Property Tax Credit Templates

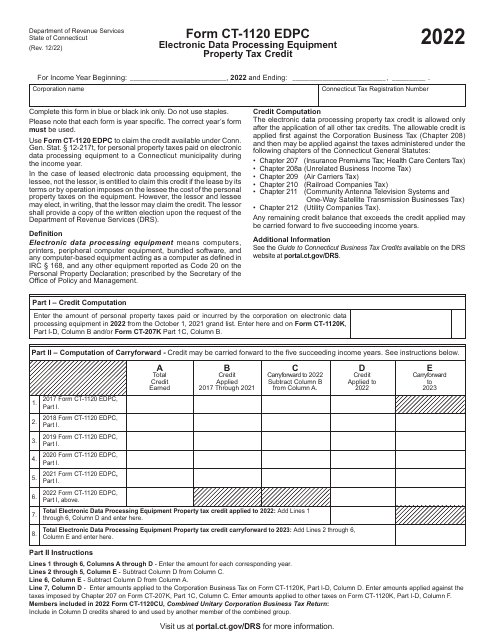

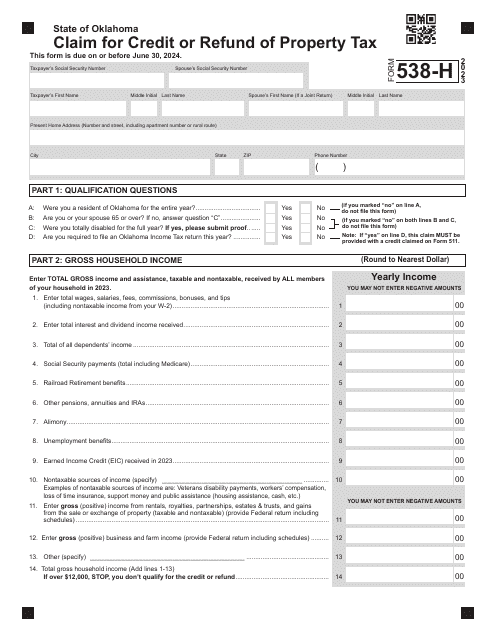

Are you a homeowner looking to save money on your property taxes? Look no further, because we have the ultimate resource for you - the Property Tax Credit collection. This collection of documents provides valuable information and resources to help homeowners like yourself navigate the complex world of property tax credits.

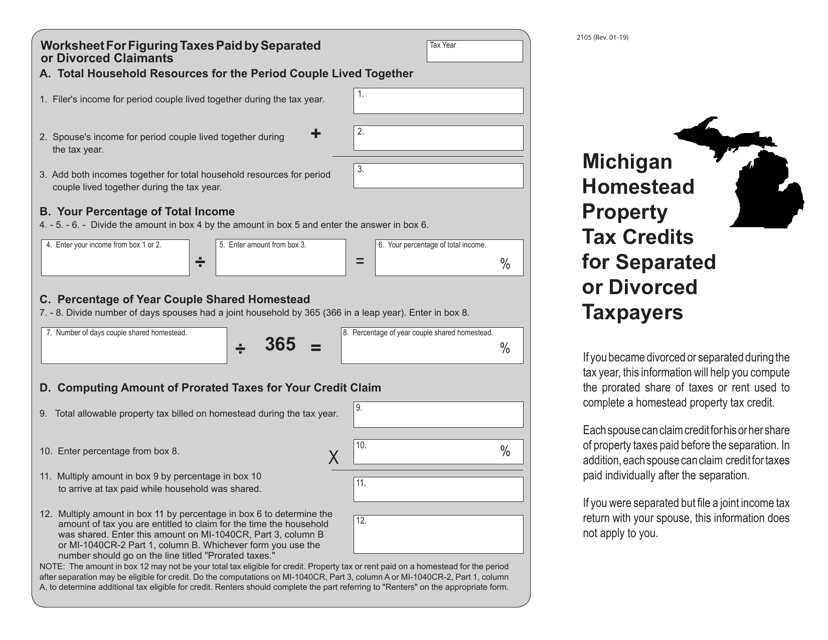

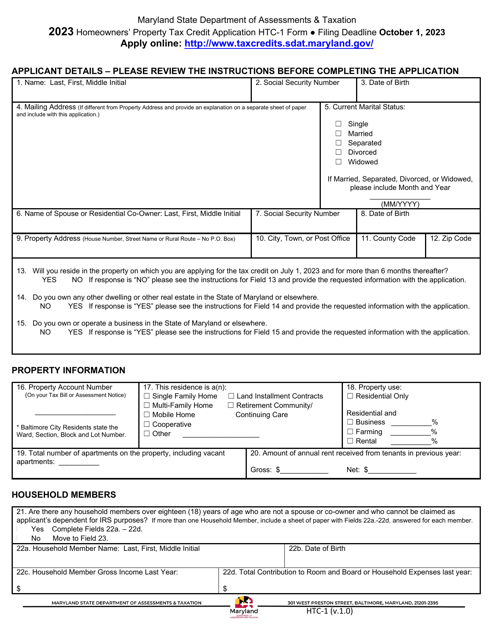

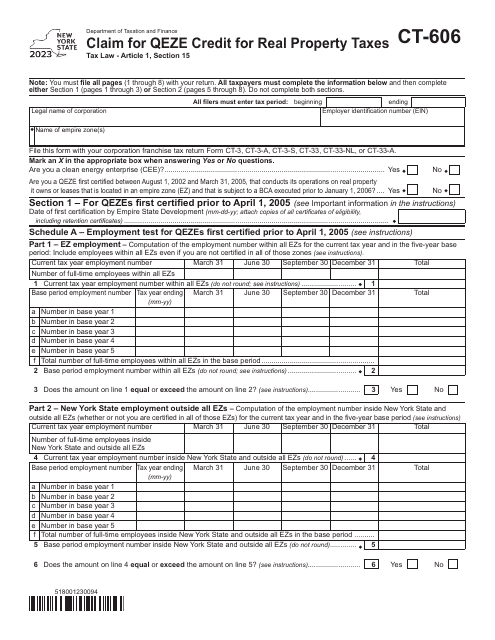

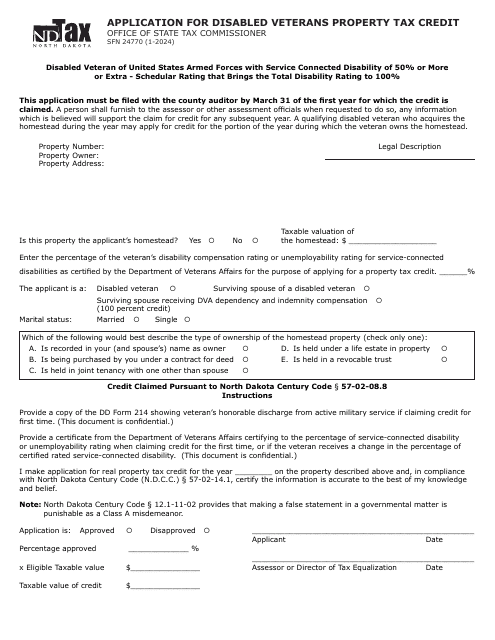

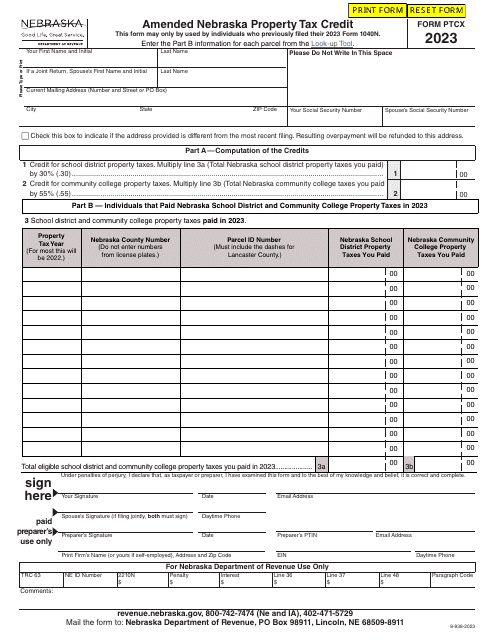

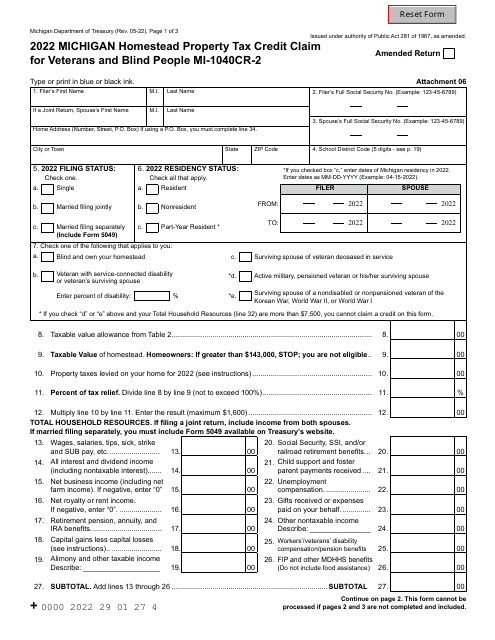

Whether you're a disabled veteran in North Dakota, a homeowner in Maryland, a veteran in Allegany County, New York, or a resident of Nebraska or Michigan, this collection has you covered. You'll find forms, questionnaires, and claim documents specifically tailored to your unique situation, ensuring that you receive the maximum property tax credit you're entitled to.

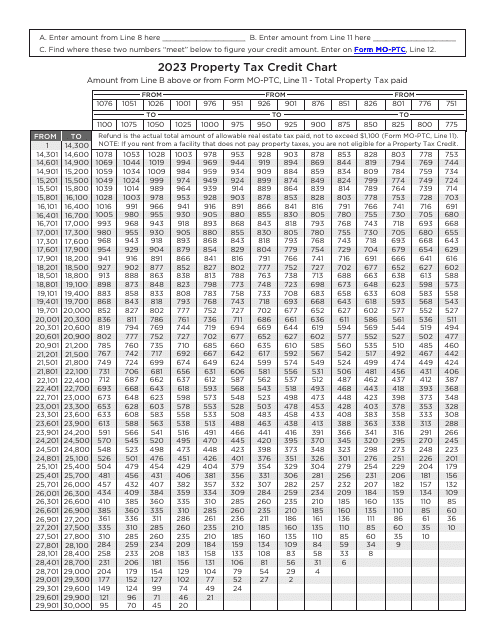

Our Property Tax Credit collection is also known as the Tax Credit Property collection, Property Tax Credits collection, and even the Property Tax Credit Chart. No matter the name, the purpose remains the same - to provide homeowners with the tools and information they need to take advantage of property tax credits and save money.

So don't miss out on potential savings. Explore our Property Tax Credit collection today and discover the resources that can help you reduce your property tax burden. With our easy-to-use forms and helpful guides, you'll be on your way to saving money on your property taxes in no time.

Documents:

35

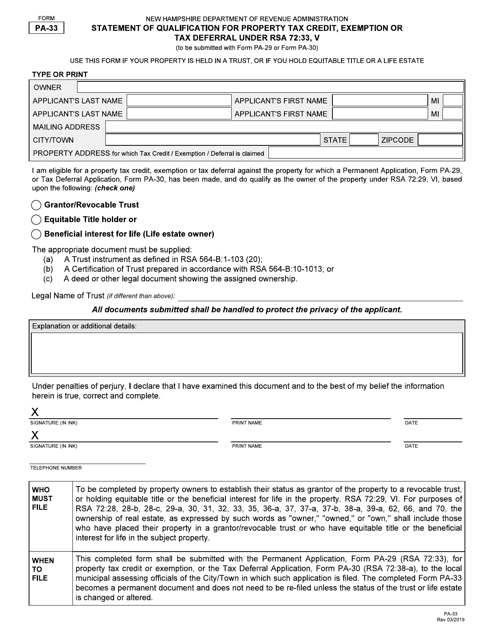

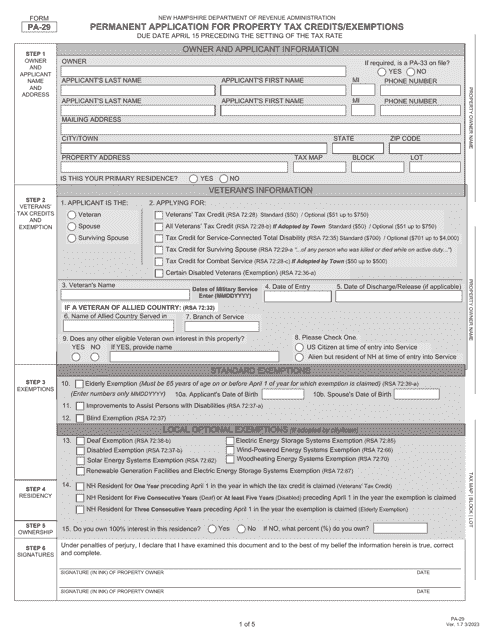

This form is used for applying for a property tax credit, exemption, or tax deferral in New Hampshire under RSA 72:33.

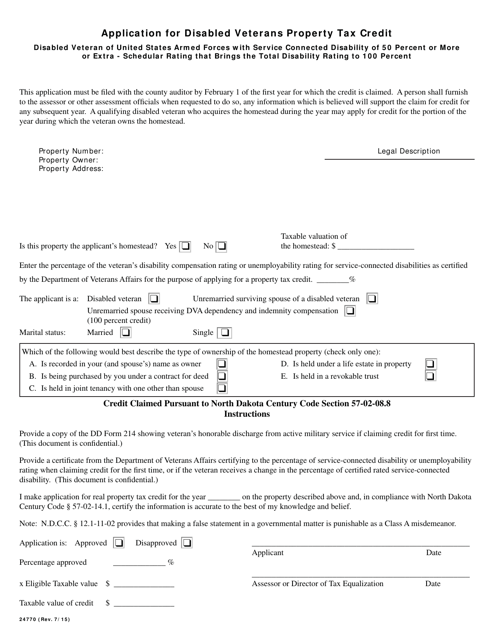

This form is used for applying for the Disabled Veterans Property Tax Credit in North Dakota. This credit provides tax relief to disabled veterans by reducing their property tax burden.

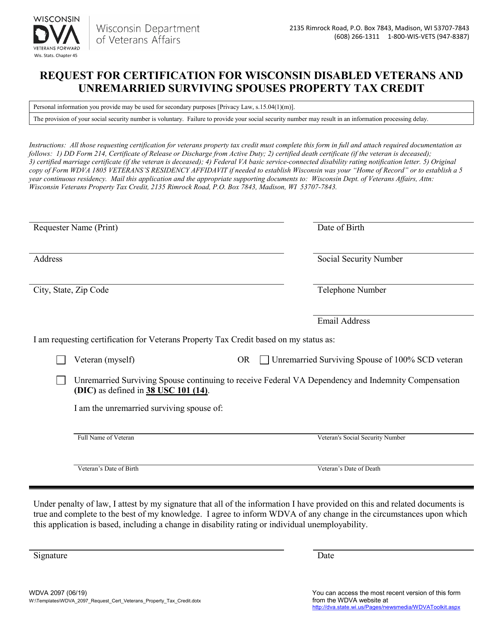

This Form is used for requesting certification for the Wisconsin Disabled Veterans and Unremarried Surviving Spouses Property Tax Credit in Washington.

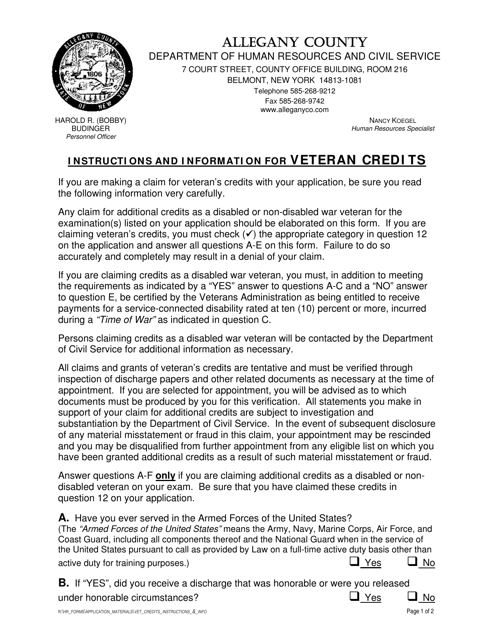

This type of document provides information about veteran credits available in Allegany County, New York. It describes the credits and eligibility requirements for veterans in the county.