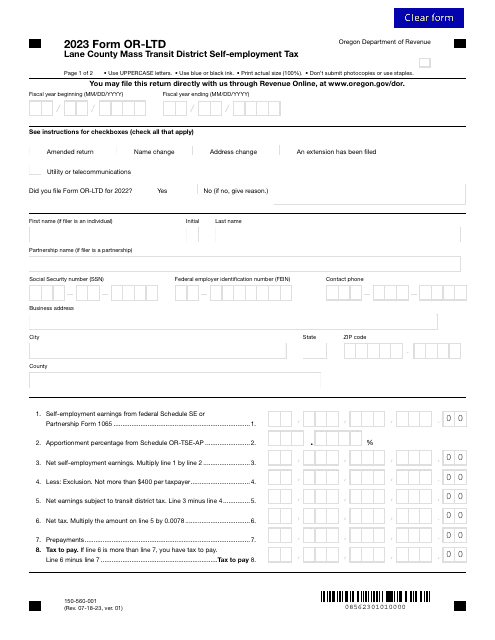

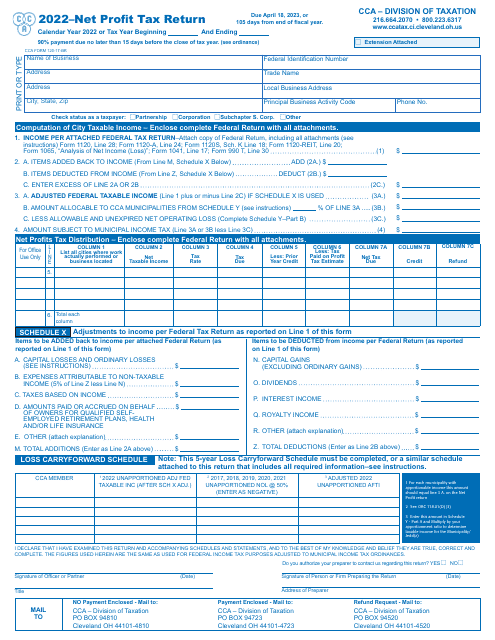

This form is used for filing the net profit tax return with the City of Cleveland, Ohio.