Roll Your Own Tobacco Templates

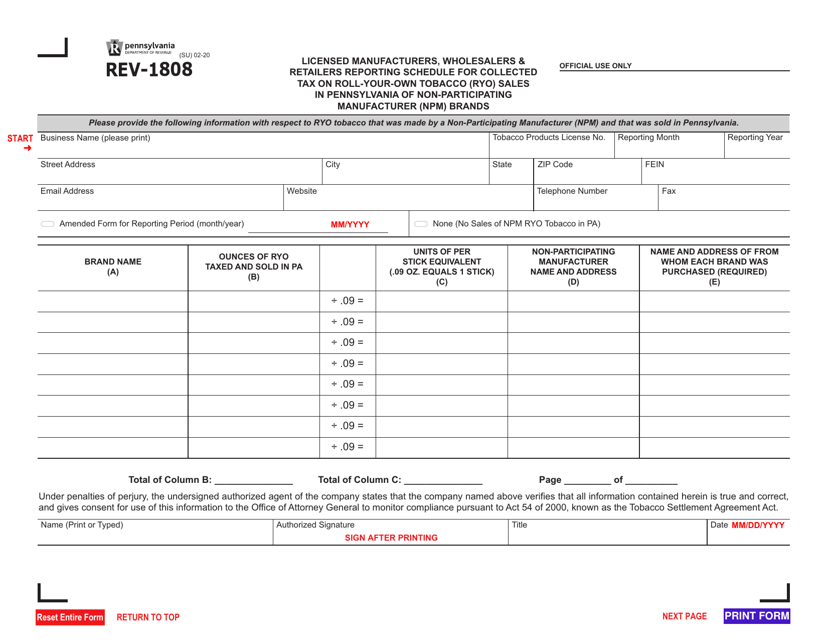

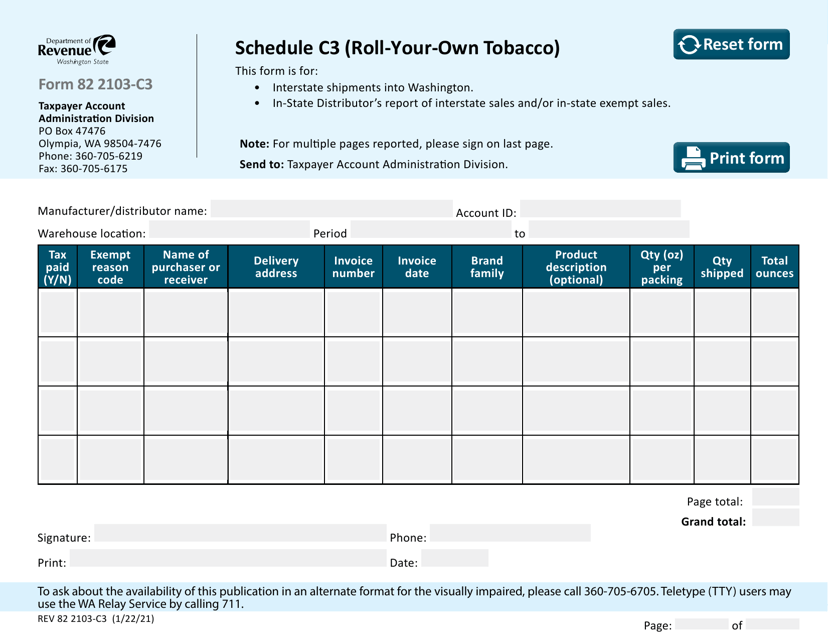

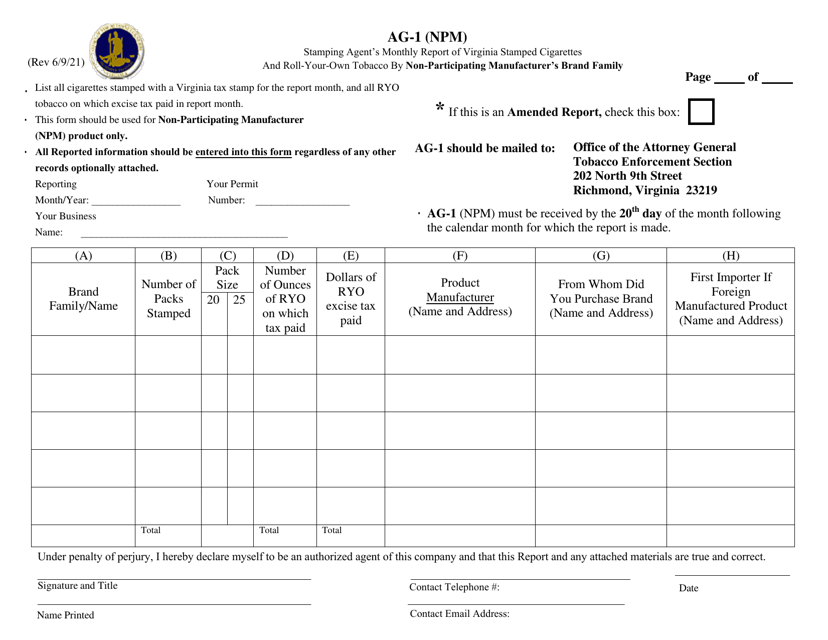

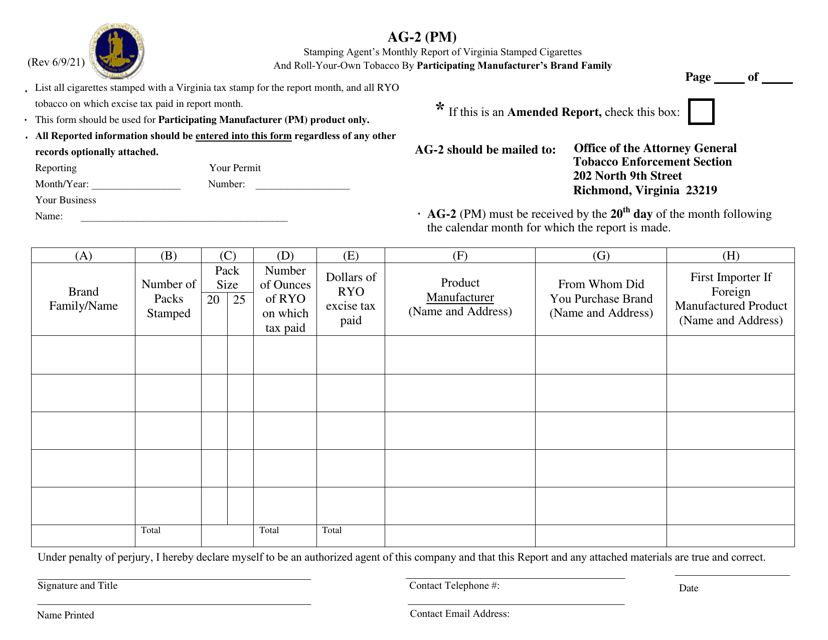

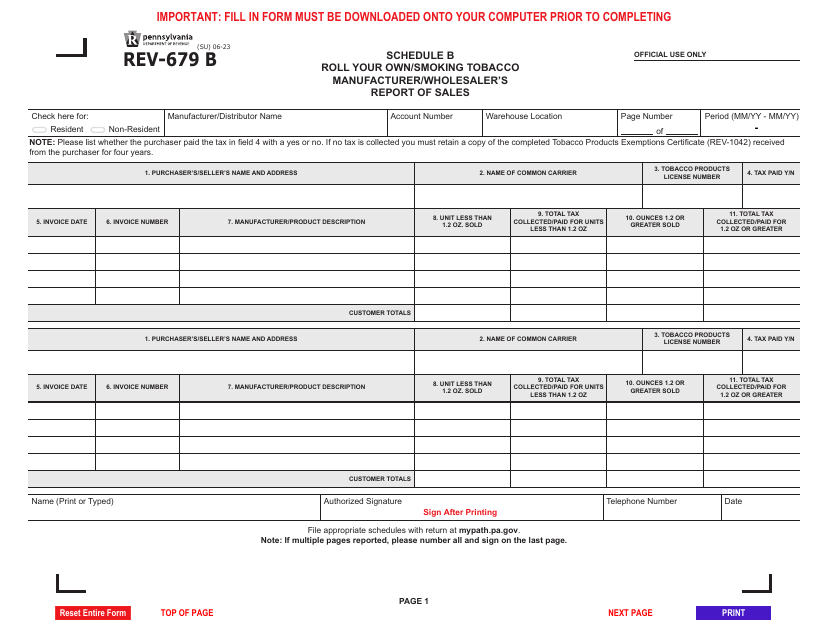

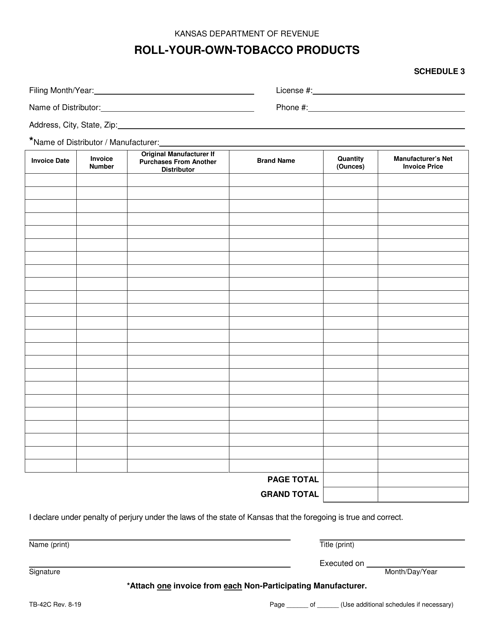

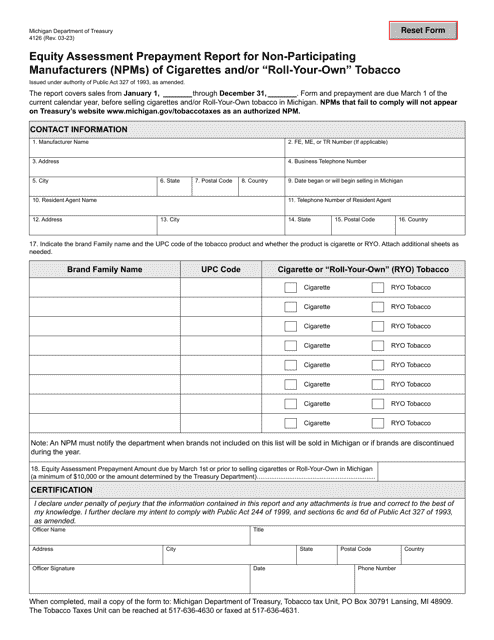

Are you a fan of rolling your own tobacco? Look no further! Our roll your own tobacco collection is a comprehensive resource for everything related to this popular hobby. Whether you're a licensed manufacturer or retailer reportingsales tax on roll-your-own tobacco, or a stamping agent providing monthly reports on Virginia stamped cigarettes and roll-your-own tobacco, we have the forms you need. From Washington's Schedule C3 for roll-your-own tobacco to Kansas' Form TB-42C for roll-your-own tobacco products, our collection covers it all. Don't miss out on Michigan's Form 4126 for prepayment reports on non-participating manufacturers of cigarettes and roll-your-own tobacco. With our extensive roll your own tobacco collection, you'll find all the information you need for your business or personal use. Check out our website now and explore our diverse range of documents on roll your own tobacco.

Documents:

18

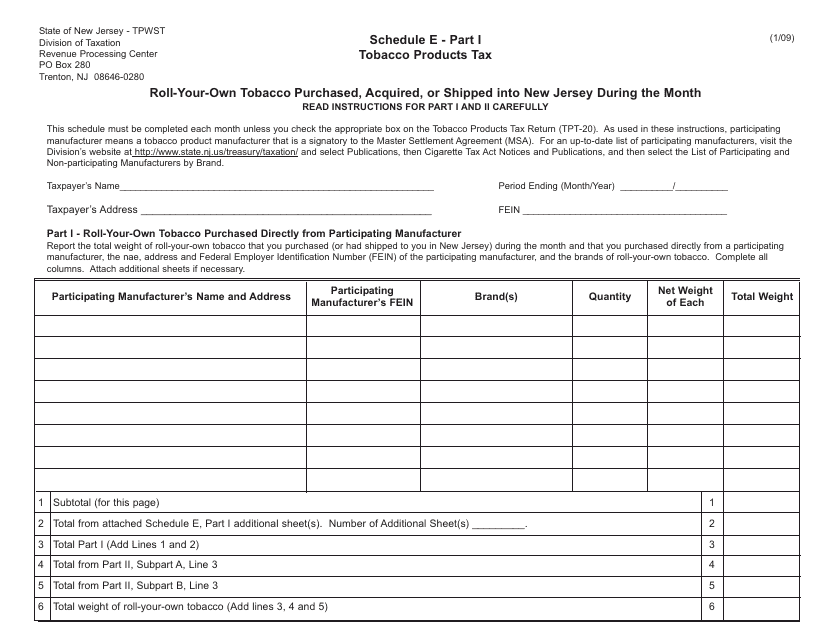

This form is used for reporting the purchase, acquisition, or shipment of roll-your-own tobacco into New Jersey during a specific month.

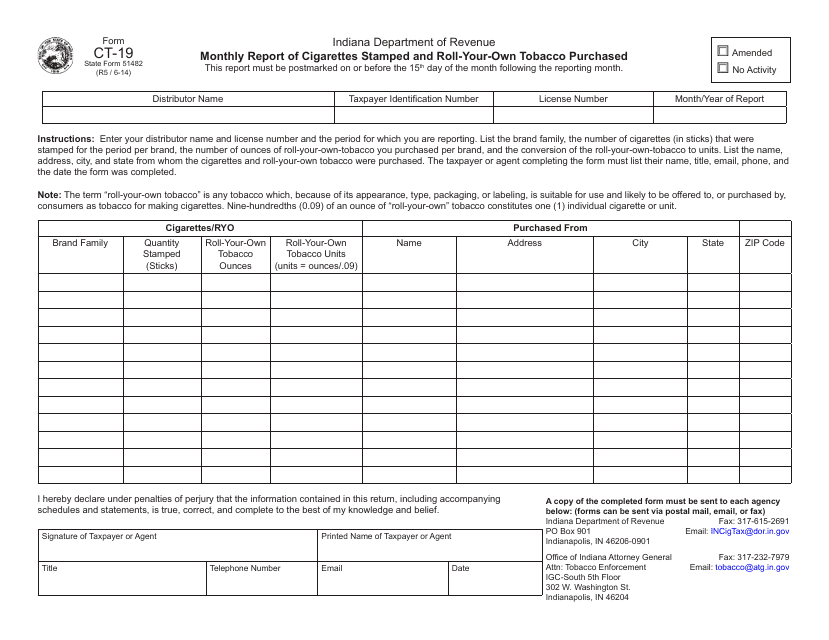

This form is used for reporting monthly purchases of stamped cigarettes and roll-your-own tobacco in the state of Indiana.

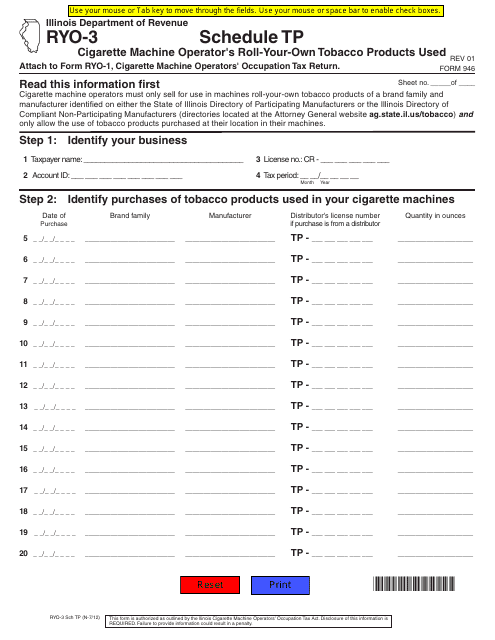

This Form is used for reporting the amount of roll-your-own tobacco products used by cigarette machine operators in Illinois.

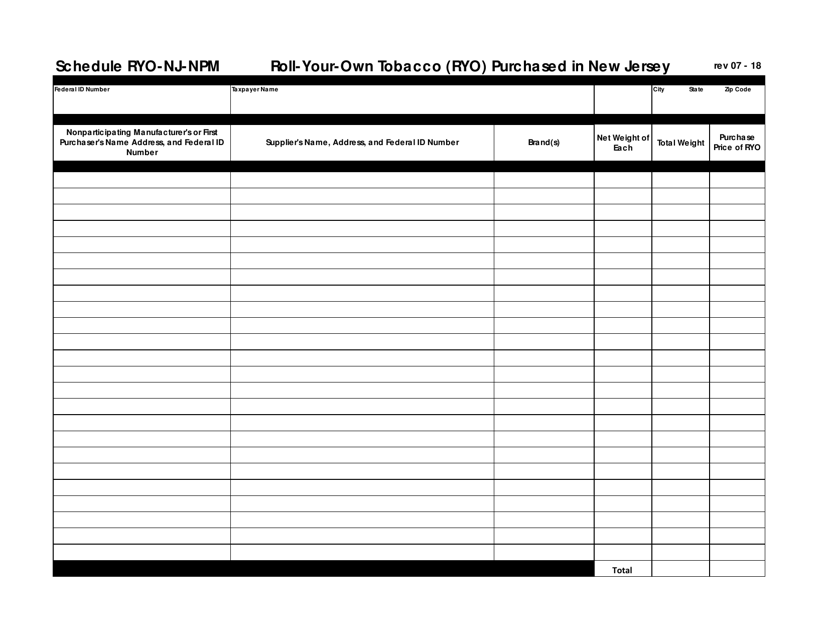

This document is used for reporting the purchase of roll-your-own tobacco (RYO) from a non-participating manufacturer (NPM) in New Jersey. It is specific to businesses in New Jersey that deal with RYO tobacco products.

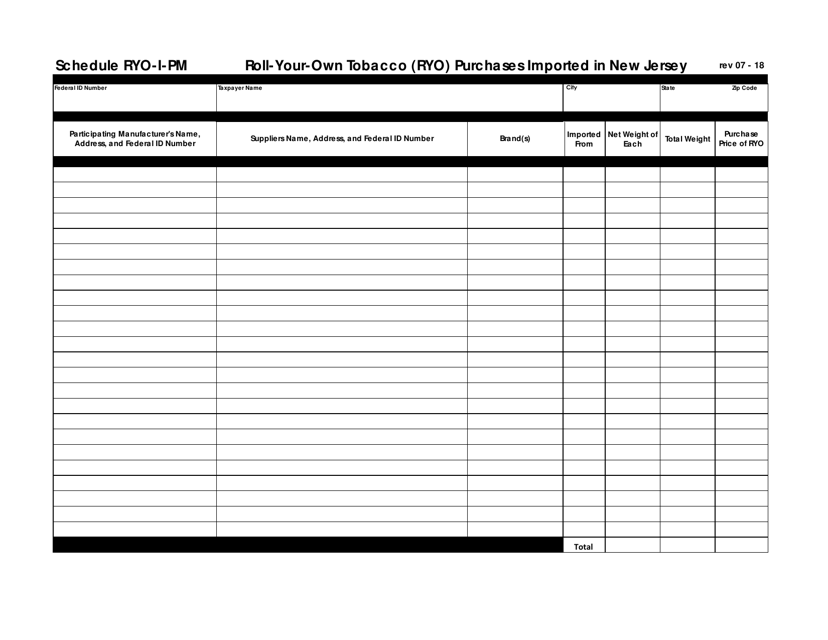

This document is used for reporting imported roll-your-own tobacco purchases in New Jersey.

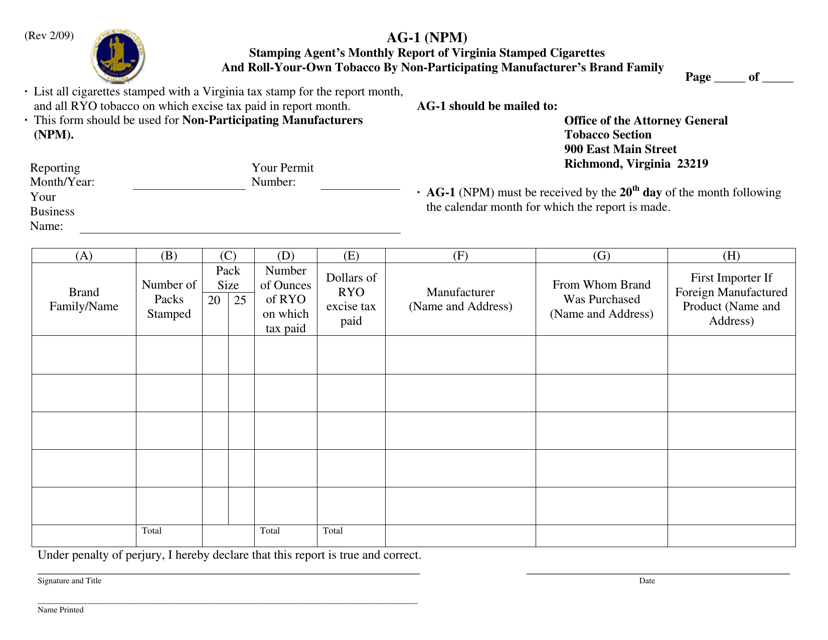

This form is used for stamping agents in Virginia to report on the monthly sales of stamped cigarettes and roll-your-own tobacco by non-participating manufacturer's brand family.

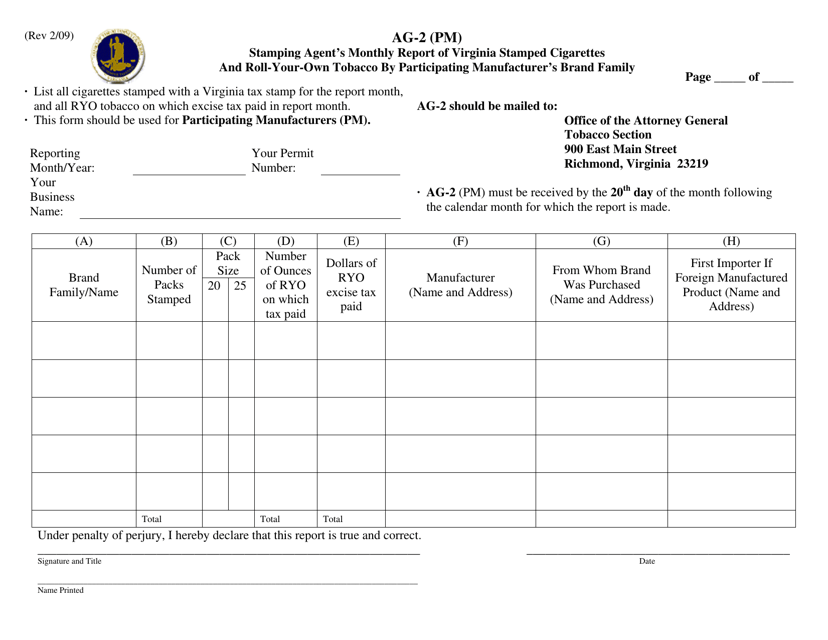

This form is used for reporting the monthly stamping activity of cigarettes and roll-your-own tobacco by participating manufacturer's brand family in the state of Virginia.