Capital Tax Templates

Are you looking for information and guidance on capital tax? Look no further, because we have a comprehensive collection of documents and resources related to this topic. Whether you're a financial corporation in Prince Edward Island, Newfoundland and Labrador, Saskatchewan, or Ontario, our documents cover various aspects of capital tax.

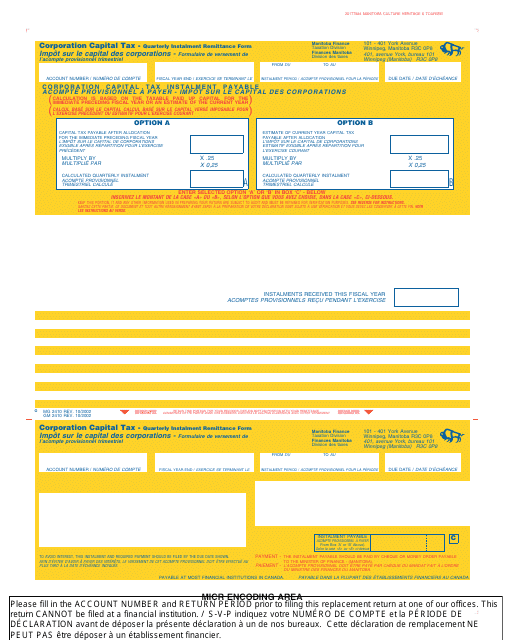

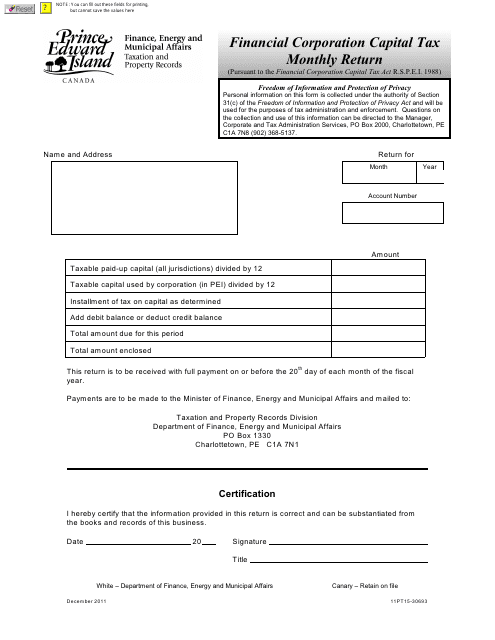

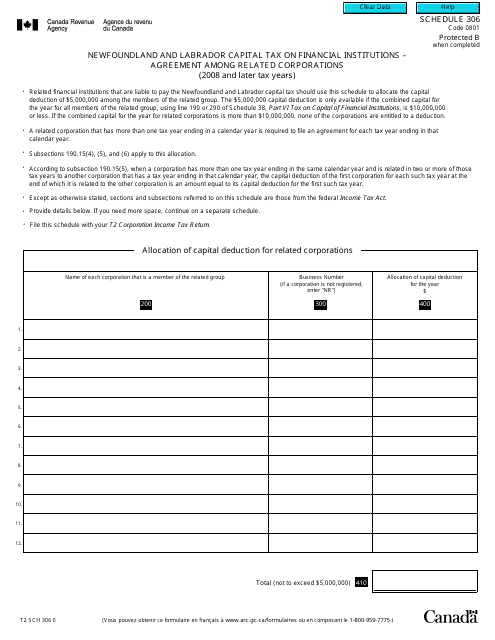

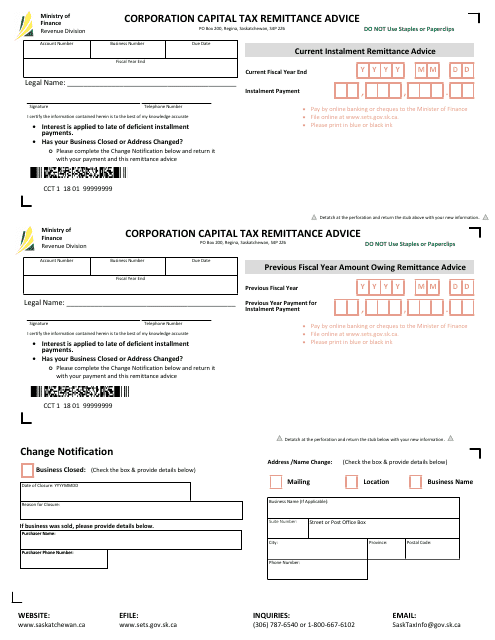

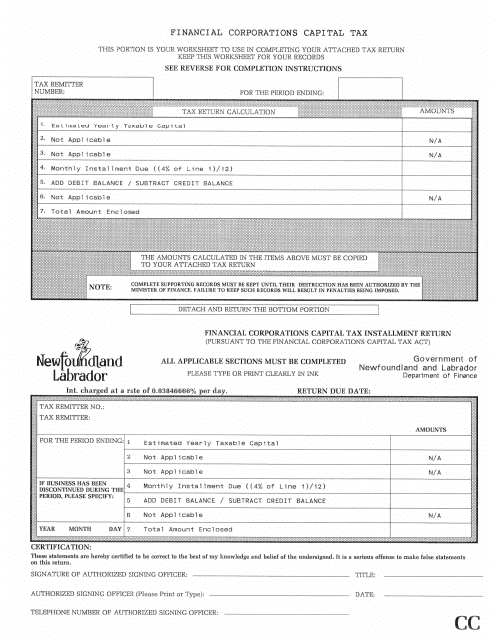

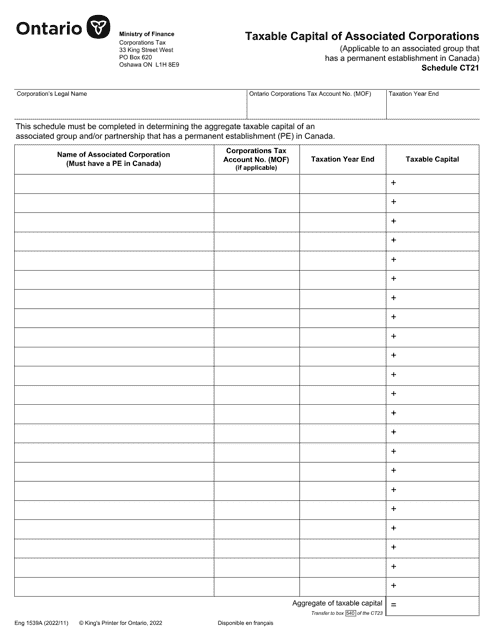

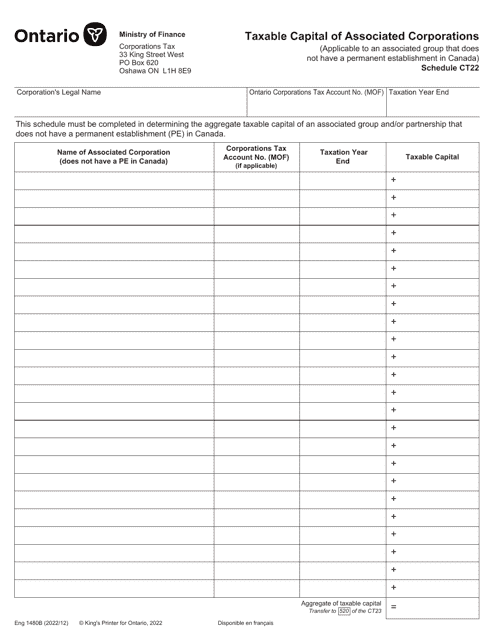

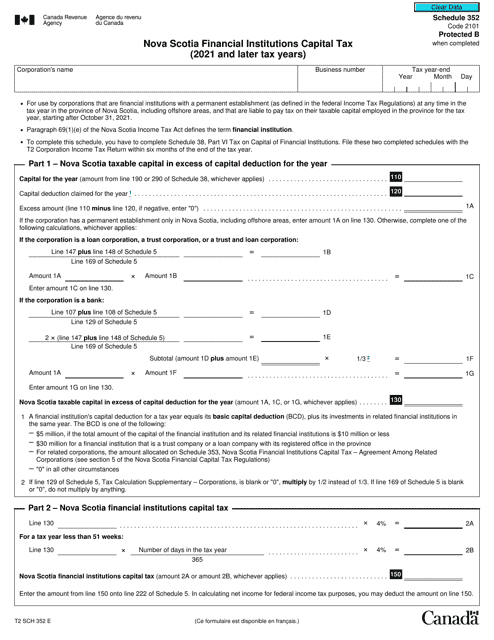

Our documents provide guidance on how tofill out different forms such as Form 11PT15-30693, Form T2 Schedule 306, Corporation Capital Tax Remittance Advice, Form 1539A Schedule CT21, and Form 1480B Schedule CT22. These forms are designed to help you accurately report and pay your capital tax liabilities.

Capital tax, sometimes also referred to as financial corporation capital tax, is a key consideration for businesses operating in certain provinces in Canada. It is a tax assessed on the taxable capital of corporations, and our documents will help you understand the rules and requirements specific to your jurisdiction.

Our collection of documents is regularly updated to reflect the latest regulations and guidelines, ensuring that you have access to the most current information related to capital tax. We understand that navigating the world of taxes can be complex, but our documents aim to simplify the process and provide clear instructions to help you fulfill your tax obligations.

Whether you're a small business or a large corporation, understanding and managing your capital tax liabilities is essential. Our documents offer valuable insights into the calculation of taxable capital, associated corporations, and other important factors that impact the assessment of capital tax.

So, don't let the complexities of capital tax overwhelm you. Explore our comprehensive collection of documents and resources to gain the knowledge and guidance you need to effectively manage your capital tax obligations.

Documents:

8

This document is used for remitting quarterly instalments of capital tax for corporations in Manitoba, Canada. The form is available in English and French.

This Form is used for filing the monthly financial corporation capital tax return in Prince Edward Island, Canada. It is compulsory for financial corporations to report their tax liabilities on a monthly basis.

This form is used for reporting the capital tax on financial institutions in Newfoundland and Labrador. It is specifically for related corporations and applies to tax years starting from 2008 and onwards.

This document is used for remitting capital tax owed by corporations in the province of Saskatchewan, Canada.

This document is for regular financial corporations in Newfoundland and Labrador, Canada to report and pay capital tax.

This form is used for reporting the taxable capital of associated corporations in Ontario, Canada.

This form is used for reporting the Nova Scotia Financial Institutions Capital Tax for tax years 2021 and later in Canada.