Exempt From Income Tax Templates

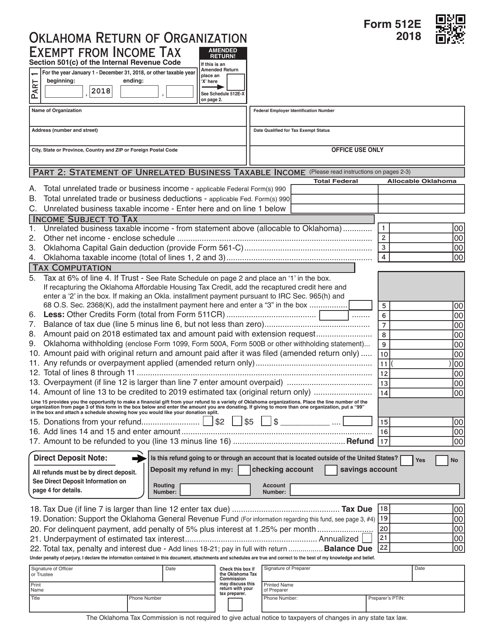

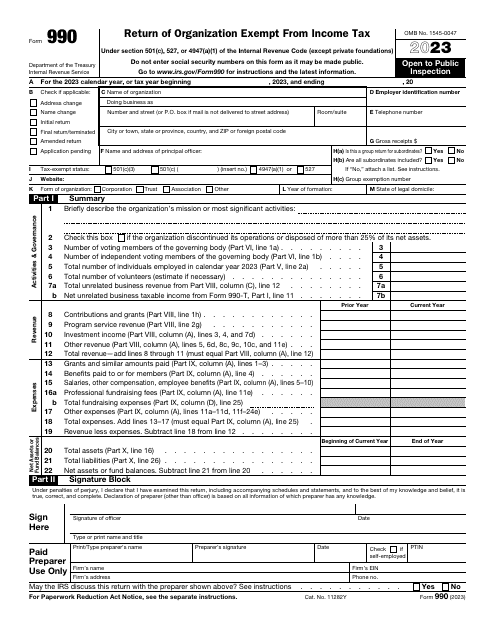

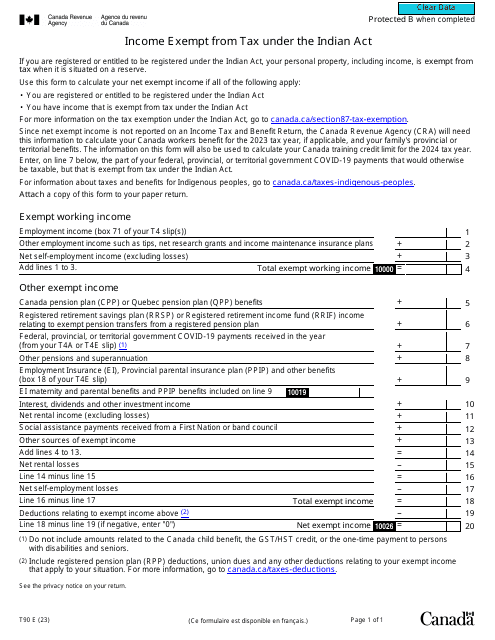

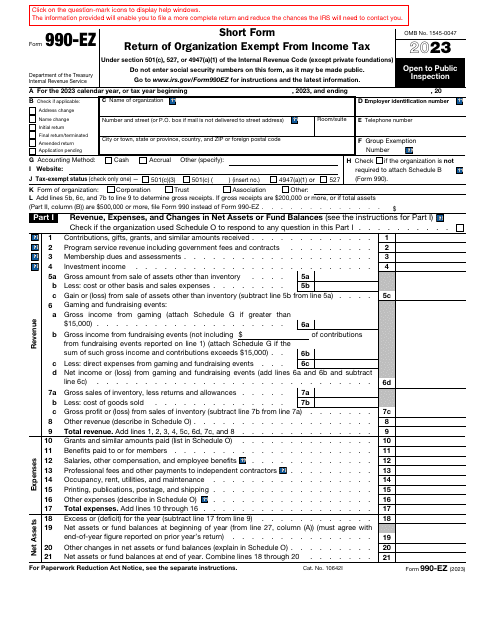

Are you looking for information on organizations that are exempt from income tax? Look no further! We have compiled a collection of documents that highlight these tax-exempt organizations. These documents provide valuable information, guidelines, and regulations for organizations seeking tax exemption. Whether you're a non-profit organization or a charitable institution, these documents serve as essential resources for understanding the criteria and requirements to qualify for tax exemption. Discover the various forms and filings necessary to maintain your organization's tax-exempt status. Stay informed about the latest updates and updates in tax laws and regulations. Explore our comprehensive collection of documents on organizations exempt from income tax, also known as income exempt from tax. Start your journey towards tax exemption today!

Documents:

6

This form is used to supply the Internal Revenue Service (IRS) with information regarding receipts, gross income, disbursements, and other data used by tax-exempt organizations to summarize their work during the tax year.

This is a fiscal form used by tax-exempt organizations required to inform tax organizations about their earnings, expenses, and achievements over the course of the year.