Innocent Spouse Relief Templates

Are you facing tax debt or penalties due to your spouse or former spouse's actions? You may be eligible for Innocent Spouse Relief, a program designed to provide relief for individuals who unknowingly filed joint tax returns that contained errors or fraudulent activity. Also known as Innocent Spouse Relief Form, this program allows you to separate your tax liability from your spouse and avoid being held responsible for their actions.

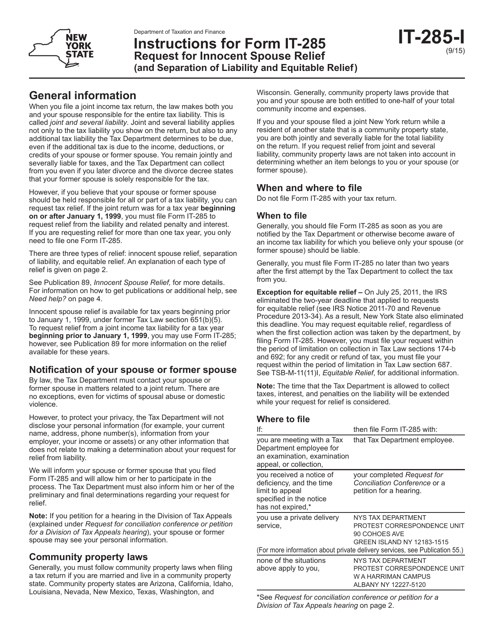

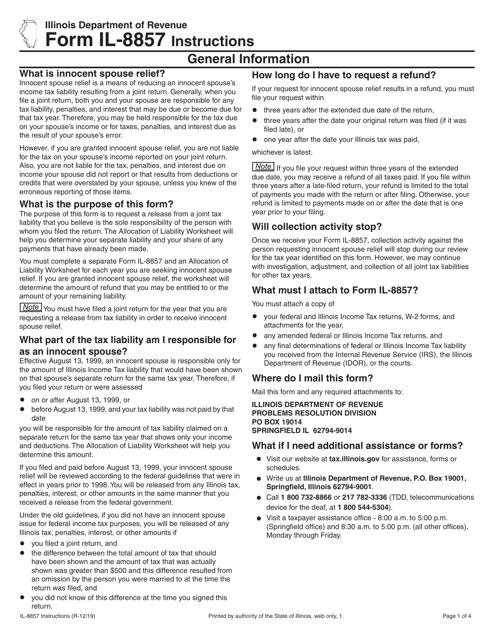

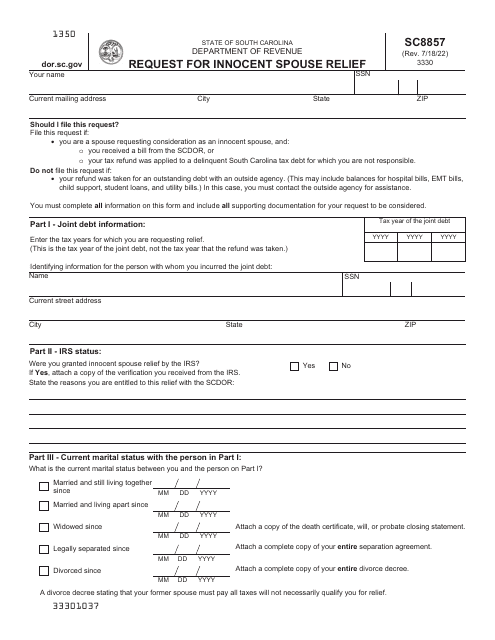

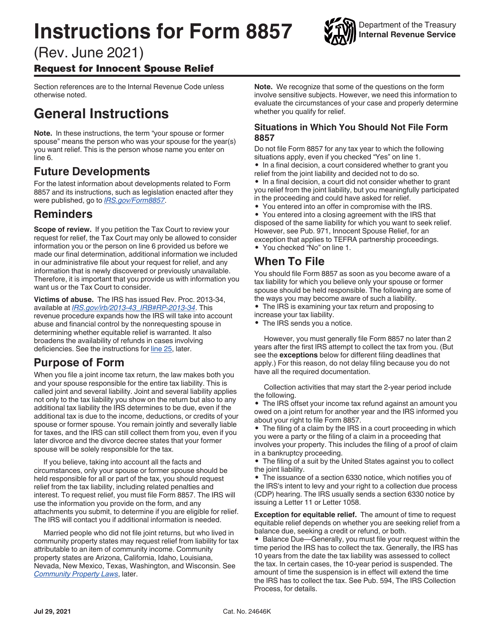

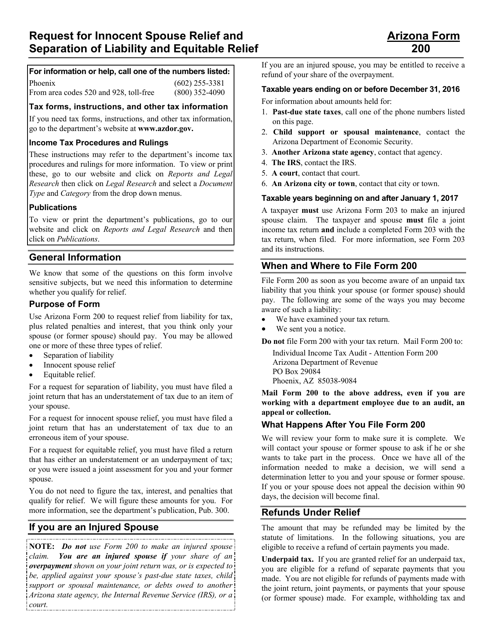

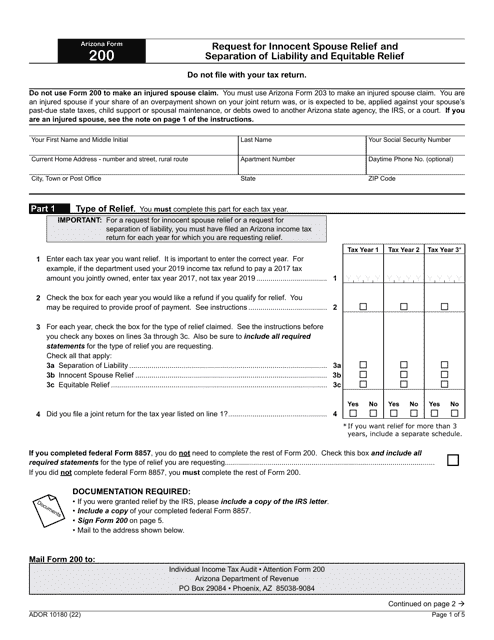

The Innocent Spouse Relief program is available in various states, such as Utah, New York, Illinois, and Arizona, each with its own set of requirements and procedures. To apply for relief, you will need to fill out the appropriate forms, such as Form TC-8857 in Utah, Form IT-285 in New York, Form IL-8857 in Illinois, and IRS Form 8857 at the federal level. These forms provide the necessary information to prove your eligibility and the extent of your spouse's involvement in the tax-related issues.

Innocent Spouse Relief provides a way for innocent taxpayers to start fresh and move forward without the burden of their spouse or former spouse's tax problems. It can help alleviate financial stress, protect your assets, and restore your peace of mind. If you think you may qualify for Innocent Spouse Relief, consult with a tax professional who can guide you through the process and ensure that you meet all the necessary requirements.

Note: The examples provided are for illustrative purposes only and may not reflect the specific forms or procedures applicable to your state. Please consult the official forms and instructions provided by your respective state's tax authorities or the Internal Revenue Service (IRS) for accurate and up-to-date information.

Documents:

16

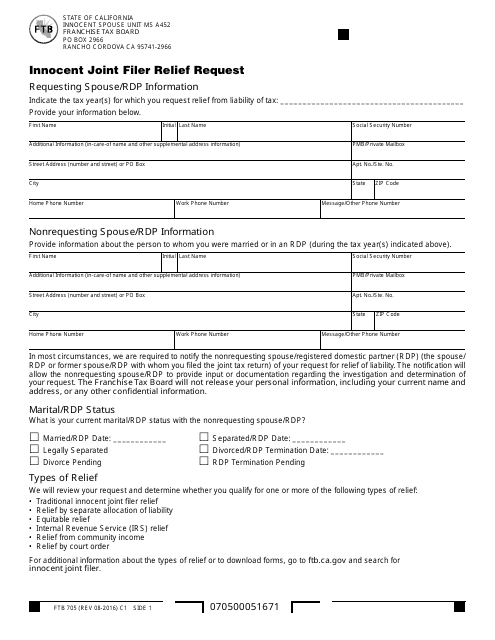

This form is used for requesting innocent joint filer relief in the state of California.

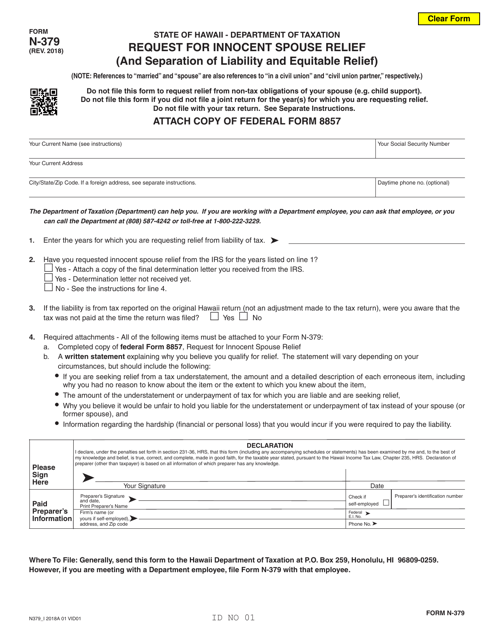

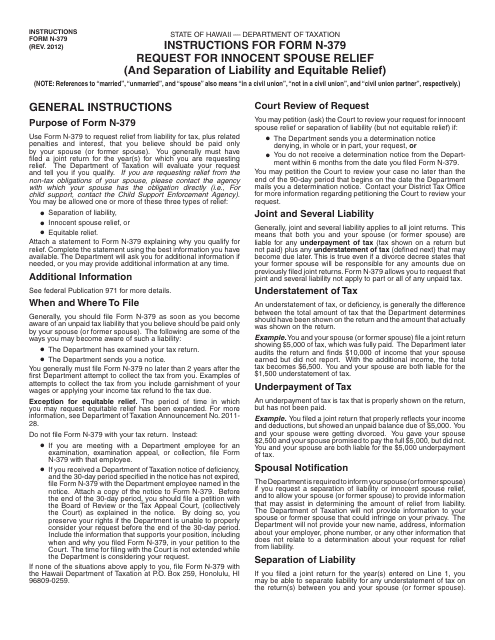

This Form is used for requesting innocent spouse relief in the state of Hawaii. It provides instructions on how to apply for relief from joint tax liability when a spouse or former spouse believes they should not be held responsible for the other spouse's tax obligations.

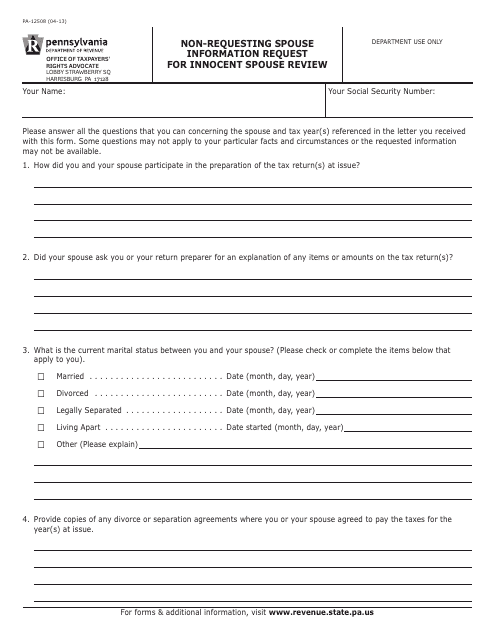

This form is used for requesting information from the non-requesting spouse in order to conduct an innocent spouse review in the state of Pennsylvania.

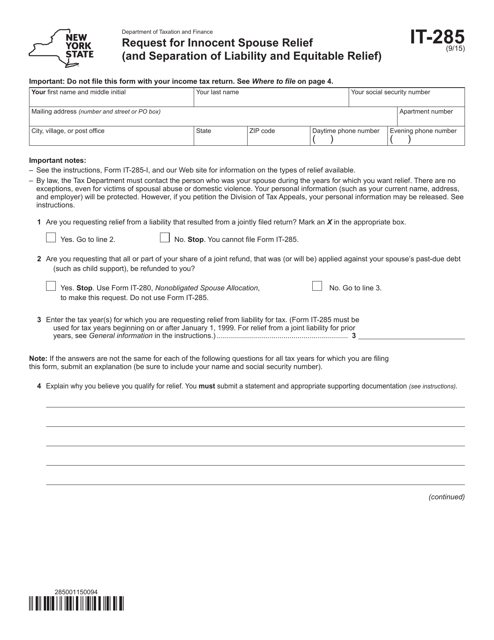

This form is used for residents of New York who are seeking innocent spouse relief, as well as separation of liability and equitable relief. It allows taxpayers to request relief from certain tax liabilities that were caused by their spouse or former spouse.

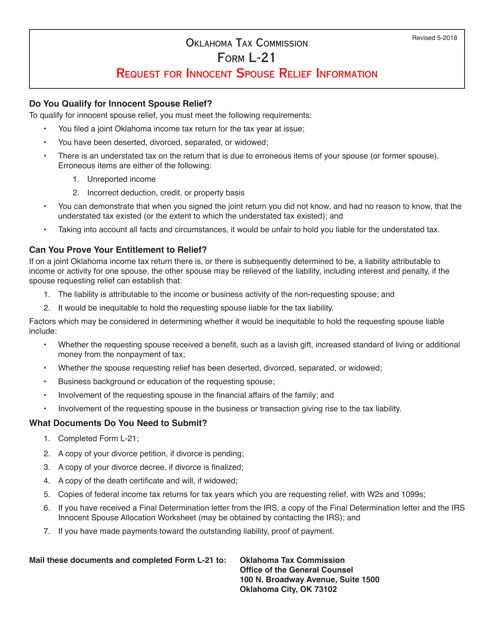

This form is used for requesting innocent spouse relief in the state of Oklahoma.

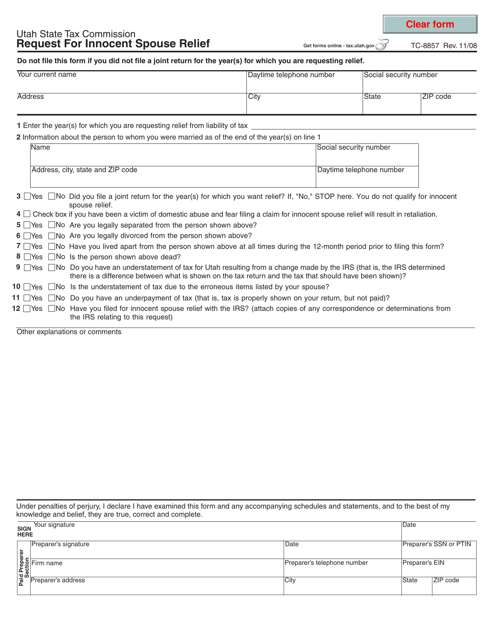

This form is used for requesting innocent spouse relief in the state of Utah. Innocent spouse relief is a provision that allows individuals to avoid being held responsible for taxes owed by their spouse or former spouse. Fill out this form to apply for relief from joint tax liability.

This Form is used for requesting innocent spouse relief, separation of liability, and equitable relief in the state of New York.

This form is used for requesting innocent spouse relief in the state of Illinois.

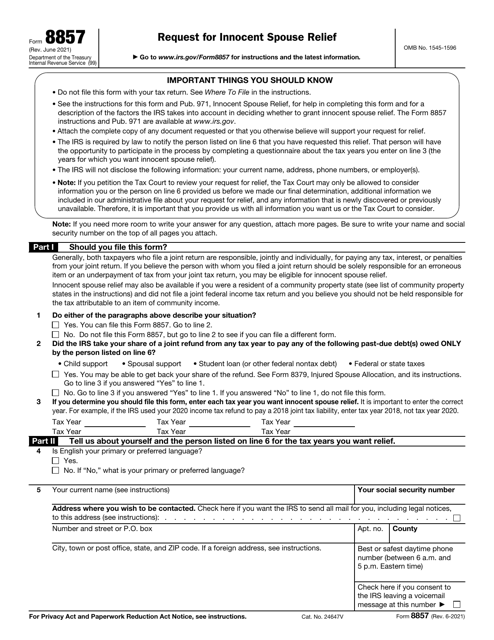

This Form is used for requesting Innocent Spouse Relief from the Internal Revenue Service (IRS). It is intended for individuals who believe they should not be held responsible for the tax liability owed by their spouse or former spouse.

This form is used for requesting innocent spouse relief and separation of liability and equitable relief in the state of Arizona. It provides instructions on how to apply for relief from joint tax liability when one spouse can prove they are not responsible for the tax debt.