Home Loan Templates

Are you looking to buy your dream home but need financial assistance? Look no further! Our comprehensive collection of documents, also known as home loan documents, is here to guide you through the home loan process. Whether you need information on loan estimates, appraisal reports, loan summaries, or mortgage or deed of trust, we've got you covered.

Our collection of home loan documents is designed to provide you with all the necessary forms and information you need to successfully navigate the home loan application and approval process. We understand that applying for a home loan can be overwhelming, but with our extensive collection of documents, you can feel confident and prepared every step of the way.

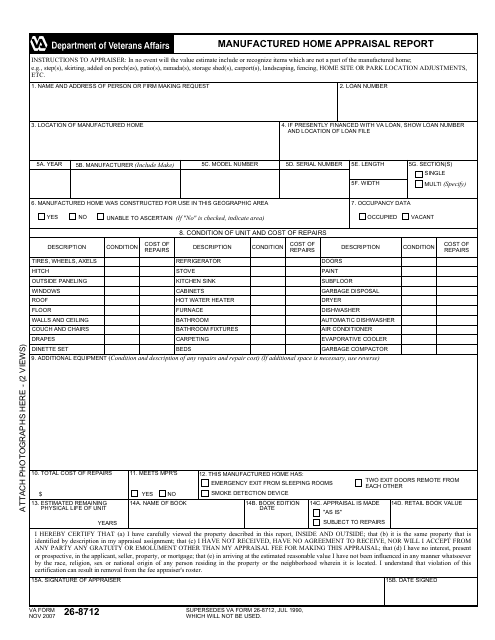

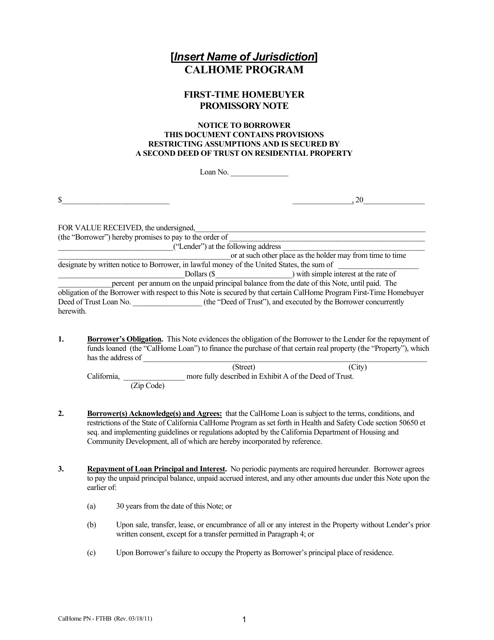

Our home loan documents, also referred to as home loan forms, include everything from the Loan Estimate Form, which gives you an overview of the loan terms and estimated closing costs, to the VA Form 26-8712 Manufactured Home Appraisal Report, specifically designed for veterans wishing to purchase a manufactured home. If you're a first-time homebuyer, our collection also includes the First-Time Homebuyer Promissory Note - Calhome Program - California, which offers special financing options for California residents.

Let our home loan documents be your trusted resource for all your home loan needs. Don't let the home buying process intimidate you - empower yourself with knowledge and ensure a smooth and successful home loan experience. Browse our extensive collection of home loan documents today and get one step closer to owning your dream home.

Documents:

33

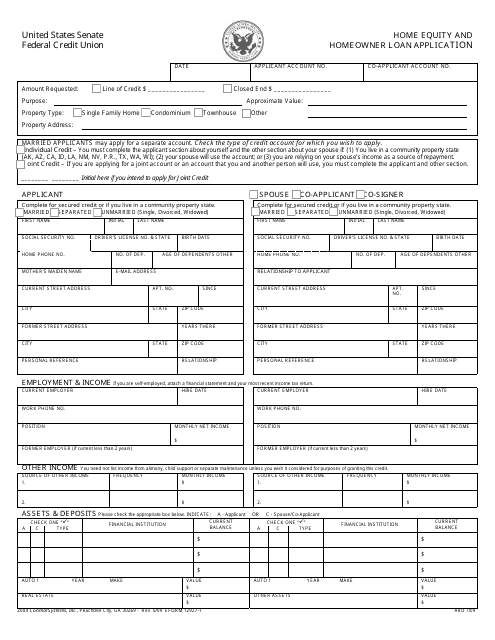

This Form is used for applying for a home equity or homeowner loan.

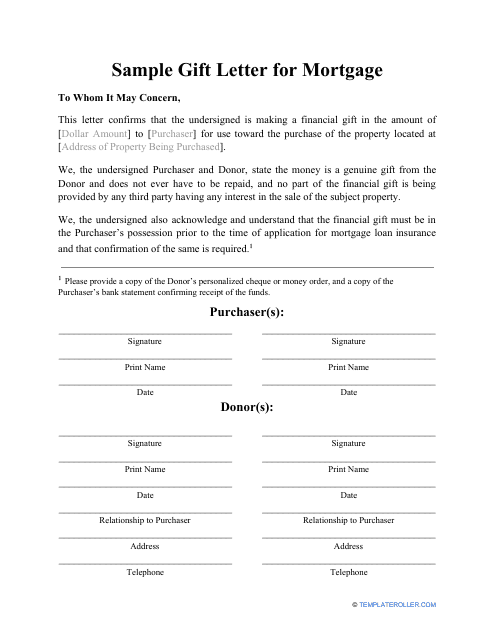

Use this sample letter to confirm that you are making a gift of money to another individual who will use it for a mortgage.

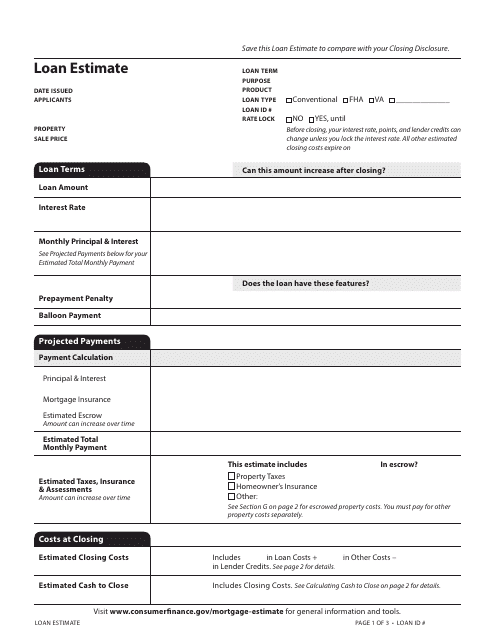

This document is used for providing borrowers with an estimate of the costs and terms associated with a mortgage loan. It includes details on interest rate, closing costs, and monthly payments.

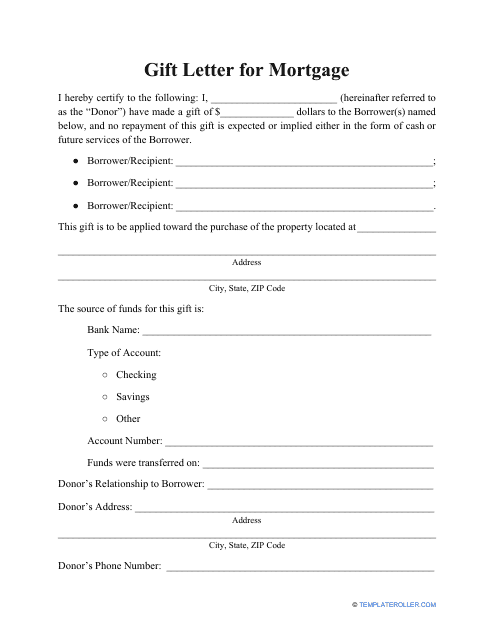

This is a two-page template of a Mortgage Gift Letter. As with other letters of this kind, it notes that no repayment of this gift is expected or implied either in the form of cash or future services of the recipient.

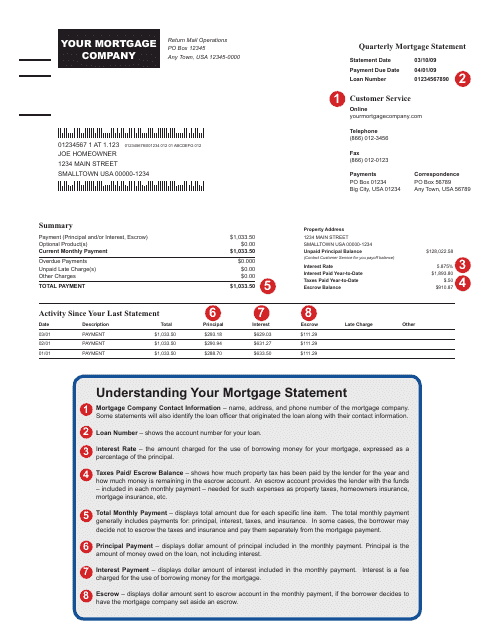

This document provides a summary of your mortgage account activity over a three-month period, including your loan balance, payments made, and any fees or charges applied. It helps you track your mortgage progress and better understand your financial obligations.

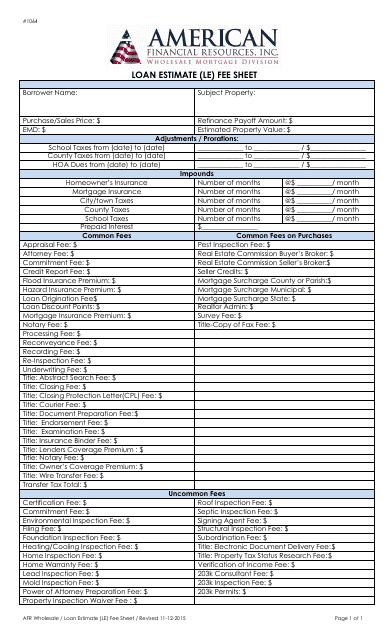

This document provides a breakdown of the fees associated with obtaining a loan from American Financial Resources, Inc.

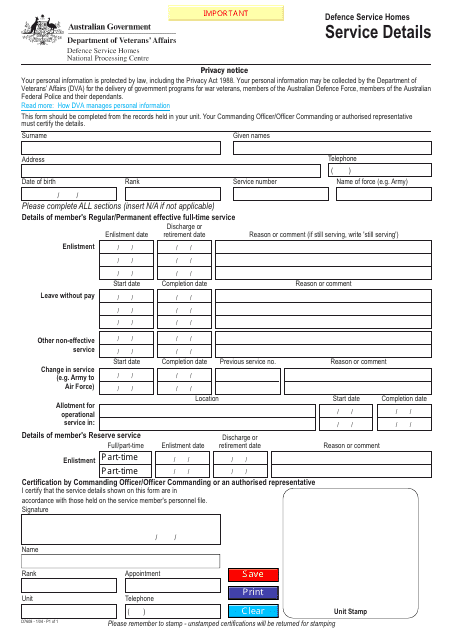

This form is used for providing service details for Defence Service Homes in Australia.

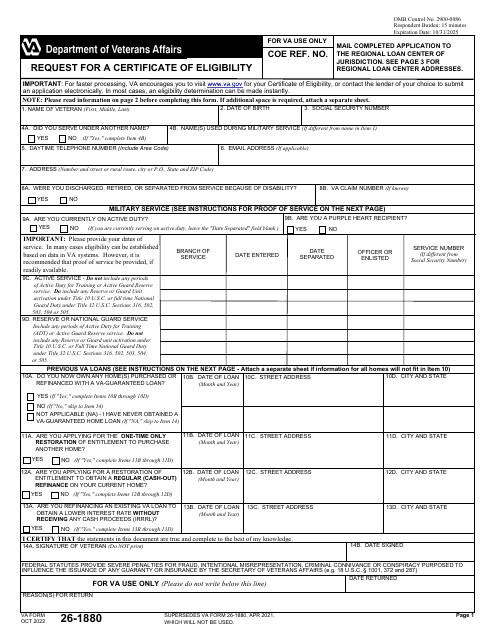

This certificate is used to claim a home loan that is provided by the Department of Veterans Affairs (VA) in case you meet the required criteria and complete the paperwork. The document you will receive is called a Certificate of Eligibility (COE). It is given to the lender to show that you are eligible for the VA home loan.

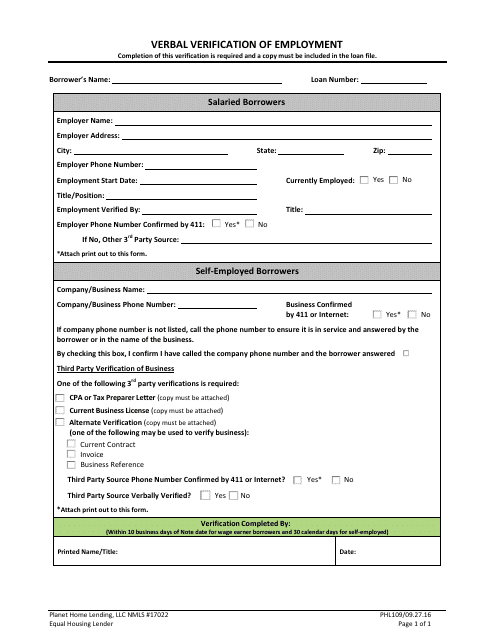

This Form is used for verifying employment information of Planet Home Lending applicants verbally.

This form is used for completing an appraisal report for a manufactured home. It helps evaluate the value and condition of the home.

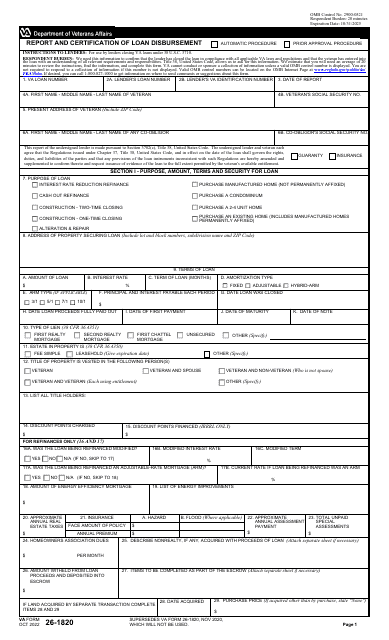

This document is prepared and signed by a lender and a veteran servicemember to confirm that a loan requested by the veteran is closed and that the veteran is now responsible for making loan payments.

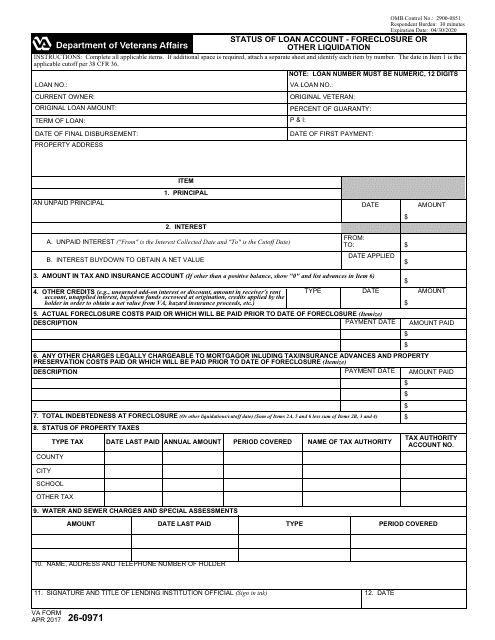

This document is used to determine the status of a loan account, specifically in relation to foreclosure or other forms of liquidation.

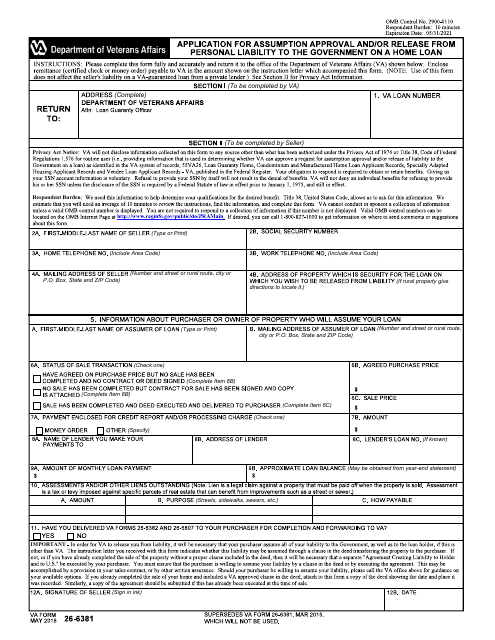

This Form is used for applying for approval and/or release from personal liability to the government on a home loan.

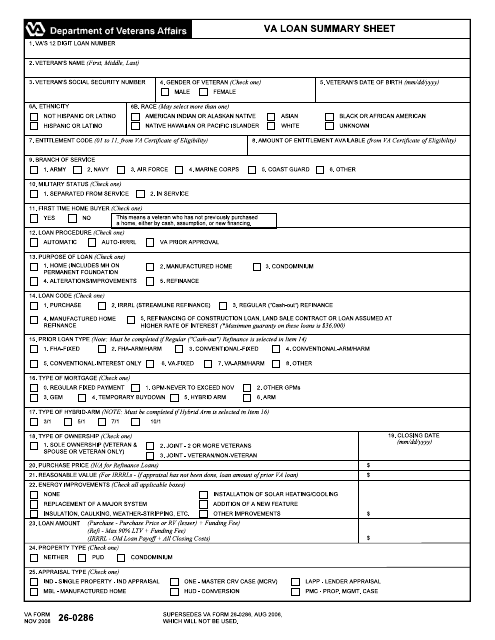

This document provides a summary of information related to a VA loan. It is used to summarize important details of a VA loan application.

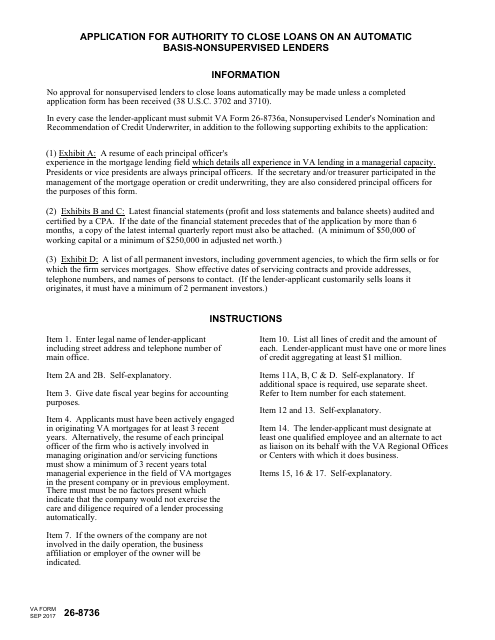

This Form is used for non-supervised lenders to apply for authority to close loans on an automatic basis.

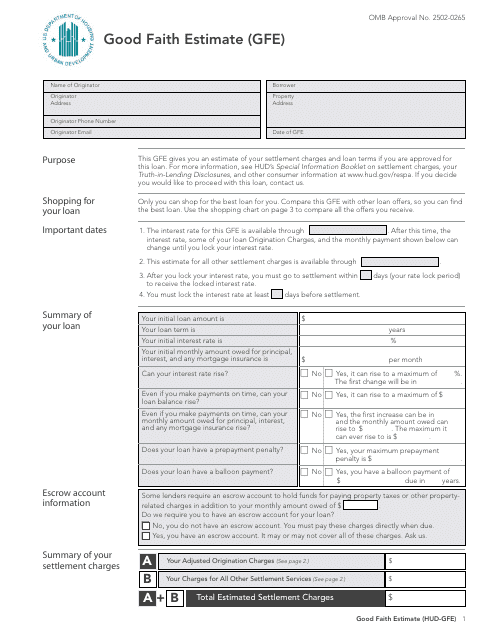

This type of document, known as a Good Faith Estimate (GFE), is used to outline the estimated costs and fees associated with obtaining a mortgage loan. It provides transparency for borrowers and helps them to compare loan offers from different lenders.

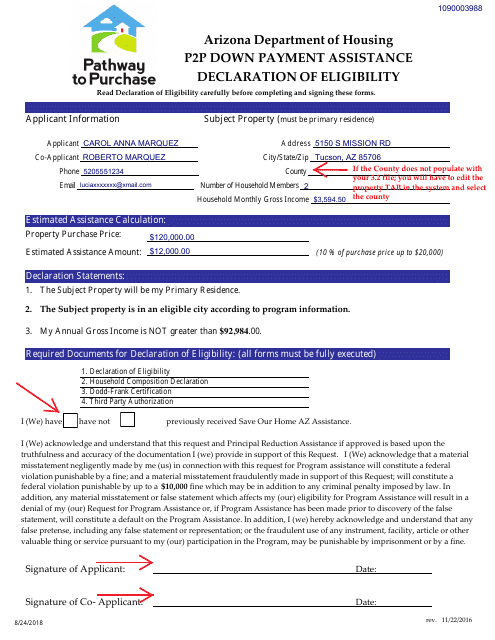

This document is for individuals in Arizona who are applying for down payment assistance through the P2p program. It is used to declare their eligibility for the program.

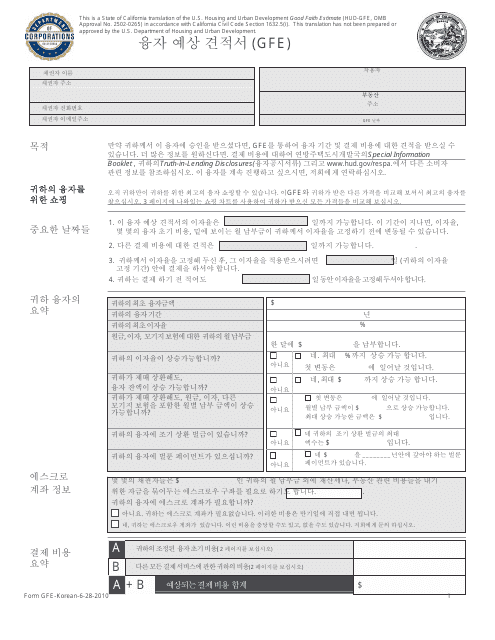

This type of document is used for providing an estimate of the closing costs for a mortgage loan in California. The form is available in Korean.

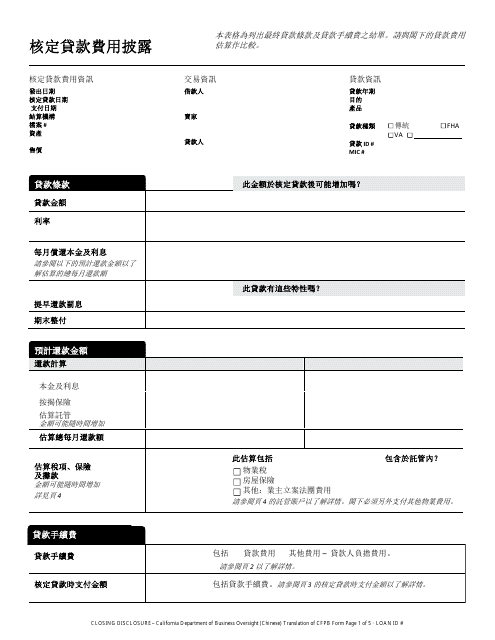

This document is used for providing closing details in a real estate transaction in California. It is available in Chinese language for convenience.

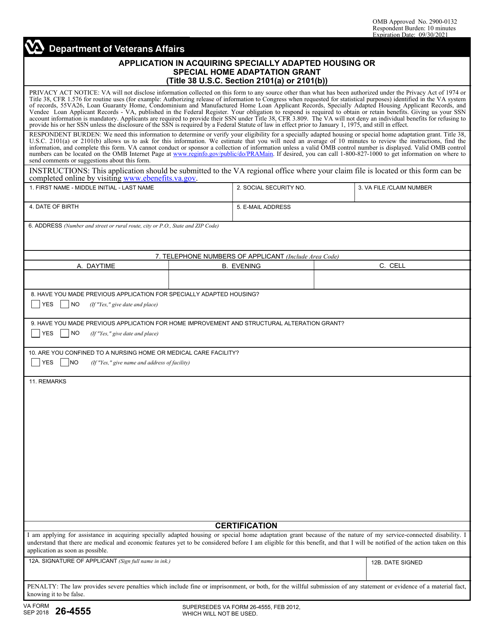

This Form is used for applying for a specially adapted housing or special home adaptation grant through the Department of Veterans Affairs. It is for veterans who meet the criteria outlined in Title 38 U.S.C. Section 2101(A) or 2101(B).

This type of document is used to secure a loan for a property. It gives the lender the right to take ownership of the property if the borrower fails to repay the loan.

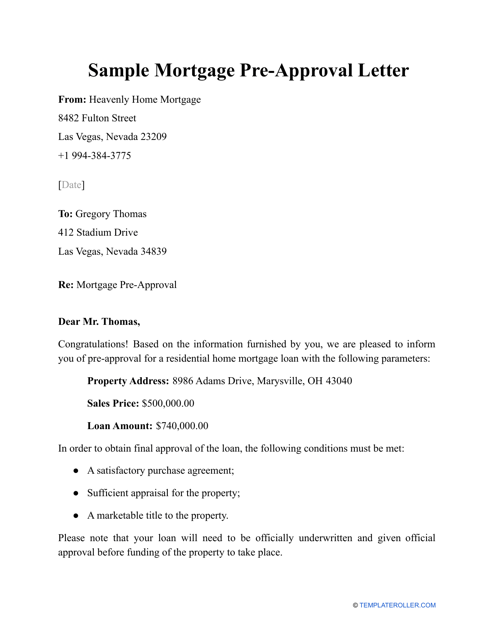

This letter is sent to the borrower after their mortgage application is accepted.

This formal letter can be used to confirm the willingness of a lender to sign a mortgage agreement with a borrower.

This document describes the changes in the Canadian mortgage market and its impact.

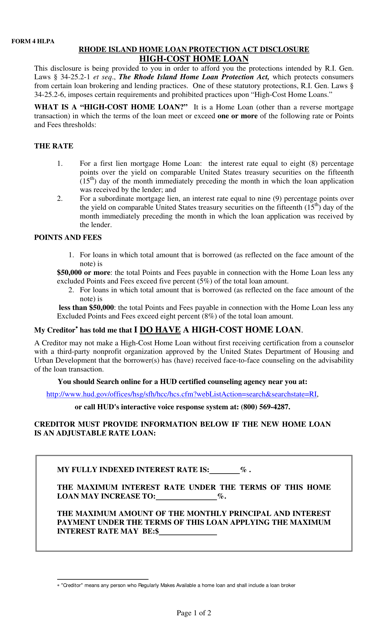

This form is used for disclosing information related to high-cost home loans in Rhode Island under the Rhode Island Home Loan Protection Act. It provides important details about the loan terms and costs.

This letter can be used as a reference to show that a customer has maintained a good credit history and has saved the necessary funds that will later help them qualify for a mortgage loan.

This is a written statement composed by a lender and sent to a borrower to notify the latter their mortgage application has been evaluated and approved subject to certain conditions the borrower must adhere to.

This document is for first-time homebuyers participating in the CalHome Program in California. It is a promissory note that outlines the terms of the loan, repayment schedule, and other details related to the home purchase.

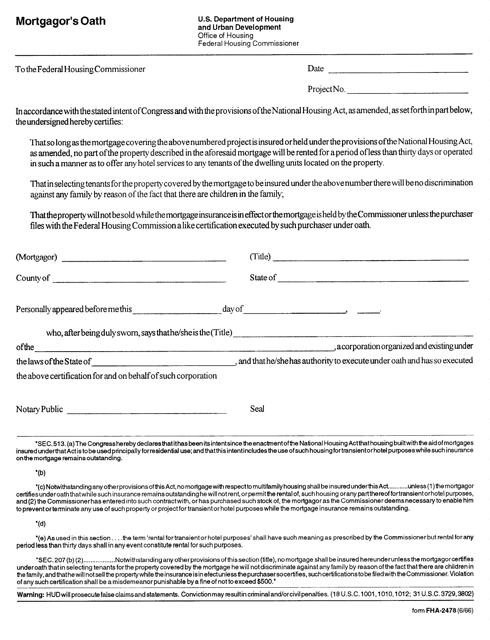

This form is used for the mortgagor to take an oath in a Federal Housing Administration (FHA) mortgage.

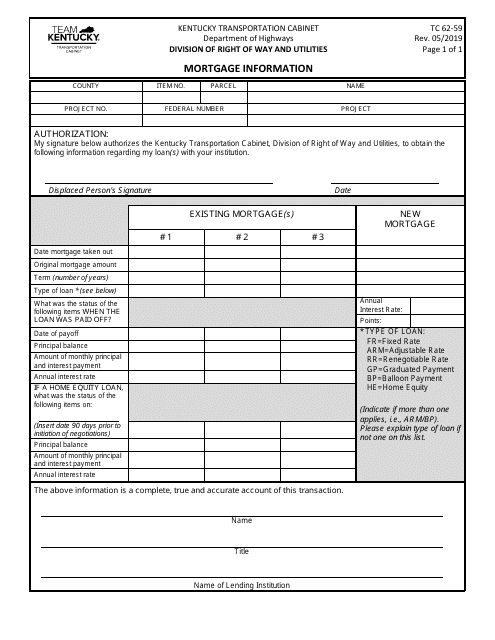

This document collects and provides important information about a mortgage in the state of Kentucky. It contains details regarding the mortgage agreement and terms.

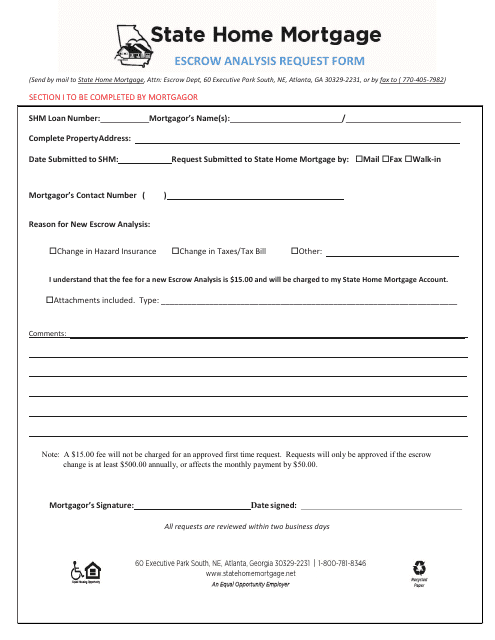

This Form is used for requesting an analysis of escrow payments for homeowners with a State Home Mortgage in the state of Georgia.