Loan Guarantee Templates

Are you looking for financial assistance to start or expand your business? Look no further than our comprehensive collection of loan guarantee documents. A loan guarantee is a promise by a guarantor to assume responsibility for the repayment of a loan if the borrower defaults. This gives lenders an added layer of security, which in turn allows them to offer more favorable terms and conditions to borrowers.

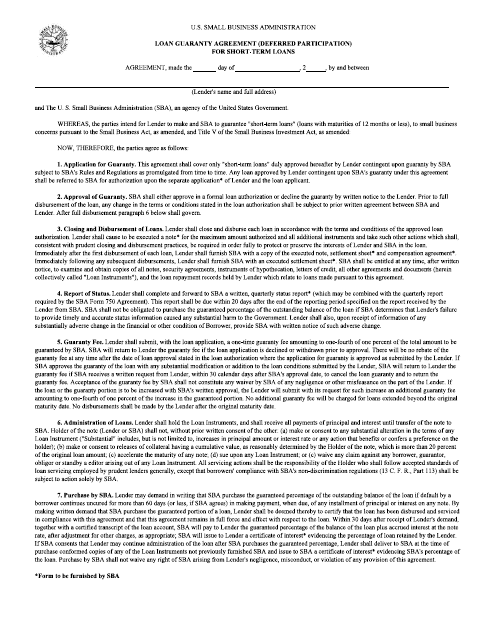

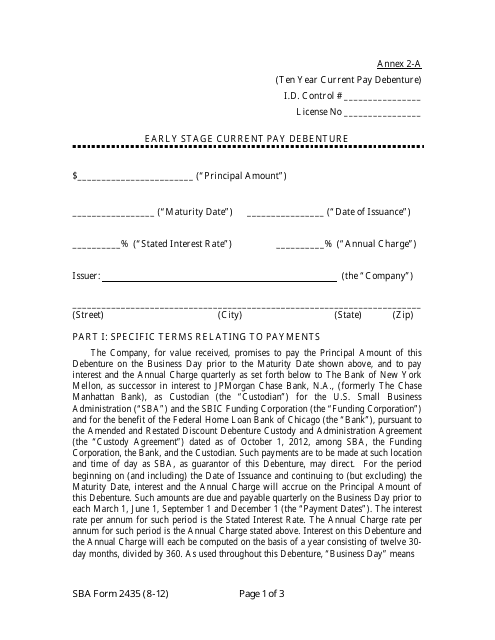

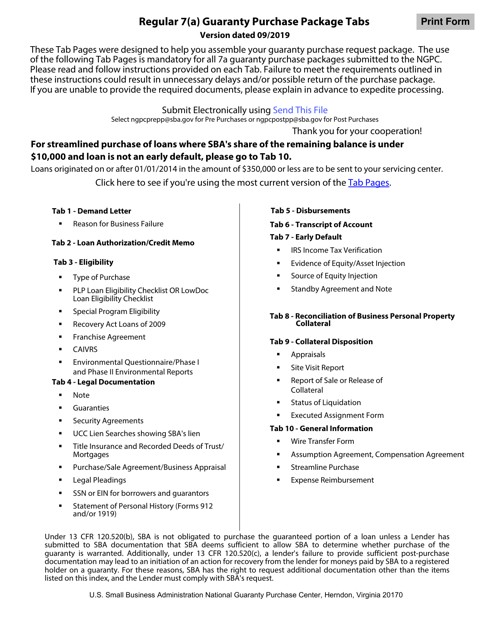

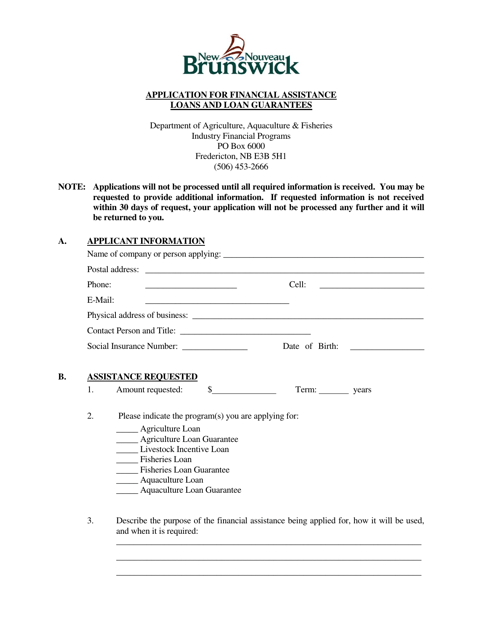

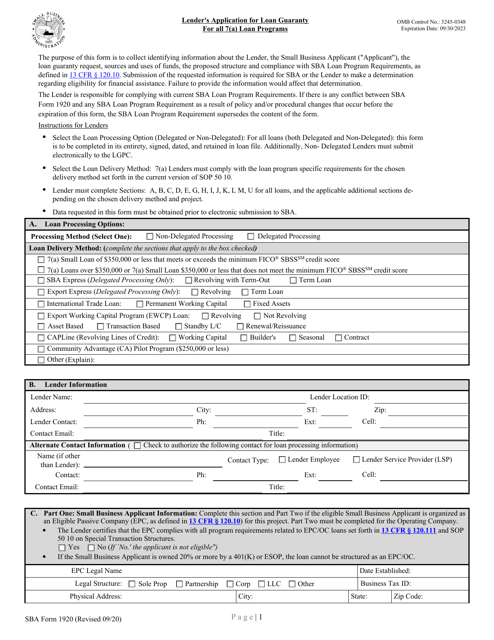

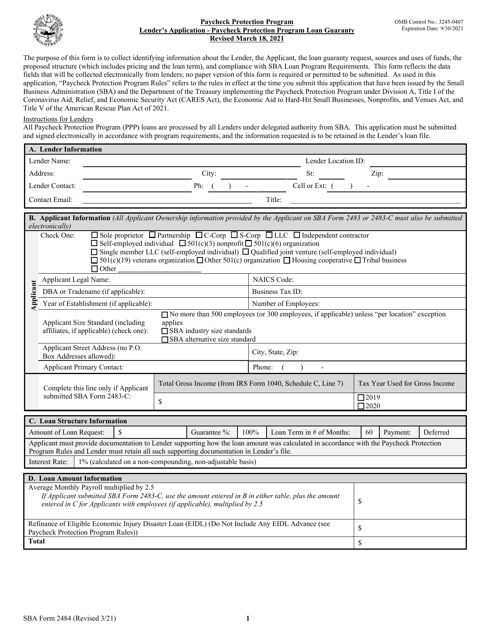

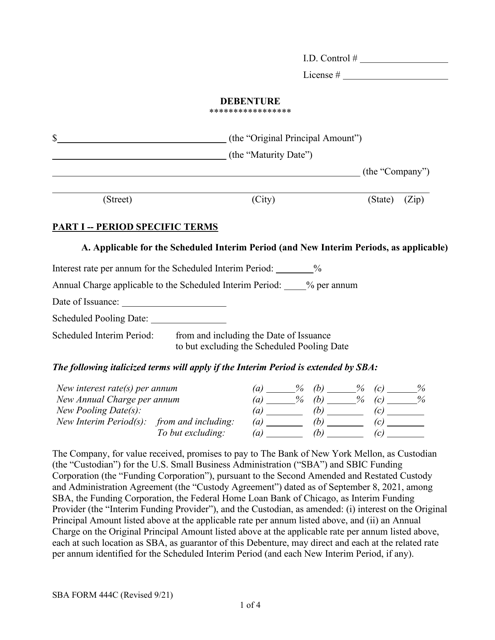

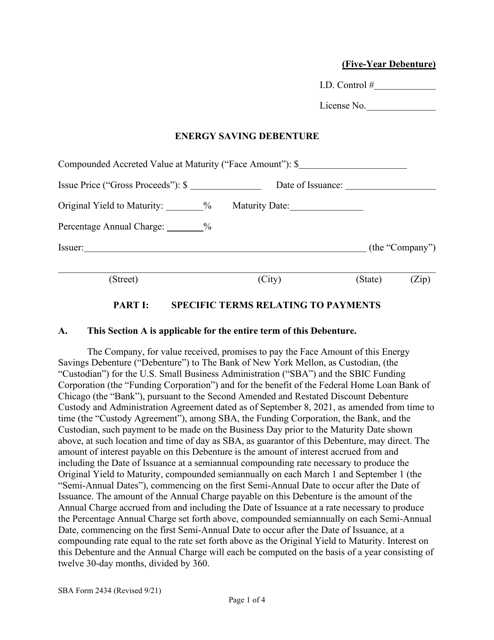

Our loan guarantee documents include a wide range of forms and agreements that are used in various loan guarantee programs. Whether you are applying for a short-term loan, seeking financial assistance in Canada, or participating in an export-related program, we've got you covered. Some of the documents you'll find in our collection include the SBA Form 750B Loan Guaranty Agreement (Deferred Participation) for Short-Term Loans, Regular 7(A) Guaranty Purchase Package Tabs, Application for Financial Assistance Loans and Loan Guarantees in New Brunswick, Canada, SBA Form 444C Debenture Certification Form, and EIB Form 11-05 Exporter's Certificate for Direct Loan, Loan Guarantee & Mt Insurance Programs.

Our loan guarantee documents provide you with the necessary paperwork to navigate the loan guarantee process smoothly and efficiently. They help ensure that you understand your rights and responsibilities as a borrower or guarantor and enable lenders to have confidence in your loan application. With our collection of loan guarantee documents, you can confidently apply for loans, secure financial assistance, and achieve your business goals.

Don't let lack of financial resources hold you back from pursuing your dreams. Explore our loan guarantee documents today and take the first step towards a brighter, more prosperous future.

Documents:

33

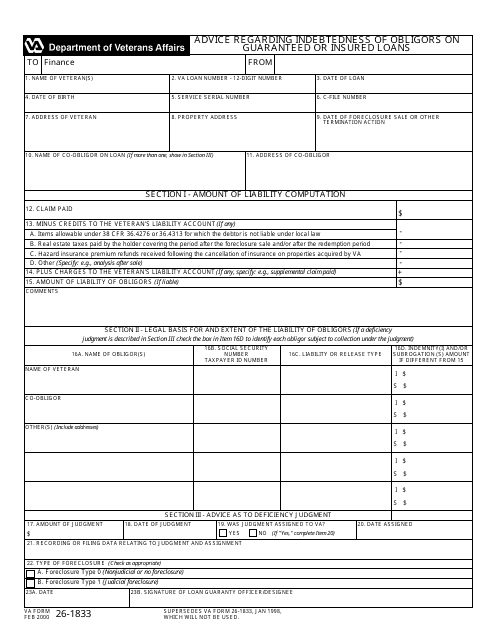

This form is used for providing advice regarding the indebtedness of borrowers on guaranteed or insured loans.

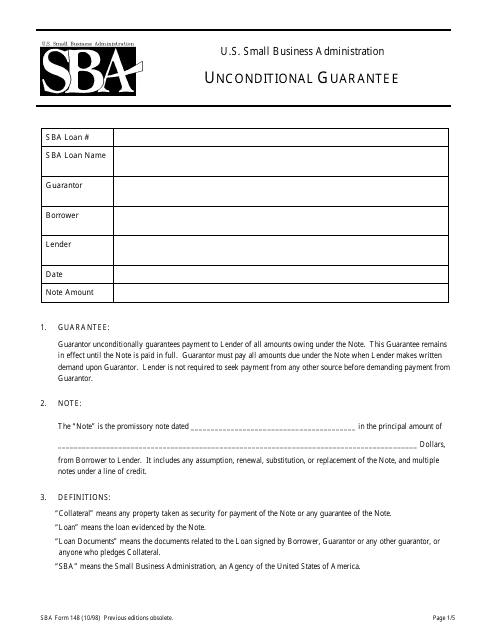

Use this document if you are a lender and the guarantor is liable for the repayment of the entire amount of the borrower's loan.

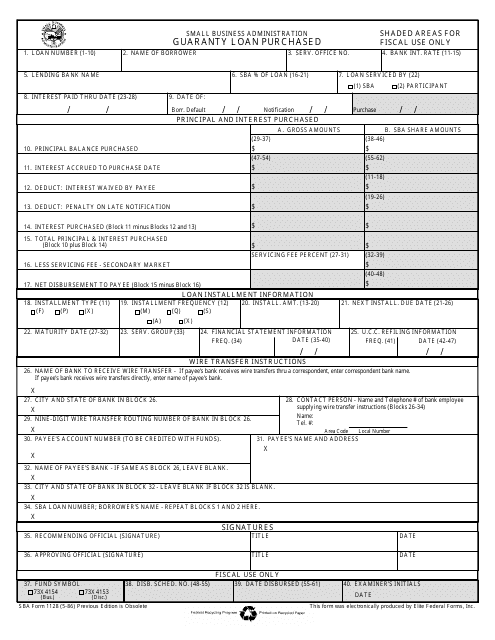

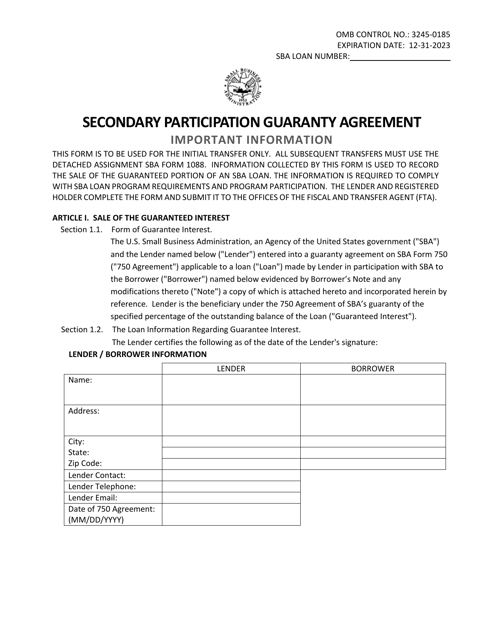

This Form is used for purchasing a guaranteed loan through the Small Business Administration (SBA).

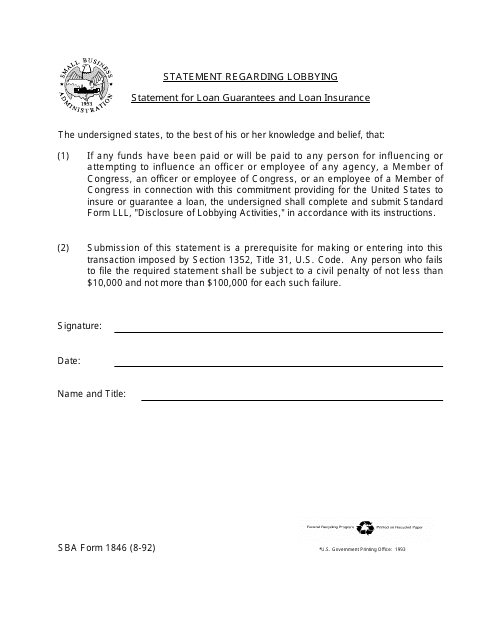

This Statement Regarding Lobbying form is required for closing a Small Business Administration (SBA) Statement for loan guarantees and loan insurance.

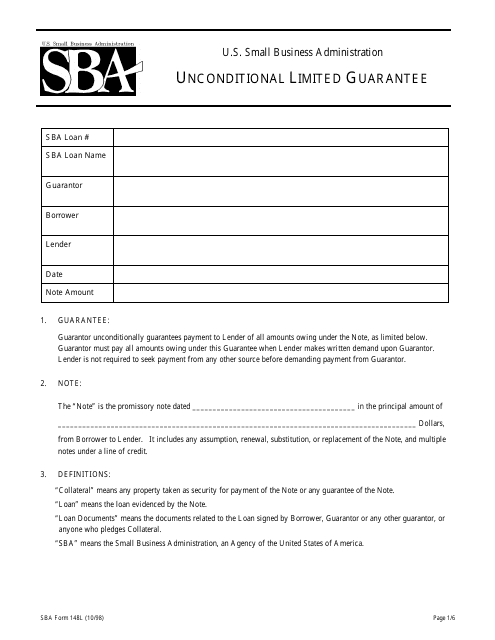

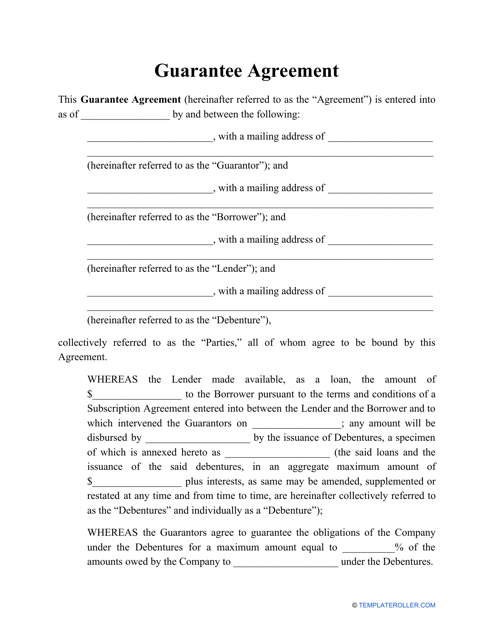

This form is completed by a guarantor of the loan. It contains an unconditional promise to pay the debt on the loan, in case the borrower fails to pay it.

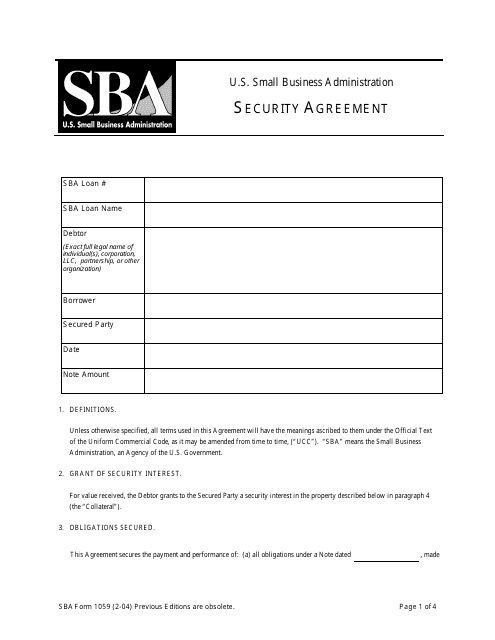

This form is used for creating a legally binding agreement between a borrower and a lender to secure a loan or credit with specified collateral.

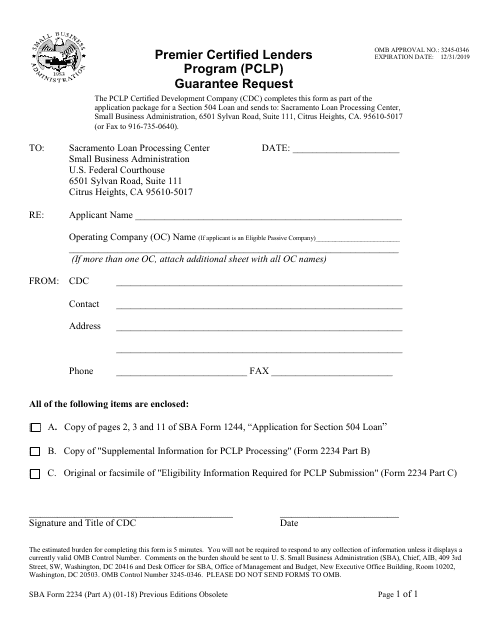

This form is used for requesting a guarantee through the Premier Certified Lenders Program (PCLP) offered by the Small Business Administration (SBA).

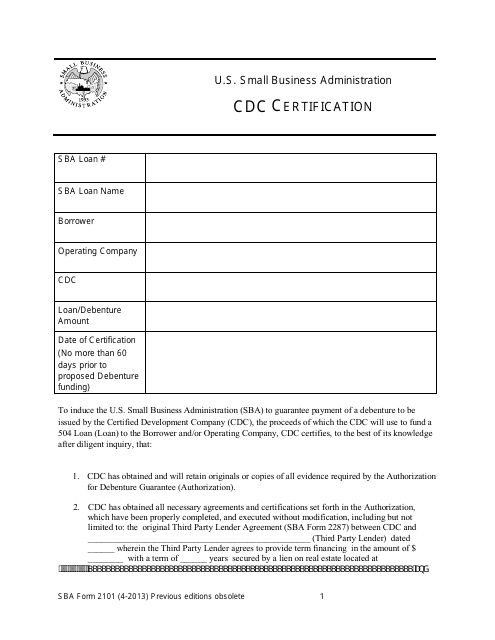

This form is used for the Small Business Administration (SBA) CDC (Certified Development Company) certification process. It verifies the qualifications of CDCs under the SBA's 504 loan program.

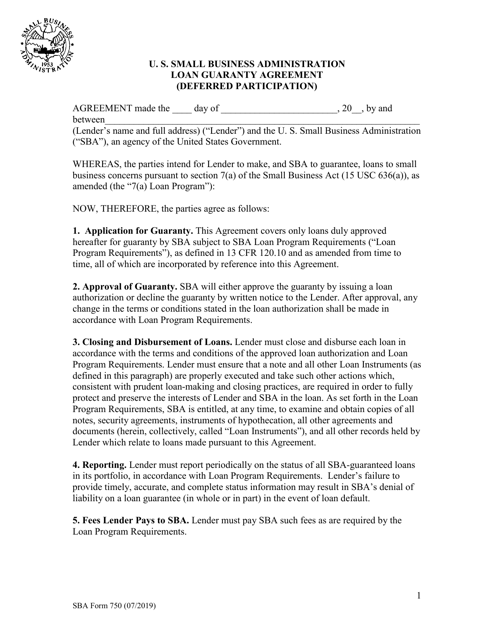

This document is used for the Loan Guaranty Agreement (Deferred Participation) for Short-Term Loans under the Small Business Administration (SBA) program.

This document is used for applying for an early stage current pay debenture with the Small Business Administration (SBA).

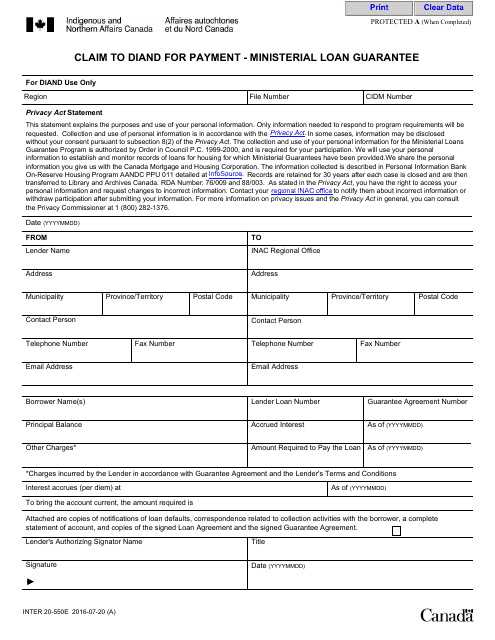

This Form is used for filing a claim to the Canadian government for payment under the Ministerial Loan Guarantee program.

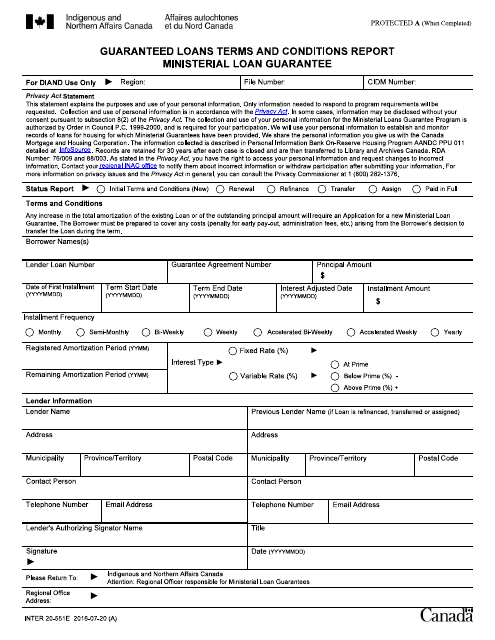

This form is used for reporting the terms and conditions of Ministerial Loan Guarantee for guarantee loans in Canada.

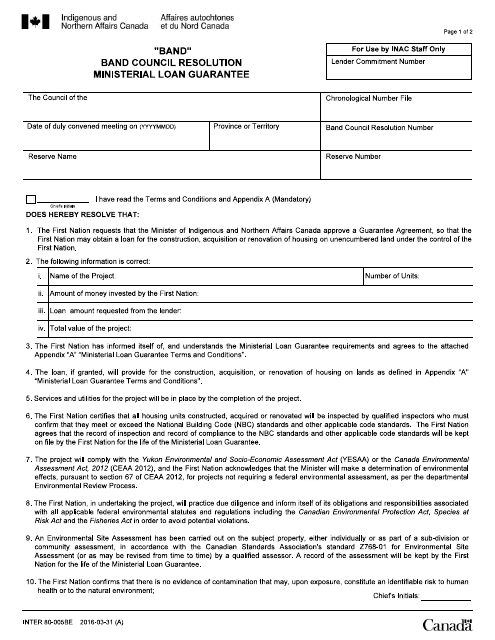

This Form is used for a Band Council Resolution in Canada to obtain a Ministerial Loan Guarantee.

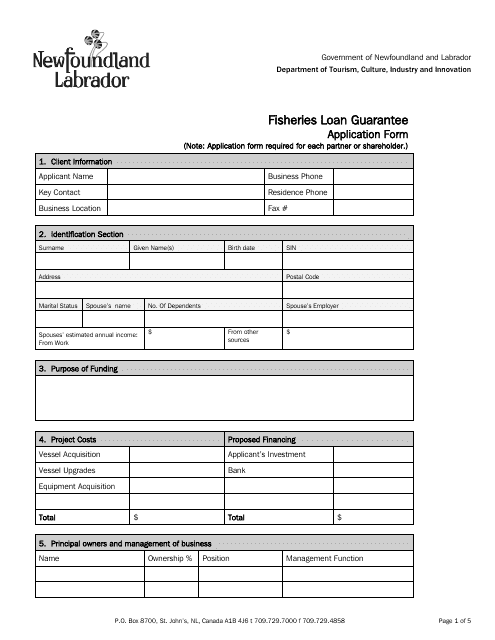

This form is used for applying for a loan guarantee in the fisheries industry in the province of Newfoundland and Labrador, Canada.

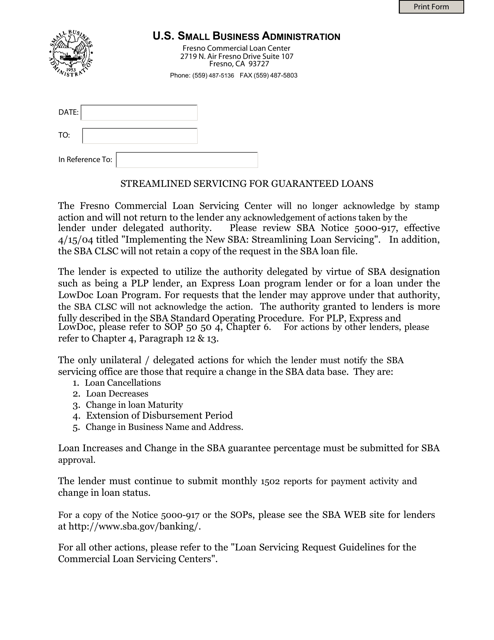

This document provides information and guidelines for a simplified process of managing and servicing loans that are guaranteed by a certain entity. It outlines the steps and requirements for efficient loan administration.

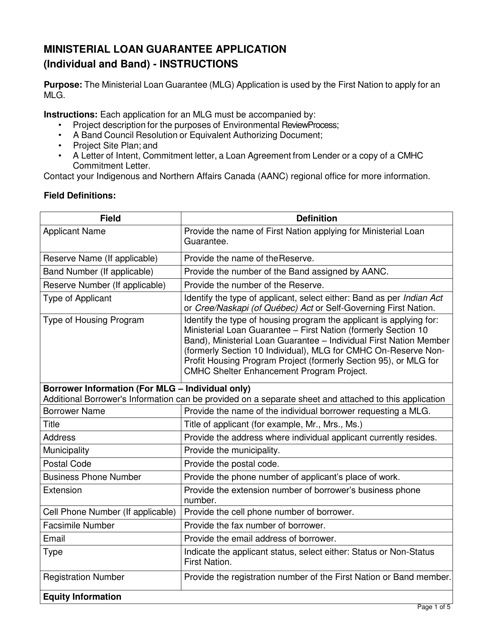

This document is a set of instructions for applying for a Ministerial Loan Guarantee in Canada. It provides guidance for both individuals and bands on how to complete the application process.

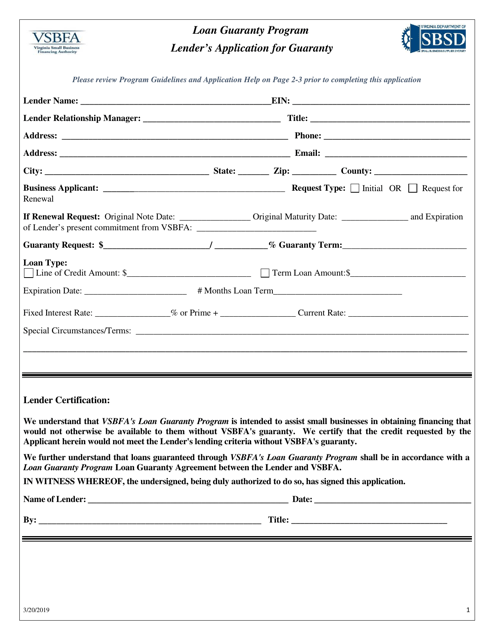

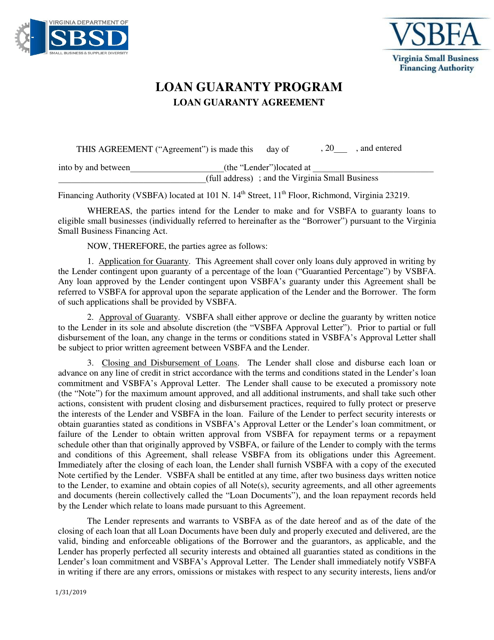

This document is for lenders in Virginia who want to apply for a loan guaranty through the Loan Guaranty Program.

This document is an application form for financial assistance loans and loan guarantees in the province of New Brunswick, Canada. It is used by individuals or businesses seeking financial support from the government.

This document acts as an official pledge listing a third party (known as the guarantor) who will ensure payment of a debt will be fully repaid to the creditor.

This document is a Loan Guaranty Agreement specific to the state of Virginia. It outlines the terms and conditions of a loan guarantee between the borrower and the guarantor.

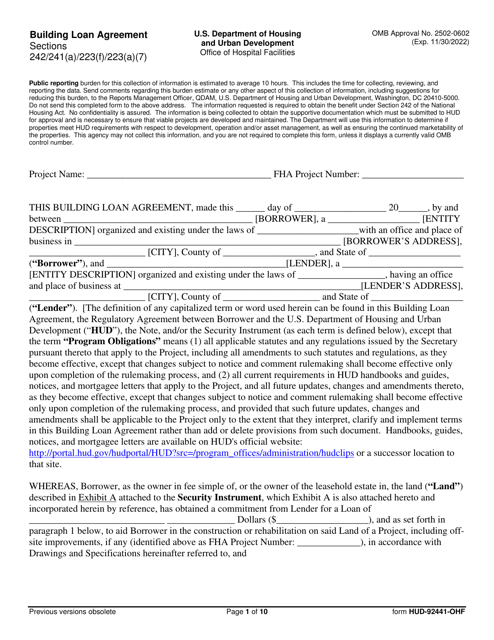

This document is a Building Loan Agreement form (Form HUD-92441-OHF) used by the U.S. Department of Housing and Urban Development (HUD) for financing the construction or rehabilitation of affordable housing projects.

This form is used for certification of a 5-year energy-saving debenture by the Small Business Administration (SBA).

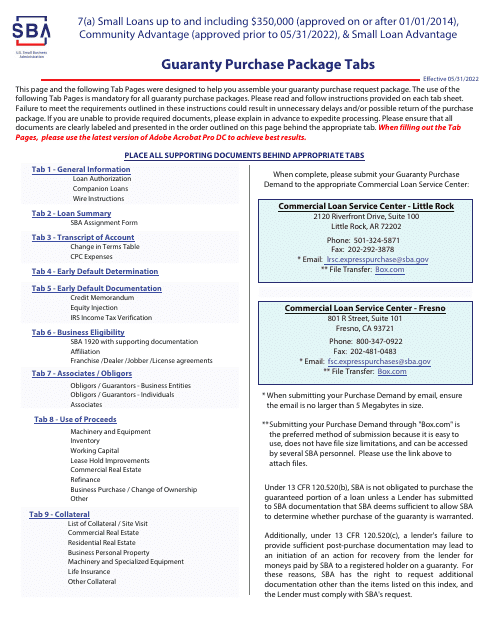

This document includes tabs for different types of small loans, including the 7(A) Small Loans, Community Advantage, and Small Loan Advantage. It provides information on the guarantee purchase package for loans approved on or after January 1, 2014, and for Community Advantage loans approved prior to May 31, 2022.

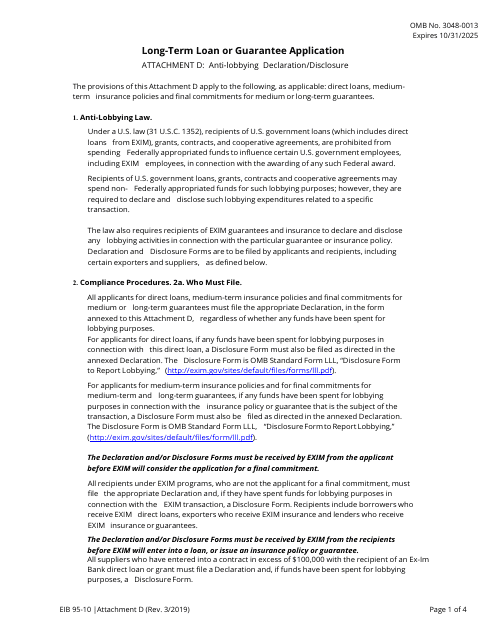

This document is used for applying for a long-term loan or guarantee, and it includes an anti-lobbying declaration/disclosure.

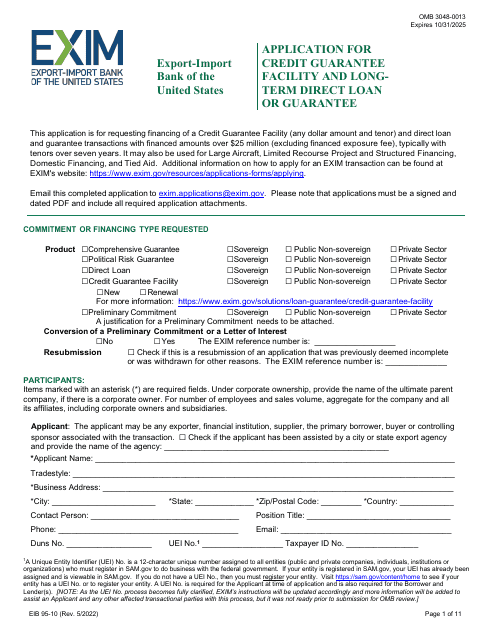

This Form is used to apply for a credit guarantee facility and long-term direct loan or guarantee from the European Investment Bank (EIB).

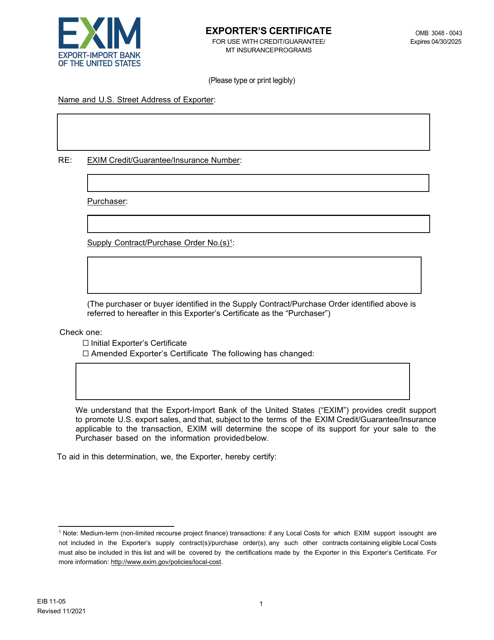

This Form is used for the Exporter's Certificate required for Direct Loan, Loan Guarantee, and Mt Insurance Programs.