Small Employer Templates

Are you a small employer looking for guidance on various forms and tax credits related to health insurance premiums, real property improvement, and investment? Look no further! Our website provides a wealth of resources for small employers like yourself.

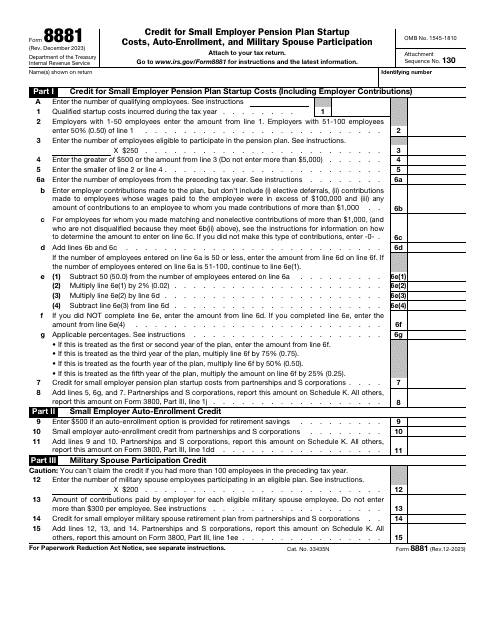

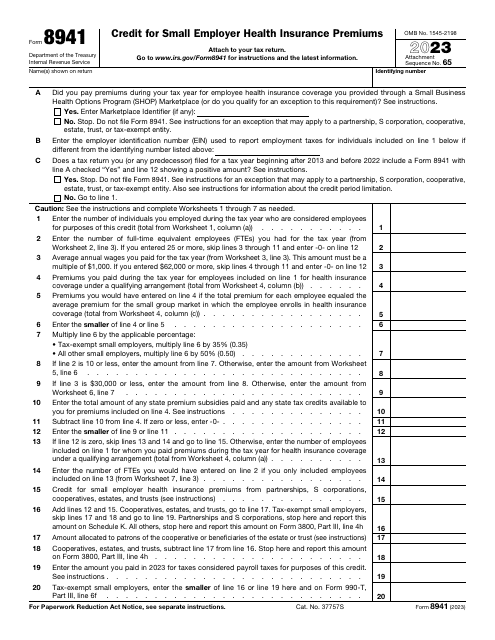

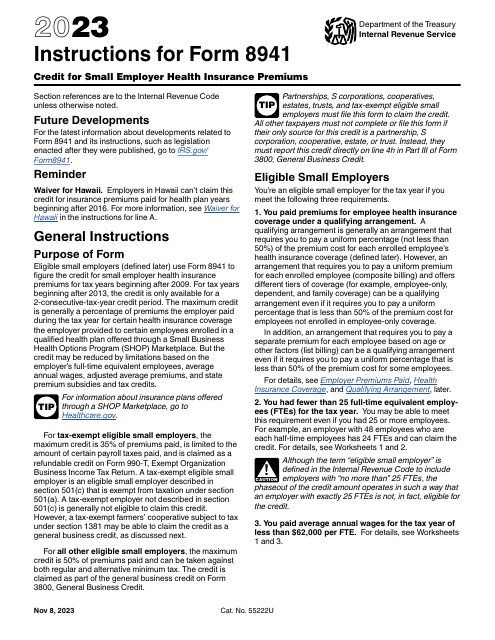

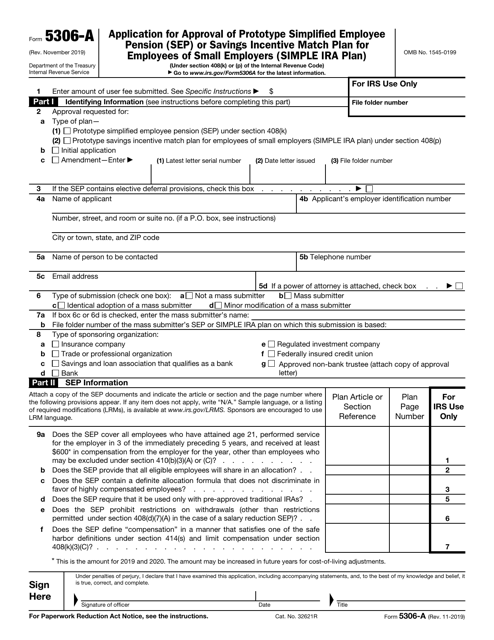

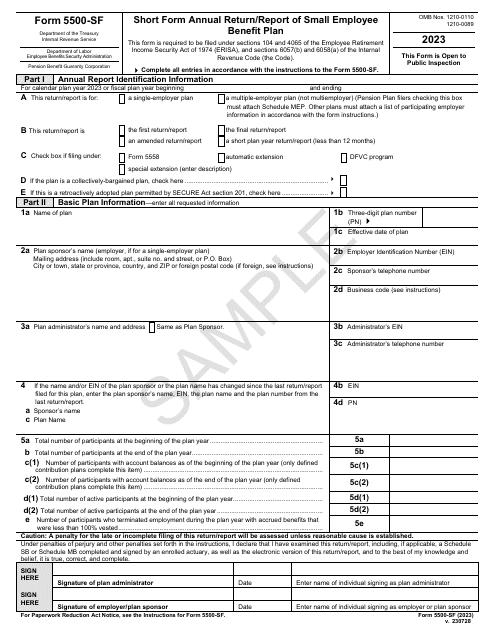

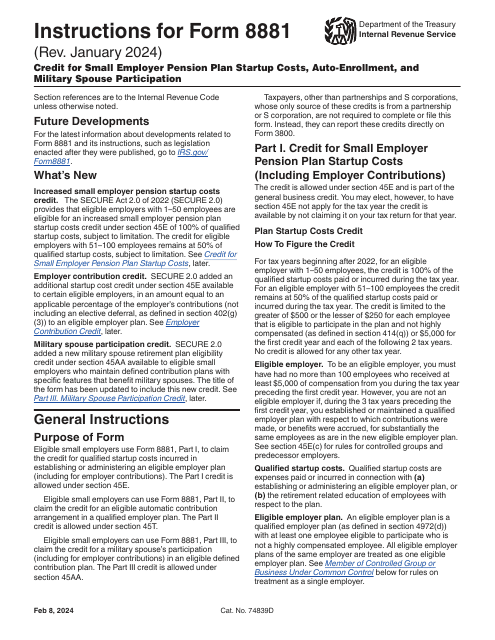

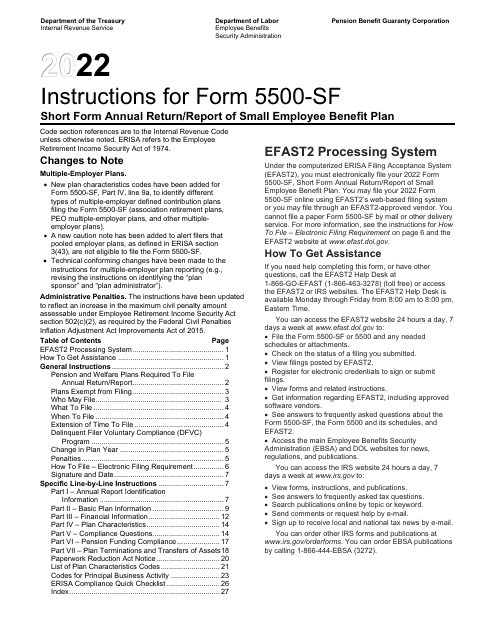

As a small employer, you may be eligible for various tax credits and incentives that can help alleviate some of the financial burdens associated with running a business. Our collection of documents includes instructions for IRS Form 8941, which covers the Credit for Small Employer Health Insurance Premiums. This credit can help offset the costs of providing health insurance coverage to your employees.

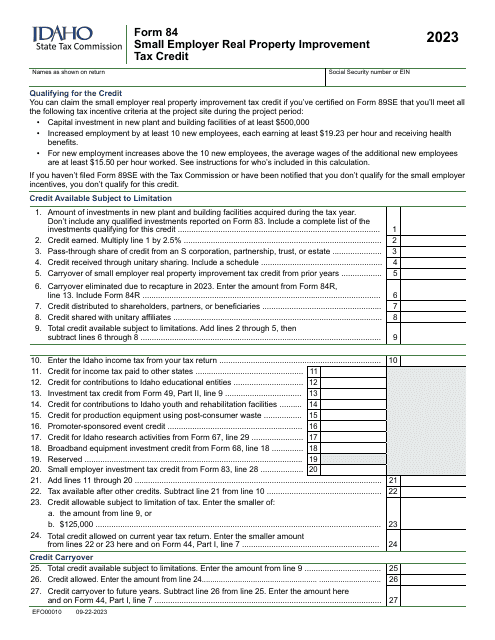

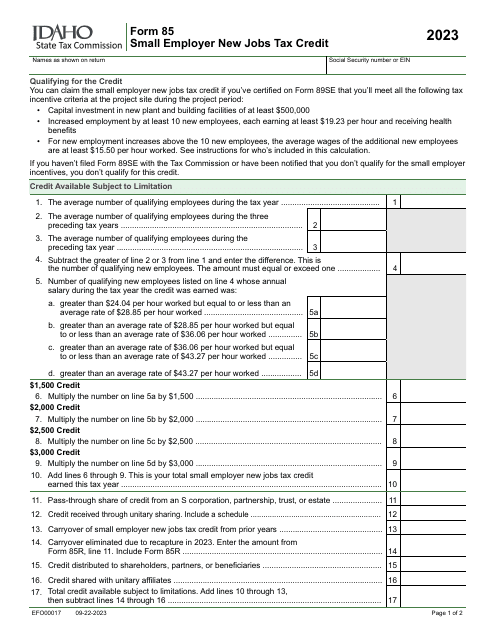

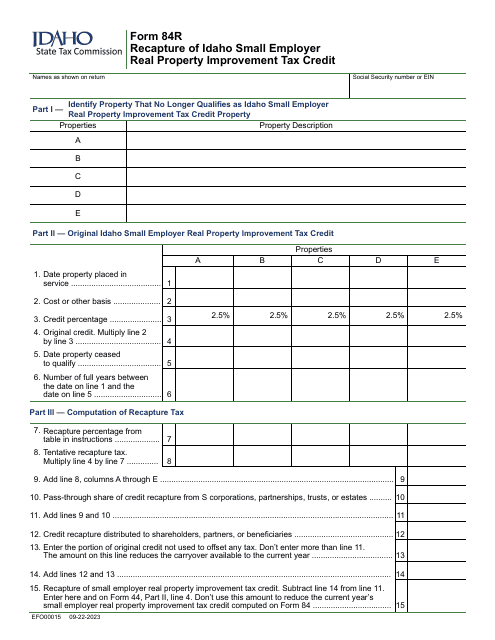

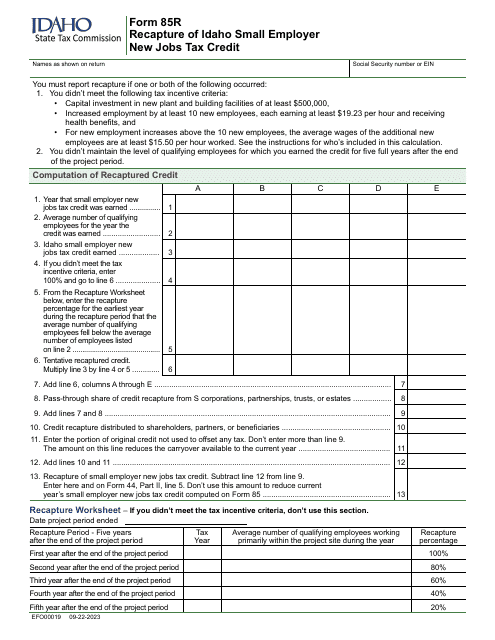

Additionally, we have forms such as Form 84 (EFO00010), which pertains to the Small Employer Real Property ImprovementTax Credit in Idaho. This credit is specifically designed to assist small employers in Idaho who have made improvements to their property. The documentation provided will guide you through the process of claiming this credit and provide any necessary instructions.

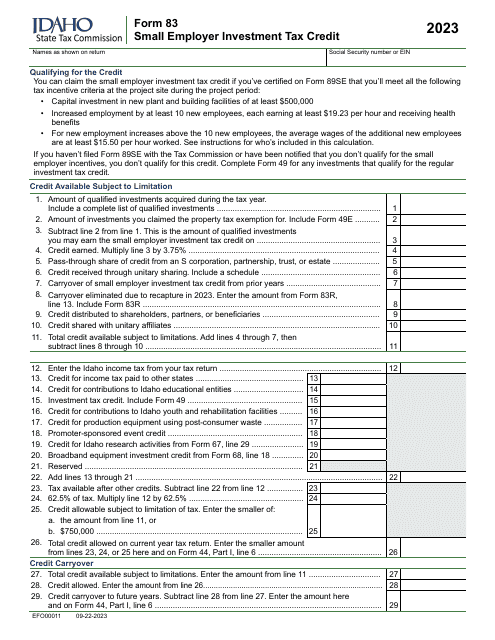

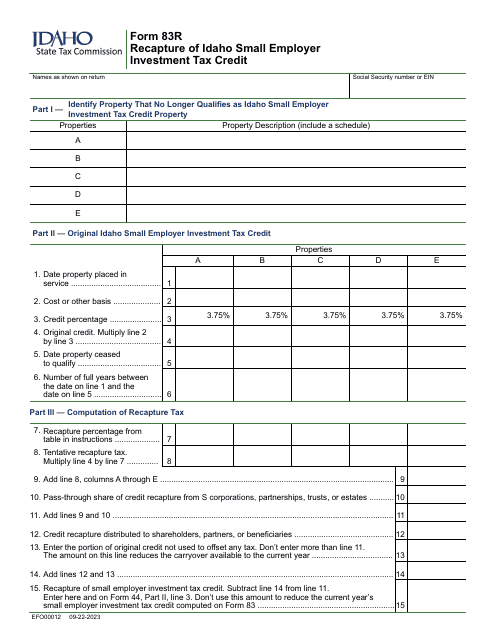

If you're a small employer in Idaho, you may also be eligible for the Small Employer Investment Tax Credit, covered by Form 83 (EFO00011). This credit is aimed at encouraging small businesses to invest in their operations and can provide additional financial support.

We understand that navigating through the various forms and documentation related to small employer tax credits can be daunting. Our website aims to streamline this process by consolidating all the necessary resources in one place, allowing you to easily access the information you need.

At our site, you'll find comprehensive information on the tax credits available to small employers, along with step-by-step instructions on how to complete the necessary forms. Whether you're looking to claim the Credit for Small Employer Health Insurance Premiums, the Small Employer Real Property Improvement Tax Credit, or the Small Employer Investment Tax Credit, we've got you covered.

Take advantage of the benefits available to small employers and explore our extensive collection of documents today. You'll discover invaluable resources that can help you navigate the complexities of small business taxation and maximize your financial savings. Let us assist you in unlocking the potential of small employer tax credits.

Documents:

38

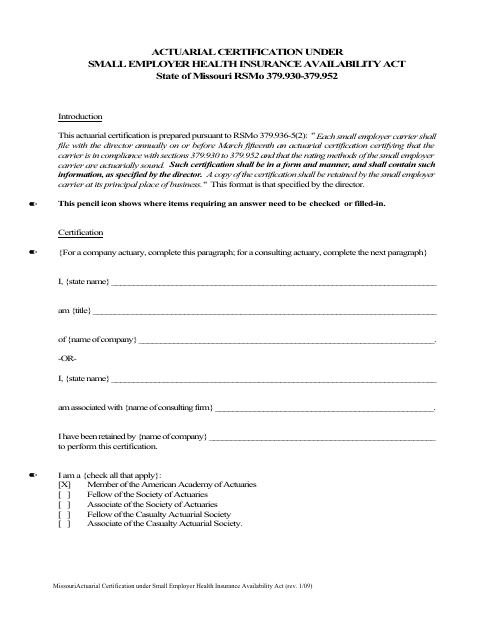

This document certifies actuaries under the Small Employer Health Insurance Availability Act in Missouri.

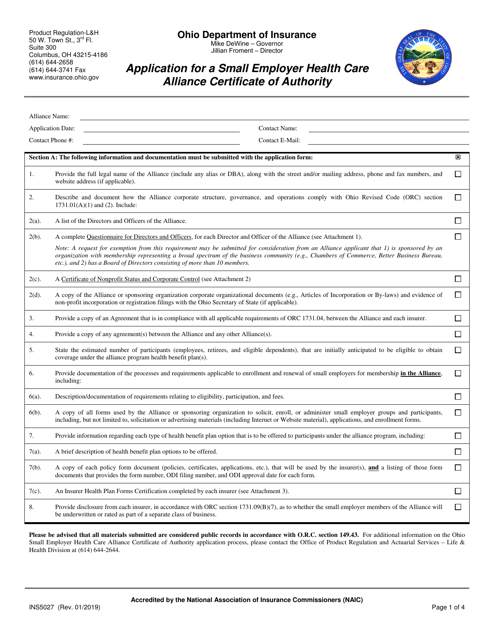

This Form is used for applying for a Certificate of Authority for a Small Employer Health Care Alliance in Ohio.

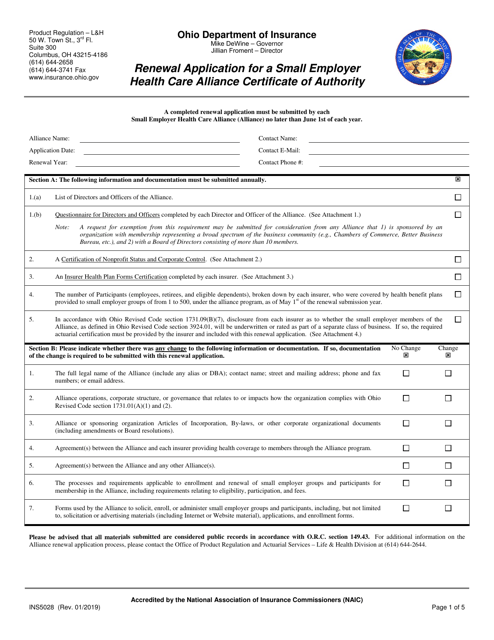

This application form is used to renew a Small Employer Health Care Alliance Certificate of Authority in the state of Ohio.

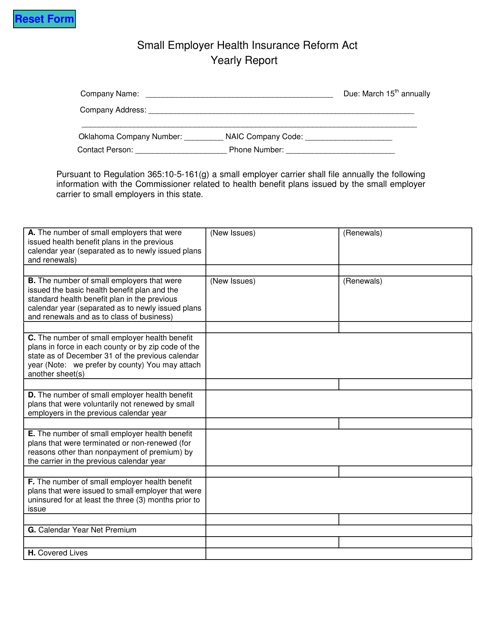

This document is the yearly report required under the Small Employer Health Insurance Reform Act in Oklahoma. It provides information on the health insurance coverage offered by small employers in the state.

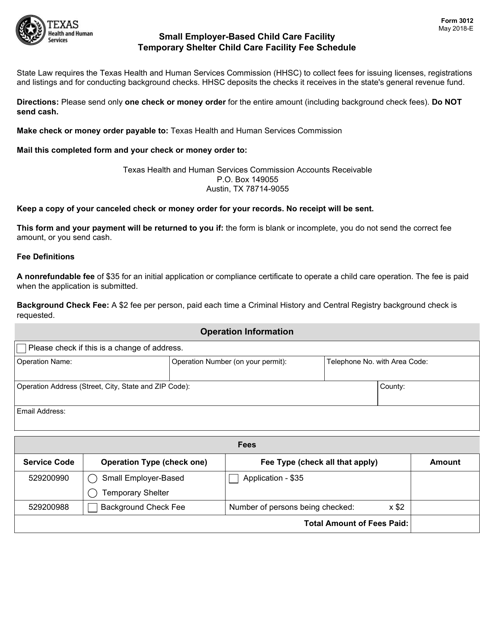

This form is used to determine the fee schedule for small employers operating child care facilities in Texas.

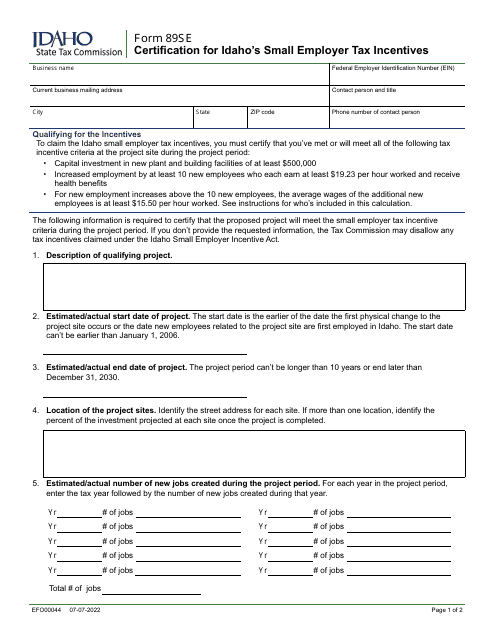

This form is used for certifying small employer tax incentives in Idaho. It is known as Form 89SE (EFO00044).

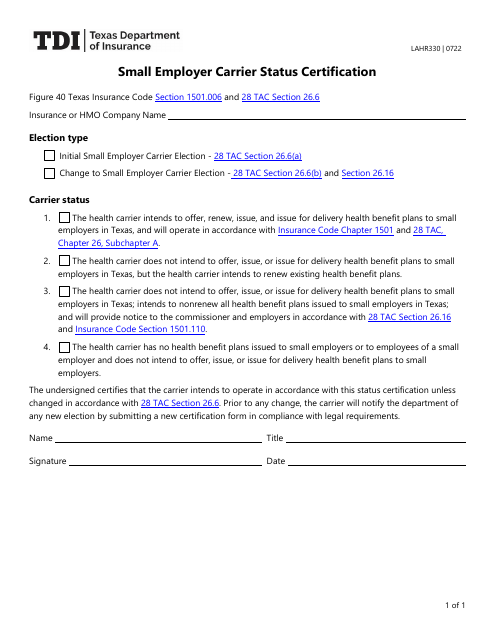

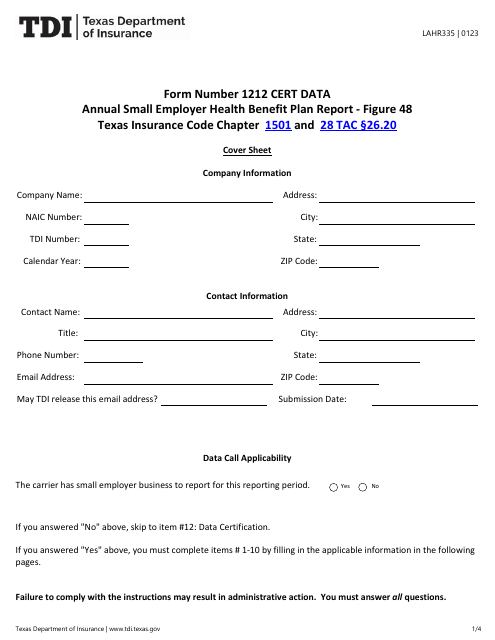

This form is used for small employers in Texas to certify their status as a carrier.