Beverage Tax Templates

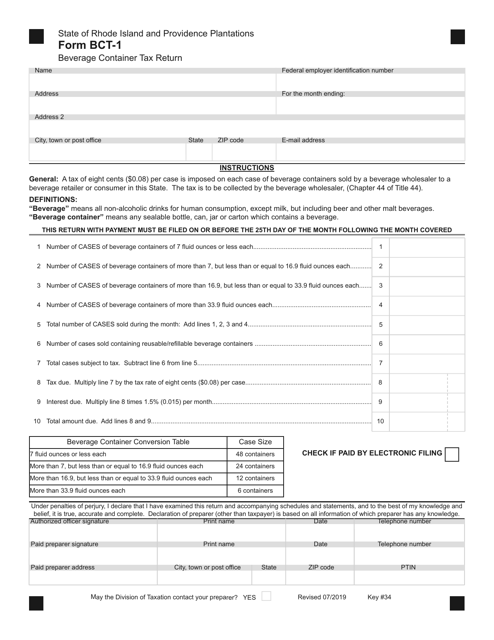

Are you a business that deals with the production, distribution, or sale of beverages? Stay informed and compliant with the latest regulations and requirements imposed by the beverage tax. Our extensive collection of documents, also known as the beverage tax library, provides comprehensive resources to help you navigate the complexities of this tax.

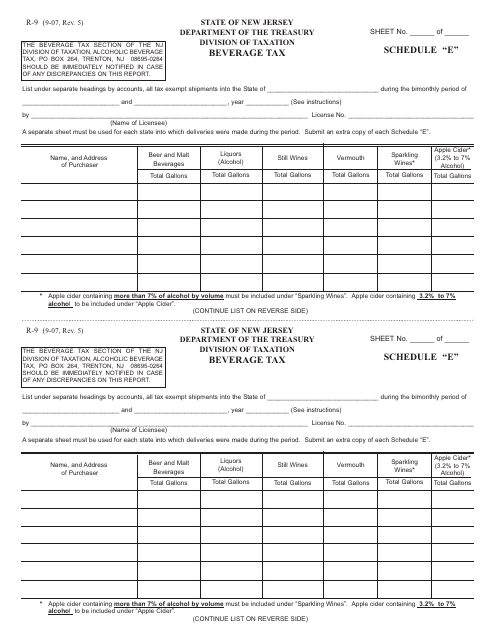

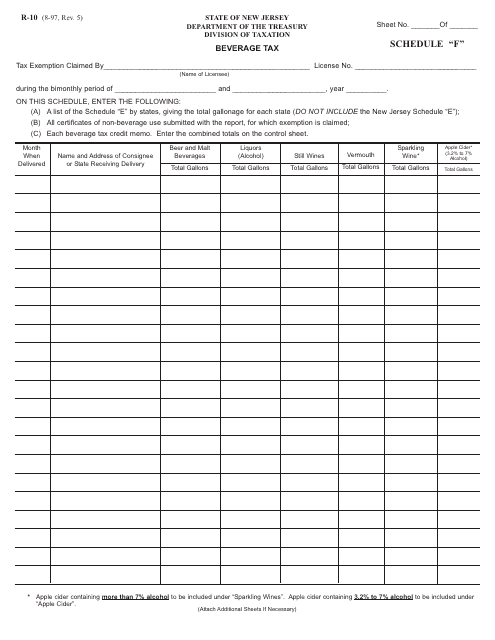

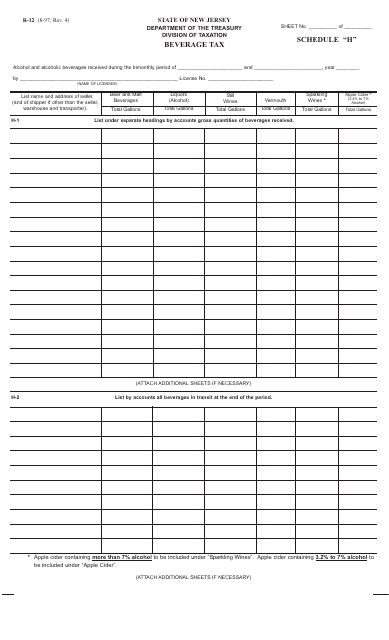

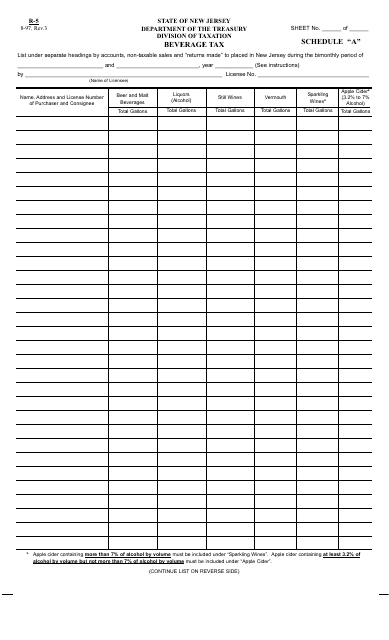

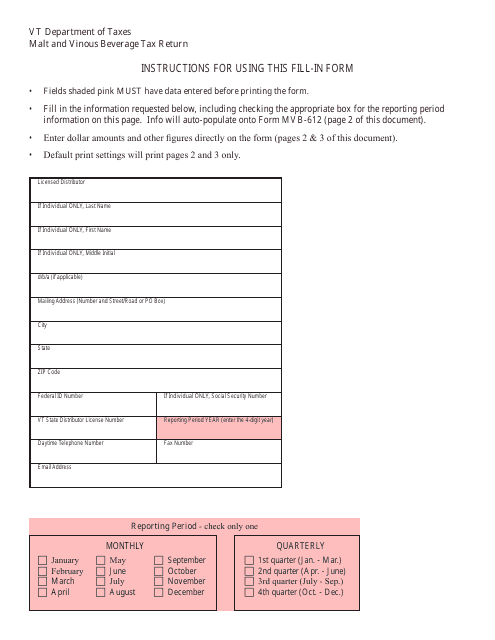

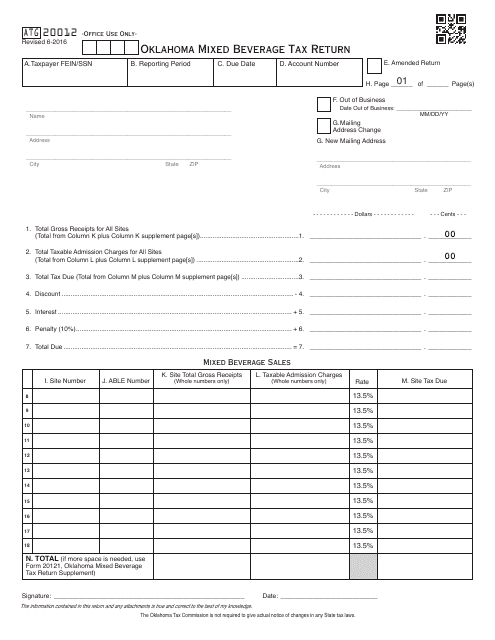

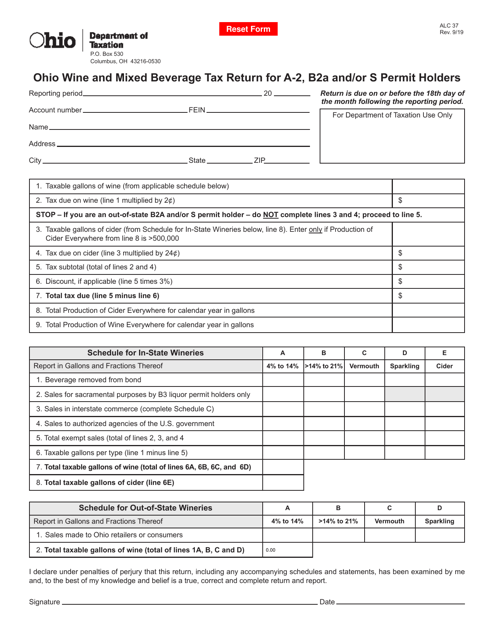

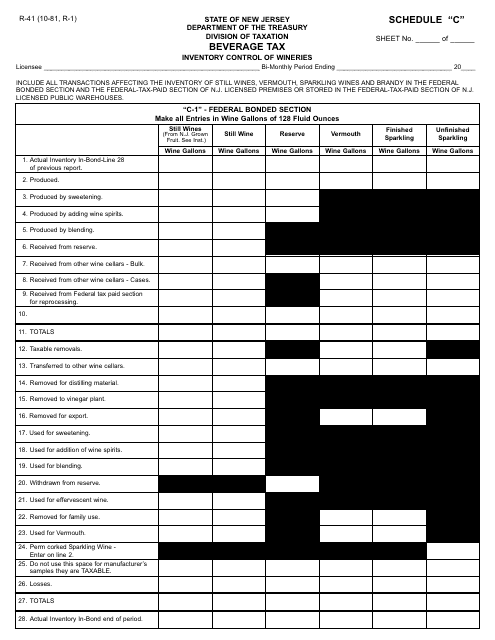

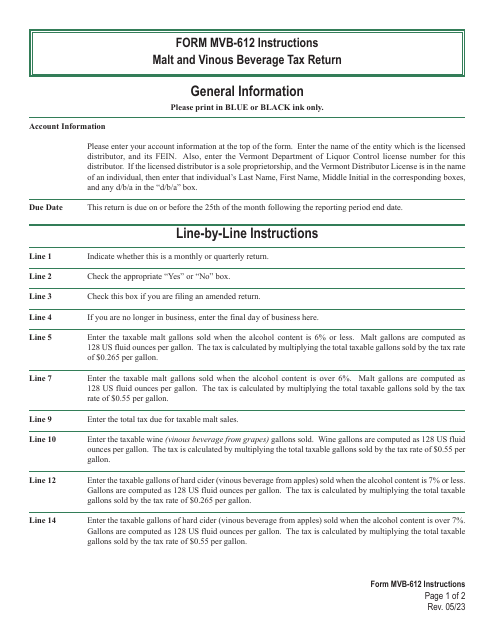

Ensure accuracy in your reporting and filing by accessing documents such as the Form R-9 Schedule E Beverage Tax in New Jersey, the OTC Form ATG20012 Oklahoma Mixed Beverage Tax Return in Oklahoma, and the Form R-23 Public Warehouse Report - Beverage Tax in New Jersey. These documents, along with others in our collection like the Form R-41 Schedule C Inventory Control of Wineries - Beverage Tax and the Form MVB-612 Malt and Vinous Beverage Tax Return in Vermont, are designed to assist you in fulfilling your tax obligations.

Stay up to date with changes in beverage tax laws, maintain compliance, and avoid penalties by utilizing our beverage tax resources. With our user-friendly platform, you can easily access the documents you need, ensuring that your business remains in good standing with regulatory authorities.

Documents:

26

This form is used for reporting and paying beverage tax in the state of New Jersey.

This form is used for reporting beverage taxes in New Jersey

This form is used for reporting and paying beverage taxes in the state of New Jersey.

This form is used for reporting and paying beverage tax in the state of New Jersey. The form includes a schedule for calculating and reporting the tax owed based on the type and quantity of beverages sold.

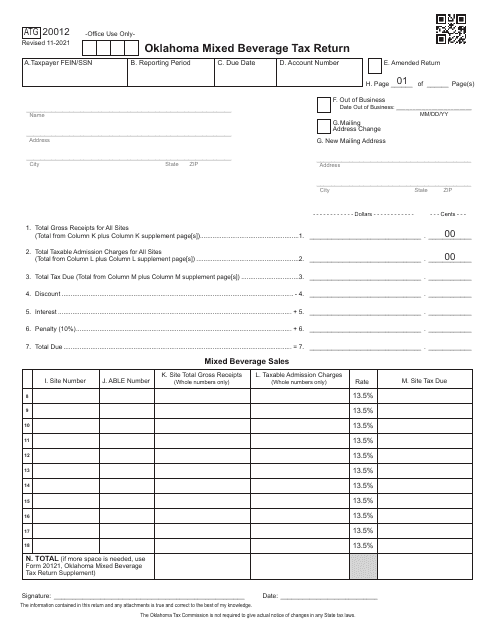

This form is used for filing Mixed Beverage Tax Return in Oklahoma.

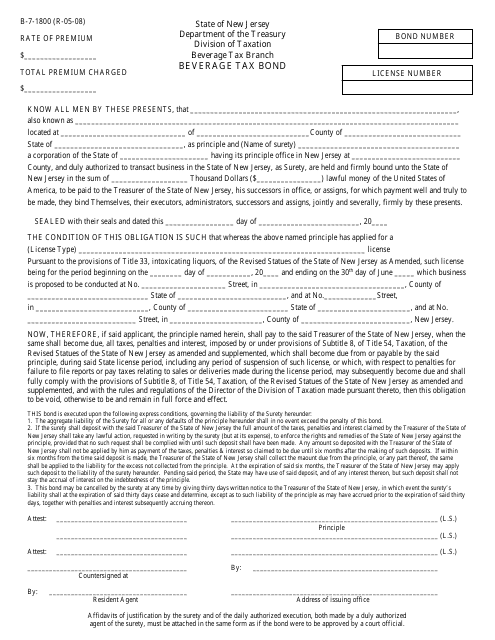

This form is used for obtaining a beverage tax bond in the state of New Jersey. The bond is required for businesses that sell or distribute beverages and ensures compliance with tax obligations.

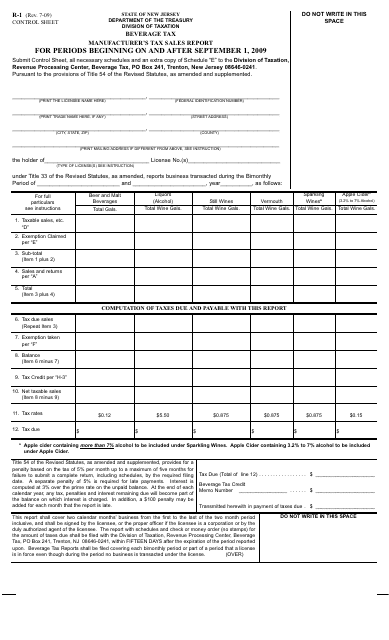

This form is used for reporting the sales of beverages and calculating the manufacturer's tax in New Jersey for periods beginning on or after September 2009.

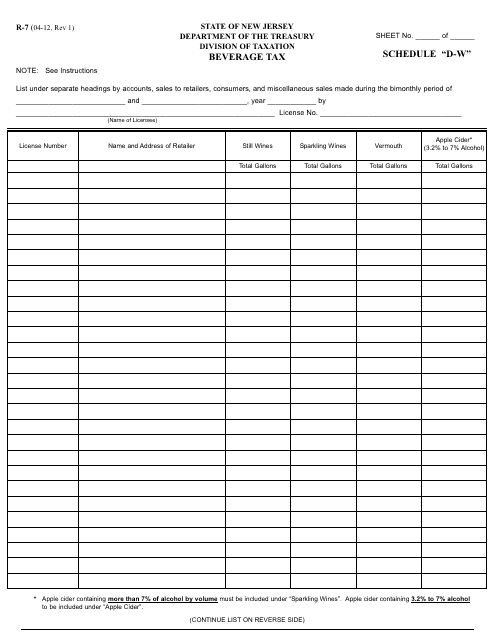

This form is used for reporting and paying beverage tax in New Jersey. It is specifically for Schedule D-W, which applies to wholesalers.

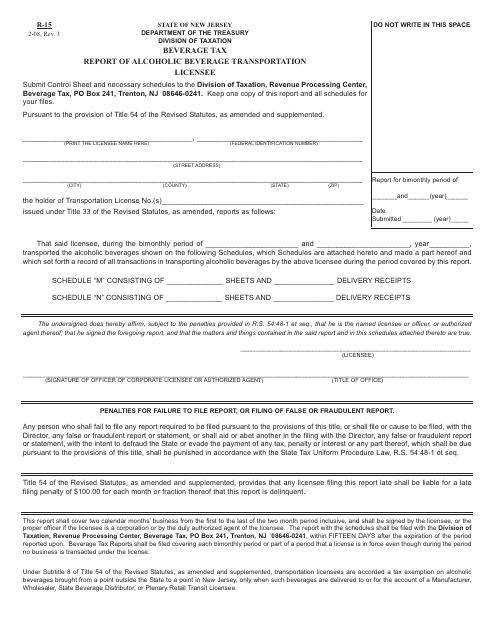

This form is used for reporting the transportation of alcoholic beverages by licensees in New Jersey, and the payment of applicable beverage taxes.

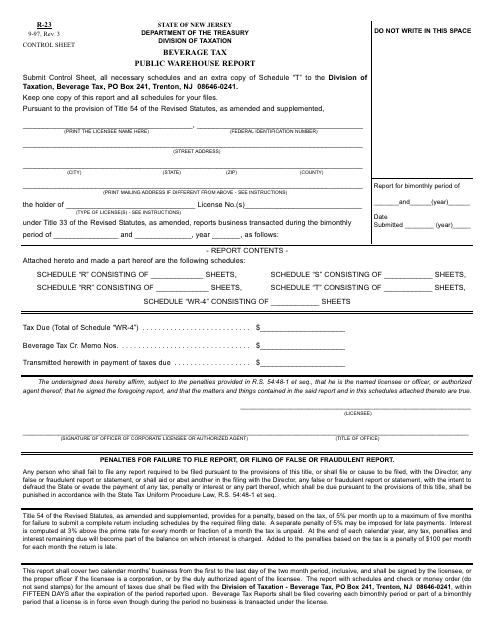

This form is used for filing a public warehouse report for beverage tax in New Jersey.

This form is used for inventory control of wineries in New Jersey for the purpose of beverage tax.

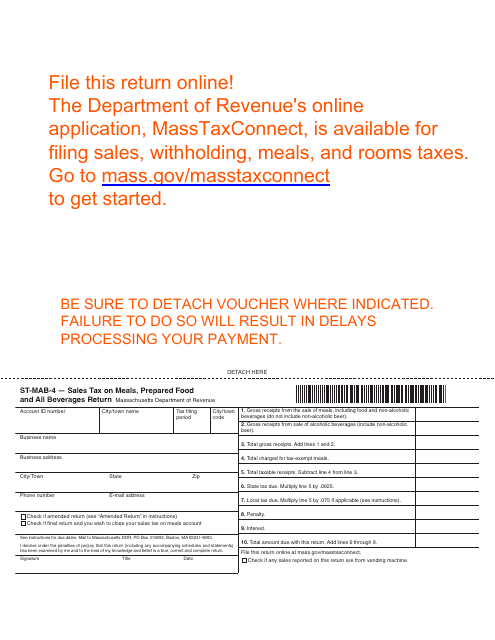

This Form is used for reporting and paying sales tax on meals, prepared food, and all beverages in Massachusetts.

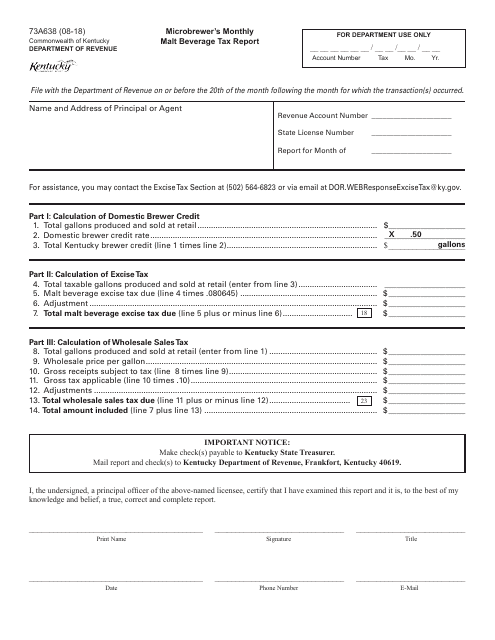

This document is used for reporting monthly malt beverage tax for microbrewers in Kentucky.

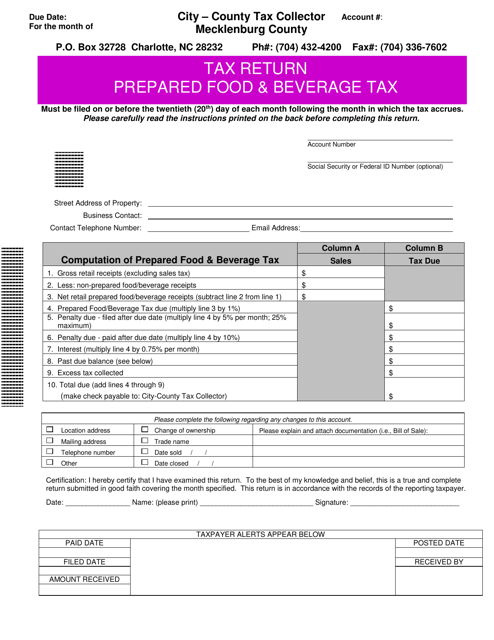

This document is used for reporting and paying the prepared food and beverage tax in Mecklenburg County, North Carolina. It is required for businesses that serve or sell prepared food and beverages in the county.

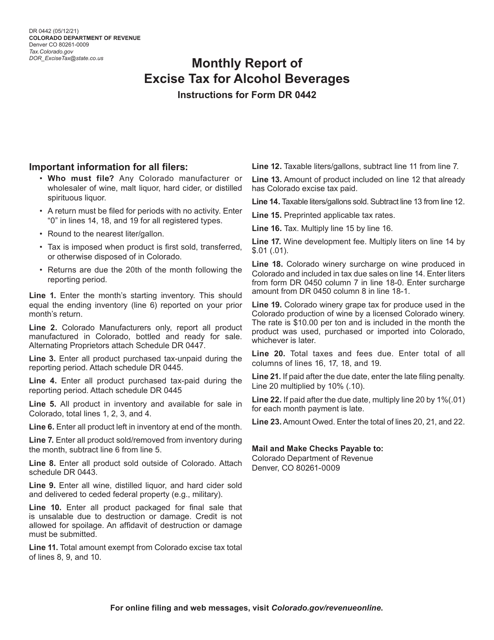

This form is used for reporting monthly excise tax on alcohol beverages in Colorado. It helps the state government track and collect taxes from alcohol sales.

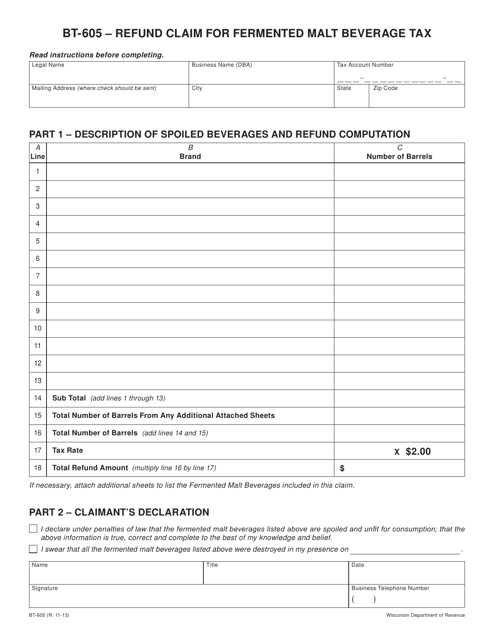

This form is used for claiming a refund for the fermented malt beverage tax in Wisconsin. It is for individuals or businesses who have paid this tax and are eligible for a refund.

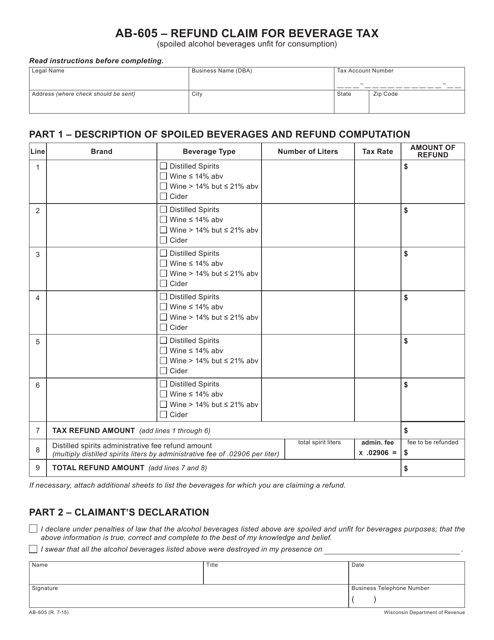

This form is used for claiming a refund of beverage tax in the state of Wisconsin.

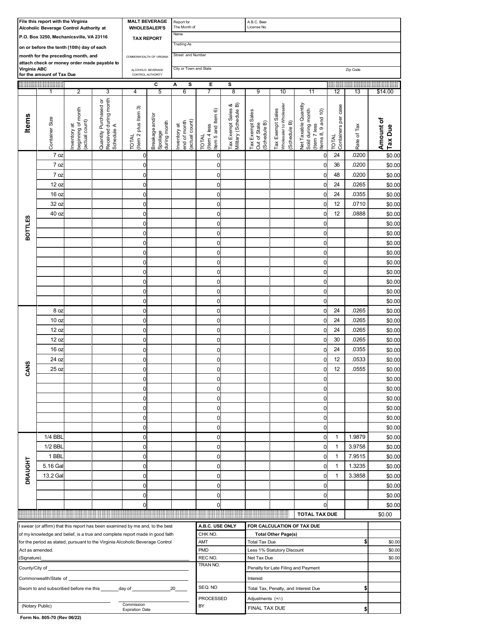

This form is used for reporting and paying the wholesale tax on malt beverages by wholesalers in Virginia.

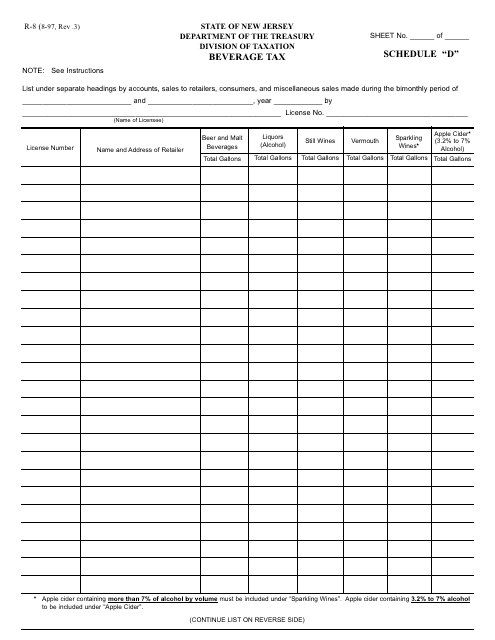

This form is used for reporting and paying beverage tax in the state of New Jersey. It is a schedule D form that is part of the R-8 form series.