Tax Payment Plan Templates

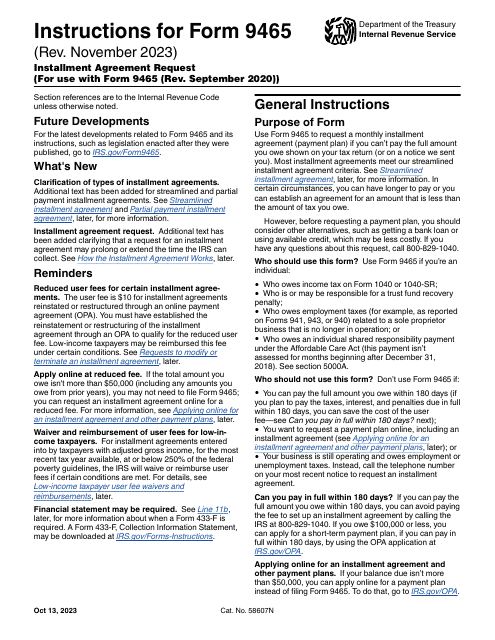

Are you struggling to pay your taxes on time? Don't worry, we have the solution for you – the tax payment plan. This flexible plan allows taxpayers to make monthly installments towards their tax obligations, providing much-needed relief from the burden of a lump sum payment.

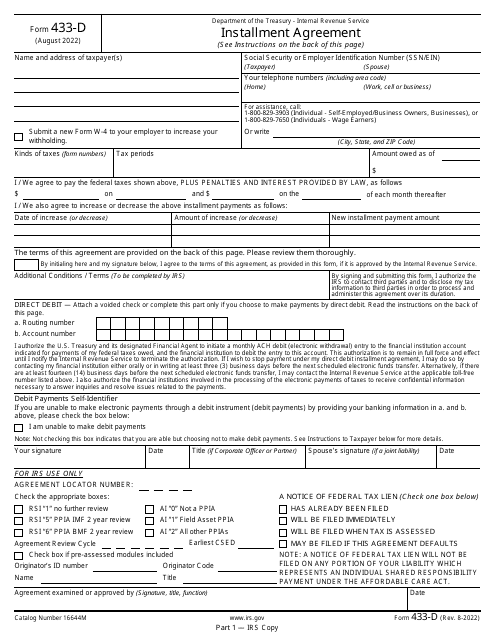

Whether you owe taxes to the Internal Revenue Service (IRS) or state tax authorities, the tax payment plan can help you manage your financial situation more effectively. By spreading out your payments over an extended period, you can avoid the stress of accumulating interest and penalties that can accompany late payments.

With the tax payment plan, you no longer need to worry about facing financial difficulties due to your tax obligations. This plan offers a lifeline to individuals and businesses alike, ensuring that you can fulfill your tax responsibilities in a manageable and sustainable way.

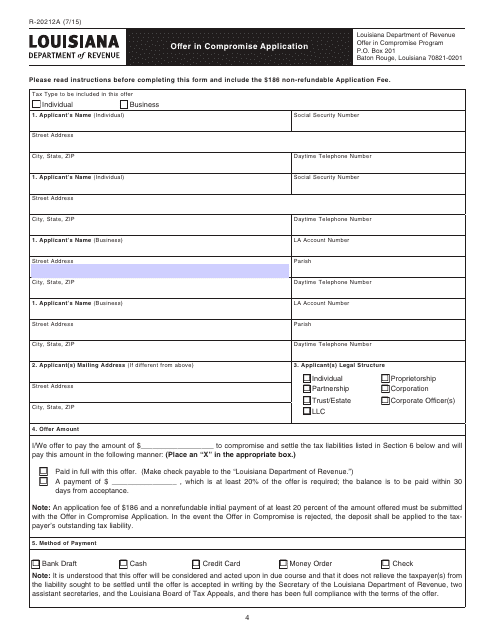

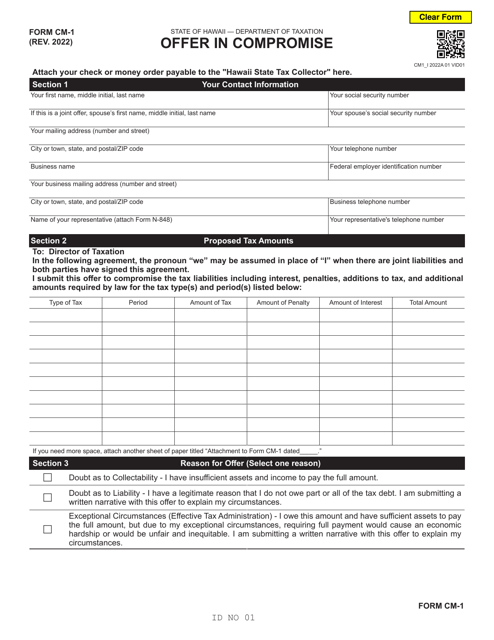

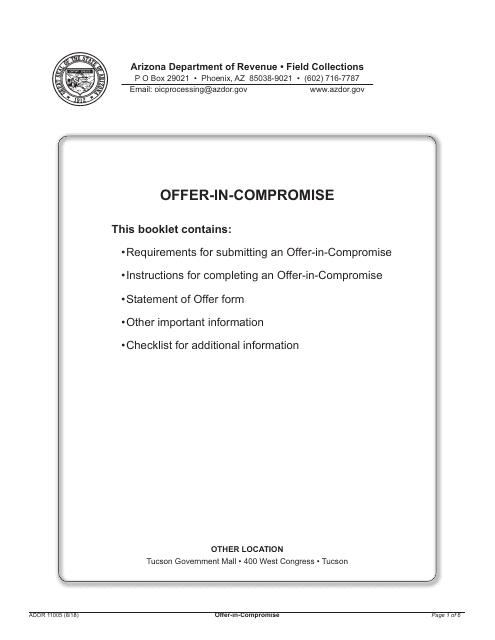

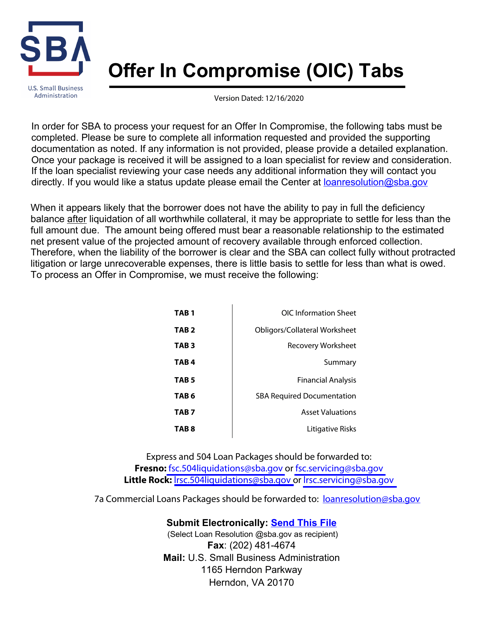

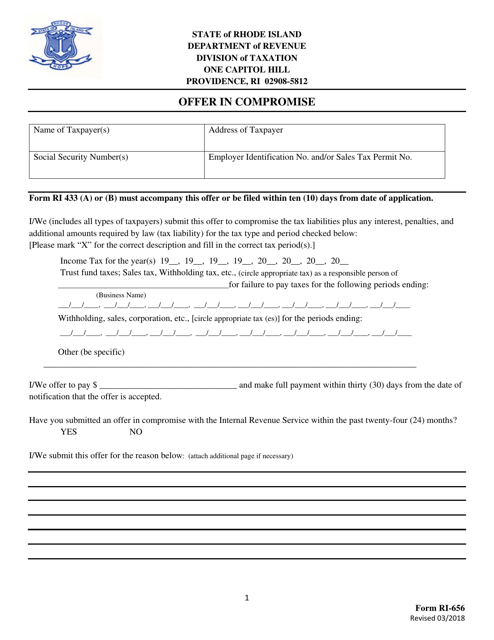

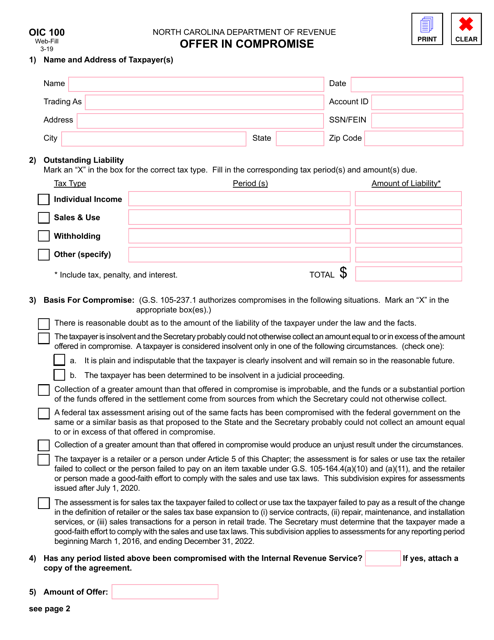

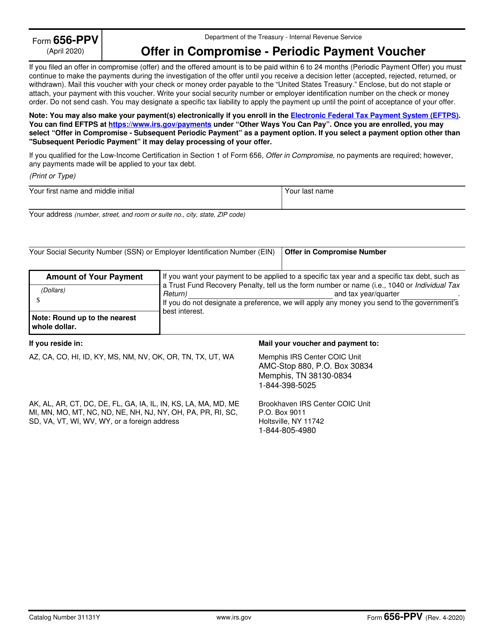

To apply for the tax payment plan, you can submit the appropriate form specific to your state or federal jurisdiction. Some common examples include the Offer in Compromise Application (Form R-20212A) for Louisiana, the Offer-In-Compromise (Form ADOR11005) for Arizona, the Offer in Compromise Application (Form CDTFA-490-C) for California, the Offer in Compromise (Form RI-656) for Rhode Island, or the IRS Form 656-PPV for Periodic Payment Vouchers.

Don't let your tax obligations overwhelm you. Take advantage of the tax payment plan and ease your financial burden today. Apply now and experience the peace of mind that comes from knowing that your taxes are being paid off in a manageable and structured way.

(Note: Mention the alternate names in different context if they are generic or doesn't fit in the paragraph above.)

Documents:

19

This Form is used for filing an Offer in Compromise Application in the state of Louisiana.

This form is used for submitting an offer-in-compromise to the Arizona Department of Revenue. It allows taxpayers to propose a settlement for their outstanding tax liabilities with the state of Arizona.

This form is used for submitting an offer in compromise application to the California Department of Tax and Fee Administration.

This form is used for making an offer in compromise to the state of Rhode Island to settle a tax debt.

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.

This document is used for submitting an Offer in Compromise to the state of North Carolina. It is a request to settle a tax liability for less than the full amount owed.

This is a fiscal form used by a taxpayer to express their intention to pay off their tax debt via a direct debit payment.

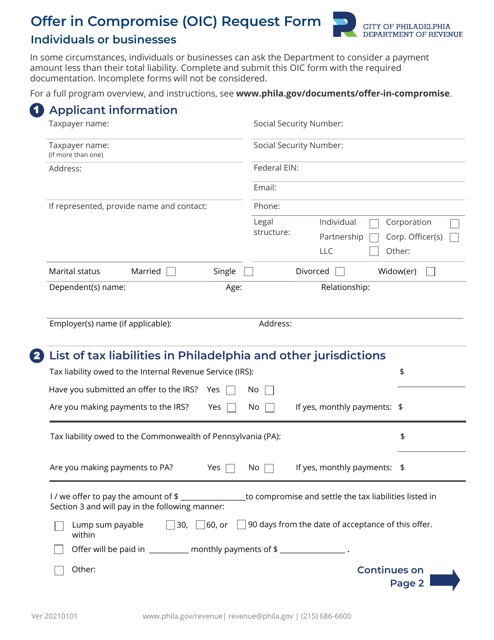

This form is used for requesting an Offer in Compromise (OIC) from the City of Philadelphia, Pennsylvania. An OIC is a way for taxpayers to settle their tax debt for less than the full amount owed.

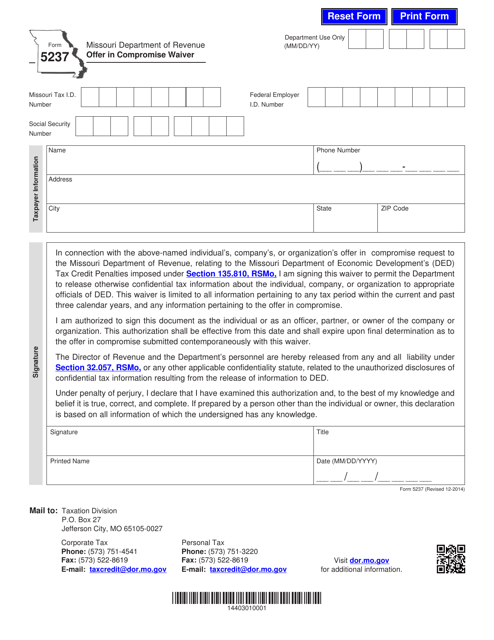

This form is used for applying for an offer in compromise waiver in the state of Missouri.

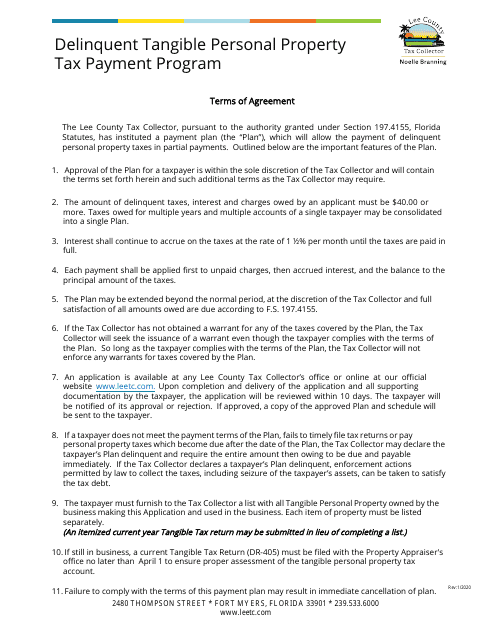

This document is for applying for a payment plan to pay delinquent tangible personal property taxes in Lee County, Florida.

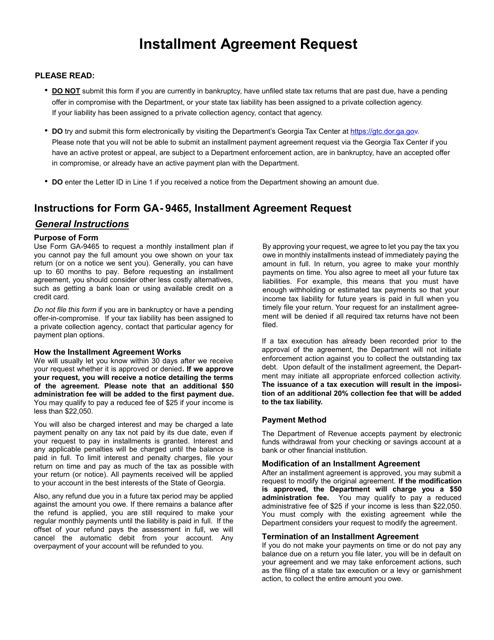

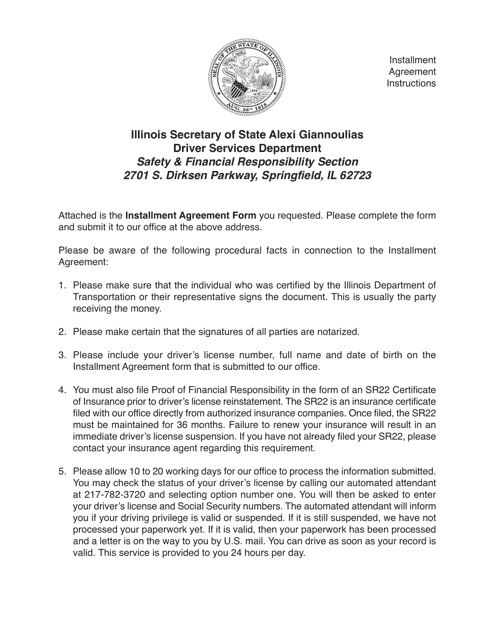

This form is used for applying for an installment agreement in the state of Illinois. It allows taxpayers to make smaller, more manageable payments over time for their tax liabilities.