Trust Income Templates

Trust income refers to the income generated by trusts, which are legal arrangements that allow one party to hold assets on behalf of another. This type of income includes various forms of financial gains such as dividends, interest, and capital gains earned by the trust.

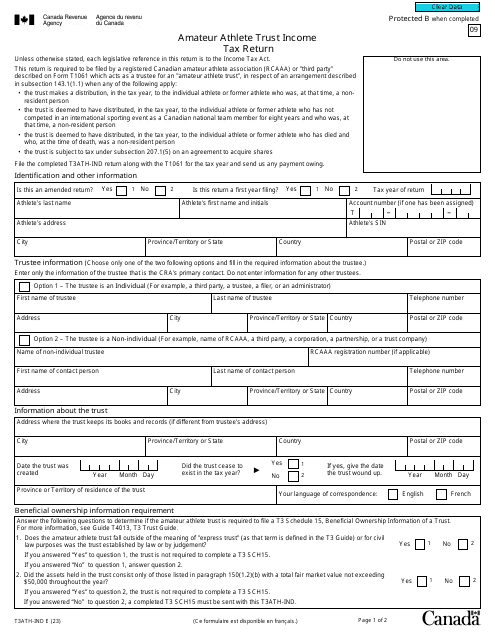

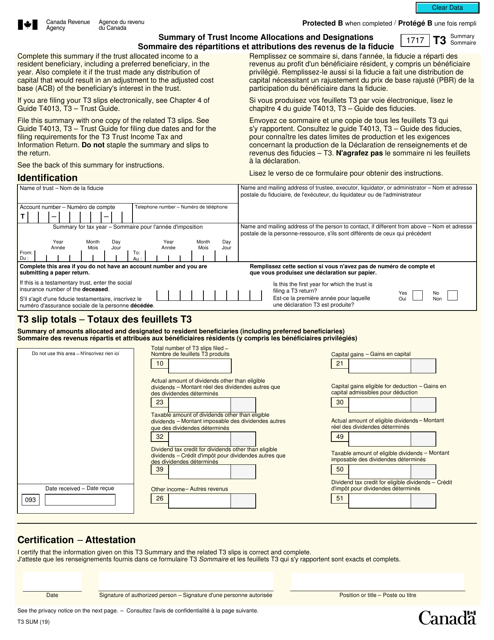

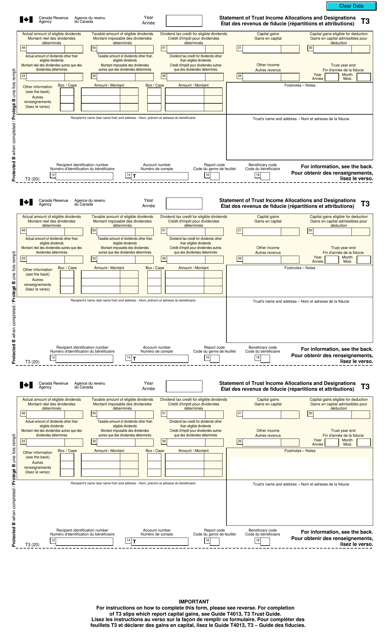

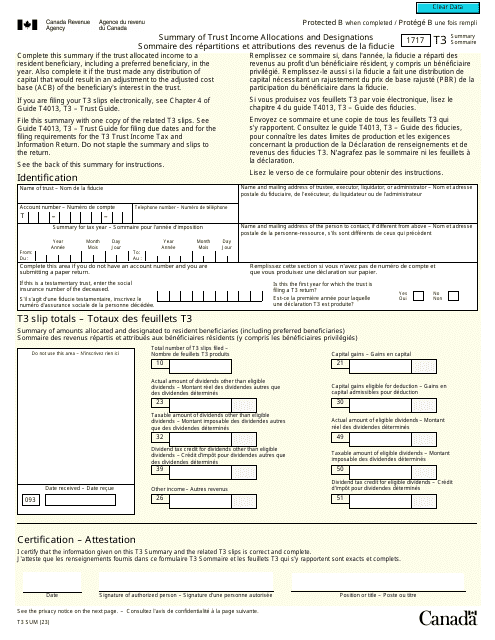

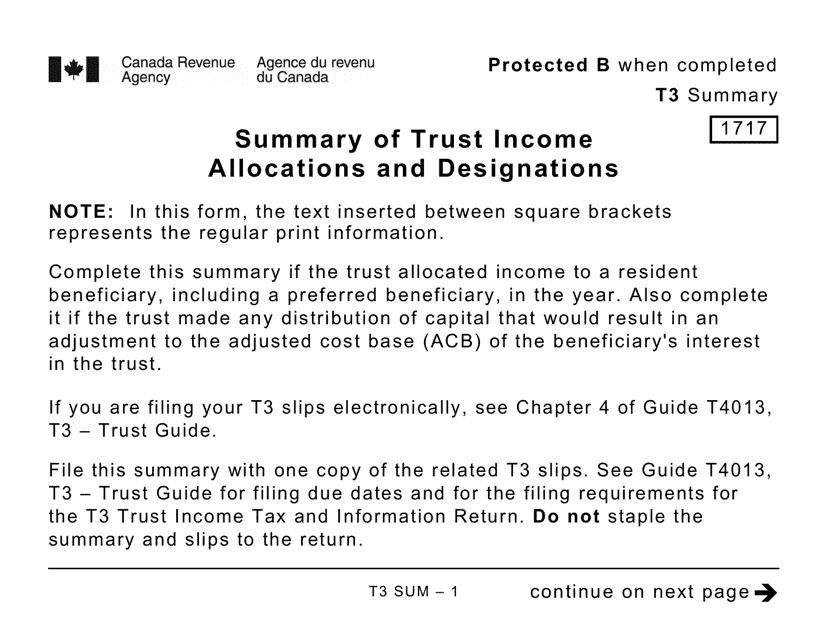

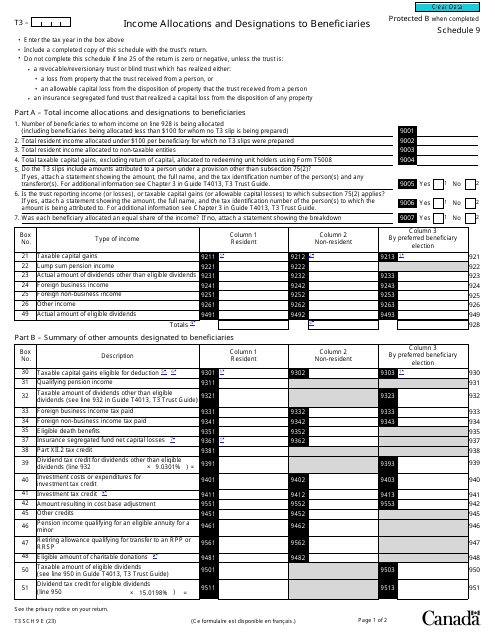

When it comes to managing and reporting trust income, there are several important documents that need to be filed. For instance, in Canada, individuals may need to submit the Form T3ATH-IND Amateur Athlete Trust Income Tax Return, which is specifically designed for reporting trust income related to amateur athlete trusts. Another important document is the Form T3SUM Summary of Trust Income Allocations and Designations, which provides a comprehensive overview of trust income allocations and designations in both English and French.

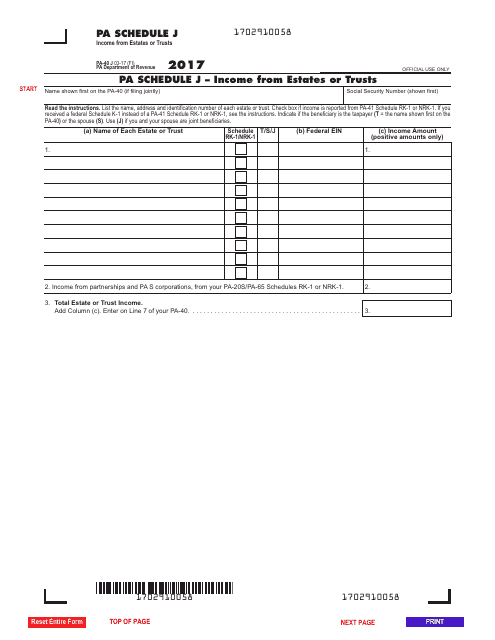

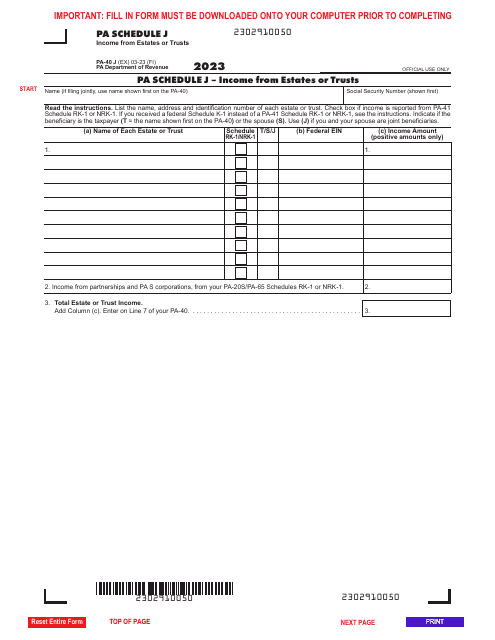

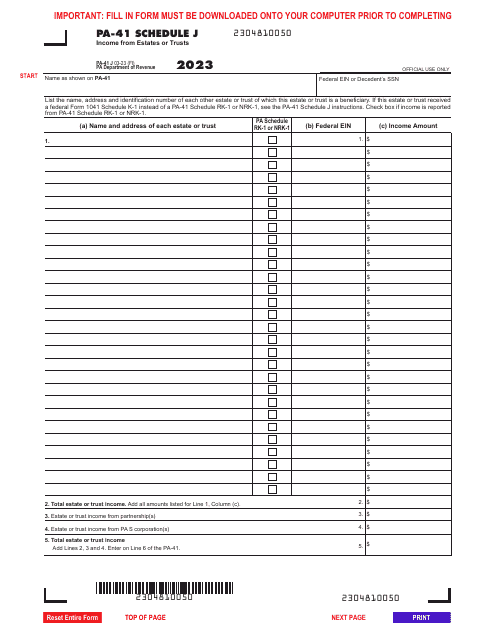

In the United States, different states may have their own specific forms for reporting trust income. In Pennsylvania, for example, individuals may need to complete the Form PA-41 Schedule J or the Form PA-40 Schedule J to report income from estates or trusts. These forms ensure that accurate information about trust income is reported for tax purposes.

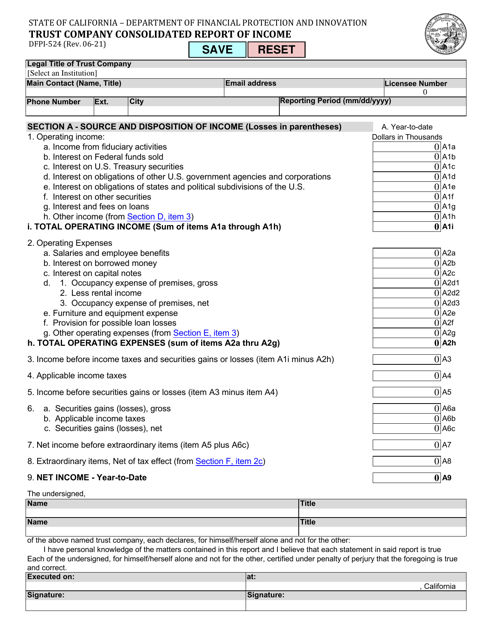

Additionally, each state may have its own requirements for trust companies. In California, for example, trust companies are required to file the Form DFPI-524 Trust CompanyConsolidated Report of Income. This document allows trust companies to consolidate their income and accurately report it to the state authorities.

Managing and reporting trust income is essential for financial transparency and compliance. It is important to understand the specific requirements of your jurisdiction and consult with a knowledgeable professional to ensure that all trust income is accurately reported. Trust income documentation plays a crucial role in maintaining the integrity of the trust system and protecting the interests of all parties involved.

Documents:

17

This form is used for reporting income from estates or trusts in Pennsylvania. It helps individuals to calculate and report their income from these sources for tax purposes.

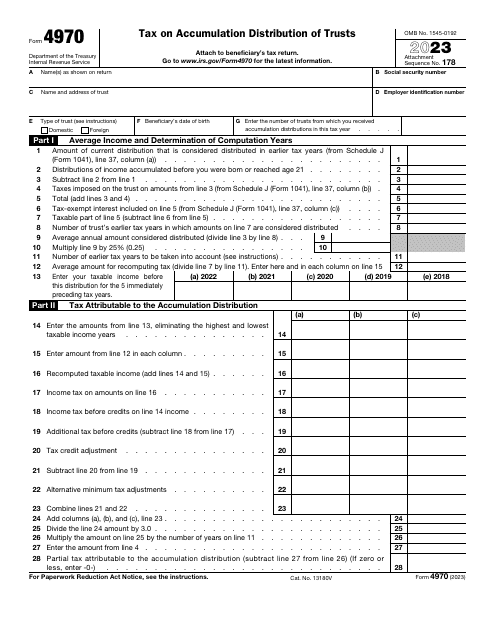

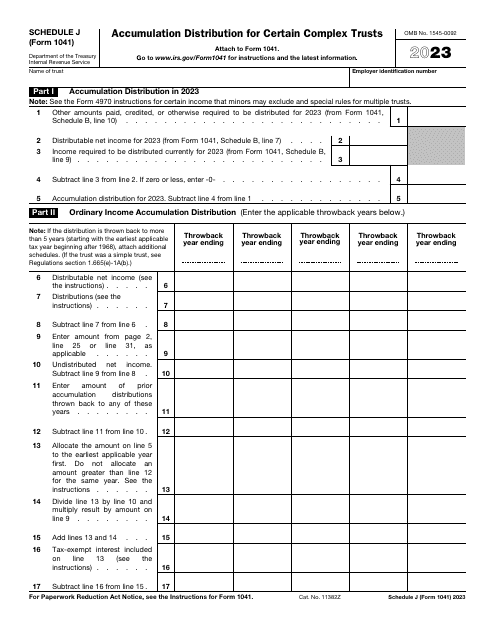

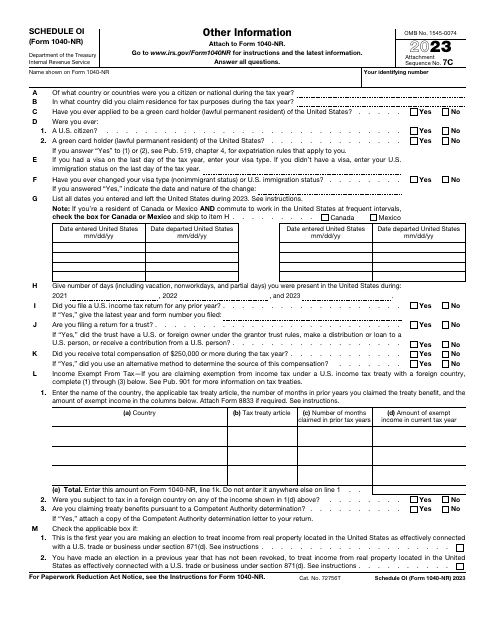

This is a formal instrument used by taxpayers to clarify how much investment income they have received and to figure out the amount of supplementary tax they have to pay.

This form is used for summarizing trust income allocations and designations in Canada. It is available in both English and French.

Canadian taxpayers may use this form when they would like to report the investment income they have received during the year.

This form is used for trust companies in California to report their consolidated income. It helps regulators monitor the financial health and compliance of these companies.

This type of document, Form T3 SUM Summary of Trust Income Allocations and Designations (Large Print), is used in Canada for summarizing the income allocations and designations for trusts.