Schedule Tc Templates

Welcome to our webpage on Schedule TC, also known as tc schedule. This document group consists of various documents related to tax credits and corporate income tax credits in certain states.

These documents provide instructions and forms for individuals and businesses to claim tax credits on their tax returns. They outline the eligibility criteria, the steps to complete the forms, and the supporting documentation required.

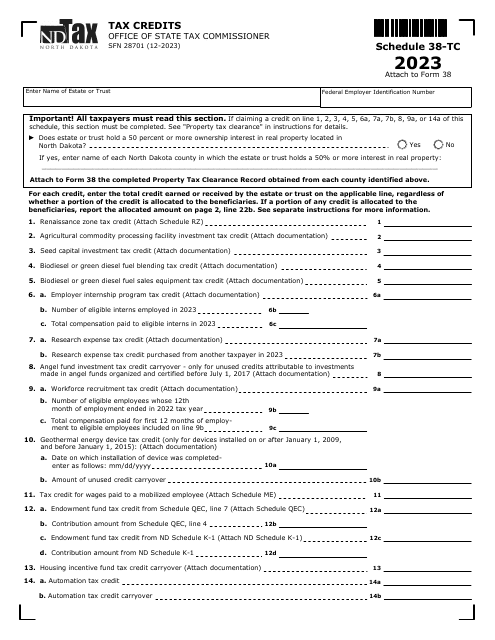

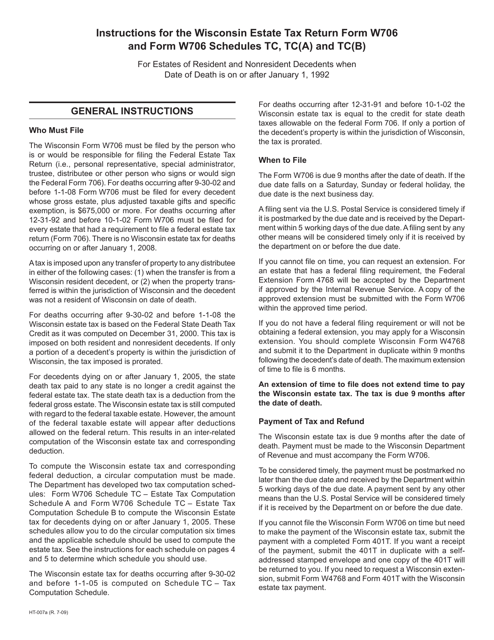

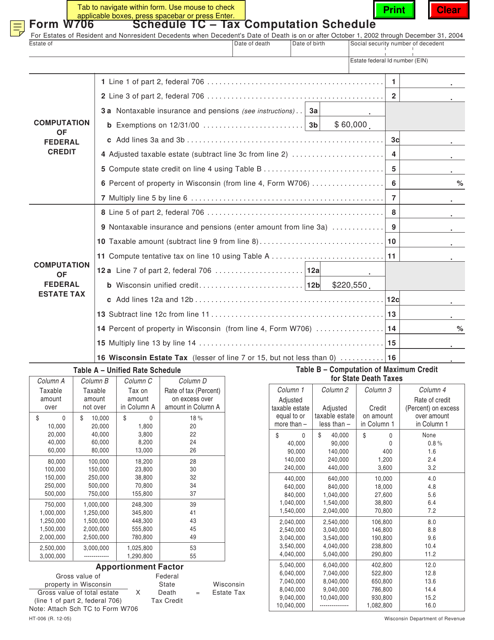

Some example documents in this group include Form SFN28701 Schedule 38-TC Tax Credits - North Dakota, Instructions for Form W706 Schedule TC, TC(A), TC(B) - Wisconsin, and Instructions for Form 40, SFN28740 Schedule TC Corporate Income Tax Credits - North Dakota.

Whether you are an individual seeking personal tax credits or a business looking to claim corporate income tax credits, these documents will provide you with the necessary information and guidance.

Please note that the specific documents and procedures may vary depending on the state and the type of tax credits you are claiming. It is important to carefully review the instructions and consult with a tax professional if needed.

Browse through our comprehensive collection of Schedule TC documents to find the information you need to maximize your tax credits and minimize your tax liabilities.

Documents:

10

This form is used for providing instructions for completing Schedule TC, TC(A), and TC(B) of Form W706 in Wisconsin.

This form is used for tax computation for deaths in Wisconsin occurring between October 1, 2002 and December 31, 2004.

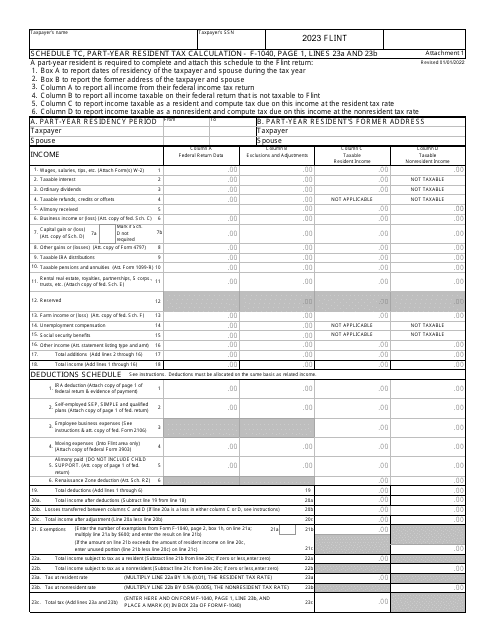

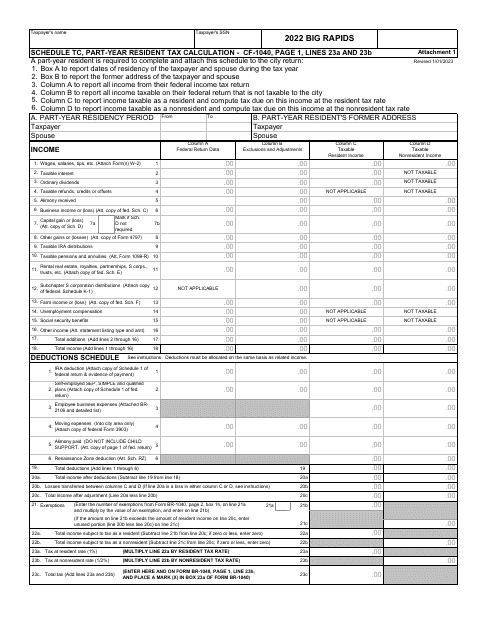

This Form is used for reporting and paying city taxes in Big Rapids, Michigan.