Notice of Appraised Value Templates

The notice of appraised value is a crucial document that provides property owners with important information regarding the appraised value of their properties. This document is designed to inform property owners about the assessed value of their real or personal property, which is determined by government authorities.

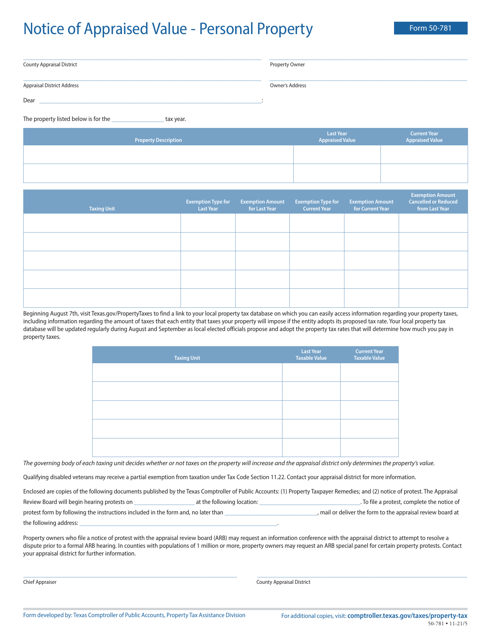

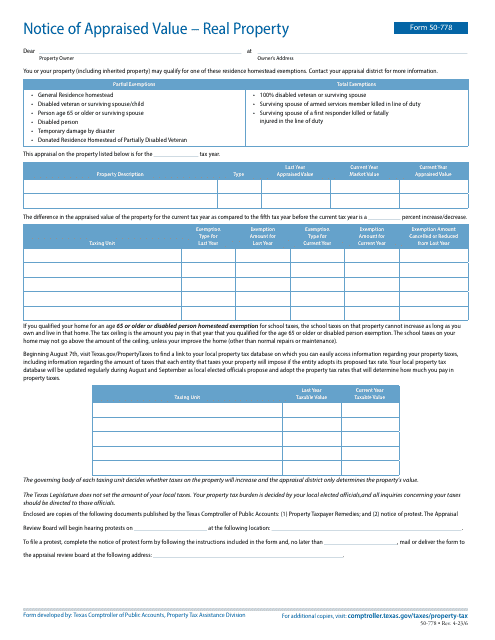

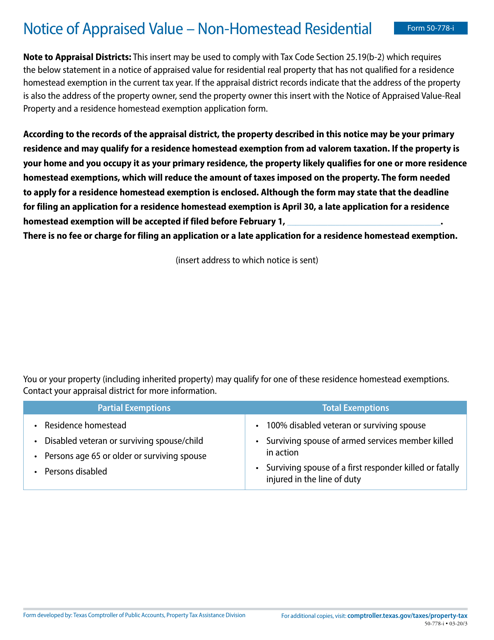

The notice of appraised value, also known as Form 50-781, Form 50-778, or Form 50-778-I, is issued by the government to notify property owners about the appraised value of their properties, whether it be real property, personal property, or non-homestead residential property. This document plays a significant role in keeping property owners informed about changes in their property's value, ensuring transparency and fairness in the assessment process.

By receiving the notice of appraised value, property owners can stay updated on the current market values and make informed decisions regarding their properties. This document is crucial for property owners who need accurate information about the assessed value of their properties for taxation purposes, insurance coverage, or potential sales or refinancing.

Whether you own real estate, personal property, or non-homestead residential property, it is essential to understand the appraised value and how it affects your assets. The notice of appraised value serves as a reliable resource to assist property owners in understanding the value assigned to their properties by government authorities.

Documents:

6

This Form is used for notifying property owners in Texas about the appraised value of their non-homestead residential property.